Tokenized Treasury funds pushed closer to the $9 billion mark this week, rising 0.94% over the past seven days as onchain demand for yield-bearing government debt continues to hold firm.

Tokenized Treasury Market Inches Higher as Issuers Jockey for Share

Data compiled from the tokenized Treasury sector, according to rwa.xyz stats, shows total value climbing to roughly $8.99 billion, supported by a modest increase in weekly yields, with the average seven-day annual percentage yield (APY) sitting at 3.71%.

The market now spans 60 active products and more than 57,600 holders, which highlights how quickly blockchain-based access to U.S. government debt has moved from niche experiment to institutional-grade infrastructure. Essentially, tokenized Treasuries are digital representations of short-term U.S. government debt or money market funds issued and settled on blockchains.

Tokenized U.S. Treasury funds are now closing in on the $9 billion zone. Source image via rwa.xyz on Dec. 16, 2025.

They allow investors to hold exposure to Treasuries in token form, enabling near-instant settlement, programmability, and compatibility with onchain financial applications. Demand has grown as investors look for dollar-based yield without leaving crypto rails, particularly during periods when traditional finance (TradFi) fixed-income products remain less accessible or slower to settle.

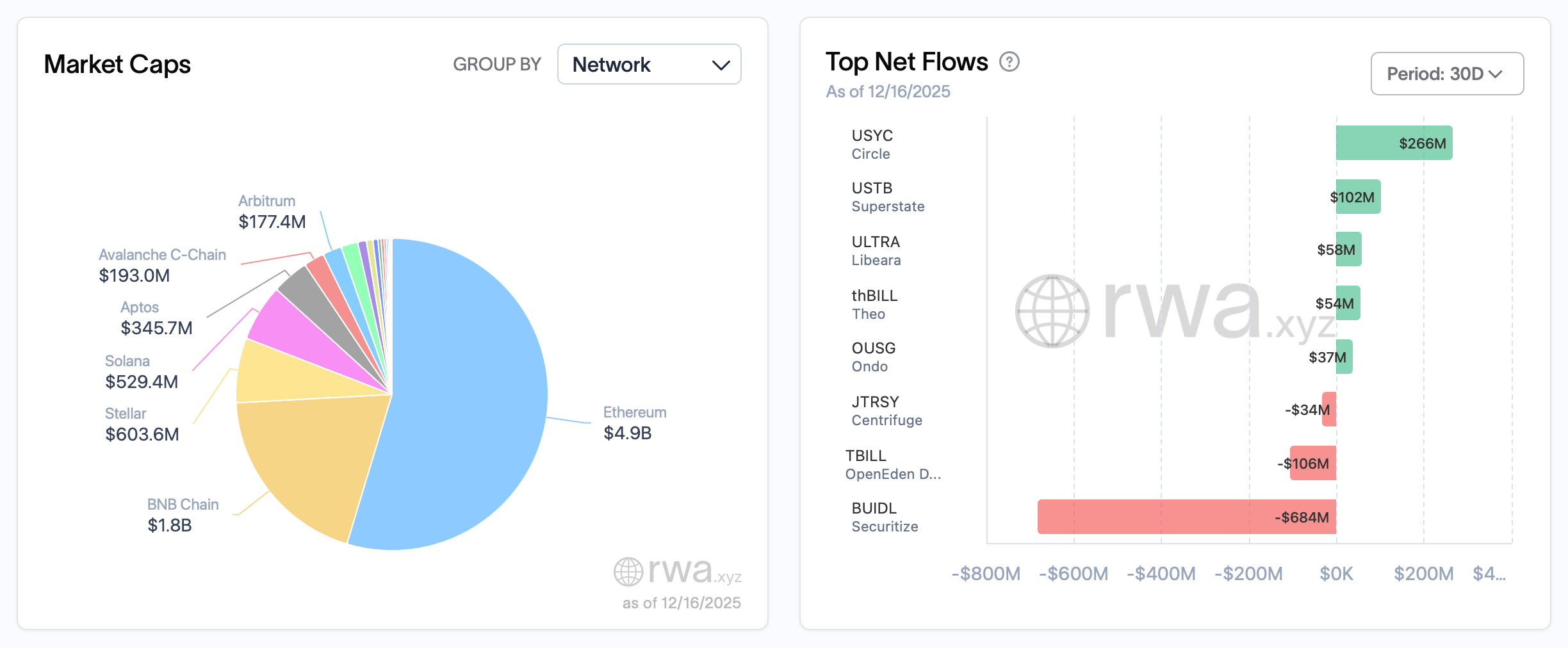

Ethereum continues to dominate the tokenized Treasury sector’s blockchain footprint, hosting approximately $4.9 billion in tokenized Treasury market capitalization. BNB Chain follows with about $1.8 billion, while Stellar accounts for roughly $603.6 million. Solana holds around $529.4 million, Aptos stands near $345.7 million, and Avalanche’s C-Chain carries close to $193 million. Arbitrum rounds out the notable networks with about $177.4 million, illustrating how Treasury tokens are spreading across both major and emerging blockchains.

Market caps by blockchain and top net flows over the last month. Source image via rwa.xyz on Dec. 16, 2025.

Rwa.xyz’s data dashboard shows net flows over the past month reveal a market in motion rather than one moving in a single direction. Circle’s USYC led inflows with roughly $266 million, followed by Superstate’s USTB at $102 million and Libeara’s ULTRA at $58 million. Theo’s thBILL added about $54 million, while Ondo’s OUSG saw $37 million in net inflows. On the other side of the ledger, Securitize’s BUIDL recorded net outflows of about $684 million, Openeden’s TBILL dropped $106 million, and Centrifuge’s JTRSY shed roughly $34 million, signaling capital rotation rather than a wholesale retreat.

Among platform issuers, Securitize remains the largest by total value at approximately $1.9 billion, though it posted a 26.61% decline over the past 30 days, largely tied to BUIDL outflows. Ondo follows with $1.5 billion and a 3.45% monthly increase, while Circle holds about $1.3 billion after a strong 25.18% gain. Libeara manages roughly $841.8 million with a 7.81% increase, and Franklin Templeton’s BENJI platform sits near $819.1 million despite a 3.64% pullback.

Wisdomtree this week controls about $711.5 million in tokenized Treasuries and recorded a 1.45% increase over the past month. Superstate’s footprint reached $613 million, marking a sharp 29.25% rise. Fidelity Investments holds $264.1 million after a 12.19% increase, while Centrifuge slipped 11.12% to roughly $263.1 million. Theo rounds out the top ten with $193 million and a 36.99% jump over 30 days.

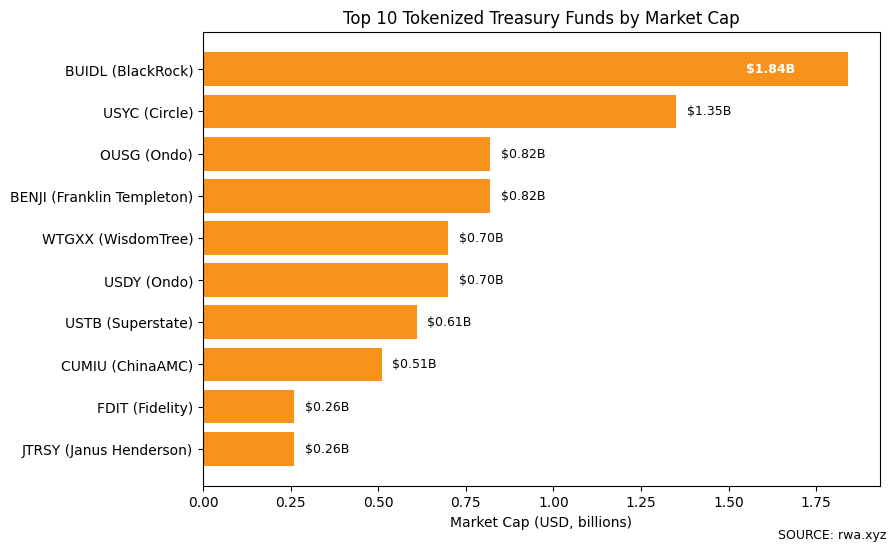

At the product level, Blackrock’s USD Institutional Digital Liquidity Fund (BUIDL) remains the single largest tokenized Treasury product, with a market cap of about $1.84 billion and a 7D APY of 3.70%. Circle’s USYC follows at roughly $1.35 billion and leads yields among the top products with a 4.79% APY. Ondo’s Short-Term U.S. Government Bond Fund (OUSG) holds about $822.6 million with a 3.59% yield.

Also read: Visa Expands US Settlement Rails With USDC for Institutional Payments

Franklin Templeton’s Onchain U.S. Government Money Fund (BENJI) sits close to $819.1 million with a 3.69% APY, while Wisdomtree’s Government Money Market Digital Fund (WTGXX) accounts for about $704.9 million at 3.68%. Ondo’s USDY follows closely with $702.8 million and a matching 3.68% yield, reflecting tight competition among top issuers.

Superstate’s USTB holds roughly $613 million with a 2.75% APY, while ChinaAMC’s CUMIU product stands at about $510.1 million. Fidelity’s Digital Interest Token (FDIT) accounts for $264.1 million, and Janus Henderson’s JTRSY rounds out the top ten at approximately $263.1 million with a 4.09% yield, one of the higher returns in the group.

The steady climb toward $9 billion highlights why tokenized Treasuries continue to attract attention. They offer a bridge between traditional finance and DeFi infrastructure, combining perceived safety with onchain efficiency. As issuers refine products and investors grow more comfortable holding government debt on blockchains, tokenized Treasuries are increasingly positioning themselves as a core building block of the digital dollar economy.

FAQ 🧠

- What are tokenized Treasury funds?They are blockchain-based tokens that represent exposure to U.S. government debt or Treasury-backed money market funds.

- Why are investors using tokenized Treasuries?They provide dollar-based yield with faster settlement, transparency, and onchain usability.

- Which blockchain hosts the most tokenized Treasuries?Ethereum leads the sector, hosting roughly $4.9 billion in market value.

- How large is the tokenized Treasury market today?The sector is valued at nearly $9 billion after growing 0.94% over the past week.