[ad_1]

This is a segment from the Empire newsletter. To read full editions, subscribe.

It used to be that pop culture ran on a 20-year cycle. These days, it’s more like 10, or even five.

Crypto is undergoing something very similar, and it’s fast becoming ICOs’ turn.

Seven years ago, a tidal wave of public token sales hit Ethereum, with over 2,000 separate offerings raking in more than $10 billion — almost two-thirds coming in the first three months of 2018 alone.

Here’s one clear sign that initial coin offerings are coming back: Corn’s recent token sale was seven times oversubscribed in the first few hours, so much so they ended up turning away thousands of investors.

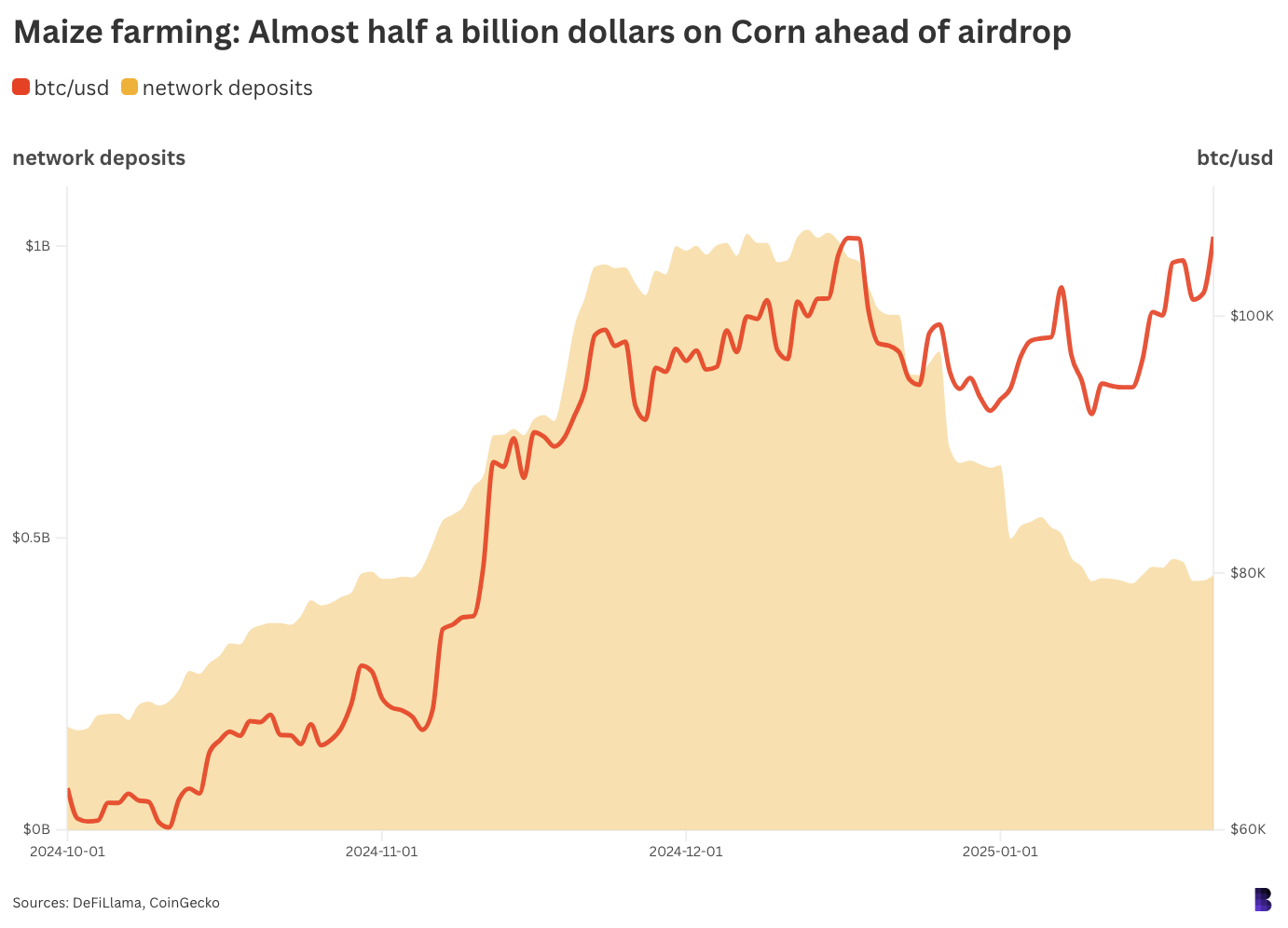

Corn is merging two hot narratives from cycles past: public token sales and yield farming. It debuted last year as the “super yield network,” an Ethereum layer-2 on the Arbitrum Orbit stack with a Bitcoin twist.

It’s built to use tokenized wrapped bitcoin, BTCN, as its native asset — to stake, pay gas and otherwise be put to work across its budding DeFi ecosystem.

You’ve heard of DeFi Summer. How about BTCFi Spring?

Corn’s ICO was conducted through MiCA-compliant token sale platform Legion. Nearly 4,300 applicants requested $69 million in allocations, with the team accepting $8.3 million from around 700 investors.

Legion is a merit-based venue for connecting projects with the right capital. All participants (which excludes UK and retail in the US) must first KYC, but the real value add is that users can also connect their crypto wallets, X accounts and GitHub profiles.

This allows projects to prioritize investors who are active in crypto, whether that’s showing up onchain or in code, if they so choose.

“We thought: ‘How do we create something that’s fair and open for small and big, and how do we get very targeted with our token distribution, so we can be in a place to say we have 1,000 or 2,000 long-term committed investors well before the token goes live?” Chris Spadafora, Corn founder, told me over the weekend.

“That’s what drove us to go down this path, but it wasn’t an easy decision and it required a lot of work to kind of coordinate all the different groups.”

Early Corn users are earning points (or Kernals) for keeping crypto within the Butter Network

Those parties included existing Corn backers from its seed and venture rounds last year — venture capital firms Polychain Capital, GSR, Laser Digital and more.

“Anyone that participated in this round went through an identical process,” Spadafora said. “They had to onboard to Legion, they had to apply, and then we had to accept them.”

The kicker, according to Spadafora, is now that all those funds have been onboarded, the next project that wants to launch on Legion has a direct line and access to some of the biggest funds in the world — along with another 10,000 or 100,000 people on Legion that can invest at the same terms.

But if ICOs really are back, there would need to be improvements. ICOs in 2017 and 2018 were often opaque and painfully skewed toward insiders. Corn’s offering meanwhile had no side letters or secret undisclosed deals.

“There was one contract, it was loaded. If you wanted to invest $1,000 or a million dollars, it was the same deal. Take it or get the fuck out of here,” Spadafora said, and that attitude might be just what ICOs needed all along.

[ad_2]