[ad_1]

Blockchain protocol MakerDAO (MKR) continues to see significant gains, maintaining a strong upward trend throughout the year. MKR has seen significant growth of over 358%, accompanied by positive metrics reflecting increased adoption and usage of the protocol.

In addition, upcoming voting initiatives aim to further increase the platform’s benefits for its stakeholders.

MakerDAO Announces Plans For Rate System Changes

In a recent announcement, MakerDAO stated that it closely monitors developments in the cryptocurrency market and has gained a better understanding of the impact of recent proposals.

As a result, the protocol is recommending the next set of changes to its rate system. MakerDAO emphasized that further adjustments will likely be introduced shortly, contingent upon market dynamics, such as prices, leverage demand, and the external rate environment encompassing centralized finance (CeFi) funding rates and decentralized (DeFi) effective borrowing rates.

Related Reading: US Spot Bitcoin ETFs Experience Record Outflows, Losing $740 Million In Three Days

The protocol further noted that the Maker rate system will be adjusted accordingly if the external rate environment continues to exhibit signs of decline.

Efforts are underway to update the rate system language within the Stability Scope, including developing a new iteration of the Exposure model. These updates aim to ensure that the system can adjust rates more gradually and effectively in the future.

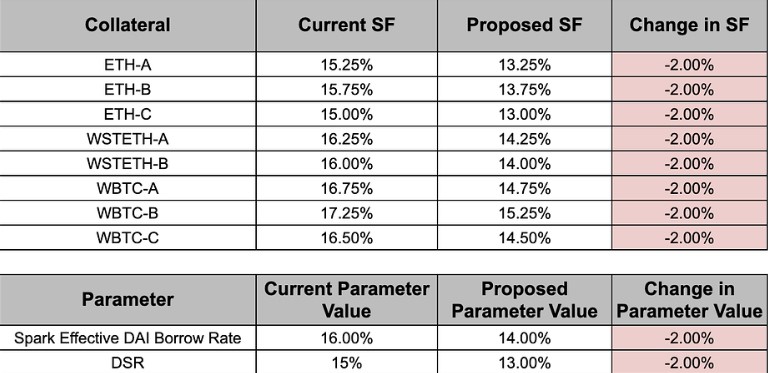

Based on recommendations from BA Labs, a blockchain infrastructure provider, the Stability Facilitator proposes various parameter changes to the Maker Rate system, which will be subject to an upcoming Executive vote.

As shown in the table above, the proposed changes include reducing the Stability Fee by 2 percentage points for various collateral types such as ETH-A, ETH-B, ETH-C, WSTETH-A, WSTETH-B, WBTC-A, WBTC-B, WBTC-C. In addition, the Dai Savings Rate (DSR) and the Effective DAI Borrowing Rate for Spark will also be reduced by 2 percentage points.

However, one active protocol user offered an alternative viewpoint, suggesting using the demand shock opportunity to expand the net interest margin. While agreeing with the proposed 2% interest rate reduction for borrowers, the user advocates for a larger 4% reduction in the DSR, which he believes will further benefit MakerDAO’s net interest margin.

Ultimately, the outcome of the voting process will determine whether these proposed changes are implemented and benefit the stakeholders of MakerDAO. Further decisions regarding rates and fees will be made based on the results.

Market Cap Skyrockets

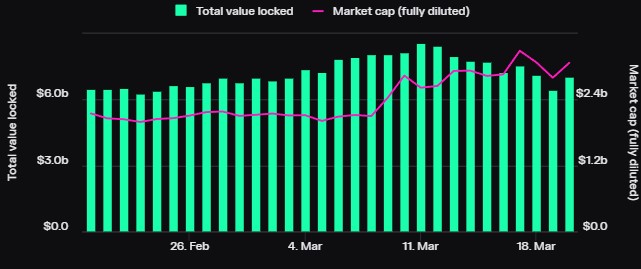

According to data from Token Terminal, MakerDAO has demonstrated significant growth and positive performance across various key metrics over the past 30 days.

In terms of market capitalization, MakerDAO’s fully diluted market cap has reached approximately $3.07 billion, reflecting a notable increase of 40.9% over the past 30 days. The circulating market cap is around $2.82 billion, showing a similar growth rate of 41.1%.

On another note, the total value locked (TVL) in MakerDAO has increased by 10.1% over the past 30 days to approximately $7.05 billion.

The token trading volume for MakerDAO has surged 126.6% over the past month, reaching approximately $4.35 billion. This increase in trading volume suggests heightened market activity and interest in the protocol.

In terms of user activity, MakerDAO has seen an increase in daily active users, with an increase of 32.2% to 193 users. On the other hand, weekly active users decreased by 22.6% to 783 users. However, monthly active users have shown a positive growth rate of 10.0%, reaching 2.88k users.

Short-Term Outlook For MKR

Regarding price action, MKR is currently trading at $3,158, reflecting a 4.8% growth in the past 24 hours, 10% in the past seven days, and an impressive 49% increase in the past fourteen and thirty-day time frames.

The token has encountered a support wall for the short term at $3,048. This support level is significant for the token’s growth prospects. Another key support level is at $2,884, which further contributes to the token’s short-term stability and potential growth.

Related Reading: Crypto Expert Reveals The Possibility Of Bitcoin Reaching $500,000

On the other hand, the nearest resistance level is observed at its 28-month high of $3,321. This level represents the highest point reached by the token since November 2021.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]