Hyperliquid now controls roughly 80% of the decentralized perpetual futures market, highlighting its rapid dominance over competitors. However, this concentration raises concerns about sustainability and potential risks if trading volumes decline.

Summary

- Hyperliquid has quickly become the leading decentralized perpetual futures platform, handling up to $30 billion in daily trades.

- Its lean, self-funded team built a fast, execution-focused blockchain with fee-sharing incentives that attract traders and developers.

- Despite rapid growth, risks like validator concentration, transparency gaps, and reliance on high trading volumes leave its future uncertain.

In just over a year, Hyperliquid has grown into the dominant player in decentralized perpetual futures, with Redstone estimating it controls about 80% of the market, trading volumes on par with big centralized exchanges, and fresh concerns over how long such concentrated activity can last.

At its peak, the platform processed as much as $30 billion in daily trades. That milestone, only a few decentralized exchanges have ever reached, despite being run by a lean team of just 11 people.

The platform, co-founded by Jeff Yan, a former Hudson River Trading quant and Harvard graduate, chose from the start to avoid venture capital, a decision that, combined with timing, gave Hyperliquid an opening it exploited faster than rivals.

Trading volume across decentralized exchanges | Source: CoinGecko

At the start of 2024, decentralized exchange dYdX had roughly 30% of trading volume across decentralized exchanges. By the end of that year, its share had fallen to around 7%, while Hyperliquid’s share stabilized above 65%, per CoinGecko’s data.

Much of Hyperliquid’s growth seems tied to execution. One-click trading, zero gas fees, and sub-second order finalization make it feel closer to a centralized exchange than most DEXs, which has helped attract both retail and professional traders.

“Built by a lean, self-funded team that refused to accept VC investors’ money, they’ve proven that technical excellence and community-first economics can outcompete well-funded competitors.”

RedStone

You might also like: Hyperliquid API outage causes freeze on trading, HYPE down 5%

The platform runs on its own blockchain with HyperBFT, a consensus system designed to process hundreds of thousands of orders per second with settlement finality under a second. By focusing first on speed and reliability before expanding infrastructure, Hyperliquid appears to have earned credibility among traders faster than most peers.

Incentives and Revenue

The platform splits trading fees with its community. People who list new spot markets can keep up to half of the fees those trades generate. Developers who build user interfaces earn a share that can even exceed the protocol’s own cut. And those who launch perpetual markets share their fees with the investors who stake behind them.

This setup has pushed outside developers to build on the platform without needing grants or subsidies. They’ve already created tools to fill gaps like letting traders use one balance across different positions or borrow against their assets. The result is a growing ecosystem that competing decentralized exchanges haven’t been able to replicate.

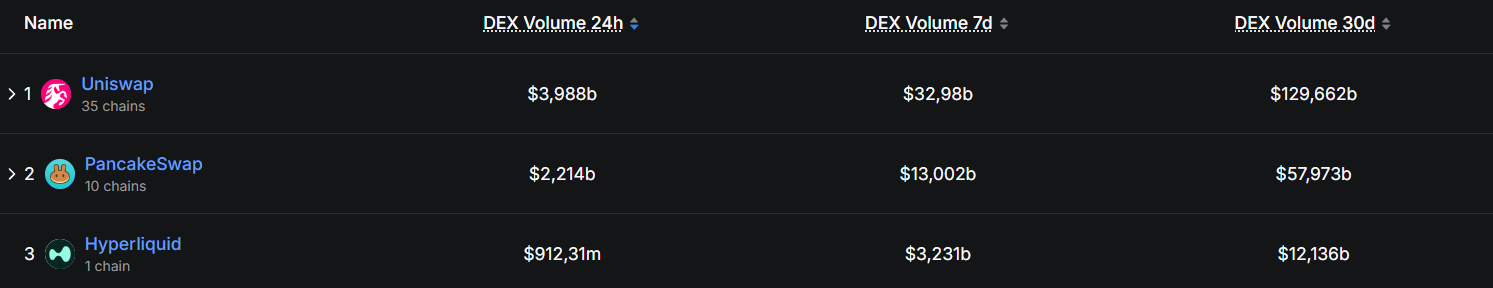

Decentralized exchanges by trading volume | Source: DefiLlama

DefiLlama data shows Hyperliquid ranks third among decentralized exchanges by weekly trading volume, generating over $12 billion, behind only PancakeSwap and Uniswap. That surge has helped Hyperliquid produce more than $1 billion in annualized revenue, translating to an estimated $102.4 million per employee.

As previously reported by crypto.news, that figure exceeds Tether at $93 million, OnlyFans at $37.6 million, Nvidia at $3.6 million, and Cursor at $3.3 million.

Risks ahead

A joint report from OAK Research and GL Capital notes that despite Hyperliquid’s rapid growth, “several key milestones must still be met to validate [the valuation] thesis.”

“Centralization remains a concern, with only 16 validators, and the lack of transparency in the codebase could deter third-party developers. While full control over the infrastructure is a powerful model, it also exposes the platform to vulnerabilities, as demonstrated by the HLP incident.”

OAK Research and GL Capital

The platform’s reliance on sustained trading volume further amplifies risk. A prolonged bear market could temporarily depress returns and challenge the token buyback system that supports much of the HYPE ecosystem.

From a valuation perspective, analysts describe the opportunity as “asymmetric risk/reward,” with HYPE’s fair value estimated between $32 and $49 under conservative assumptions, which is about 86% of the top of that range, given that HYPE is trading at $42.

Hyperliquid has demonstrated rapid adoption, but it still faces multiple structural and market risks. Validator concentration, transparency gaps, reliance on high trading volumes, and execution-dependent growth all mean that results remain sensitive to both internal decisions and external market conditions.

Read more: Circle chooses Hyperliquid as its next USDC stronghold amid $5.5b AUM boom