Today the price of Bitcoin seems to want to make a rebound after the crash of the last few days that led to the liquidation of a multitude of long positions.

Let’s go over what the causes of the dump have been by analyzing the general context of the market and see what lies on the horizon.

Are we back in a bear market or is there still room for a recovery?

Let’s see everything in detail below.

Analysis of today: what happened to the price of Bitcoin in the last few days?

With a clear mind today we can analyze what has caused such a massive dump in the price of Bitcoin in recent days. In the last 7 days the cryptocurrency has recorded a 16.5% drop in quotations, which has temporarily sent it back to the 50,000 dollar area.

We hadn’t seen such a violent movement since March 2020, during the famous “covid crash”, when the entire crypto sector rapidly collapsed.

#Bitcoin

2020 COVID CRASH

2024 WTF CRASH pic.twitter.com/mrtWORIHtu— CROW (@TheCrowtrades) August 5, 2024

A confluence of various extremely negative news has accompanied the capitulation of prices, leaving little room for a possible immediate reversal.

While Bitcoin was plummeting, we witnessed an escalation of tensions in Middle East between Iran and Israel, with the former officially declaring war.

At the same time, there was a strengthening of the Japanese yen against the US dollar, which triggered the forced closure of a series of speculative positions. In fact, since interest rates are very low in Japan, several investors had borrowed yen to short in favor of dollars and buy US stocks.

As soon as this mechanism was interrupted (rate increase of 0.25 points), a collapse of billion-dollar positions across the entire American stock market and all Asian markets occurred. The fierce dump in the price of Bitcoin reflects the risk of recession that the USA is facing.

The sharp rise in the JPY/USD is causing a massive unwind of Yen carry trade positions and contributing to the sharp decline in US stocks. For those who do not understand how this works, a brief explanation

1) Many traders were borrowing Jap Yen (JPY) at low interest rates,… pic.twitter.com/sfi0Hva56M

— Adam Khoo (@adamkhootrader) August 5, 2024

It is not over here: Jump Crypto, an investment fund that went bankrupt along with FTX, has liquidated millions of dollars in BTC and ETH over the weekend.

Targeting an illiquid market at a moment of weakness when buying pressure is almost nonexistent, chaos ensued.

Think that on August 5th, in just one hour of trading, 370 million dollars of long positions were liquidated.

Jump have been moving coins relentlessly for at least 22 hours straight

That means they got ppl to work fuckin SHIFTS dumping their books on an illiquid weekend following the worst stock market day in years

This is a conscious decision to inflict the maximum amount of pain https://t.co/5sAHBiczum pic.twitter.com/j8zu4UOD7E

— Wazz (@WazzCrypto) August 4, 2024

Finally, giving an extra boost to the bear market was also the strengthening of Kamala Harris‘s forecasts in the election campaign against Donald Trump.

The response of the bulls arrives today after the crash: how far can Bitcoin bounce back?

Today the price of Bitcoin has recorded a rebound that has brought the coin back above 55,000 dollarsafter even touching 49,000 dollars.

From the bottom of yesterday’s spike, Bitcoin has grown overall by 13%, giving a sigh of relief to its holders.

Despite this, however, it is still too early to celebrate victory: today’s green candle is still largely contained within the body of yesterday’s candle.

In order to hypothesize an immediate recovery from the downtrend, we should at least first see Bitcoin above 58,000 dollars and then evaluate the market’s reaction,

As long as we remain at current levels, with today’s rebound timidly trying to fight the ongoing bearish trend, the probabilities of a reversal are strongly unfavorable. It is especially important to observe the response of the volumes: a large amount of trading is indeed more significant than a few isolated trades.

Source: https://it.tradingview.com/chart/1hwwyywT/?symbol=COINBASE%3ABTCUSD

Expanding the time horizons, the situation actually appears less tragic than it seems. The price of Bitcoin in the month of August broke down the lateral conditions that had been persistently present since March. However, the month of August has just begun, so we could hypothetically see a recovery of the entire price area lost up to 63,000 dollars.

Furthermore, even closing a monthly in red, it would still have room to land around 45,000 dollars and restart stronger than before.

In short, it is still too early to shout the start of the bear market: the dump of the last few days, mixed with today’s unconvincing rebound, obviously favors a bearish continuation. In any case, we know how unpredictable Bitcoin can be and how quickly the hands of the market sentiment can move.

For now, no fear traders: if you are afraid of downward movements like the last one, it means that you are excessively financially exposed in Bitcoin or altcoin.

If you have a strategy and have gone through at least one bear market in the past, these drastic situations will only tickle you.

Source: https://it.tradingview.com/chart/1hwwyywT/?symbol=COINBASE%3ABTCUSD

Positive signals on the macro front

In conjunction with today’s slight recovery in the price of Bitcoin, we have some positive signals in the macroeconomic field.

First of all, we point out how the US government has initiated a buyback policy of Treasury securities at an estimated rate of 30 billion dollars per day.

The type of operations that will be carried out are essentially in support of the liquidity of the American market and for cash management issues.

This could be the fuel that Bitcoin, and the entire crypto sector, needs to attempt a bull run.

BREAKING: 🇺🇸STARTING TOMORROW THE US WILL START $30 BILLION PER MONTH TREASURY BUY BACKS

Money printer go BRRRRRRR!!! pic.twitter.com/1RLBZ80fMZ

— Kyle Chassé (@kyle_chasse) August 6, 2024

Together, it seems that the Nikkei (Japanese market) has recovered from yesterday’s hit, with today’s quotations showing a +11%.

The index at the time of writing records a price of 34,675 points, still down 15% in the last month but on a recovery trajectory.

The crash of the Nikkei after the rise in Japanese yen rates had also spread its bad mood to the Bitcoin market. The rise of the Asian sector is seen as a good omen for the crypto exchanges.

The Nikkei has recovered all of its historic losses from yesterday and added more now net up on the week pic.twitter.com/YuMYjWSGL2

— TheUndefinedMystic (@pennycheck) August 6, 2024

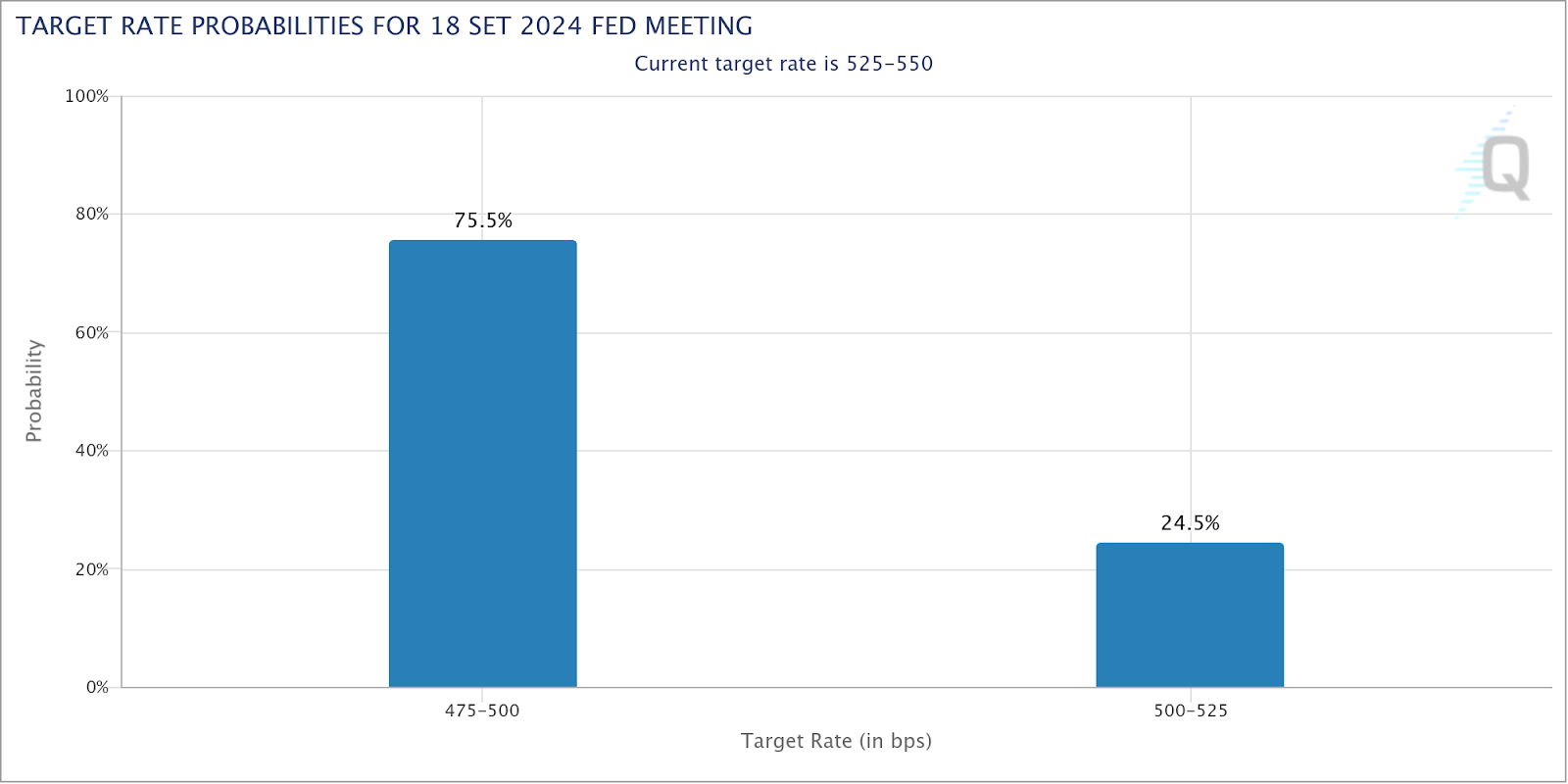

Finally, we report the increase in the probabilities for a sharp rate cut by the FED in the United States. On September 18, the meeting of the Central Bank officials is expected, who will likely decide whether to lower the interest on government bonds by 25 or 50 basis points.

A 50-point cut is seen as an “emergency cut” after the risk of recession is currently priced at 75%.

For the November meeting, a further cut of 25 points is expected, with probabilities highlighting a 50% feasibility.

This double cut could favor the confluence of liquidity into more risk-on assets, favoring more trades in the market and lifting the price of Bitcoin.

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html