[ad_1]

The Nasdaq Stock Market LLC, acting on behalf of Canary Capital, submitted a 19b-4 filing with the U.S. Securities and Exchange Commission (SEC) on Monday for a spot Hedera (HBAR) exchange-traded fund (ETF). The filing follows Canary Capital’s earlier S-1 registration for the fund in November. The proposed ETF aims to provide direct exposure to Hedera’s native cryptocurrency used for transactions on the network.

Regulatory Filing Process and Approval Timeline

The 19b-4 filing marks the second phase of the regulatory process required for crypto ETFs. Once the SEC acknowledges the filing, it will be published in the Federal Register, triggering a formal review period. The SEC’s decision will determine whether the ETF gains approval, similar to other recent spot crypto ETF proposals.

Canary Capital’s initial S-1 registration in November signaled its intent to launch an HBAR ETF. Following SEC feedback, the firm amended the filing last week, indicating continued regulatory discussions.

Hedera’s Network and Governance Structure

Hedera operates as a decentralized public network utilizing the Hashgraph consensus mechanism. The protocol is designed for fast and secure transactions, differentiating itself from traditional blockchain networks. Unlike most cryptocurrency projects, Hedera is governed by a council consisting of multinational corporations and organizations that oversee network decisions and token allocations.

The SEC filing states that while Hedera is not primarily designed as a payment system, it requires a native token to facilitate network operations and encourage user participation. The token enables consensus verification and rewards participants for securing the network. This structure aligns with other public distributed ledger technologies that rely on native assets for functionality.

Market Response to HBAR ETF Filing

Following the 19b-4 filing, Hedera’s token experienced a slight price increase, trading around $0.22 as of publication. Market participants closely monitor ETF developments, as approvals for similar crypto-based products have historically impacted asset prices.

Bloomberg ETF analyst Eric Balchunas noted that the SEC’s feedback on Canary’s S-1 amendment suggests potential approval, placing HBAR and Litecoin among leading candidates for upcoming spot ETFs.

Canary Capital’s Litecoin ETF Progress

Separately, Canary Capital’s spot Litecoin ETF has been listed on the Depository Trust and Clearing Corporation’s (DTCC) website. The fund was assigned the ticker symbol LTCC, an important step in the ETF approval process. The DTCC provides post-trade clearance, settlement, and custody services, and its listing of an ETF typically signals progress toward potential launch.

The DTCC listing follows Nasdaq’s submission of a 19b-4 form for the Litecoin ETF last month. The SEC later called for public comments on the proposal, indicating that the review process is ongoing. If approved, Litecoin would become the first cryptocurrency beyond Bitcoin and Ether to serve as the underlying asset for a spot ETF in the U.S.

Significance of DTCC Listing and Regulatory Review

Although the DTCC listing is a procedural milestone, it does not guarantee regulatory approval. The organization clarified that listed ETFs may be in pre-launch status and remain subject to SEC clearance before activation. VanEck’s spot Ethereum ETF, for instance, was listed on the DTCC in May 2024 and began trading on the Cboe exchange two months later.

The SEC’s review of crypto ETFs has gained momentum in recent months, particularly after approving multiple spot Bitcoin ETFs earlier this year. Analysts view the ongoing dialogue between issuers and regulators as a critical factor in determining the approval chances of new funds. Industry observers consider Canary’s spot ETFs among the most advanced non-Bitcoin proposals currently under review.

Ethereum and Bitcoin ETFs are reshaping market trends as institutional demand grows and regulatory discussions advance. These investment products have introduced new liquidity streams, influencing price movements and overall market sentiment. Tracking the market trend of both Bitcoin and Ethereum ETFs, a varied market movement is notable.

Bitcoin ETFs Market Insights

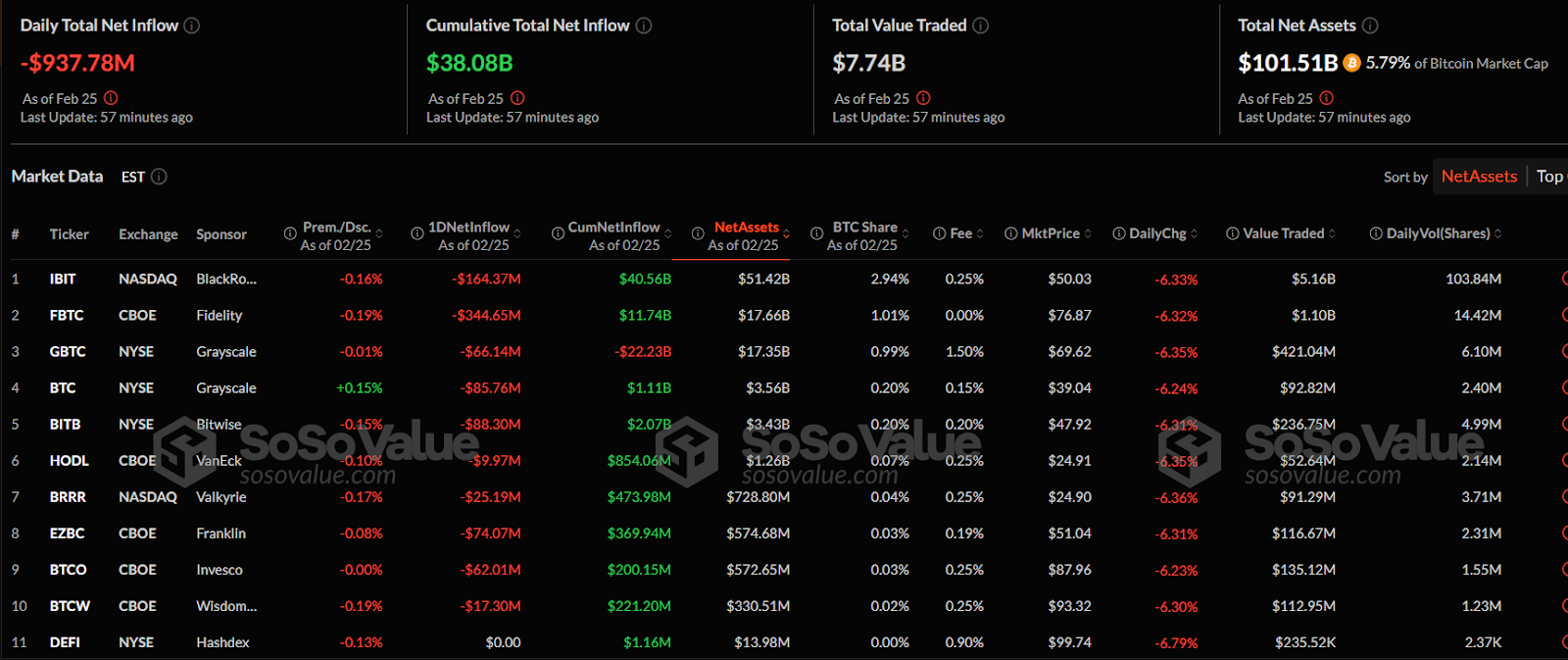

According to a recent update by SoSoValue, The market data shows a significant daily net outflow of -$937.78 million across Bitcoin ETFs. The cumulative total net inflow remains positive at $38.08 billion, indicating strong long-term participation. The total net assets of Bitcoin ETFs stand at $101.51 billion, representing 5.79% of Bitcoin’s market cap.

Source: SoSoValue

Among the top ETFs, BlackRock’s IBIT on NASDAQ has a net asset value of $51.42 billion. It recorded a daily net outflow of -$164.37 million and a market price decline of 6.33%. Fidelity’s FBTC, listed on CBOE, holds $17.66 billion in assets but saw a larger net outflow of -$344.65 million.

Grayscale’s GBTC on NYSE experienced an outflow of -$66.14 million, bringing its cumulative net outflow to -$22.23 billion. Despite this, it maintains $17.35 billion in assets. The Grayscale BTC ETF also registered an outflow of -$85.76 million, with net assets at $3.56 billion.

Other ETFs, including those from Bitwise, VanEck, and Franklin, recorded varying outflows, reflecting investor movements. The total market value traded reached $7.74 billion, with daily percentage changes showing declines across all major ETFs.

What About Ethereum ETFs?

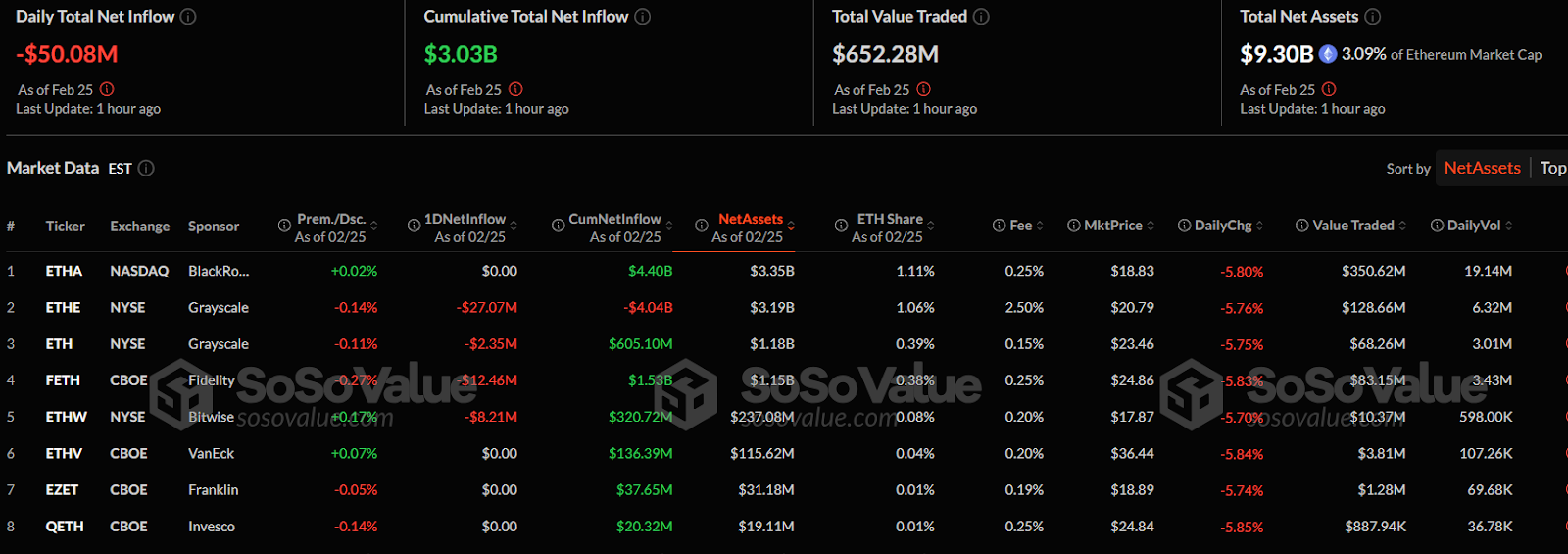

Ethereum ETFs recorded a daily net outflow of -$50.08 million, reducing cumulative total net inflow to $3.03 billion. The total net assets for Ethereum ETFs stand at $9.30 billion, representing 3.09% of Ethereum’s market cap. The total value traded reached $652.28 million as of February 25.

Source: SoSoValue

BlackRock’s ETHA ETF on NASDAQ holds $3.35 billion in assets with no inflows recorded. Grayscale’s ETHE ETF on NYSE has $3.19 billion in assets but saw a -$27.07 million outflow. Fidelity’s FETH ETF, listed on CBOE, recorded a $12.46 million inflow, increasing its cumulative net inflow to $1.53 billion.

Bitwise’s ETHW ETF and VanEck’s ETHV ETF reported smaller movements, with ETHW losing -$8.21 million in outflows. The largest price decline was seen across all ETFs, ranging between −5.70% and −5.85%. Trading volumes varied, with ETHA leading at 19.14 million shares exchanged.

Checking on the future outlook of Exchange Traded Funds, the SEC’s handling of Canary Capital’s filings will offer insights into how additional altcoin ETFs may be evaluated. As regulatory frameworks for digital assets evolve, ETF applications for tokens beyond Bitcoin and Ethereum could set precedents for broader market adoption.

[ad_2]