The excitement over spot Bitcoin (BTC) ETFs has calmed, but a fresh wave of enthusiasm is emerging. Could the prospect of an Ethereum (ETH) ETF propel the crypto market to new heights?

In the United States, competition is unfolding for supremacy in the exchange-traded fund (ETF) market, with a particular emphasis on prominent crypto assets. While the initial funds, both operational and awaiting regulatory approval, were exclusively linked to Bitcoin, a new wave of ETFs has seized the spotlight. These latest offerings enable investors to speculate on the price movements of ETH, the second-largest cryptocurrency.

Why does the market need cryptocurrency ETFs?

The launch of the first ETFs pegged to the price of Ethereum occurred two years following the introduction of the first Bitcoin futures ETF in the United States – the Bitcoin Strategy ETF from ProShares, with shares traded on exchanges under the ticker BITO. At that time, the launch coincided with the pinnacle of excitement surrounding the crypto market, marked by historical record highs for Bitcoin and other cryptocurrencies. The landscape has evolved somewhat since then: the crypto industry is currently grappling with substantial regulatory scrutiny globally, and the trading volume on crypto exchanges has dwindled to its lowest point in three years.

You might also like: Ethereum ETF becomes most attractive prospect, poll shows

In the context of the cryptocurrency market, ETFs enable investors to track the price movements of coins without directly owning them. Rather than navigating exchanges and wallets independently, investors can purchase ETF shares through standard brokerage accounts. This investment approach is more prevalent among clients of management companies or pension funds in the United States.

The U.S. Securities and Exchange Commission (SEC) has given the green light to several Bitcoin ETFs, specifically those based on futures contracts. Unlike spot ETFs, futures ETFs do not offer direct ownership of cryptocurrency and do not entail its delivery (i.e., buying it on the market). Instead, they track futures contracts that forecast their price at a future date. Several market players introduced Ethereum futures funds on October 2, 2023.

ProShares, Bitwise, and VanEck, among others, debuted their Ethereum funds after receiving regulatory approval to launch them. A few hours before the opening of the American market and the commencement of fund trading, the price of the ETH cryptocurrency surged by almost 5%. However, during the trading session, it started to decline, and within a day, it had dropped even lower, erasing all the previous gains.

Source: CoinMarketCap

Do we need an Ethereum ETF?

Investor interest in Ethereum could reignite if its prices recover to previous highs, particularly considering that many prefer Ether to Bitcoin due to numerous options for utilizing its blockchain as infrastructure for various projects and financial services.

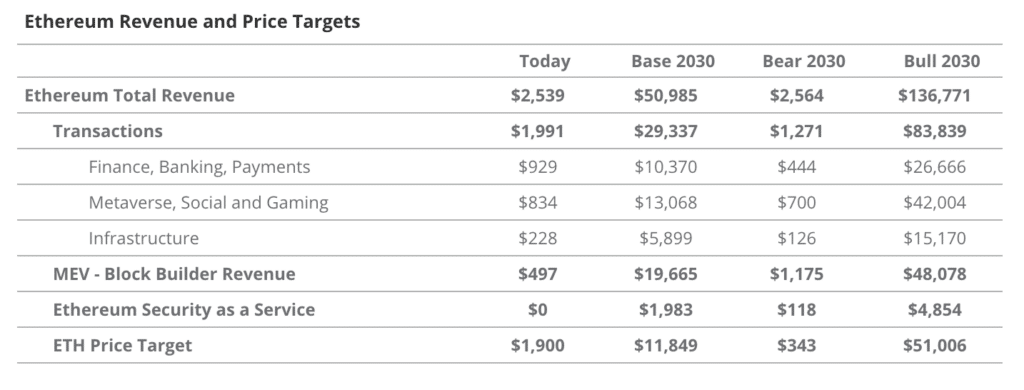

Back in May 2023, a few months before the launch of their Ethereum-ETF, VanEck analysts published an extensive report in which they shared the results of a study on the technical component of the Ethereum blockchain and its prospects. Based on their calculations and the rationale for the demand for the ETH cryptocurrency as “fuel” for future infrastructure, they predicted a range of future prices for the coin.

Source: VanEck

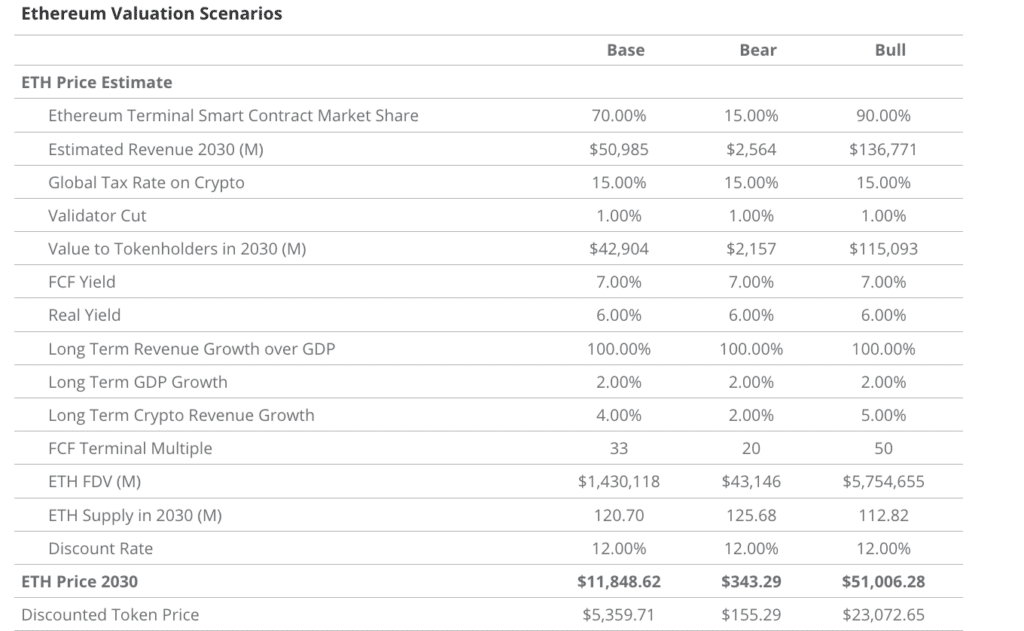

According to their estimates, by 2030, the price of ETH under the “base” scenario will be $11,848, and under the “bullish” scenario, the coin will exceed $51,000. Moreover, in the worst-case scenario and with a lack of proper demand, the ETH exchange rate, according to their estimates, may drop to almost $300.

Source: VanEck

Who has applied for Ethereum ETFs?

In August 2023, crypto asset manager Valkyrie announced the conversion of its Bitcoin futures ETF into a fund that invests in Ethereum futures. At the beginning of October, several market players, including ProShares, Bitwise, and VanEck, launched futures ETFs on Ethereum.

In September 2023, entrepreneur Cathie Wood’s Ark Invest also applied for a spot Ethereum ETF.

In November 2023, the world’s largest investment firm, BlackRock, filed with the SEC to list a spot ETF on Ethereum.

You might also like: SEC postpones decision on Grayscale’s application for spot Ethereum ETF

Will applications for spot Ethereum ETFs be approved?

Analysts believe that spot Ethereum ETFs could also be approved within a year. Bloomberg analyst Eric Balchunas said he does not see a scenario in which Bitcoin ETFs will be authorized but Ethereum ETFs will not.

The expert added that he estimates the likelihood that the SEC will approve spot Ethereum ETFs before May is 70%. Lawyer Joe Carlasar believes the agency will do this before the end of the year, but “the process will take longer than people expect.”

Bloomberg analyst James Seyffart is confident that the SEC will “give the green light” to spot Ethereum ETFs. BlackRock CEO Larry Fink is now expecting the launch of spot ETH ETFs.

However, SEC Chair Gary Gensler is exercising caution on Ethereum. While acknowledging the approval of Bitcoin ETFs, he emphasized that this was specific to Bitcoin as a non-security commodity token.

You might also like: SEC postpones deadline for decision on Invesco Galaxy spot Ethereum ETF