Google is backing $3.2B for TeraWulf’s HPC hosting deal with Fluidstack and could end up owning ~14% of the company. Will more hyperscalers turn to Bitcoin miners for their energy and infrastructure needs?

TeraWulf’s New HPC Deal

The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on Aug. 22, 2025, it was penned by Bitcoinminingstock.io author Cindy Feng.

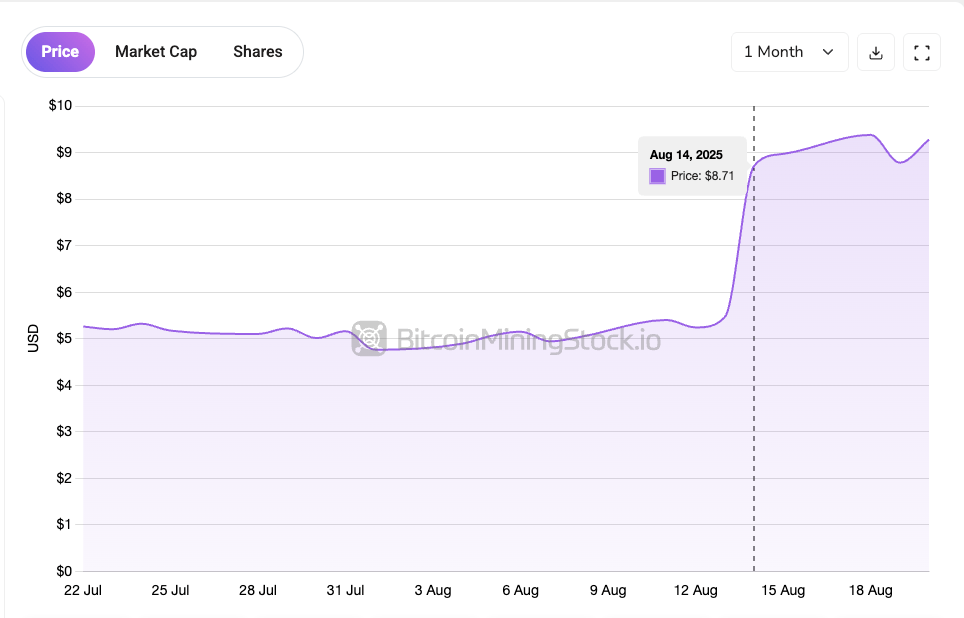

Another major HPC deal among Bitcoin miners is now confirmed. Like Core Scientific’s agreement with CoreWeave in 2024, TeraWulf’s recent announcement has drawn significant attention from investors that sent its stock price up ~60%. Obviously, the projected multi-billion-dollar revenue is the major highlight, but the involvement of Google is like the cherry on top. In this case, Google has backstopped $3.2 billion for the deal and may hold up to 14% of TeraWulf through warrants. This is the first time a major hyperscaler has entered such an agreement with a Bitcoin miner. Though not as a direct customer or lessee, it validates a long-held speculation: hyperscalers are eyeing Bitcoin miners, recognizing their power access and data center infrastructure.

$WULF rose nearly 60% following the announcement of its HPC hosting agreement.

What makes TeraWulf’s deal more exciting is that it outlines a repeatable blueprint for other public miners, since some peers have even larger power pipelines and infrastructure. In this post, I’ll break down key aspects of the deal and share some thoughts to help evaluate future hyperscaler partnerships in Bitcoin mining.

TeraWulf x Fluidstack: $6.7B in Contracted Revenue with Upside to $16B

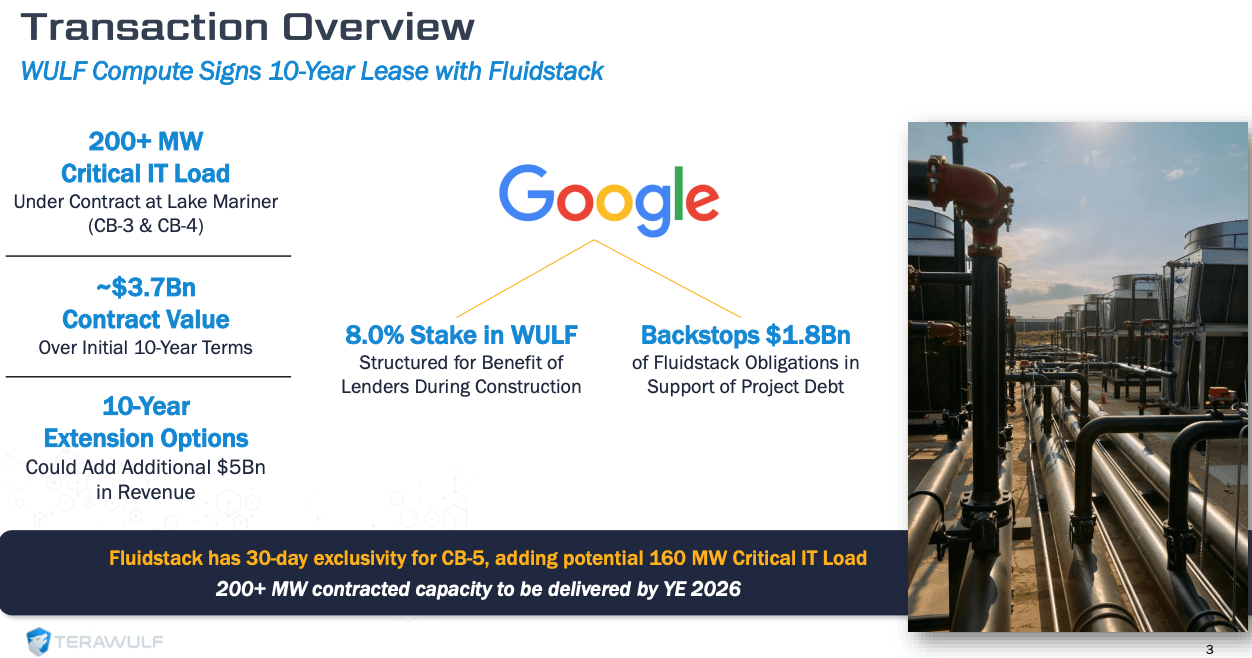

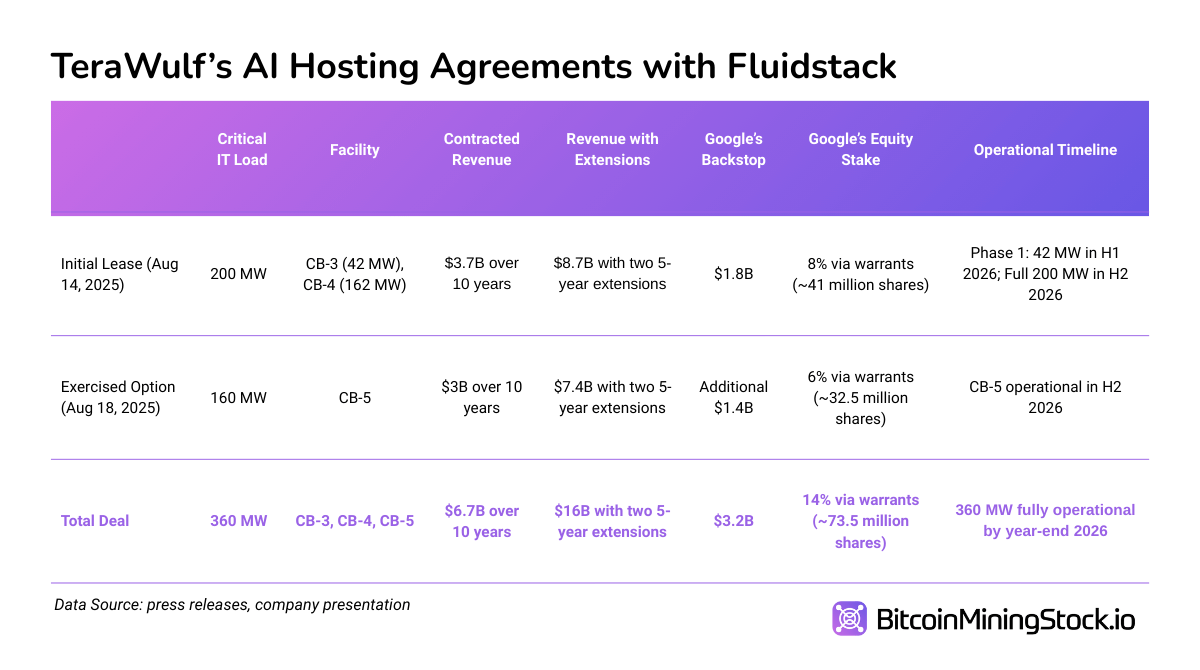

TeraWulf first announced a 10-year HPC hosting agreement with Fluidstack on August 14, 2025. The agreement covers over 200 MW of infrastructure capacity at the company’s Lake Mariner facility in New York. It is expected to generate $3.7 billion in contracted revenue over the initial term, with a potential to reach $8.7 billion should contract extensions be exercised.

Summary of the initial 10-year lease (screenshot from the presentation of TeraWulf).

The agreement is structured as a colocation model where the clients bring their own hardware and TeraWulf provides scalable power and purpose-built data center space (CB-3 and CB-4). The critical IT load to Fluidstack is expected to come online by mid-2026.

On August 18, 2025, Fluidstack exercised its option to expand further by leasing a third building (CB-5), adding another 160 MW. This brings the total contracted capacity to approximately 360 MW at Lake Mariner, which represents $6.7 billion in contracted revenue and a potential upside to $16 billion (if leases are extended).

For those who are not aware, this is not TeraWulf’s first HPC deal. In 2024, the company announced partnership with Core42, a subsidiary of G42, for 72.5 MW at the same site. Agreements with these two partners combined amount to over 420 MW of committed HPC infrastructure, which is higher than TeraWulf’s current 250 MW mining operation. This marks a slow shift from Bitcoin-focused operations to infrastructure provider of both mining and HPC hosting in the near term.

Google’s Involvement: Financial and Strategic Support

The reason why TeraWulf’s new HPC deal brings extra excitement is Google’s participation. The giant’s role is both strategic and financial in nature. Through its partnership with Fluidstack, Google is guaranteeing $1.8 billion of the initial 10-year lease obligations to support project-related debt financing. With the exercise of an additional 160MW option, Google will provide a total $3.2 billion backstop. Interestingly, Google is also backing Fluidstack’s lease obligations that include early termination protections for the first 6 years. All such support from Google helps de-risk the revenue stream and enables TeraWulf to secure financing more easily.

In exchange, Google will acquire approximately a total 73.5 million shares of TeraWulf via warrants. If fully exercised, this would give Google a 14% stake, making it one of the largest shareholders of WULF. While these warrants are not immediate dilution, they signal Google’s long-term alignment with TeraWulf’s upside. If TeraWulf executes, Google stands to gain a sizable equity stake.

Overall, Google’s involvement offers much more than capital security; it sends a strong signal to the broader market about the company’s credibility and infrastructure value. It helps open the door to future direct relationships with hyperscalers, a development that could reshape the miner-HPC hosting landscape.

In TeraWulf’s Q2 earnings call, its CEO Paul B. Prager emphasized the significance of this deal over the long haul:

“With this new customer and the $1.8 billion Google backstop, our credit profile is significantly enhanced, enabling us to pursue low-cost, scalable capital solutions that align with our growth trajectory.”

Financing Strategy for the HPC Build-Out: Lean and Leveraged

To build out the infrastructure required for the Fluidstack deal, TeraWulf is pursuing an asset-light model. Clients are responsible for providing their own GPUs and compute clusters, which significantly reduces TeraWulf’s upfront capital requirements for expensive and quickly-depreciating hardware.

Another funding source comes from prepaid hosting fees, which offers immediate cash flow support during buildout. This approach aligns with a common data center financing strategy: secure long-term contracts first, then use them to underwrite capital expansion.

In order to accelerate construction and fund short-term needs, TeraWulf also announced convertible note offering shortly after the Fluidstack deal. The initial $400 million convertible notes offering was upsized to $850 million on August 18. According to the announcement, $743.2 million of proceeds will primarily fund the CB-5 buildout and other HPC infrastructure at Lake Mariner.

While I can’t tell you the exact reason for management’s decision to go with convertibles, I think this approach provides low-cost capital (1.00% interest rate) compared to traditional debt, and preserves cash flow while funding rapid HPC expansion to meet Fluidstack’s timeline (H2 2026). The capped call transactions also mitigate dilution risk that protect shareholders as TeraWulf’s stock price has surged (55% YTD, 101% over 12 months as of August 19, 2025).

How Does It Compare to Core Scientific’s Deal?

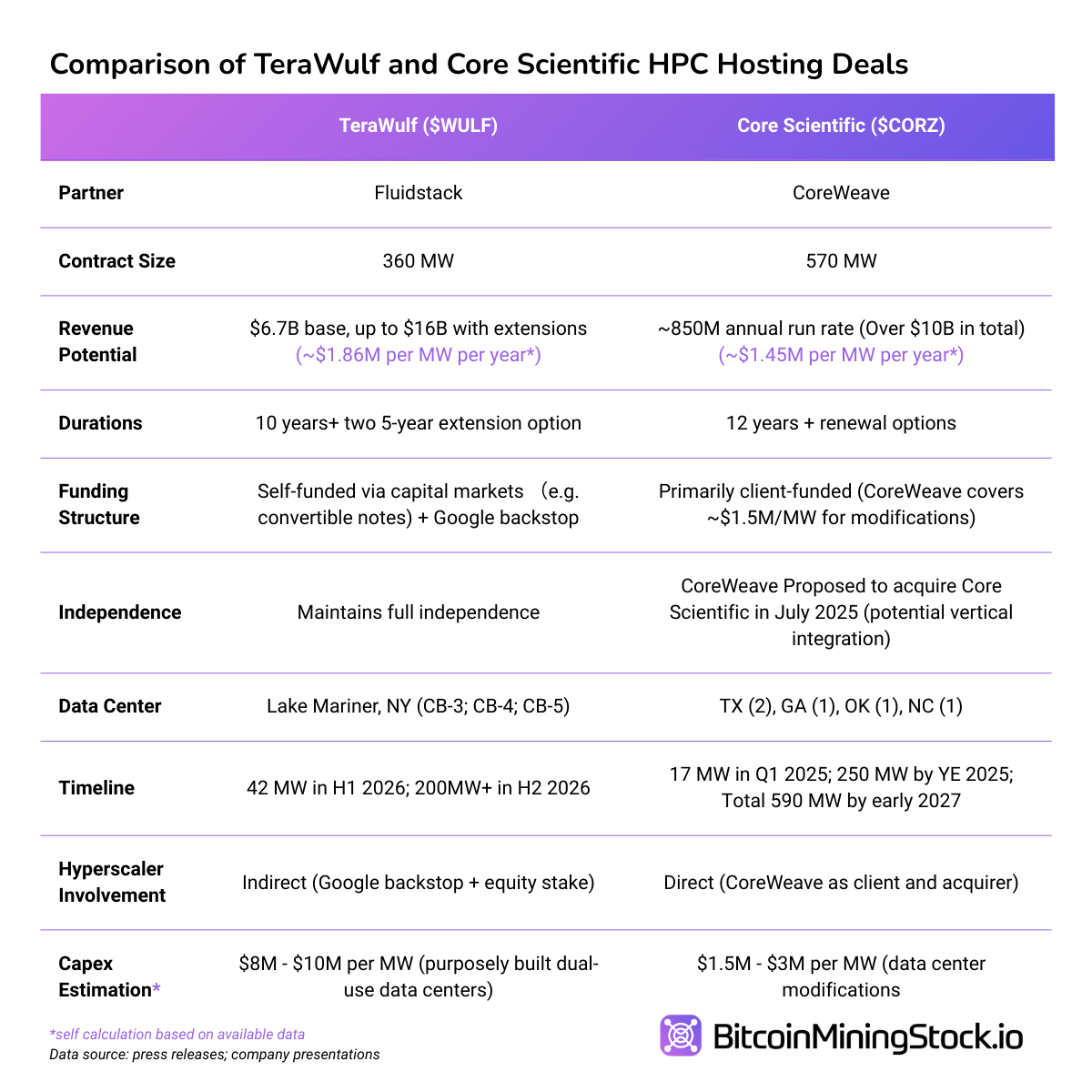

While both TeraWulf and Core Scientific landed major HPC hosting deals, their models differ in one way or another.

While Core Scientific‘s contract has the advantage of scale and capex, TeraWulf’s deal is larger in terms of total revenue potential. Most importantly, it includes direct financial involvement from Google – a first in the space. This could boost credibility among investors and other potential clients.

Final Thoughts

TeraWulf may have entered the HPC hosting game later than some of its peers, but it’s quickly proving that being early isn’t everything – execution is. From its initial partnership with Core42 in 2024, to the Fluidstack deal in 2025, the company has shifted from being “just another miner” to becoming a credible infrastructure partner in the AI and HPC economy.

Unlike some companies who aggressively market their AI pivot without much to show for it, TeraWulf has a relatively low profile on X. Yet it secured one of the largest HPC hosting deals among all public miners so far. Institutional investors have taken notice: over 55% of the company’s shares are held by institutions, while retail accounts for just ~15%. One likely reason is communication. TeraWulf has consistently spoken its business in a language familiar to traditional investors. For example, they treat Bitcoin mining like a commodity business, focused on marginal unit economics that investors can easily understand.

This clarity likely resonated not just with investors, but also with partners. In the Fluidstack deal, Google’s involvement is especially telling. Through a $3.2 billion backstop commitment and associated warrants, Google could become a 14% stakeholder in TeraWulf (if fully exercised). That’s not just capital support. That’s a credibility boost, both in the eyes of potential clients and the capital markets.

More importantly, this deal introduces a replicable playbook for other miners: secure the right partners and deliver results; speak in a language institutional players understand; think carefully about your financing- and then execute again.

The demand for HPC is real. Those who adapt their infrastructure and messaging to meet it, without over-promising, may well land the next big hyperscaler partnership. Deals involving names like AWS, Microsoft, Meta, or Oracle may no longer be “mission impossible.”