[ad_1]

As competition among Ethereum Layer-2 chains intensifies, Startale Group is positioning Soneium as a compliance-first platform rooted in Japan. With partners such as SBI and Sony, the company aims to blend financial infrastructure with entertainment-driven adoption.

CEO Sota Watanabe spoke to BeInCrypto about the long-term vision, growth metrics, decentralization, and regulation. The project seeks to stand out globally.

Background: Can a Japan-Born L2 Compete?

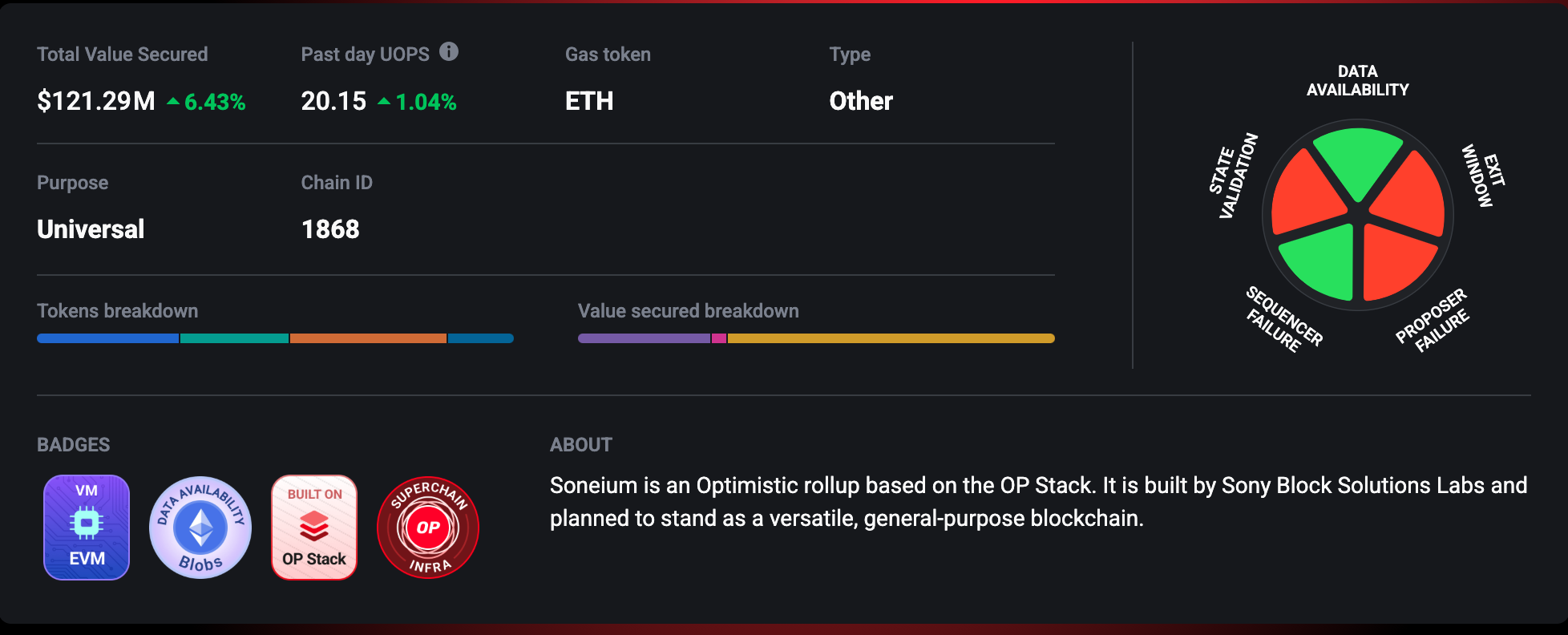

L2BEAT listed Soneium with methodology notes and governance risks. OKLink confirmed heavy on-chain throughput. Blockscout records ERC-4337 account-abstraction operations, providing a transparent log of user-level interactions. Together, these signals show that Soneium is already operating at real scale under external scrutiny. They demonstrate that a Japan-born Layer-2 can meet transparency benchmarks set by global leaders.

Sony set up a JV and incubator in 2023. It announced Soneium development in 2024 and launched mainnet in 2025. Meanwhile, SBI Holdings published joint-venture plans to connect Soneium with capital markets. Together, these alliances signal how entertainment and finance are converging in Japan’s blockchain landscape.

Mission and Global Vision: Can Japan Lead?

Startale’s medium- and long-term goals focus on building a global position beyond 2025. The company aims to prove how a Japan-born blockchain can compete at the highest level. With Soneium, the SBI joint venture, and other initiatives, Startale is extending its presence across both technology and finance.

However, as projects multiply, the vision is not always clear. Watanabe said the firm was founded to prove Japan could deliver enterprise-grade blockchain infrastructure. Therefore, compliance and reliability, not speculation, remain the top priorities.

“We believe that the next iteration of the internet will be built on blockchains. I want to see Japan take a lead on that. That’s the reason we founded Startale. We aimed to show Japan can develop world-class blockchain infrastructure. This isn’t just for crypto enthusiasts. It’s for enterprises. It’s for companies like Sony, SBI, and other global conglomerates that demand reliability, compliance, and security.”

Mission: Bring the World Onchain.

How: Utilize distribution channels and traditional assets.

What: Build chains to apps vertically starting with Sony and SBI.

Why: Easier for existing companies to acquire crypto users than for crypto to acquire existing users.

That’s us.

— Sota Watanabe (@WatanabeSota) September 18, 2025

He added that the long-term vision is for Japan to stand as a global leader in blockchain. Just as the country exported manufacturing and culture, Startale aims to export blockchain infrastructure. To achieve this, the firm is building a team that blends engineering expertise with business development and partnerships.

Investment Story: Resilience Amid Headwinds?

The broader Layer-2 market is seeing slowing capital inflows. Existing tokens also struggle to sustain investor appeal. How Soneium is perceived therefore matters. Watanabe noted that scale and composability are now baseline features. Consequently, Startale aims to stand out through distribution channels and new user segments.

“The industry has been maturing. Competition has shifted beyond existing crypto users to entirely new user segments who have never engaged with crypto before. The number of companies moving on-chain in 2025 makes this clear. Startale and Astar have worked on this since 2023. We are good at securing distribution channels, and that becomes a moat.”

He cited activity data: as of September 2025, Soneium had processed over 295 million transactions (OKLink showed 297.16 million). It averaged roughly 90,000 daily active addresses and more than 4.8 million addresses in total. It also recorded over 350,000 account-abstraction operations. These figures, therefore, demonstrate scale.

However, L2BEAT’s Total Value Secured rankings show Arbitrum and Base securing tens of billions in assets, underscoring the gap. Moreover, academic research such as Optimistic MEV in Ethereum Layer 2s highlights how MEV extraction and spam loads vary across Arbitrum, Base, and Optimism. This frames Soneium’s growth not only in raw numbers but also in the quality of usage.

At the same time, Flashbots analyzed spam loads across OP-Stack rollups, reminding observers to weigh quality alongside throughput. Asked which metrics matter most—TVL, user base, or application growth—he instead pointed to distribution channels. In his view, securing new pipelines for adoption is a more durable moat than chasing raw numbers.

Token Design: Sustainability or Sticking Point?

Soneium currently uses ETH as gas. But questions remain about native tokens and sustainable revenue. Watanabe acknowledged that a native token could arrive later, an issue tied to U.S. SEC scrutiny of Layer-2 “independence.”

For now, he stressed that sustainable revenue must come from sequencer fees, joint ventures, and compliance-driven services. Token incentives, by contrast, are short-lived. The U.S. Securities and Exchange Commission issued KPI-disclosure guidance that calls for clarity on growth and value creation. Therefore, Watanabe emphasized reinvesting sequencer revenues, joint-venture income, and account-abstraction activity back into the ecosystem instead of relying on quick token incentives.

“The Layer-2 ecosystem has matured quickly. Differentiators like scale, composability, and protocol-level innovation are now baseline requirements. Simply launching with a bridge or a DEX isn’t enough. Our approach is to secure distribution, expand into new user bases, and reinvest sequencer and JV revenues into the ecosystem to support long-term growth.”

Sony’s Edge: Catalyst for Native Demand?

Soneium’s TVL still leans on bridged assets. DeFiLlama shows this reliance clearly, in contrast to the more diversified liquidity profiles of Arbitrum and Optimism.

Nevertheless, Sony’s IP provides a consumer channel few chains can match. Watanabe outlined plans to tokenize music, film, and gaming content. He also highlighted wallets, compliance tools, and account abstraction to make experiences seamless.

“Startale is working on entertainment and media use cases on top of Soneium. We offer opportunities to tokenize music, film, and gaming with ecosystem builders. We also provide wallets, account abstraction, and compliance tools that enable these fan experiences and monetization models. This drives native demand because users engage with content they love, not speculation.”

Between Centralization and Decentralization

Soneium still runs a centralized sequencer and a centralized fraud-proof authority. L2BEAT already flags these as governance risks. Arbitrum’s DAO, for instance, enforces timelocks on upgrades. Meanwhile, Base remains tied to Coinbase through its sequencer. In this context, Soneium’s phased approach looks like a deliberate balance between usability and compliance.

“Pure decentralization without usability won’t achieve mass adoption. Complete centralization defeats the purpose of Web3. We began with a centralized sequencer for stability and scale. From there, we are upgrading the network step by step toward more open and eventually decentralized models.”

He cited the Yoake concert app, where fans voted on-chain without realizing it. This example shows how invisible UX can merge compliance with Web3 capabilities.

Enterprise Strategy in Asia: Trust as a Pillar?

In Japan, Singapore, and Hong Kong, enterprises prioritize auditability and predictable costs. For a Sony-aligned L2, trust is central. Watanabe described three pillars: regulatory-first infrastructure, cross-border scalability, and developer-friendly integration. Startale calls this framework Entertainment Tokenized Assets (ETA). It packages programmable rights and royalties around cultural IP. Thus, enterprises can adopt blockchain without sacrificing compliance or user trust.

“Our strategy focuses on enabling enterprise adoption, and Soneium is a key part of that. Enterprises care most about three pillars: regulation with robust security, scalability across Asia and beyond, and seamless infrastructure such as wallets and account abstraction.”

Connecting Japan’s Strengths to Capital Markets

Startale and SBI formed a joint venture to launch tokenized stock and RWA markets. SBI Holdings published a detailed release on the initiative. Watanabe argued that Japan’s combination of regulatory clarity, trusted institutions, and cultural IP provides an advantage in shaping tokenization at scale.

“Japan has a unique combination of strengths that can shape the future of tokenization. Our regulatory clarity, trusted financial institutions, and globally influential cultural IP put us in a position few other markets can match. Our broader vision is to make Japan a model for how tokenized markets can work at scale.”

Managing Settlement Lags and Price Gaps

Tokenized assets in other contexts revealed basis risk from gaps between on-chain execution and off-chain settlement. Watanabe said Startale will apply safeguards modeled on traditional markets, including circuit-breaker-style pauses and clear user disclosures calibrated with regulators.

“Settlement lags and pricing gaps are real challenges in tokenized markets, and our principle is simple: Startale builds infrastructure that applies regulated-market standards. Automated safeguards can pause trading when discrepancies exceed thresholds, calibrated with regulators and modeled on existing standards for circuit breakers.”

Japan’s Financial Services Agency finalized rules under the Payment Services Act and the Financial Instruments and Exchange Act (FIEA). In addition, Reuters reported that further amendments could expand the scope of financial instruments.

Stablecoin Interoperability and UX

By 2025, multiple regulated stablecoins are expected to coexist—from bank-backed instruments to USDC and GHO—raising UX challenges. Watanabe said infrastructure should absorb complexity, not users. With account abstraction, users can rely on familiar log-ins, recovery flows, and gasless transactions. Chambers & Partners outlined how Japan’s stablecoin regime aligns with this compliance-first design.

“We expect multiple bank-backed and regulated stablecoins to coexist, and we design for interoperability across them. Our philosophy is simple: Web3 should feel as intuitive as Web2. Behind the scenes, our account abstraction framework removes friction—users can log in with familiar credentials, recover accounts easily, and transact without worrying about gas.”

Tokenization and the Role of ETFs

Japan’s blockchain market could expand materially this decade. This raises questions about whether tokenization will reduce reliance on ETFs and proxy stocks. Watanabe argued that direct, fractional, programmable exposure with real-time settlement can streamline corporate actions and change how liquidity is packaged.

“Tokenization fundamentally redefines the role of ETFs and proxy stocks by removing the need for layered financial wrappers. A token can directly represent the underlying asset with real-time settlement, transparent ownership, and global reach. Smart contracts enable automated market making and peer-to-peer trading across time zones, while treasuries can automate dividends and governance rights, lowering costs and operational risk.”

Regulatory and Policy Strategy

Global frameworks are evolving. The European Commission published Markets in Crypto-Assets (MiCA) texts. Japan’s Financial Services Agency finalized domestic guardrails. The U.S. Securities and Exchange Commission also issued KPI-disclosure guidance. Watanabe framed Startale’s infrastructure as compliant by design. Consequently, he argued that Japan can serve as a model for balancing innovation with trust.

“We were early supporters of Japan’s Payment Services Act and the Financial Instruments and Exchange Act because they provide a clear framework that balances innovation with trust. Our job is to ensure our infrastructure meets not only Japan’s standards but also MiCA, SEC guidance, and other global rules. Ultimately, our goal is for Japan to demonstrate that Web3 can be both innovative and compliant—setting the standard for global adoption.”

Watanabe’s remarks portray Soneium as a Layer-2 designed for enterprises under Japan’s regulatory clarity and supported by institutional partnerships. The strategy emphasizes distribution channels, entertainment-driven demand, phased decentralization, and market safeguards. For investors and enterprises, the test is whether headline growth converts into durable adoption—and whether Japan’s framework can credibly serve as a template for global tokenization.

[ad_2]