Ethereum (ETH) is only 2% away from its 2021 all-time high. However, selling pressure has already emerged, pushing its price back below $4,700. Additionally, a large amount of ETH is waiting to be unstaked in the second half of August, which could intensify selling pressure.

Industry experts offer mixed opinions on how this upcoming wave of ETH could impact the market.

ETH Unstake Queue Hits Four-Year High

Staking on Ethereum is crucial to its Proof-of-Stake (PoS) consensus mechanism, introduced in 2022 after The Merge. To become a validator, users must stake at least 32 ETH, helping secure the network and earn rewards.

However, the unstaking process isn’t always straightforward. After requesting an exit, validators must wait in a queue. Processing time depends on the number of pending requests.

According to ValidatorQueue data, as of August 15, 767,536 ETH—worth over $3.5 billion—was in the queue to be unstaked, the highest level since May 2021.

ETH Unstake Queue. Source: Validator Queue

Yet, the market might not need to wait until all ETH in the queue is unstaked to feel the effects. The sheer size of the number already influences investor sentiment.

Samson Mow, CEO of JAN3, believes negative sentiment could drive stronger selling pressure. He warns that ETH could face a deeper correction, with the ETH/BTC pair potentially dropping to 0.03 BTC or even lower.

“And there’s the pullback. Ethereum still has to come down a lot more. There’s around $3B in ETH that is being unstaked right now, which is a tedious process (by design) whereby you have to queue first and then withdraw. Once the floodgates open, I expect ETHUSD to drop massively,” Mow said.

His concern aligns with common market logic: a sudden supply surge typically hurts prices.

Moreover, ValidatorQueue data shows that the ETH waiting to be staked is also rising, but currently, it is only around 324,000 ETH—less than half the unstaking amount.

Historical data support this concern. On July 26, over 743,000 ETH sat in the unstake queue. Between July 28 and August 15, ETH’s price fell from above $3,900 to $3,365—a drop of about 14%.

The correlation between the unstake queue size and ETH’s price appears clear.

Can the Market Absorb Over 767,000 ETH About to Be Unstaked?

Kyle Doops, a well-known analyst on X, points out that unstaking doesn’t automatically mean a sell-off.

In his post, he explains that some withdrawn ETH may be held, moved into decentralized finance (DeFi) protocols for higher yields, or reinvested elsewhere—without adding selling pressure.

“Doesn’t automatically mean selling… some of it could be restaked, moved into DeFi, or just held. With withdrawals capped daily, the line’s only getting longer,” Doops explained.

ETH has countless market use cases. Large investors, or “whales,” often employ various DeFi strategies to optimize portfolios rather than simply holding tokens. This perspective helps ease concerns, especially as Ethereum benefits from a potentially improving regulatory environment for staking.

DefiMoon, a DeFi-focused account on X, believes ETF inflows could offset unstaking pressure. Based on his calculations, daily inflows from ETH ETFs could absorb most of the withdrawn ETH, possibly pushing higher prices.

“If ETF inflows average $300m per day that should nullify most of these outflows, but still should be part of the analysis!” DefiMoon said.

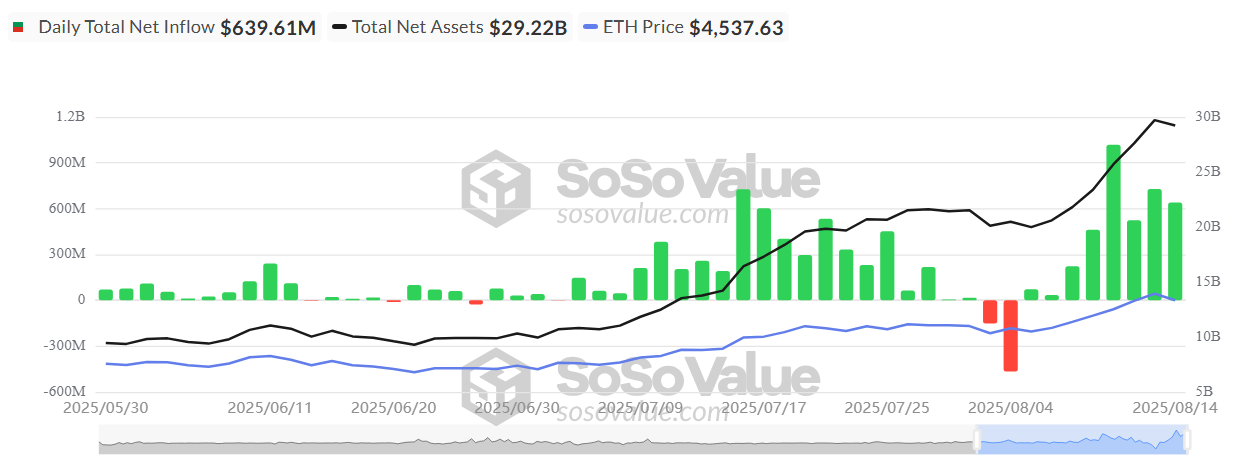

Meanwhile, SoSoValue data shows that US ETH ETF inflows last week ranged from $400 million to over $1 billion daily, exceeding DefiMoon’s estimates.

ETH ETF Daily Total Net Inflow. Source: SoSoValue.

There are differing opinions regarding the large ETH unstaking queue. Some caution about increased risks of price drops and sell-offs, while others highlight the market’s capacity to absorb these changes through DeFi and ETF inflows.

The delay will last for more than nine more days. By the third week of August, investors may have a clear answer about the impact of this unprecedented event.

The post What Experts Say About Over $3.5 Billion Worth of ETH Waiting to Unstake in August appeared first on BeInCrypto.