Democratic Senator Kirsten Gillibrand has played a significant role in the GENIUS Act, a bipartisan bill that, if passed, will regulate the use of stablecoins in the United States. But, as a lead co-sponsor of the bill, Gillibrand’s involvement in its passage comes with its share of controversy.

In an investigation into campaign financing during the 2024 federal election cycle, BeInCrypto found that the combined donations from individuals associated with prominent crypto firms—including Coinbase, Ripple, Uniswap Labs, Andreessen Horowitz, and dYdX Trading—exceeded $200,000 for the New York Senator’s campaign.

The GENIUS Act: A Step Closer to Federal Stablecoin Regulation

On Monday night, the Senate advanced the GENIUS Act concerning stablecoins by approving a procedural vote. This vote was for cloture, which limits debate and prevents a filibuster.

Cloture requires the support of 60% of senators present. The bill still needs a full Senate vote to pass. To reach the required threshold, 16 Democrats voted in favor of the move, with Senator Gillibrand leading the initiative.

The road to getting there was difficult. During a previous Senatorial reunion on May 8, the same vote failed to advance to the final round of discussions. Nine Democratic senators – including Gillibrand – retracted their initial support of the bill during that round of debate.

Opposition to the bill stemmed from several concerns. These included inadequate consumer protections, potential risks to national security, and apprehension regarding how the legislation might be affected by or even exacerbate issues related to President Donald Trump’s involvement in different crypto ventures.

During this latest round, some of those Senators, like Delaware Senator Blunt Rochester, decided to greenlight the bill, while others, like New Jersey Senator Andy Kim, remained unconvinced.

What’s certain is that the US is closer than ever to national crypto legislation on stablecoins. Senator Gillibrand’s efforts significantly influenced the road to get here. Her negotiating skills have been instrumental in securing sufficient Democratic support for the bill at every step.

However, her connections to the crypto industry raise questions about her motivations for advocating its passage.

Which Crypto Firms Contributed to Gillibrand’s Campaign?

Gillibrand has been a Senator for her home state of New York since 2009. Last year, she was re-elected to office for a fourth term.

According to OpenSecrets, a non-profit organization that tracks and publishes campaign finance and lobbying data, Gillibrand received tens of thousands of dollars from individuals representing different crypto entities during the last election cycle.

The sum of contributions from donors associated with Coinbase toward Gillibrand’s 2024 election campaign. Source: OpenSecrets.

Under US federal law, corporations generally cannot donate directly to congressional campaigns. This prohibition applies to contributions from a corporation’s treasury funds.

Nonetheless, OpenSecrets monitors contributions from individuals, who are typically required to disclose their employer when donating.

Considering this information, in 2024, contributors associated with Coinbase were the tenth-largest corporate donors to Off the Sidelines, Senator Gillibrand’s leadership PAC. Together, they donated $59,900 to her re-election campaign.

Following its lead, venture capital firm Andressen Horowitz donated $57,000 to Gillibrand’s efforts. In 16th place was Uniswap Labs, where individuals contributed $48,900.

Ripple donors came in 40th place, contributing a total of $32,000. Further down the list was dYdX Trading, donating $19,200.

Gillibrand received $217,000 in total from these different crypto entities. Searching through the Federal Election Commission (FEC) database, BeinCrypto revealed the identities of some of these independent contributors.

Key Individual Donors to Gillibrand’s Leadership PAC

According to data compiled by the FEC, Gillibrand’s leadership PAC received $366,043.12 worth of individual contributions between 2023 and 2024.

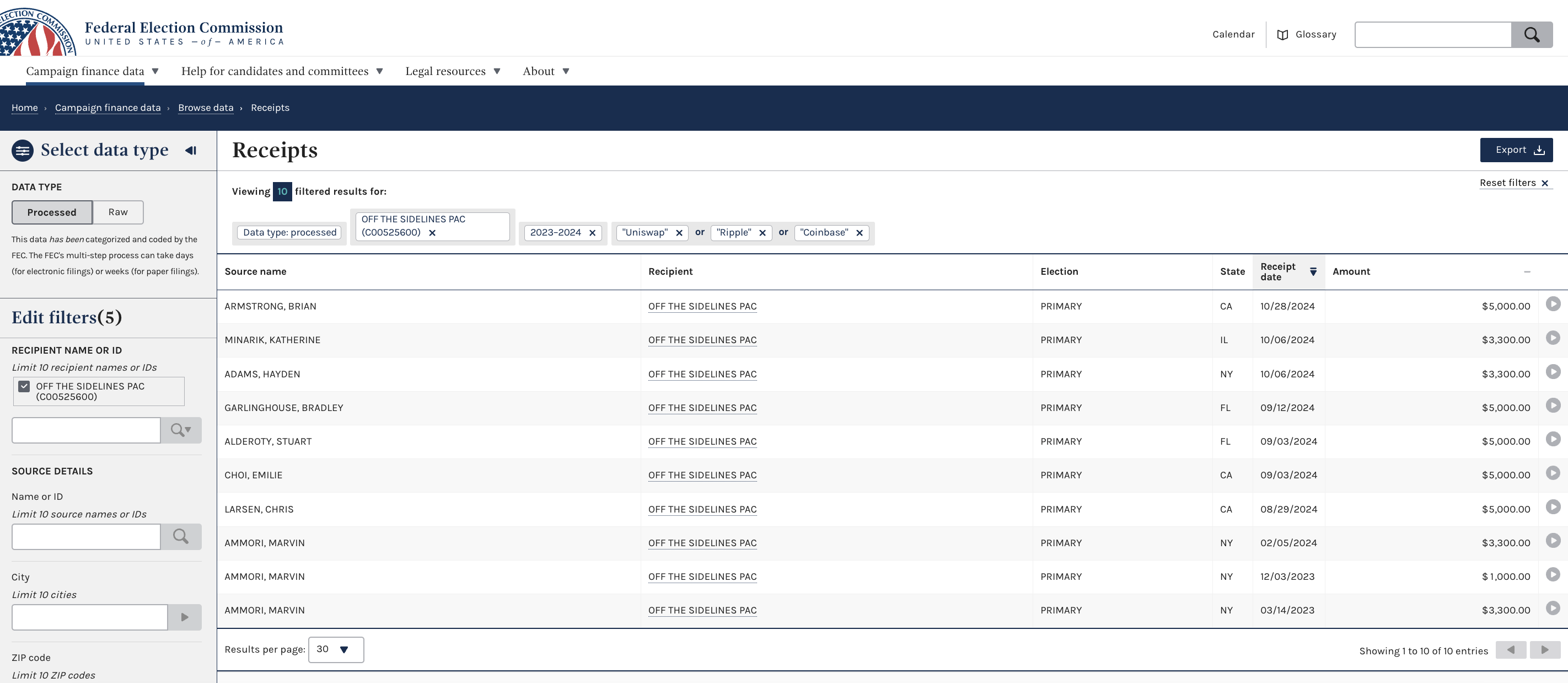

Combining these contributions, BeInCrypto found 10 individual donations from prominent figures who listed Coinbase, Ripple, and Uniswap Labs as their employers.

Individual contributors from Coinbase, Ripple, and Uniswap who donated to Off the Sidelines. Source: FEC.

Under the Federal Election Campaign Act, individuals are generally limited to donating $5,000 per calendar year to a traditional Political Action Committee (PAC). This limit applies per election cycle, meaning separate donations can be made for primary and general elections.

Among Coinbase-associated names were CEO Brian Armstrong and Chief Operating Officer Emilie Choi, who donated a total of $8,300 to Gillibrand’s leadership PAC during last year’s primary elections.

Meanwhile, Ripple Labs CEO Bradley Garlinghouse, Chief Legal Officer Stuart Alderoty, and Co-founder Chris Larsen each donated $5,000.

In the case of Uniswap, CEO Hayden Adams and Chief Legal Officer Katherine Minarik each donated $3,300. Marvin Ammori, also a Chief Legal Officer, donated a sum of $7,300 on three separate occasions.

BeinCrypto found no individual contributions from dYdX or Andressen Horowitz employees to Gillibrand’s leadership PAC.

Is Crypto Funding Influencing Congressional Impartiality?

Campaign financing from prominent names in the crypto industry, whether from political action committees or individual contributors, became a household activity during last year’s elections.

According to a report by Public Citizen, Behemoths like Coinbase and Ripple Labs each contributed $50 million to Fairshake, the crypto super PAC that spent $119 million during the 2024 federal elections.

In fact, OpenSecrets labeled Fairshake as one of the few Super PACs that qualify as bipartisan committees. Crypto contributions toward Republican and Democratic candidates alike demonstrate the industry’s broad range of investments to achieve a brighter regulatory future for crypto in Washington.

But they also raise questions over the impartiality of congressional representatives like Senator Gillibrand when it comes to voting on legislation that will directly impact the businesses of the very actors who contributed to their political campaigns.