[ad_1]

When Uniswap’s administrators filed their “UNIfication” proposal on Nov. 10, it read less like a protocol update and more like a corporate overhaul.

The plan would activate dormant protocol fees, channel them through a new on-chain treasury engine, and utilize the proceeds to purchase and burn UNI tokens. This is a model that mirrors share-repurchase programs in traditional finance.

A day later, Lido introduced a comparable mechanism. Its DAO proposed an automated buyback system that redirects excess staking revenue toward repurchasing its governance token, LDO, when Ethereum’s price exceeds $3,000 and the annualized revenue exceeds $40 million.

The approach is deliberately anti-cyclical as it is more aggressive in bullish markets and conservative when conditions tighten.

Together, these initiatives mark a significant transition for decentralized finance.

After years dominated by meme tokens and incentive-driven liquidity campaigns, major DeFi protocols are repositioning around the significant market fundamentals of revenue, fee capture, and capital efficiency.

Yet this shift is forcing the sector to confront uncomfortable questions about control, sustainability, and whether decentralization is giving way to corporate logic.

DeFi’s new financial logic

For most of 2024, DeFi growth leaned on cultural momentum, incentive programs, and liquidity mining. The recent reactivation of fees and the embrace of buyback frameworks indicate an effort to tie token value more directly to business performance.

In Uniswap’s case, the plan to retire up to 100 million UNI reframes the token from a pure governance asset into something closer to a claim on protocol economics. This is even if it lacks the legal protections or cash-flow rights associated with equity.

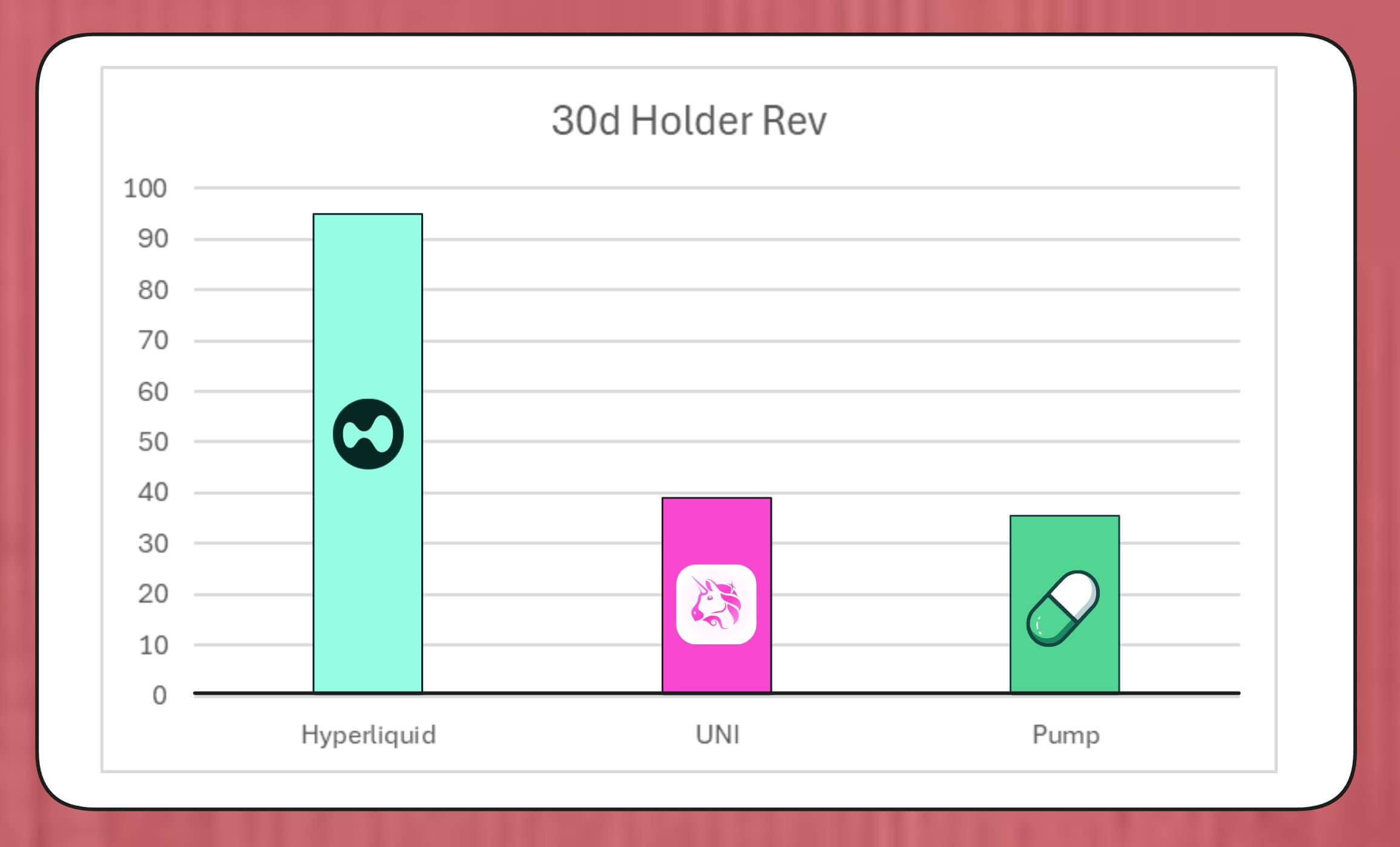

The scale of these programs is material. MegaETH Labs researcher BREAD estimates Uniswap could generate roughly $38 million in monthly buyback capacity under current fee assumptions.

That amount would exceed the repurchase velocity of Pump.fun and trail Hyperliquid’s estimated $95 million.

Lido’s modeled structure could support about $10 million in annual repurchases, with acquired LDO paired with wstETH and deployed into liquidity pools to improve trading depth.

Elsewhere, similar initiatives are accelerating. Jupiter is channeling 50% of operational revenue into JUP repurchases. dYdX allocates a quarter of network fees to buybacks and validator incentives. Aave is also making concrete plans to commit up to $50 million annually to treasury-driven repurchases.

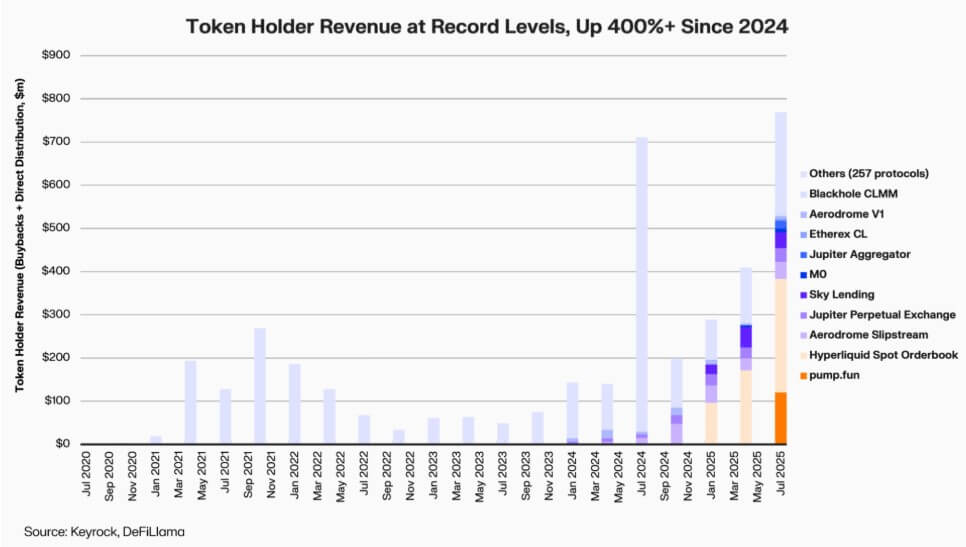

Keyrock data suggests revenue-linked tokenholder payouts have climbed more than fivefold since 2024. In July alone, protocols distributed or spent about $800 million on buybacks and incentives.

As a result, roughly 64% of revenue across major protocols now flows back to tokenholders, which is a stark reversal from earlier cycles that prioritized reinvestment over distribution.

The momentum reflects an emerging belief that scarcity and recurring revenue are becoming central to DeFi’s value narrative.

The institutionalization of token economics

The buyback wave reflects DeFi’s increasing alignment with institutional finance.

DeFi Protocols are adopting familiar metrics, such as price-to-sales ratios, yield thresholds, and net distribution rates, to communicate value to investors who assess them in a similar manner to growth-stage companies.

This convergence provides fund managers with a common analytical language, but it also imposes expectations for discipline and disclosure that DeFi was not designed to meet.

Notably, Keyrock’s analysis already pointed out that many programs heavily rely on existing treasury reserves rather than durable, recurring cash flows.

This approach may generate short-term price support but raises questions about long-term sustainability, particularly in markets where fee revenue is cyclical and often correlated with rising token prices.

Moreover, analysts such as Marc Ajoon of Blockworks argue that discretionary repurchases often have muted market effects and can expose protocols to unrealized losses when token prices decline.

Considering this, Ajoon advocates for>stated:

“In their current form, buybacks aren’t a silver bullet…Because of the “buyback narrative”, they are blindly prioritized over other routes that may offer higher ROI.”

Arca CIO Jeff Dorman takes a more comprehensive view.

According to him, while corporate buybacks reduce outstanding shares, tokens exist within networks where supply cannot be offset by traditional restructuring or M&A activity.

So, burning tokens can drive a protocol toward a fully distributed system, but holding them provides optionality for future issuance if demand or growth strategies require it. That duality makes capital allocation decisions more consequential than in equity markets, not less.

New risks emerge

While the financial logic of buybacks is straightforward, their governance impact is not.

For context, Uniswap’s UNIfication proposal would shift operational control from its community foundation to Uniswap Labs, a private entity. That centralization has raised alarms among analysts who argue it risks replicating the very hierarchies decentralized governance was designed to avoid.

Considering this, DeFi researcher Ignas pointed out that:

“The OG vision of crypto decentralization is struggling.”

Ignas highlighted how these dynamics have emerged over the past years and are evidenced in how DeFi protocols respond to security issues through emergency shutdowns or accelerated decisions by core teams.

According to him, the concern is that concentrated authority, even when economically justified, undermines transparency and user participation.

However, supporters counter that this consolidation can be functional rather than ideological.

Eddy Lazzarin, Chief Technology Officer at A16z, describes UNIfication as a “closed-loop” model in which revenue from decentralized infrastructure flows directly to token holders.

He adds that the DAO would still retain authority to issue new tokens for future development, balancing flexibility with fiscal discipline.

This tension between distributed governance and executive execution is hardly new, but its financial consequences have grown.

Leading protocols now manage treasuries worth hundreds of millions of dollars, and their strategic decisions influence entire liquidity ecosystems. So, as the economics of DeFi mature, governance debates are shifting from philosophy to balance-sheet impact.

DeFi’s maturity test

The accelerating wave of token buybacks shows that decentralized finance is evolving into a more structured, metrics-driven industry. Cash-flow visibility, performance accountability, and investor alignment are replacing the free-form experimentation that once defined the space.

Yet, with that maturity comes a new set of risks: governance may tilt toward central control, regulators could treat buybacks as de facto dividends, and teams might divert attention from innovation to financial engineering.

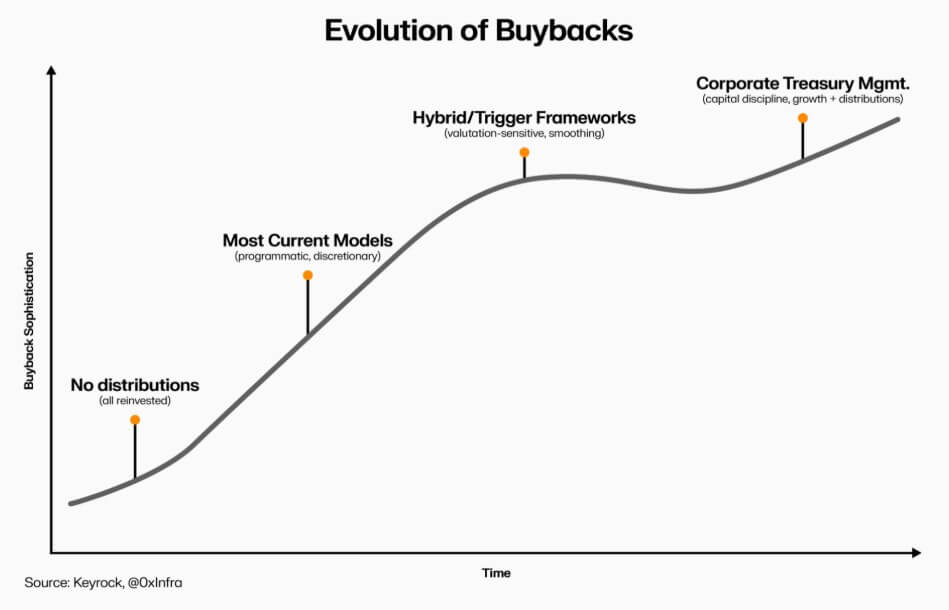

The durability of this transition will hinge on execution. Programmatic models can hard-code transparency and preserve decentralization through on-chain automation. Discretionary buyback frameworks, while faster to implement, risk eroding credibility and legal clarity.

Meanwhile, Hybrid systems that link repurchases to measurable, verifiable network metrics may offer a middle ground, though few have proven resilient in live markets.

However, what is clear is that DeFi’s engagement with traditional finance has moved beyond mimicry. The sector is incorporating corporate disciplines such as treasury management, capital allocation, and balance-sheet prudence without abandoning its open-source foundation.

Token buybacks crystallize this convergence as they merge market behavior with economic logic, transforming protocols into self-funded, revenue-driven organizations accountable to their communities and measured by execution, not ideology.

[ad_2]