Ripple and its founders and cryptocurrency exchanges occupy top entries on the XRP rich list in 2024. Out of the total circulating supply of XRP, 20.38% of all coins are controlled by the top 10 addresses. Addresses between the 10th and 50th spot on the list control 28.71%, while the remaining addresses hold 50.91% of the XRP circulating supply.

XRP is one of the largest digital assets in terms of total dollar value. With a market cap of over $28 billion, the native cryptocurrency for the Ripple Network is owned by millions of investors worldwide.

Despite the decline in its price over the years due to the SEC lawsuit, many are still bullish on the coin. Out of the fixed supply of 100 billion coins, 54.51 billion are currently in circulation.

In this article, we discuss those who currently make up the XRP rich list, i.e., those holding the most XRP coins.

Buy XRP on Kraken

Key highlights:

- The XRP rich list is dominated by Ripple founders, exchanges like Binance, Kraken, and Uphold, holding significant portions of XRP.

- Ripple’s own addresses contain the highest amounts of XRP, with one address holding nearly 2 billion coins.

- Compared to other cryptocurrencies, XRP shows a more centralized distribution, with the top 10 addresses controlling over 20% of its supply.

- XRP’s market cap exceeds $28 billion, making it a major player among digital assets, despite price declines due to legal challenges.

Who is on the XRP Rich List?

The addresses holding the most XRP coins generally belong to the project founders and executives, including Chris Larsen and Brad Garlinghouse, and centralized exchanges such as Binance, Kraken, Uphold, Bitbank, and others. These centralized exchanges and crypto lenders centralized exchanges and crypto lenders are the top XRP holders by percentage, holding XRP coins worth hundreds of millions in several addresses on behalf of their customers. Ripple and its founders also own a significant amount of XRP.

Most exchanges’ XRP holdings are usually customers’ deposits kept in reserves. This explains why Binance has one of the largest supplies of XRP coins. The top 10 addresses on the BNB Chain hold 168 million XRP, more than 60% of the overall XRP supply of the coin’s BEP20 variety.

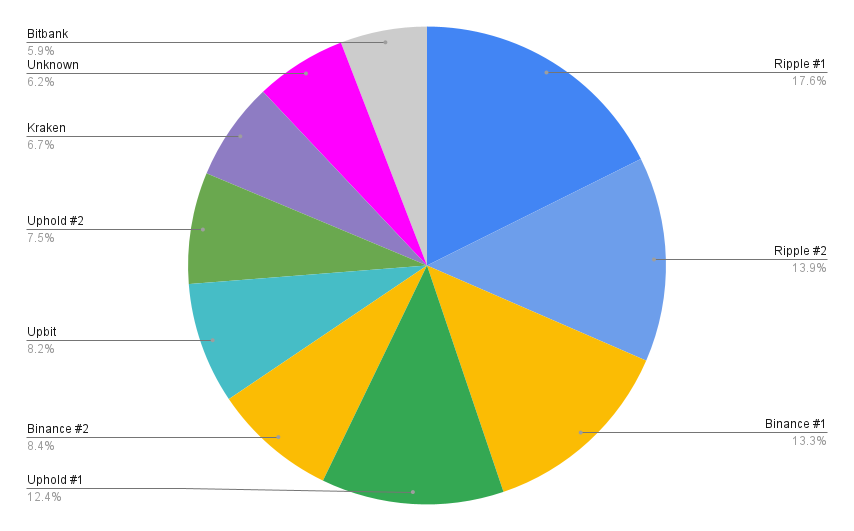

Top XRP Holders by Percentage

Distribution of XRP’s circulating supply on the mainnet.

The top 10 addresses with the largest XRP supplies hold roughly 11 billion XRP, worth approximately $5.72 billion at current market rates. If we take into account the top 50 XRP addresses instead, they control 15.6 billion XRP or 28.7% of the entire circulating supply.

If you want to check the top addresses that are XRP whales yourself, we’ve prepared a list of the ten largest XRP addresses, with direct links to XRP Scan:

*Data collected on Feb 12, 2024

As we can see from the table above, one of Ripple’s own addresses has the single highest amount of XRP in a single wallet, with nearly 2 billion XRP coins in one address. The second largest address also belongs to Ripple. For easier visualization of the distribution of the circulating supply, and how much XRP is in the hands of the top 10 whales, take a look at the XRP rich list graph for 2024.

The top 10 largest addresses control roughly 11 billion XRP.

Ripple founders and their XRP holdings

At the time of founding the project, the founders Chris Larsen, Jed McCaleb, and Arthur Brito allocated 20 billion XRP to themselves. Over the years, they have sold part of their holdings. Jed left the company in 2014, taking 9 billion XRP coins. He has been selling since then and recently sold off all his holdings. It took him eight years to finish selling off his XRP holdings.

However, the other co-founders are still holding most of their XRP. This is partly because of the SEC case against the company and its founders, in which the regulator considers XRP to be a security. Until the case is resolved in favor of Ripple, there is a risk that selling XRP could amount to selling unregistered securities in the US. This is why the cryptocurrency exchanges registered in the US have also delisted the coin.

According to Forbes, the co-founder and former CEO Chris Larsen is one of the largest holders with over 5 billion XRP. At least five addresses, containing 2.5 billion XRP in total, are directly traceable to him. The current CEO, Brad Garlinghouse, is also one of the largest holders, although there are no specifics on how many XRP coins he holds.

How XRP compares to BTC, ETH, and other popular cryptos?

*Data collected on Feb 12, 2024

XRP has a fixed supply of 100 billion and is designed to be deflationary. So far, over 54 billion coins have been issued, with retail investors controlling most of the supply. This is evident in how most of the supply is now on exchanges. There are 28 addresses with at least 500 million XRP, and all these addresses hold more than 20.3 billion of all XRP in circulation. This represents 37.3% of the circulating supply.

Bitcoin Whales

For Bitcoin, only four addresses have over 100,000 BTC, and these addresses control more than 670,000 BTC. One hundred and eight addresses have between 10,000 and 100,000 BTC, a total of almost 2.3 million BTC, while 1,964 addresses have between 1,000 and 10,000 BTC, a total of 4.6 million BTC. Overall, these addresses control about 7.7 million of BTC supply. That is over 40% of the circulating supply.

Ethereum Whales

Over 244 million Ethereum addresses are holding the 120.4 million Ether in circulation, according to Etherscan. 16.6% of that supply is locked in the Ethereum staking contract, while 3%, which is 3.7 million, is the Wrapped Ether contract. Several exchanges, such as Binance, Gemini, Kraken, OKX, Bitfinex, Crypto.com, Compound, and others, also hold a significant portion of ETH supply.

Layer 2 networks such as Abitrum and Polygon also hold significant ETH on their bridge contracts. Overall, 113 addresses hold at least 100,000 ETH, mostly institutional addresses. The top 100 addresses on Ethereum hold about 41.5% of the supply. There are over 1200 addresses that hold at least 10,000 ETH, and these wallets account for more than 70% of the total supply.

Dogecoin Whales

Dogecoin has a total supply of 139 billion, and 100 addresses have over 100 million DOGE. These addresses hold over 92 billion DOGE, 66% of the circulating supply, according to Dogecoin Explorer. However, most addresses with this large holding belong to exchanges such as Robinhood, Binance, Kraken, Crypto.com, etc. Individuals also own some, although their identity is unknown.

Solana SOL Whales

Meanwhile, the top 100 SOL holders have 33.29% of the overall supply of 539.3 million, with the 100th address holding 604,707 SOL. Per Coincarp, the top ten wallets hold 10.78% of the assets, with the number one wallet holding 16.87 million coins.

Cardano ADA Whales

Unlike most other coins, ADA whales don’t control a sizable portion of the circulating supply. The coin has a circulating supply of 35.7 billion, and the top 10 holders only control 6.41%, according to Cardano Explorer data. The top 100 wallets with the most ADA hold 18.97% of the circulating supply, which leads to a much less top-heavy rich list than XRP.

Final Thoughts

XRP whales mostly comprise exchanges and crypto firms with billions of XRP in multiple addresses for their client. The top 20 addresses alone control 32% of the circulating supply. But most of these belong to exchanges, meaning they are for retail investors. Overall, XRP is significantly less centralized in terms of its distribution than some of its crypto counterparts, particularly Ethereum and Dogecoin.

If you want to explore how the distribution of other cryptocurrencies impacts their overall tokenomics structure, check the articles below:

- Bitcoin Rich List: Biggest Bitcoin Holders

- Top 10 Dogecoin Holders

- Top 10 Shiba Inu Holders

- Top 10 HEX Holders