Ventuals, a protocol designed for trading tokenized private and pre-IPO companies, launched its HYPE liquid staking vault today, which will be used to fund the protocol’s HIP-3 permissionless derivatives market on Hyperliquid.

The launch included a minimum stake threshold of 500,000 HYPE, worth roughly $19 million, which was filled in just five minutes, with the top depositor contributing 250,000 HYPE. Users who deposited before the threshold was hit will receive a 10x multiplier on their points distribution and an official Ventuals NFT.

Inflows continued to pour in, with a little over 1 million HYPE, worth $38 million, raised in the first half hour. The total sits at 1.29 million HYPE at the time of writing.

vHYPE Staking – Ventuals

The protocol is set to compete with other HIP-3-related protocols, including Hyperliquid’s largest liquid staking platform, Kinetiq, and TradeXYZ, a derivatives trading market launched by Unit, the ecosystem’s leading tokenization platform.

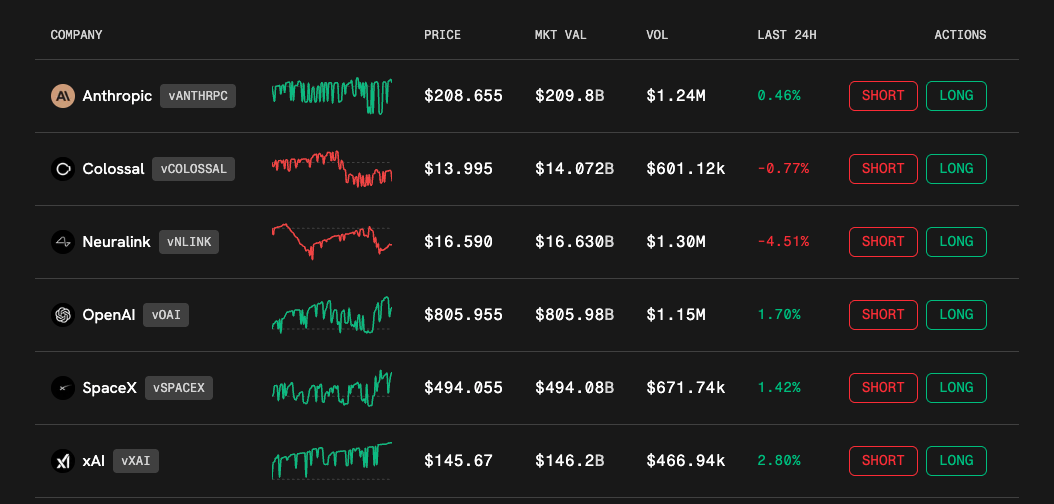

Ventuals sets itself apart by focusing specifically on private equity and pre-IPO companies, including OpenAI, SpaceX, and Kraken. Some of the most popular markets by testnet volume include Kraken, Neuralink, and Polymarket.

Ventuals Testnet Markets