[ad_1]

Cryptocurrencies are now a big thing in today’s financial scene. As digital assets gain more traction, we’ve seen a ton of cryptocurrency exchanges pop up where you can buy, sell, and trade different cryptocurrencies.

But with so many choices out there, it’s crucial to know the types of exchanges and how to pick the one that fits your needs best.

Table of Contents

What are crypto exchanges?

Cryptocurrency exchanges run on blockchain technology, which is the backbone ensuring transactions are secure and reliable. Think of them like digital marketplaces, where users effortlessly join, deposit their cryptocurrencies, and smoothly withdraw them to their external wallets or bank accounts.

You might also like: SEC greenlights Coincheck to be the first Japanese crypto exchange on Nasdaq

Beyond the basics, these exchanges offer traders a toolkit for success: tools like limit orders for setting specific buying or selling prices, market orders for immediate transactions at current market rates, and insightful price charts and trading histories to analyze trends.

Each exchange has its own set of rules — from user registration requirements to identity verification protocols and trading volume restrictions. They may also charge fees for transactions and services provided, and these fees can vary significantly.

Popular examples of crypto exchanges are Coinbase, Binance, Kraken, and more.

Types of crypto exchanges

In the world of cryptocurrencies, you’ll find several main types of exchanges to choose from:

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

Let’s discuss each type in more detail.

Centralized exchanges (CEX)

A centralized exchange (CEX) functions as a hub where cryptocurrency buyers and sellers convene, facilitated by a central authority.

Like banks or brokerage firms, centralized exchanges cater to cryptocurrency users by offering a range of services. They provide secure storage for digital assets, easy ways to deposit and withdraw funds, and the capability to trade various cryptocurrencies.

Moreover, some of these exchanges support margin trading and enable users to exchange between cryptocurrencies and traditional fiat currencies, allowing for flexible investment management.

CEX often go beyond basic trading services, offering features like staking rewards, lending opportunities, Initial Exchange Offerings (IEOs), and DEFI services, catering to the diverse needs of cryptocurrency enthusiasts.

The key feature of CEX is that they operate under centralized management by companies that own them. The three main characteristics of centralized exchanges are:

- Ownership by a company;

- Responsibility for the security of users’ funds;

- Compliance with legal norms and standards (external regulation).

Decentralized exchanges (DEX)

A decentralized exchange (DEX) is an alternative to traditional Centralized Exchanges. It operates as a blockchain-based trading platform that does not store cryptocurrency assets or traders’ personal information. Instead, a DEX matches buy and sell orders.

In essence, a decentralized exchange connects buyers directly with sellers who wish to trade their tokens. Here, owners conduct asset transactions without intermediaries.

The primary feature of a Decentralized Exchange is automated transactions and trading, facilitated through smart contracts and decentralized applications (dApps), ensuring the safety of digital currency.

Users need not trust their assets to anyone else, eliminating the need for intermediaries. In other words, a DEX functions as an efficient, independent ecosystem.

Decentralized exchanges are considered safer because their smart contracts are meticulously crafted, which adds layers of complexity for hackers attempting to exploit vulnerabilities. Users on DEX platforms must be vigilant about securely storing their passwords and taking full charge of their account security themselves.

Key characteristics of decentralized exchanges include:

- Prioritizing transaction anonymity;

- Enabling direct connections between asset holders without relying on intermediaries;

- Featuring interfaces that might pose challenges for newcomers due to their complexity.

Hybrid exchanges

Hybrid exchanges blend features from both centralized (CEXs) and decentralized exchanges (DEXs), aiming to harness the advantages of each.

They provide the liquidity and transaction speed typical of centralized exchanges, while also offering enhanced security measures and greater user autonomy similar to decentralized exchanges.

How do crypto exchanges work?

A cryptocurrency exchange works much like a traditional stock market. Here, traders engage in buying assets at lower prices and selling them at higher ones to capitalize on the price difference. This strategy isn’t limited to virtual currencies; it applies across commodities, company stocks, and various other assets traded globally.

However, success in this field requires a patient approach, as asset values can fluctuate unpredictably over time — whether it’s a sudden spike overnight or gradual growth over years. This unpredictability underscores why cryptocurrency exchanges offer an additional avenue for earning: currency exchange.

In this scenario, traders meticulously select advantageous trading pairs and swap different cryptocurrencies. While the profit from each individual trade may seem modest, the potential to accumulate substantial earnings arises from making numerous trades with minimal losses.

It’s a game of strategy, persistence, and seizing opportunities in the dynamic world of digital finance.

Key features of crypto exchanges

One of the key attractions of crypto exchanges is the wide array of trading pairs they offer.

These exchanges also provide tools like limit orders for precise pricing, market orders for swift execution at current rates, and stop-loss orders to mitigate risks — all designed to empower traders with flexibility and competitive pricing strategies.

For those constantly on the move, some exchanges offer mobile apps that bring this trading excitement directly to your fingertips, whether you’re commuting or taking a break at a café. It’s trading on your terms, wherever you are.

Security is paramount in this digital realm. To safeguard users’ assets, some exchanges go the extra mile with insurance policies. These act as a safety net, providing peace of mind against potential breaches or security vulnerabilities.

How to choose a crypto exchange

Imagine you’re embarking on a journey into the world of cryptocurrency trading, just like exploring a lively market in a new city. Finding the right exchange is like stumbling upon a spot where locals go for great products and friendly service — somewhere you can feel confident and comfortable.

- Reputation: Just like hearing recommendations from seasoned travelers, seek out exchanges with glowing reviews and a reputation for reliability.

- Security: Think of it as exploring a marketplace fortified with guards and vigilant security measures. Look for exchanges that prioritize your safety with robust protocols like two-factor authentication and secure storage methods — like keeping your valuables under lock and key.

- Fees: Picture yourself haggling for the best price at a market stall. Compare the fees different exchanges charge for trades and withdrawals. Some may have hidden costs like deposit fees, so it’s wise to know all the details upfront.

- Payment options: Consider how you prefer to pay — a bit like choosing between cash, card, or mobile payment at a market. Ensure the exchange accepts your preferred method smoothly and without hassle.

- Supported currencies: It’s akin to discovering a market that stocks all your favorite goods. Make sure the exchange offers the cryptocurrencies you’re eager to trade.

- User interface: As a newcomer, you want an exchange with a simple layout that feels intuitive, much like navigating a well-marked path through the market. Avoid the confusion of overly complex interfaces.

- Jurisdiction: Just like checking local regulations before going to a new city, ensure the exchange operates under clear laws and guidelines. This safeguards your rights and protections if anything unexpected happens.

How many crypto exchanges are there?

There are a multitude of exchanges where you can buy cryptocurrencies.

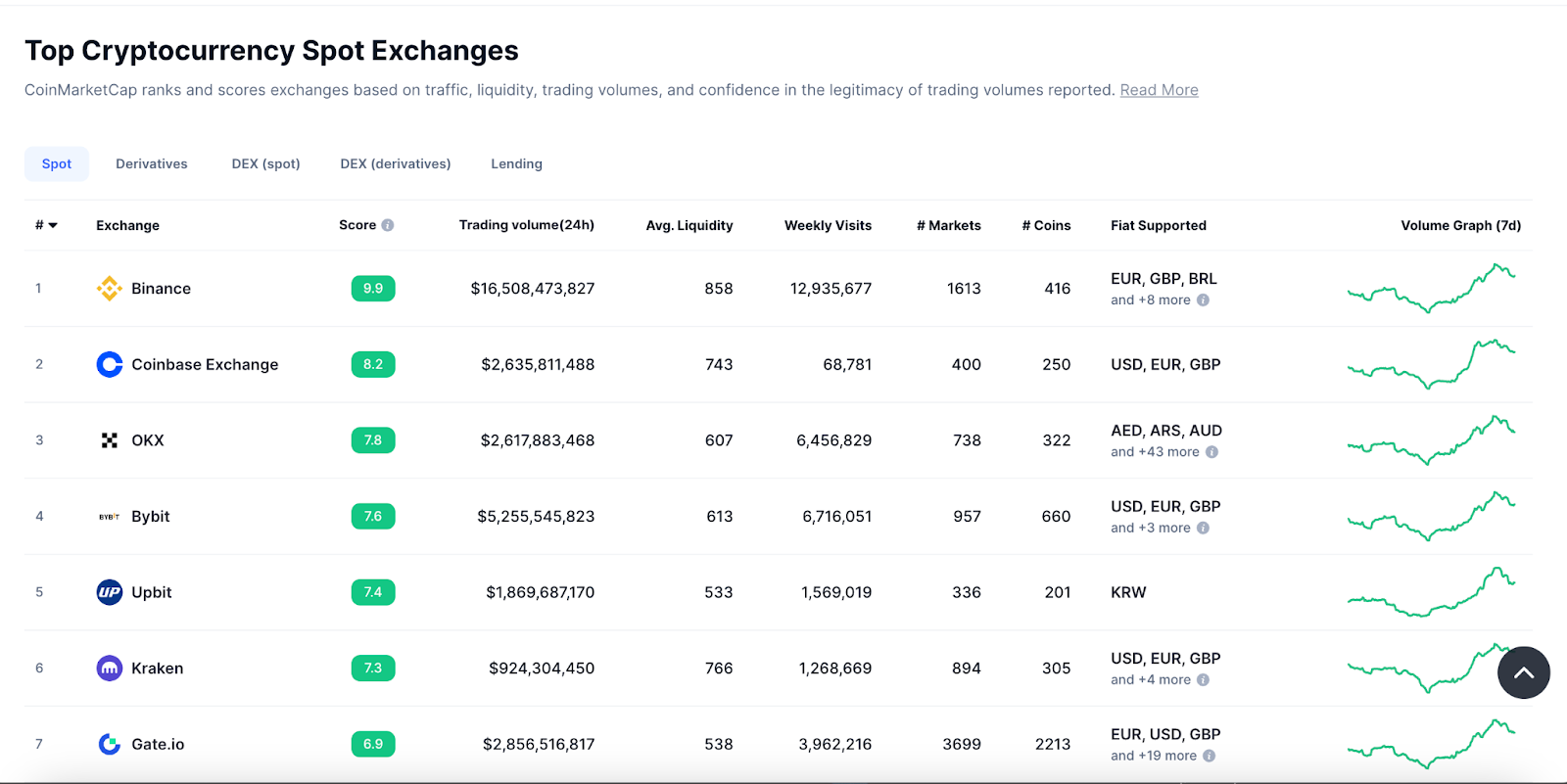

Source: CoinMarketCap

CoinMarketCap monitors 251 top spot exchanges to help you choose the best one for your needs.

Future of crypto exchanges

Looking ahead, crypto exchanges are poised for significant transformations. Regulations will become clearer, offering users greater peace of mind about security and legitimacy.

You might also like: Revolut brings crypto exchange to 30 new markets across Europe

In the near future, crypto exchanges are gearing up to blend the best of DeFi’s innovation with the trusted reliability of centralized services. This means users can expect more robust tools and a wider array of choices to manage their digital finances effectively.

Technological advancements will simplify trading processes, making it easier and cheaper for everyone involved.

As cryptocurrencies gain global popularity, these exchanges are set to revolutionize how we manage and expand our finances. They’ll introduce innovative investment opportunities beyond the traditional avenues, opening up a whole new realm for everyone to explore the world of digital assets.

[ad_2]