Following recent geopolitical events, the correlation between gold and Bitcoin prices has once again come under scrutiny by market analysts. Here’s a comprehensive dive into the relationship and its implications.

The Gold And Bitcoin Correlation

After the recent Israel-Hamas war, gold experienced a rapid uptick in its price. This shift interestingly mirrored movements in the Bitcoin market, emphasizing a revived correlation between the two assets. Skew, a reputable market analyst, shared his insights on X (formerly Twitter), noting on October 11 that “correlation has been rather loosely applicable to BTC periods of 35 days + where there’s price disconnection between both markets.”

However, only days later, on October 16, he observed a potential “re-correlation” as both Bitcoin followed the latest gold rally. Today, the statement stands stronger with Skew’s latest tweet, “BTC & gold correlation still there it seems. Gold may lead the next big move for BTC.”

In his recent insights shared in the Onramp Weekly Roundup, Bitcoin analyst Dylan LeClair emphasized the implications of the ongoing selloff in government bonds. Rising costs for long-term financing directly influence the global cost of capital, offering a valuation yardstick for various assets.

More significantly, the treasury market underpins the global financial ecosystem. Its current instability could pressure asset prices and exacerbate the pre-existing debt cycle, potentially endangering the US’s fiscal position. This precarious state contrasts sharply with the US administration’s fiscal actions, as evidenced by plans like the “WHITE HOUSE EYES $100 BILLION UKRAINE, ISRAEL AND BORDER ASK”, suggesting a lack of fiscal restraint, according to LeClair.

Gold, Real Yields, And The Changing Landscape

Further complicating matters, Bill Dudley, former president of the Federal Reserve Bank of New York, in his recent Bloomberg piece, noted the likelihood of the current cycle of quantitative tightening (QT) persisting until late 2025. This prolonged QT could heighten long-term interest rates and risk treasury market turbulence. Yet, should severe dysfunction manifest in the treasury market, the Federal Reserve might reconsider its QT trajectory.

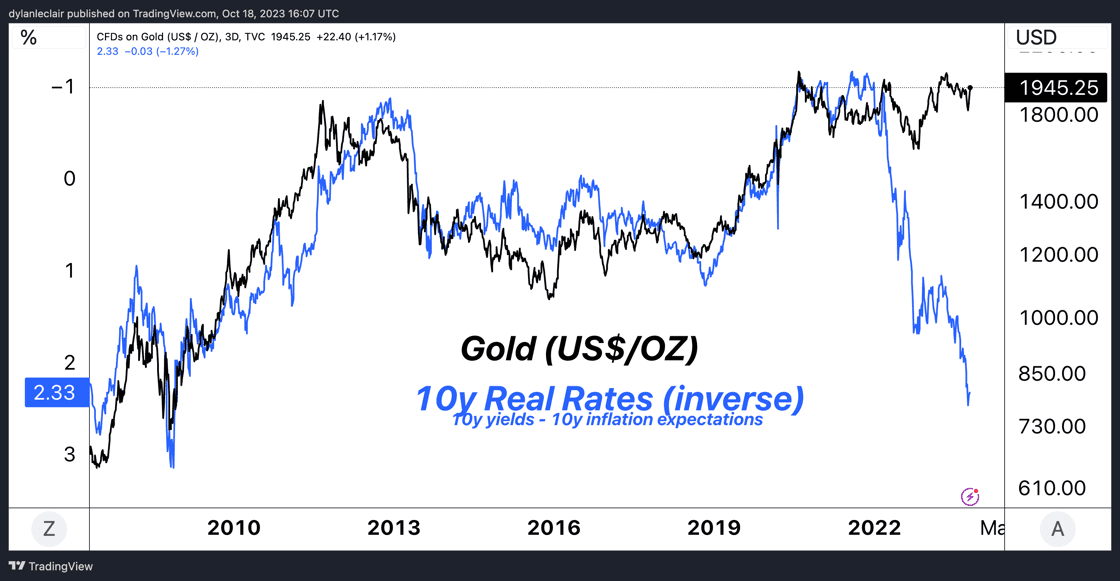

Interestingly, post the Russia-Ukraine conflict and the subsequent confiscation of Russia’s G7 reserves, gold, and real yields have shown an atypical positive correlation, challenging their historical negative relationship.

In this evolving geopolitical landscape where even G7 sovereign debt isn’t immune to confiscation, traditional ‘safe assets’ are being reevaluated. This uncertainty combined with the not-so-safe “risk free” yield from treasuries has bolstered gold’s position (and price) as a counter-risk monetary asset and may push Bitcoin on a similar trajectory.

According to LeClair:

This repositioning, however, isn’t limited to gold alone. Bitcoin, with its unique advantages and growing liquidity profile, is on a similar trajectory, albeit still in the very early stages of its monetization with a $500b market cap.

The Best BTC Price Indicator?

Under these current conditions, the price of gold may be a leading indicator for the price of Bitcoin, assuming that the correlation between the two assets continues. This would imply that Bitcoin is classified as a “safe haven” asset like gold by a majority of investors, rather than a “risk asset”.

However, this view is not shared by all. James Butterfill, the head of research at CoinShares, pointed out that the Bitcoin market has shifted its focus after the fake news regarding a spot Bitcoin ETF approval. He remarked that investors now seem to prioritize the ETF approval over macro expectations, placing less emphasis on the Federal Reserve’s actions.

Since the Coin Telegraph tweet mistake on a Bitcoin Spot ETF approval, Bitcoin prices have decoupled from December interest rate expectations – it seems like investors are solely focussed on the ETF approval now, and not what the FED does.

At press time, Bitcoin traded at $28,450.

Featured image from iStock, chart from TradingView.com