Today, enjoy the Lightspeed newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Lightspeed newsletter.

Howdy!

For today’s edition, I dove into Solana’s technical inner workings, which turned my brain into a ball of magma for a few hours.

If you need me for the rest of the day, I’ll probably be lying on a couch somewhere, contemplating the meaning of existence. Anyways:

How v1.18.15 could make Solana more efficient

Solana’s block-creating software just experienced a pretty consequential update, but there’s no way to tell how many validators are actually using it.

Over the past week, Solana validators have been upgrading to new software, version 1.18.15. The most important piece here is the creation of a central scheduler meant to make the block creation process more efficient.

However, this feature is not enabled by default, and whether validators are using the scheduler can only be discerned through self-reporting.

Roughly 90% of validators have upgraded to the new software, and many have reported using the scheduler. The largest Solana validator, Coinbase, is using v1.18, but the firm didn’t return my request for comment on whether they’ve turned on the scheduler.

The central scheduler runs an algorithm that looks ahead and plans for incoming transactions to be processed in such a way that they don’t conflict with each other, theoretically making the blockchain more efficient at handling large loads of data.

Solana is very concerned with time. The network’s largest time denominator is an epoch, which is roughly equivalent to two days. During every epoch, different validators become leaders for slots of time dependent on how much stake they control. When a validator is the so-called leader, their job is to pack transactions into blocks and broadcast them to the rest of the network. This all happens with a large emphasis on speed, because again, Solana cares a lot about time. This process can be called block production, or, for the more technically minded, the “banking stage.”

The way this banking stage has historically worked is by four independent threads taking the top 128 transactions from their local queues and trying to process them. During high-volume moments like competitive NFT mints for instance, these independent threads are shown a lot of high-priority transactions, and this can create conflicts that make Solana less efficient. There are ways the blockchain’s developers have tried to solve this problem before, but the central scheduler is a more permanent solution — or that’s how it’s being talked about, at least.

The central scheduler and its algorithm basically sits between all the transactions and the threads and decides which transactions should go to which threads to minimize conflicts.

It’s hard to find data on how much this central scheduler is improving things, but anecdotal evidence seems positive so far. Helius’ Mert Mumtaz and a few others have said the scheduler is letting validators capture more fees. Solana Compass noted a better alignment between how fees are paid and how many computing resources transactions require — resulting in hopefully more user transactions and less spam making it into blocks.

“Before [the] central scheduler, priority fees were not very useful. If you really wanted a tx to land, your best shot was Jito which had a working fee market. Now, higher priority actually helps!,” Nate, who runs the Aurora validator but declined to share his last name, told me in a text.

The central scheduler is also interesting to me because it was a feature released by Anza, the software development firm spun out of Solana Labs.

When launching in January, Anza said the new firm, which is heavily populated with former Labs executives engineers, represented another step in Solana’s decentralization. Fortune reported that Anza’s launch was partly a response to the SEC’s allegations that SOL is an unregistered security.

— Jack Kubinec

Zero In

Some validators have reported anecdotally that the new scheduler has increased their block rewards. It’s too early to conclusively say one way or another, but early data looks promising on that front.

This chart from Solana Compass shows average block rewards for roughly the past six months. As you can see, the current epoch has seen among the highest rewards of the last dozen despite only being 75% complete.

It would be poor statistics to extrapolate this epoch more broadly, but if the validator block rewards keep going up in future epochs, validators may have the central scheduler to thank.

— Jack Kubinec

The Pulse

Back in January, the Solana network introduced token extensions with features like confidential transfers, interest accumulation, and programmable restrictions on transferability, specifically designed for Real World Assets (RWAs). Reflexivity Research published a comprehensive report concerning RWAs on Solana, which the official Solana account summarized in a detailed thread on X.

Traditionally, managing RWAs like US Treasurys, real estate, and private credit involves significant friction, inefficiency, and limited accessibility, leading to higher costs and reduced liquidity for investors. To address these challenges, Solana’s ecosystem includes yield-bearing assets through services such as Ondo Finance and Maple Finance, as well as non-yield assets via Parcl and HomebaseDAO. Additionally, Credix offers private credit solutions, allowing stablecoin investments into liquidity pools for FinTech companies in emerging markets.

Reflexivity’s report says that despite the success of centralized stablecoins, the tokenization and adoption of other RWAs have been slower. However, recent trends show that things are shifting, with the total value locked in RWA protocols increasing from approximately $2 billion at the start of 2023 to nearly $8 billion today. It seems that the market is showing a clear preference for yield-bearing RWAs, which currently capture over 90% of the total value locked at time of publication.

On social media, contributors chatted about the increased efficiency and accessibility Solana brings to these markets. Tweets from users like @DegenLegends emphasize the value for future investors, while others like @JordanOnChain and @jimmyhumania express optimism about the growing RWA ecosystem.

— Jeffrey Albus

One Good DM

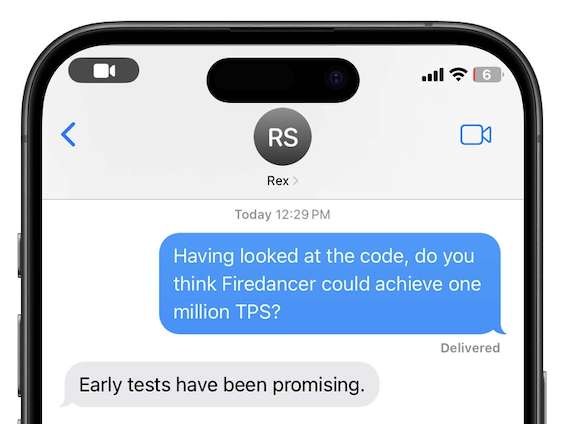

A message from Rex St. John, developer relations at Anza: