[ad_1]

The following is a guest post from Chris Thomas, Head of Blockchain and Corporate Security at GRVT.

While a chain is only as strong as its weakest link, in the world of cryptocurrency, that weak link is often security. Each year, billions of dollars vanish overnight from the crypto market due to security breaches, hacks and exploits.

The recent Bybit hack, where attackers drained over $1.5 billion in Ethereum, serves as yet another reminder of these risks. While Bybit assured users that funds were secure, the incident reinforced a fundamental issue: even the largest platforms remain vulnerable to sophisticated attacks under traditional security models.

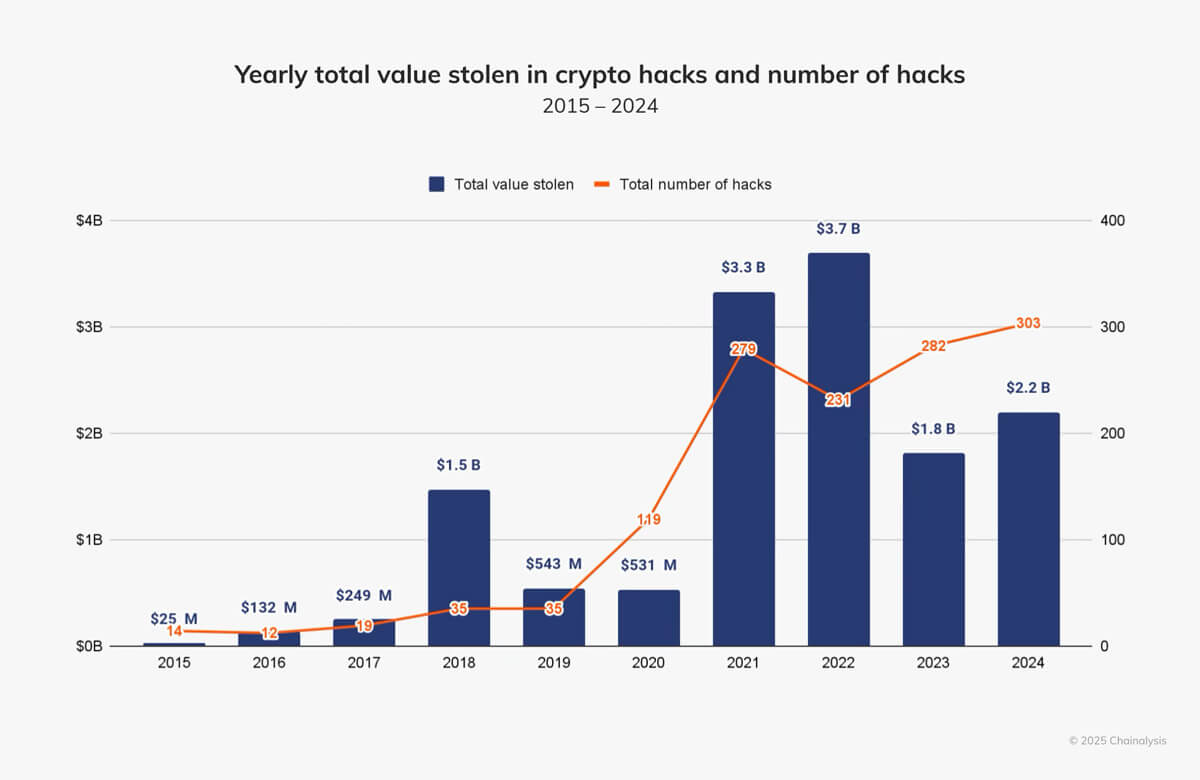

In 2024 alone, crypto-related thefts surged by 21%, totaling $2.2 billion, while hacking incidents increased from 282 in 2023 to 303. However, security failures go beyond just theft — centralized systems expose user funds to risks even without a direct breach.

Crypto’s Security Dilemma

The collapse of FTX in 2022, which erased over $8 billion in user funds, heightened concerns about custodial exchanges. Entrusting assets to centralized entities has repeatedly led to devastating losses, whether through mismanagement, fraud or outright collapse.

But decentralization hasn’t solved the problem either — flash loan attacks, smart contract exploits and governance vulnerabilities have drained liquidity pools in seconds, proving that DEXs are not immune to financial catastrophe.

The ongoing dilemma highlights a fundamental issue: neither traditional CEXs nor fully decentralized protocols offer a foolproof security model. CEXs provide user-friendly interfaces but require blind trust in a centralized entity, exposing users to custodial risks. DEXs eliminate intermediaries but introduce new challenges, such as private key mismanagement, smart contract vulnerabilities and slow governance responses to security threats.

No matter how advanced crypto technology is, fortunes can vanish in an instant. The question is no longer CEX vs. DEX — it’s how security can evolve to eliminate their weaknesses. A new approach is needed — one that blends the best of both worlds.

The Case for Hybrid Security in DeFi

A hybrid security model combines the advantages of centralized security measures with decentralized, trust-minimized solutions. Instead of forcing users to choose between control and convenience or security and usability, hybrid exchanges aim to provide institutional-grade protections while preserving self-custody.

Centralized exchanges implement multi-factor authentication (MFA), cold storage, anti-money laundering (AML) compliance and insurance coverage against cyber threats. However, these protections have limits — cold storage remains a single point of failure, MFA can be compromised through social engineering, and users must trust the exchange to act in good faith.

Decentralized exchanges rely on non-custodial asset management, smart contract audits and decentralized governance mechanisms. While these features enhance transparency and user autonomy, they do not eliminate risks. Lost private keys mean lost funds and even the most rigorously audited contracts have been subject to multi-million-dollar exploits.

A hybrid security model closes these gaps by combining CEX-level protections with DeFi resilience, allowing users to enjoy high-security standards while retaining decentralization.

How Hybrid Security Reduces Risk

Hybrid security models seek to mitigate the risks that have led to billions in losses across the crypto space. By combining decentralized self-custody with centralized security controls, these models offer a more resilient approach to asset protection.

1. Self-Custody Without Exchange Failure

Unlike traditional CEXs, which require users to relinquish control of their assets, hybrid models enforce self-custody through solutions like Secure Multi-Party Computation (MPC) technology. With the new approach, users can be confident that their funds will be protected even if the exchange is compromised, reducing the risk of catastrophic failures seen in past CEX crashes.

2. Smart Contract-Backed Withdrawal Protection

Hybrid security platforms integrate Web2 and Web3 security measures at the smart contract level. Users can whitelist withdrawal addresses, and transactions require multi-factor authentication and wallet signatures. The hybrid security model significantly reduces the likelihood of unauthorized withdrawals, even in cases of compromised login credentials.

3. Order Book Systems Prevent DeFi Exploits

One of DeFi’s biggest vulnerabilities is flash loan attacks, which exploit automated market makers (AMMs) to drain liquidity pools in seconds.

Hybrid exchanges avoid this risk by utilizing off-chain order books, preventing front-running, sandwich attacks and price manipulation that plague fully decentralized protocols.

4. Institutional-Grade Compliance with Blockchain Transparency

While implementing traditional security controls like suspicious activity monitoring and withdrawal limits, hybrid security models ensure that key aspects of governance remain decentralized. Smart contract enforcement minimizes human intervention risks while maintaining transparency on the blockchain.

Hybrid Security: The Next Evolution of DeFi

The idea that finance must be fully centralized or fully decentralized is outdated. Security should not come at the cost of autonomy, and usability should not require blind trust in a single entity.

The hybrid security model represents a logical evolution in DeFi’s development — balancing institutional safeguards with blockchain transparency. Pure CEX models have demonstrated their vulnerabilities through high-profile collapses, while fully decentralized models are still in their infancy and vulnerable to emerging exploits.

Hybrid models signal a shift towards a more robust security framework, ensuring that exchange failures and protocol breaches become relics of the past. The question is no longer whether hybrid security will define the next era of crypto but how soon the industry will accept that the old ways are no longer enough.

[ad_2]