Ethereum and Bitcoin, two of the world’s largest blockchains, are facing significant challenges in scaling their networks. As more users and transactions move to layer two (L2) solutions, these systems could undermine the security and sustainability of the base layer (L1), with fees and rewards for miners and validators dwindling.

Growing L2 Adoption Raises Concerns for Base Layers

Both Ethereum and Bitcoin are grappling with a fundamental issue: how to scale their networks to accommodate the growing number of users without sacrificing security or decentralization. Recently, Cybercapital founder Justin Bons presented his theory that Layer 2 (L2) platforms are “parasitic” to Ethereum. Bons has long cautioned about the growing influence of Ethereum L2 solutions on the main chain, as well as on other blockchains adopting L2 scaling methods. The following is an overview of the dilemma confronting Layer 1 (L1) blockchains such as Bitcoin and Ethereum.

In their current state, neither blockchain can process transactions at speeds comparable to centralized systems like Visa or Mastercard, and the fees for using the base layer can be prohibitively high. Since 2015, modifying Bitcoin’s consensus layer to improve scalability has sparked ongoing debate, leading advocates to increasingly favor L2 solutions like the Lightning Network. Ethereum core developers have likewise leaned toward enabling L2s like Arbitrum, Optimism, Base, and Linea to thrive.

These L2s promise faster transactions and lower fees, but they also introduce a new set of challenges. Layer two solutions, by design, offload transactions from the base layer, or L1, onto a secondary layer. For Ethereum, L2s like Arbitrum and Optimism bundle multiple transactions into a single L1 transaction, reducing costs and increasing throughput. For Bitcoin, the Lightning Network allows users to transact off-chain, only settling on the main blockchain when absolutely necessary. While these solutions have been celebrated for enhancing transaction speeds and reducing fees, they present a potential threat to the security and economic model of L1 blockchains.

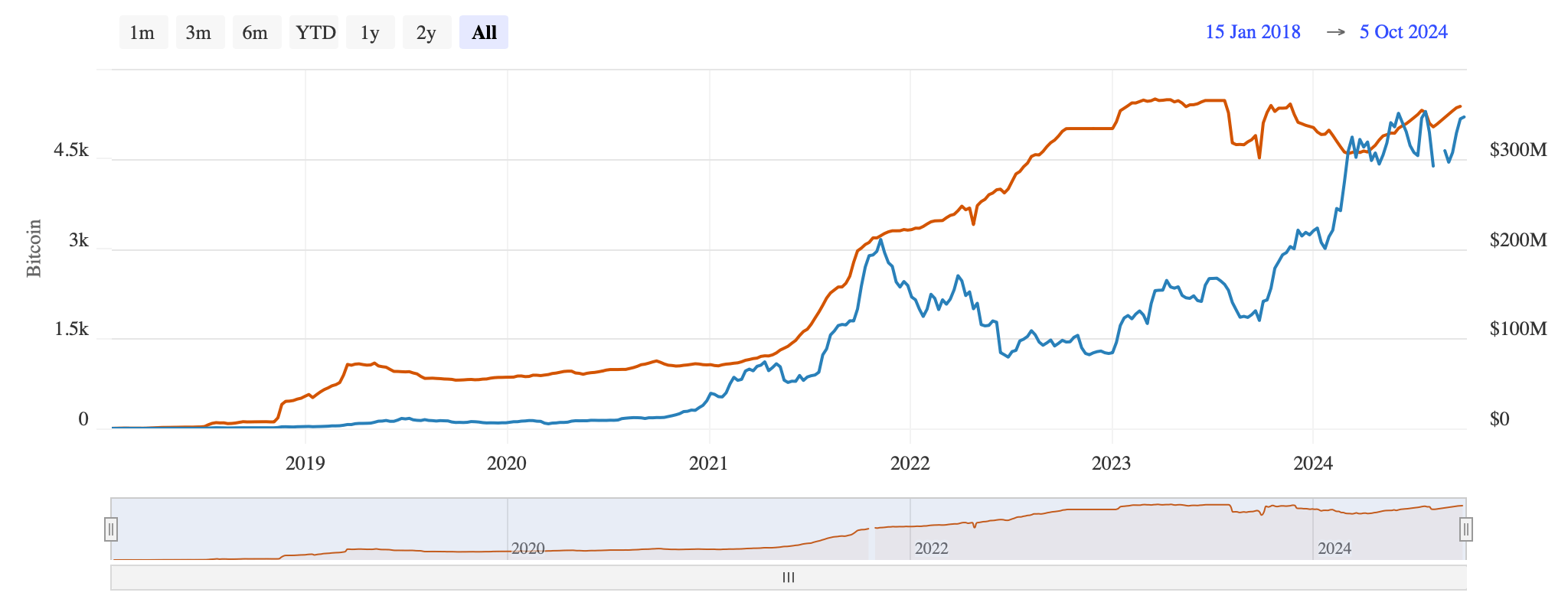

Rent Paid to L1 (Ethereum) according to growthepie.xyz.

Ethereum’s layer one once benefited significantly from the activity on these L2s. In November 2023, L2 solutions like Arbitrum, Base, Optimism, and Linea contributed an estimated $200,000 in daily rent fees to Ethereum’s L1. By December, these fees soared to as much as $1.5 million per day. However, the financial support has since dwindled. From December 2023 to March 2024, L2 payments to Ethereum fell to under $250,000 per day, only to spike to around $1.7 million at the start of March. By the end of April 2024, these fees dropped drastically, with less than $10,000 per day being paid to the Ethereum mainnet. This decline raises questions about the long-term sustainability of Ethereum’s L1 infrastructure if most activity shifts permanently to L2s.

Bitcoin faces a similar issue. Once bitcoin (BTC) is moved to the Lightning Network or other Bitcoin sidechains, transactions bypass the main chain, leaving miners without the fees they would traditionally earn from processing transactions. The economic security of Bitcoin relies on the incentives provided to miners, both through transaction fees and the block reward, which halves roughly every four years. As fees move off-chain, there is growing concern that Bitcoin miners may no longer have sufficient economic motivation to continue securing the network, making it potentially less secure over time.

As of Oct. 6, 2024, the capacity of Bitcoin’s Lightning Network (LN) is approximately 5,360 BTC, according to data from bitcoinvisuals.com. Miners only receive fees when bitcoin (BTC) is moved on or off Lightning Channels, meaning that no fees are paid to them while transactions occur off-chain on LN. Similarly, wrapped bitcoin (WBTC) and other tokenized forms of bitcoin do not contribute significant fees to the L1 once they have been converted.

Alongside Bons, Nikita Zhavoronkov, Blockchair’s lead developer, has voiced worries regarding Bitcoin’s shrinking security budget. The fundamental problem lies in the fact that both Ethereum and Bitcoin were designed with the expectation that users would pay to use the base layer. These fees are a crucial part of maintaining the security of the blockchain, especially as block rewards decrease over time. If too many transactions occur on L2s, the L1 could suffer from insufficient fees, reducing the incentives for validators and miners to secure the network.

L2 solutions like Arbitrum and Optimism, while providing immediate benefits in terms of scalability and cost efficiency, could undermine the long-term viability of Ethereum’s L1 if they are not designed to contribute sufficiently to the base layer. Likewise, Bitcoin’s Lightning Network, while it addresses some of Bitcoin’s scalability concerns, removes miners from the transaction loop entirely, making BTC’s security model reliant solely on diminishing block rewards.

While there is no doubt that L2 solutions provide a temporary fix to the scalability issues of both Ethereum and Bitcoin, they raise important questions about the long-term health of these networks. If L1 blockchains rely on a steady stream of fees to incentivize miners and validators, and if those fees are increasingly being captured by L2 solutions, the economic model of these blockchains could become unbalanced.

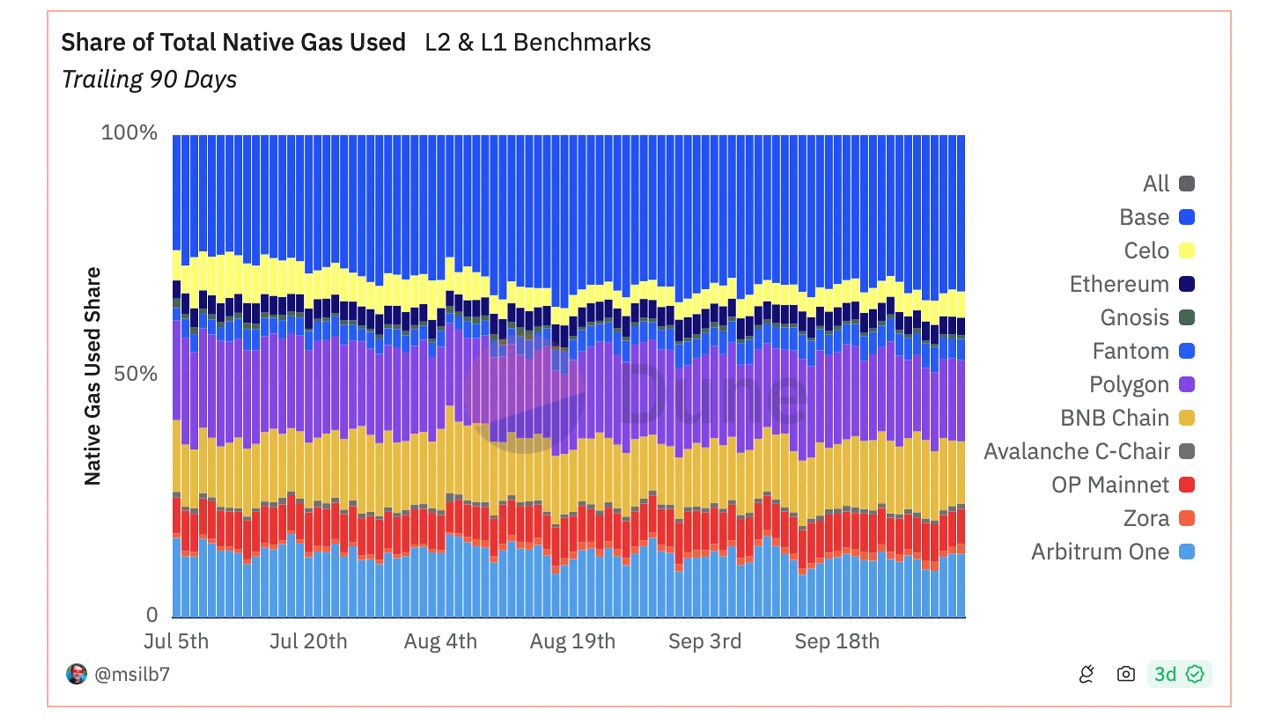

Dune.com statistics on the Share of Total Native Gas Used -L2 & L1 Benchmarks as of Oct. 6, 2024.

The ultimate goal for both Ethereum and Bitcoin has always been to create decentralized, secure networks that can handle global demand. However, if L2 solutions continue to pull transactions away from L1 without providing sufficient fees to the base layer, the security and decentralization of these networks could be at risk. Finding a balance between L1 and L2 activity is crucial for the future of blockchain scalability. The matter of rewards also fails to address the critiques against L2 concepts, which are often seen as significantly more centralized than the main chain, leaving them more vulnerable to attacks and theft.

In conclusion, while L2 solutions offer clear benefits in terms of transaction speed and cost, they also introduce significant risks to the long-term sustainability of Ethereum and Bitcoin. Without a mechanism to ensure that L2s contribute meaningfully to the base layer’s security and infrastructure, these solutions may prove to be more of a temporary workaround than a permanent solution. Both the Ethereum and Bitcoin communities will need to carefully consider how to scale their networks without compromising the fundamental principles that make them unique in the world of decentralized finance.

As mainstream adoption approaches, the urgency for Ethereum and Bitcoin communities to address these scaling issues intensifies. If a sustainable balance between L1 and L2 is not established soon, the security and decentralization of these blockchains could be jeopardized in the years to come. Resolving these challenges is crucial to maintaining the integrity of the networks and ensuring their long-term viability.

What do you think about the L2 issues the Bitcoin network and Ethereum protocol face? Tell us in the comments section below.