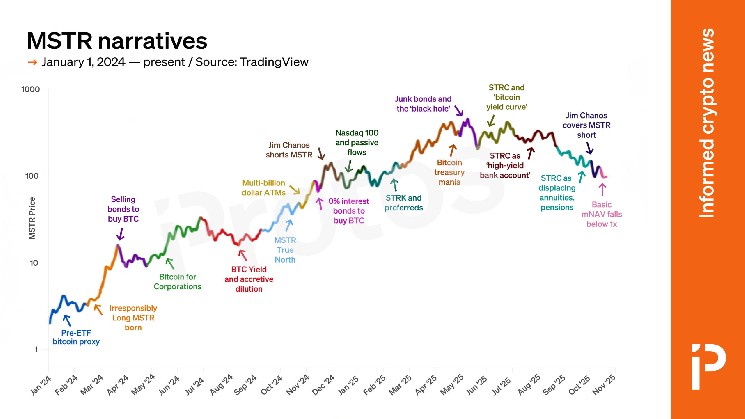

The dominant narrative driving investor interest in Strategy (formerly MicroStrategy) has changed at least a dozen times over the past two years.

However, in addition to a being financial reality for millions of investors, its rollercoaster journey followed a narrative arc and its story swung wildly over the years.

Founder Michael Saylor pitched the company as a BTC-gobbling corporate debtor, an accretive dilutor, a beneficiary of passive flows, a financial black hole, digital credit credit issuer, and even a competitor to high-yield bank accounts.

Strategy investors told many stories about why 2024’s high should have been just the beginning. Click chart to enlarge.

For example, at the start of 2024, before the SEC had approved spot BTC ETFs, Strategy was a Nasdaq-listed proxy for bitcoin (BTC) price exposure.

Its market capitalization was 1.3x the value of its BTC holdings — a generous albeit modest premium that it enjoyed amid the absence of spot BTC ETFs, and that multiple rallied to a high of 3.4x in November 2024.

However, it’s dwindled ever since.

Indeed, as of publication time, the company’s market cap is less than the value of its BTC holdings, a mere 0.8x multiple.

As its story-telling shifted over the years, Protos covered the messaging of its executives and the morphing terminology that its fan base used on social media.

Below are some of the stories that investors told themselves about why that November 2024 high should have been just the beginning.

Timeline of Strategy investment narratives

Pre-January 11, 2024: Listed proxy for BTC exposure

Prior to the SEC’s approval of spot BTC ETFs and due to Saylor’s repeated guidance that Strategy would never sell BTC, many investors purchased MSTR as a way to gain exposure to the price of spot BTC.

As opposed to spot BTC or other products like trust- or derivatives-based exchange traded products, MSTR enjoyed eligibility for retirement account inflows, a liquid Nasdaq listing, and the reputational advantage of its fully audited SEC filings by a Big Four accounting firm, KPMG.

February 23, 2024: Irresponsibly Long MSTR community born

In February, podcasters and social media influencers popularized the acronym multiple-to-Net Asset Value (mNAV) as a valuation metric.

During this month, Strategy’s mNAV rallied from the low 1x range toward 2x, and a community of leverage-hungry investors coalesced online into a community on X, Irresponsibly Long MSTR.

March 8, 2024: First bond issuance to buy BTC

Strategy’s first of several corporate bond issuances expressly intended to fund BTC purchases, in early 2024 the vision of many investors was for Strategy to sell an ever-increasing quantity of USD-denominated convertible bonds.

The perpetual USD price appreciation of BTC, in their view, would collateralize an ever-increasing amount of this debt.

Assuming the price of BTC always rallied, selling convertible bonds that converted at pre-rally prices would power a new engine of growth, “accretive dilution.”

May 1, 2024: Bitcoin for Corporations

The BTC treasury company bubble peaked in May around the time of MicroStrategy’s dedicated Bitcoin for Corporations conference in Las Vegas.

At this time, the vision was for MSTR to inspire hundreds of other public companies to use cash flows and leverage to buy BTC, bidding up the price of Strategy’s BTC.

August 2024: Bitcoin Yield and “accretive dilution“

By late summer 2024, MSTR social media had fully adopted the term “accretive dilution” and its corollary, Bitcoin Yield.

These narrative terms told a story of Saylor and Strategy’s management as adept financiers, able to tap corporate bond markets and sales of MSTR at-the-market sales (ATMs) to grow BTC per share above the dilutive effects of their actions.

MSTR, according to this narrative, had a positive Bitcoin Yield over time. Saylor’s unique access to low-cost leverage and well-timed BTC purchases would produce accretive dilution.

October 23, 2024: MSTR True North

Born out of the Irresponsibly Long MSTR community, social media influencers Ben Werkman, Jeff Walton, and Tim Kotzman created a Strategy-focused podcast, MSTR True North.

Most of their content focused on explaining Strategy’s unique terminology and financials.

November 11, 2024: First multi-billion dollar at-the-market (ATM)

In November, Strategy began maxxing out its ATMs. It sold its first, multi-billion dollar quantity of MSTR in under two weeks, buying 27,200 BTC.

November 21, 2024: First 0% coupon debt

Strategy continued its debt-fueled buying spree in November, issuing its first series of debt that paid 0% interest to debtholders who agreed to forsake interest payments altogether for upside only in the form of MSTR convertibility.

November 2024: Jim Chanos shorts MSTR

As Saylor maxed out his ATM sales, bearish short-sellers took notice.

At the same time as Strategy’s mNAV was rallying into the 3x range, a catalyst finally arrived via the company itself, as billionaire Jim Chanos explained, aggressively selling down its own mNAV via ATMs.

Chanos averaged into a hedged bet against Strategy by shorting MSTR and buying BTC.

Markets would slowly prove Chanos correct and reward his bearish trade handsomely.

Read more: Michael Saylor says short seller deployed bots to bash MSTR

December 13, 2024: Nasdaq 100 index and “passive flows”

With a market cap above $70 billion for the first time ever, Nasdaq’s indexation committee decided to add MSTR as a constituent to its prestigious Nasdaq 100 index.

The narrative of Strategy as a beneficiary of passive flows — consistent, price-insensitive buying from retirement savers around the world — would dominate this early holiday season.

Soon, investors would set their sights on the even larger and more passively inflowing index, the S&P 500.

January 27, 2025: First preferred offering, STRK

In 2025, the narrative of Strategy investors shifted away from hopes that debt or ATMs could sustain Bitcoin Yield. Instead, Saylor introduced a new hope: dividend-yielding preferred shares.

As opposed to debt which guarantees on-time interest and principal repayments, preferred shares would pay dividends at the election of Strategy’s board of directors.

Preferreds would also never repay principal, and would offer exotic financial characteristics such as an embedded, $1,000 call option in Strike (STRK).

Throughout 2025, Saylor would invent four more preferreds: STRF, STRD, STRC, and STRE.

May 2025: BTC treasury company bubble

By May 2025, dozens of Strategy copycats had spawned onto stock markets around the world.

On May 12, a few weeks after Tether launched Twenty One, the mania in BTC treasury companies peaked when David Bailey’s Nakamoto briefly traded at a 23x mNAV.

June 2025: MmC (mNAV months-to-cover)

By June 2025, Strategy’s mNAV had fallen below 2x, and some investors wondered if it would ever regain its November 2024 high.

As faith ended in Strategy ever reaching a 10x multiple to its BTC holdings, BTC treasury company apologist Adam Back attempted to popularize a new valuation metric for investors, MmC (mNAV months-to-cover).

It never gained much traction.

Read more: MicroStrategy bulls think Michael Saylor can pump it to 10X its BTC

June 2025: Junk bonds and the “black hole”

Also in June, Saylor attempted to drum up excitement for a new type of preferred share, STRD, that some analysts likened to a junk bond.

According to a new narrative, as long as the price of BTC rallied enough to pay for its generous dividends, Strategy could siphon capital from the multi-trillion dollar junk bond market.

With preferred shares with yields that competed with junk bonds, members of Irresponsibly Long MSTR tried to popularize a new narrative: Strategy could harness BTC as a financial “black hole” to suck in capital from tens of trillions of dollars of fixed income investments.

July 2025: STRC and the “bitcoin yield curve”

By July, the narrative that Strategy should focus on inventing and selling BTC-backed credit dominated every media appearance. Most of its July quarterly earnings presentation focused on the company’s creditworthiness and its ability to sustain its yield payouts.

In July, Strategy announced STRC, a quasi-pegged preferred share that Saylor described as the company’s iPhone moment and its most sophisticated feat of financial engineering.

STRC pays a variable dividend near 10% and the company tries to keep it trading near $100 per share. His excitement for this quasi-pegged, high-yield offering would only grow over the coming months.

August 2025: Reneged promise about no ATMs below 2.5x mNAV

For a few days in early August 2025, Strategy management provided guidance that it wouldn’t dilute MSTR below an mNAV of 2.5x simply to buy BTC.

Saylor soon withdrew that guidance and proceeded to tap the ATM as usual.

September 2025: STRC as a “high-yield bank account”

By September, despite a continuous slide throughout 2025 in the company’s mNAV, Saylor was spinning an increasingly energetic story about STRC.

Dwarfing the media attention of the company’s three prior bond offerings, Saylor was now claiming STRC could compete with high-yield bank accounts.

October 2025: STRC as displacing annuities, pensions

Saylor continued to focus on STRC through October 2025. By this time, he had expanded his comparisons of STRC beyond high-yield bank accounts and was now talking about competing with annuities, pensions, and even US social security payments.

In October, Strategy also proposed its first euro-denominated preferred share, STRE, with affirmations that the company was actively exploring a euro-denominated counterpart to STRC.

November 7, 2025: Jim Chanos covers his MSTR short

With an average entry price above 2x mNAV, short-seller Chanos publicly covered his short-sale of MSTR on on November 7, 2025 near an mNAV of 1.23x.

Read more: Beginning of the end? Strategy dilutes MSTR, slashes EPS guidance 76%

November 14, 2025: MSTR basic mNAV falls below 1x

By mid November 2025, the market capitalization of MSTR fell below the value of its BTC holdings. As of publication time, its basic mNAV is just 0.8x and its enterprise value mNAV (including pro forma net debt including preferreds) is just 1.1x.