[ad_1]

Jupiter DEX is facing increasing scrutiny as users have observed a nearly 50% transaction failure rate, prompting concerns and questions about the platform’s performance. Many are looking for explanations and wondering what measures are being taken to address this issue. In this article, the situation will be explored in detail, examining the factors contributing to the high failure rate and what actions are being taken to improve the user experience on the platform.

Table of Contents

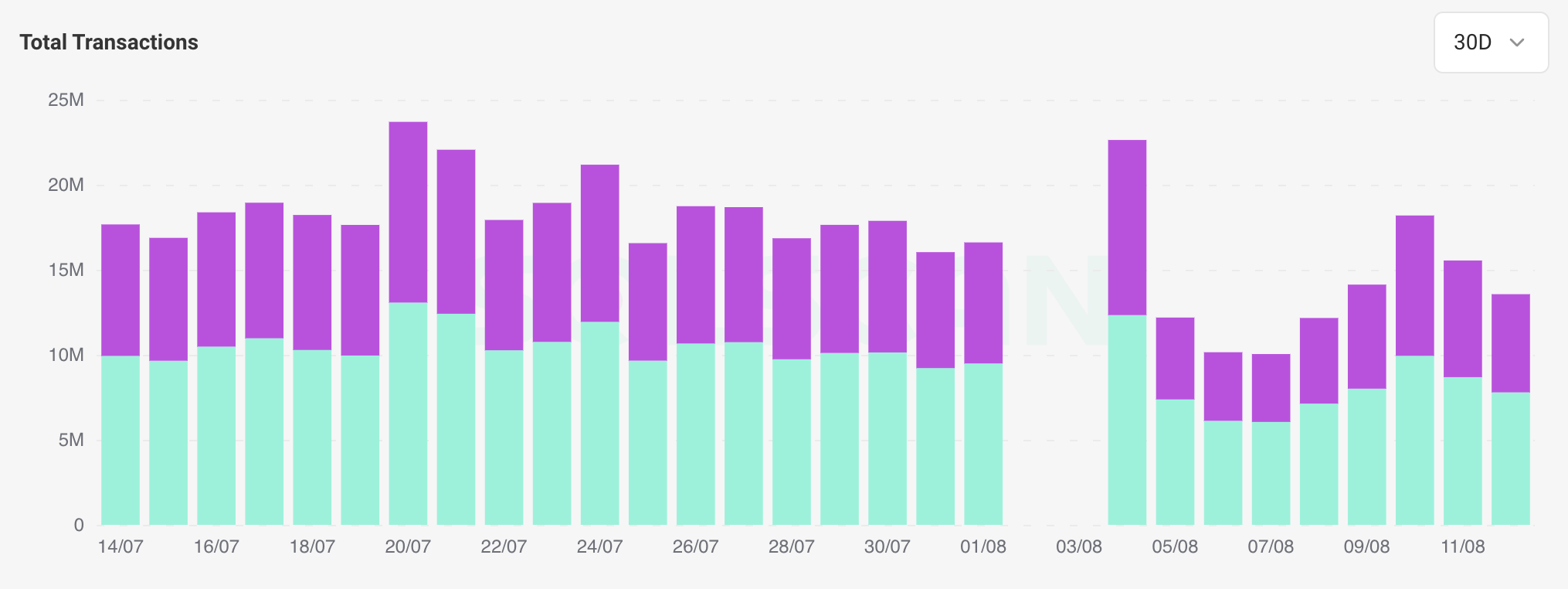

Source: Solscan

High failure rate: causes and concerns

Over the last 30 days, excluding the missing data from August 2 and 3, the average failure rate on Jupiter stands at 42.89%. This has led to an increasing number of users questioning the underlying causes of these failures and seeking clarity on what measures are being taken to improve the platform’s performance.

A particular point of frustration for many users is that they are still charged fees for failed transactions. While this might seem unfair at first glance, it is an inherent aspect of blockchain technology. Each transaction, successful or not, uses network resources like computational power and block space. Even if a transaction fails, the validator still processes it until an issue causes it to error out. Since the network is still utilized to process the request, the fee compensates for those computing resources.

You might also like: Solana-based Jupiter sparks controversy for collaborating with Irene Zhao

Increased slippage tolerance is a risky solution

To avoid repeated charges, users often increase their slippage tolerance to ensure their transactions go through. The increase makes the transaction more likely to succeed because it gives the network permission to complete the swap even if the price changes slightly from the original quote.

However, increasing slippage opens the door to another risk: front-running by bots. These bots can detect transactions with high slippage and execute their trades just before the user’s transaction, buying assets at the lower price and selling them back at the higher price set by the user’s slippage. This results in users getting less favorable rates on their swaps, effectively costing them more than just the transaction fees.

How front-running works on smart contract blockchain networks

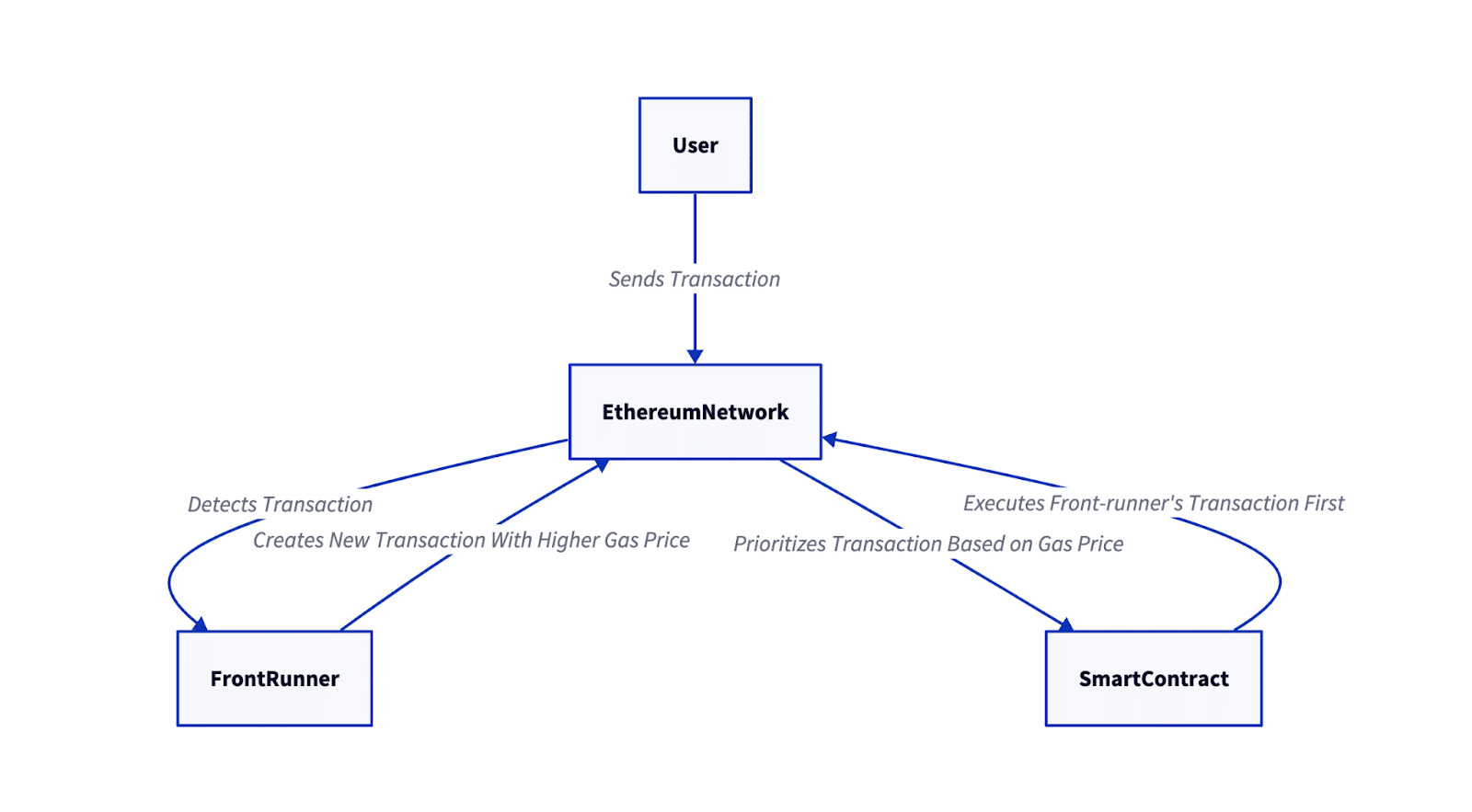

Source: Hacken

The diagram from Hacken shows how front-running works on Ethereum, but the concept also applies to Solana and other smart contract blockchains.

- Step 1: The user initiates a transaction on the network, intending to interact with a smart contract.

- Step 2: A front-runner (usually a bot) monitors the network and detects the user’s transaction.

- Step 3: The front-runner creates a new transaction with a higher gas price. The higher gas price incentivizes validators to prioritize processing the front-runner’s transaction over the user’s original transaction.

- Step 4: The blockchain network prioritizes transactions based on the gas price. Since the front-runner’s transaction offers a higher gas price than the user’s, it gets processed first.

- Step 5: The user’s transaction gets less favorable terms or even fails, which leads to financial losses or missed opportunities.

In Jupiter’s own words:

Majority of these failed transactions come from arbitrage bots that route using the program when an arb opportunity is near, hoping to land a transaction when the opportunity takes place — this leads to the higher failure rate. For our users on Jupiter UI, the transaction success rates are actually over 90%!

Nonetheless, front-running heavily depends on the trustworthiness of the RPC (Remote Procedure Call) providers used to interact with the network. The RPC provider is an intermediary between the user and the blockchain and transmits transaction data to the network. If an RPC provider is not reputable, it could potentially enable or even participate in front-running by sharing transaction details with bots or manipulating the order in which transactions are submitted. Reputable RPC providers, on the other hand, are expected to uphold ethical standards and ensure that they do not exploit users or allow such behavior to occur.

Another reason for the high rate of failed transactions is the ongoing memecoin frenzy, where tens of thousands of new tokens are being created every day. Many of these memecoins lack sufficient liquidity, meaning there aren’t enough tokens available in the market to complete trades. When users attempt to buy or sell these low-liquidity tokens, the transactions can fail because the trade can’t be fulfilled.

Throughput limitations and delays in order processing

While the memecoin surge contributes to the failure rate, Jupiter’s automated slippage and gas calculation features also play a role. These features, which generally work well in stable market conditions, struggle during periods of high volatility. Additionally, the platform is grappling with issues related to its free tier quote API, which has been exploited by users bypassing rate limits by spinning up new machines. This exploitation has resulted in increased operational costs and the risk of service degradation for legitimate users.

Furthermore, Jupiter’s throughput is currently insufficient, particularly as it is handling an overwhelming volume of orders, causing its retry logic to slow down to more than 25 seconds.

Conclusion

Jupiter DEX is facing some tough challenges, including a high rate of transaction failures, front-running risks, and infrastructure bottlenecks. These aren’t just minor issues—they directly affect user trust and the platform’s ability to perform well. The team is working hard to fix these problems, but there’s a key question that remains: Can Jupiter not only solve these immediate issues but also keep up with the growing demands of the DeFi space?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

[ad_2]