[ad_1]

Can Cardano, once hailed as the future of blockchain, recover from its steep decline, or has ADA’s journey from promise to disappointment marked the end of its ambitious dreams?

Table of Contents

How the story started

Cardano (ADA) started with big dreams. Created by Charles Hoskinson, one of Ethereum’s (ETH) co-founders, it aimed to tackle the issues of scalability, sustainability, and interoperability that troubled earlier blockchains like Bitcoin (BTC) and Ethereum. Using a proof-of-stake (PoS) system called Ouroboros, Cardano promised a greener and safer blockchain.

Cardano’s journey had some notable milestones. The Alonzo upgrade in September 2021 brought smart contracts to the network, and the Vasil hard fork in 2022 aimed to boost scalability.

These upgrades positioned Cardano as a potential heavyweight in the decentralized finance (DeFi) arena, with applications like non-fungible tokens (NFTs) and decentralized exchanges (DEXs) in tow.

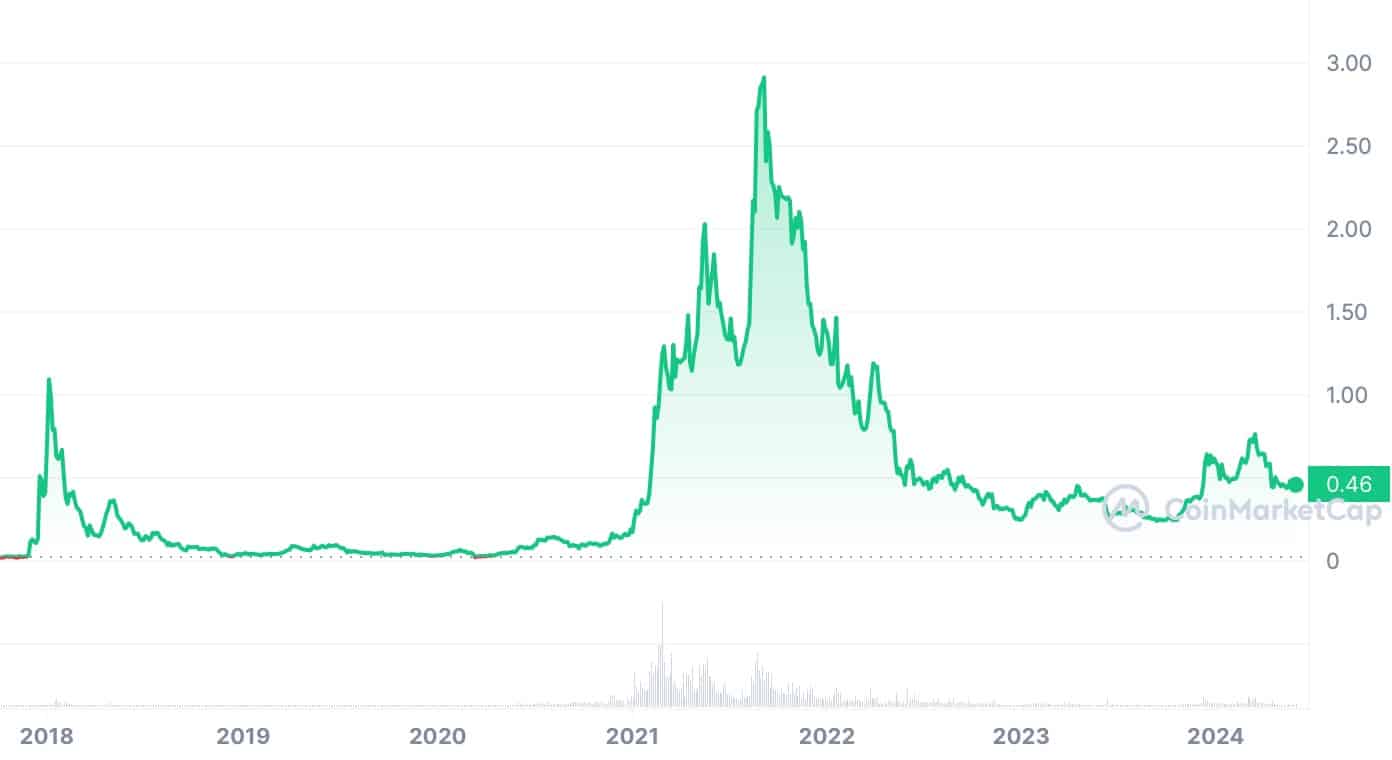

Yet, despite these advancements, Cardano has struggled to keep its momentum. ADA reached its peak price of $3.10 in September 2021, but as of May 29, it’s trading around $0.46—an 85% drop.

ADA lifetime price chart | Source: CoinMarketCap

This decline has sparked speculation, including from popular crypto influencer Ben Armstrong, also known as BitBoy Crypto.

In an April 6 video, Armstrong compared Cardano’s performance with other networks, arguing that they are “blowing up and getting a lot of recognition” while the average person “can’t name three projects on ADA.”

Armstrong attributed this to better price action and liquidity on other chains, which attract more usage and institutional money. He noted that Cardano’s liquidity is largely locked up in staking, making it less attractive for big investors.

According to Armstrong: “The markets are telling us very clearly – look at where the big money is and look at where it’s going… ADA is getting left out.”

In response, Cardano founder Charles Hoskinson expressed disappointment, stating that Armstrong “was always friendly in person to me” and found it “sad to see him go down this road,” but he still wished Armstrong well and hoped for the best.

Well @BenArmstrongsX was always friendly in person to me. Sad to see him go down this road.

Wish him well and hope for the best. https://t.co/b9lFeO70oe

— Charles Hoskinson (@IOHK_Charles) April 7, 2024

What has led to this decline, and is Cardano really dead? Let’s dive in and find out.

The current state of Cardano’s ecosystem

To better understand Cardano’s position, let’s compare it with its notable competitors: Ethereum, Binance Smart Chain (BNB), and Solana (SOL) over the last 30 days as of May 29.

Dapp development and adoption

Cardano’s decentralized application (dApp) ecosystem is expanding, with 54 active dApps and 132 smart contracts. However, these numbers seem modest when compared to Ethereum’s 4,589 dApps and over 177,000 smart contracts, as well as Binance Smart Chain’s 5,329 dApps and over 79,000 smart contracts.

Solana also outpaces Cardano with 269 dApps and 1,820 smart contracts. The limited number of dApps and smart contracts on Cardano impacts its attractiveness to both developers and users.

For developers, a smaller ecosystem means fewer opportunities for collaboration, support, and potential users. This can be a deterrent, especially for those looking to launch new projects quickly and efficiently.

For users, a limited selection of dApps translates to fewer services and functionalities available, which can affect the overall user experience.

To illustrate, consider Ethereum’s DeFi ecosystem, a major draw for developers and users. Projects like Uniswap (UNI), Aave (AAVE), and Compound (COMP) have established themselves as leaders in the space, contributing to Ethereum’s dominance.

Meanwhile, Solana’s rapid growth can be attributed to its high-performance capabilities, NFT ecosystem, prevalence of meme coins, ability to enable lightning-speed transactions, and low costs.

Cardano, while promising similar capabilities with its Hydra scaling solution, has yet to achieve comparable adoption. The limited number of dApps and smart contracts on Cardano affects the network’s ability to compete with more established ecosystems.

Cardano’s TVL and market cap to TVL ratio analysis

Cardano’s total value locked (TVL) stands at $255.57 million as of May 29, which is far lower compared to Ethereum’s $65.255 billion, Binance Smart Chain’s $5.52 billion, and Solana’s $4.84 billion, reflecting Cardano’s struggle to attract and retain substantial DeFi activity.

Interestingly, Cardano’s TVL has experienced a sharp decline of around 50% in the last two months, dropping from $490 million in March, suggesting a loss of confidence among investors and users.

Cardano TVL chart | Source: DeFi LIama

The market cap to TVL ratio further provides a dreadful overview into Cardano’s position. Cardano’s ratio is at 62.45, which is far higher than Ethereum’s 6.95, BSC’s 16.63, and Solana’s 16.09.

A high market cap to TVL ratio often indicates that a blockchain’s market valuation is much higher than the value locked in its DeFi protocols, suggesting that the market may be overvaluing the asset relative to its actual DeFi usage.

In simple words, speculative investments may be driving up Cardano’s market cap without corresponding growth in DeFi applications and user activity.

You might also like: Is Polygon a sleeping giant or a sinking ship? Analysis of MATIC’s next move

User engagement and NFT activity

Cardano’s user activity, measured by unique active wallets (UAW), stands at 40,030. This figure pales in comparison to Solana’s 5.32 million UAW, Binance Smart Chain’s 4.09 million UAW, and Ethereum’s 2.76 million UAW.

High user activity on Ethereum and Binance Smart Chain can be attributed to their extensive ecosystems, which offer a wide range of DeFi applications, NFTs, and more, providing users with varied engagement opportunities.

For NFTs, Cardano’s volume is $1.68 million, lower than Ethereum’s $442.91 million and Solana’s $73.21 million. Binance Smart Chain, although leading in dApp volume, also trails behind Ethereum in NFT volume.

The low NFT volume on Cardano points to limited marketplace activity and user interest in trading and creating NFTs on the platform.

Transaction and volume comparison

Transaction volume is another critical metric for evaluating blockchain performance. Cardano processed approximately 409,300 transactions, while Ethereum managed 7.39 million, Binance Smart Chain 21.86 million, and Solana a staggering 235.11 million.

Meanwhile, examining the overall dApp volume, Ethereum dominates with $208.21 billion, Binance Smart Chain follows with $21.71 billion, and Solana with $3.55 billion. Cardano’s dApp volume of $173.32 million is relatively small, indicating fewer financial activities and interactions within its ecosystem.

Why is Cardano lagging?

Cardano’s ecosystem faces several critical challenges that have caused it to lag behind its main competitors. Let’s break them down one by one.

Development delays and execution issues

Cardano has often been criticized for its slow and methodical approach to development. While this rigorous, peer-reviewed process ensures high-quality output, it delays the deployment of key features.

For example, Cardano introduced smart contract functionality only in September 2021, despite launching several years ahead of competitors like BNB Chain, Solana, and Polygon (MATIC), which have already onboarded millions of users through this use case.

Cardano’s late arrival to the smart contract party means it faces an uphill task against competitors hindering its ability to attract and retain users. As a result, its ecosystem has struggled to gain traction in the face of more established and dynamic platforms.

Inadequate marketing and community engagement

Cardano’s marketing efforts and community engagement have been less effective than those of its competitors. The forums and online communities dedicated to Cardano are often less active, with fewer discussions about new and innovative projects.

For instance, the Solana community is vibrant, with frequent posts about unique developments, which keeps the ecosystem lively and engaging.

In contrast, Cardano’s online presence is perceived as more stagnant, focusing on old narratives rather than new advancements. Effective marketing is crucial for attracting new users and retaining existing ones, something Cardano needs to improve.

Competition from robust ecosystems

Cardano is up against well-established ecosystems that have already captured a large market share. Ethereum, for example, is not only the pioneer of smart contracts but also continues to lead in terms of developer activity and project launches.

The Ethereum-centric programming language, Solidity, has gained immense popularity, making it the go-to choice for blockchain developers. This has resulted in a robust and thriving ecosystem with a wide array of decentralized applications.

Other competitors, including Binance Smart Chain, Avalanche (AVAX), and Polygon, have gained traction by introducing support for the Ethereum Virtual Machine (EVM).

EVM compatibility allows developers to deploy native apps seamlessly across these networks, lowering the entry barriers for new projects.

Cardano, however, is still on the path to supporting EVM, having recently launched the solution on testnet. Until full EVM support is operational, developers need to learn Cardano’s native programming language, Haskell, and Plutus’s script from scratch. This onboarding experience hasn’t been ideal, increasing the barrier for developers to migrate from other thriving ecosystems to Cardano.

As a result, the slower adoption and fewer offerings in Cardano’s ecosystem make it challenging to compete with these well-established and more developer-friendly platforms.

Limited real-world use cases

Despite its technological progress, Cardano has struggled to showcase real-world use cases that can drive large-scale adoption.

The blockchain space is highly competitive, and without compelling applications that demonstrate the practical benefits of Cardano’s technology, it becomes challenging to attract new users and developers.

Ethereum, for instance, has numerous high-profile projects and collaborations that highlight its versatility and utility in various industries, from finance to gaming.

What does the public sentiment say?

The sentiment around Cardano on Reddit is a mixed bag, reflecting both optimism and frustration among long-time holders and new observers.

A prominent holder since 2017 pointed out that the Cardano forum appears dead, with a noticeable lack of excitement and innovative discussions. The core concern is the absence of real-life use cases and direction for Cardano, leaving many to wonder about the technology’s practical applications.

Despite this, another user countered by discussing the ongoing developments within the Cardano ecosystem. They noted that much of the conversation has shifted to Twitter (X) and in-person meetups, where new programming languages like Aiken, Opshin, and Helios are being introduced.

The user even mentioned advancements in scalability with zkfold, zeko, and zk primitives, along with the construction of an account model by the Optim team. Projects are also utilizing Plutus v2+ to enhance smart contracts, indicating a strong, albeit less visible, development activity.

Meanwhile, some argued that venture capitalists and financial institutions have vested interests in seeing Cardano fail because of its fair token allocation and decentralization, which threatens traditional profit models, fueling a belief in Cardano’s long-term potential.

On the flip side, skepticism persists among those disheartened by Cardano’s slow progress and low liquidity on decentralized exchanges. These users are wary of the lack of rapid development and immediate use cases, contrasting with the high expectations set years ago.

What do the data and experts say?

A comprehensive analysis by AlphaQuest examined over 12,000 cryptocurrency projects and found that nearly two-thirds of these projects have died.

Among the top 10 ecosystems with the most defunct coins, Cardano ranks prominently, with 74% of its projects becoming inactive or ceasing to exist. This high failure rate reveals deep-rooted systemic issues, such as inadequate liquidity, low trading volumes, and insufficient developer engagement.

For instance, 93% of dead coins suffered from low liquidity or trading volume, indicating a severe decline in investor interest.

Meanwhile, the volatility and market conditions in the crypto space have further exacerbated these challenges. Major collapses, like those of Terra and FTX, had led to the demise of numerous projects.

Specifically, after the Terra crash, 35% of crypto projects were deemed defunct. This instability also affected Cardano, which saw a considerable portion of its projects fail during these turbulent times.

Amid this, institutional confidence in Cardano has also been shaken. Grayscale, a leading crypto asset management firm, recently removed Cardano from its Digital Large Cap Fund as part of its quarterly rebalancing.

At the end of the day on 4/3/2024, Grayscale Digital Large Cap Fund’s Fund Components were a basket of the following assets and weightings. As a result of the rebalancing, Cardano $ADA has been removed. https://t.co/o5jJz3NKs0$BTC $ETH $SOL $XRP $AVAX (3/6) pic.twitter.com/qVymu05BKw

— Grayscale (@Grayscale) April 4, 2024

Although the firm did not explicitly state the reasons, this move suggests a declining confidence in ADA’s performance and potential.

Grayscale’s decision to retain other assets like BTC and Solana SOL while dropping ADA suggests a shift in institutional preference towards more promising and stable assets.

The road ahead

Despite the data showing that Cardano is lagging behind its competitors, declaring it “dead” might be premature. While the road ahead is challenging, Cardano’s community could spark a renaissance.

Will Cardano rise from the ashes and redefine its path, or will it fade into obscurity as another ambitious project that couldn’t keep up? Only time will tell, but the story of Cardano is far from over.

[ad_2]