Galaxy Digital, a leading player in the digital assets sphere, has issued a bullish prediction for Bitcoin’s trajectory following the launch of the much-anticipated US-regulated spot Bitcoin ETF. According to a recent study published by the firm on October 24, the introduction of the ETF is set to considerably bolster Bitcoin’s adoption, positioning it more firmly as a recognized asset class.

Advantages Of An ETF

Galaxy’s analysis highlights that a spot Bitcoin ETF would be “one of the most impactful catalysts for the adoption of Bitcoin (and crypto as an asset class).” By the end of September, Bitcoin assets held across diverse investment products like ETPs and closed-end funds touched an impressive figure of 842,000 BTC, valuing approximately $21.7 billion.

Galaxy Digital’s study also sheds light on the challenges faced by these investment avenues, pointing to factors like high fees, tracking errors, limited liquidity, and a somewhat constrained reach amongst broader investor groups. The introduction of the spot Bitcoin ETF, the report suggests, is poised to change this scenario dramatically.

Spot Bitcoin ETFs offer a multitude of benefits over the current structures: an improved fee system, greater liquidity, better price tracking, and a much-needed break from the complications of self-custodying assets. As the report explicitly states, “The presence of a US-regulated spot Bitcoin ETF that adheres to strict regulatory compliance not only provides a more secure platform but also elevates its transparency, making it a preferable choice over existing investment products.”

Why A Spot Bitcoin ETF Matters

Galaxy believes that the introduction of a Bitcoin ETF would increase the digital asset’s “accessibility across wealth segments” and establish “greater acceptance through formal recognition by regulators and trusted financial services brands.”

The report highlights the disparity between age groups when it comes to Bitcoin investments. It reveals that while Boomers and older generations hold 62% of US wealth, only 8% of adults aged 50 and above have invested in cryptocurrency.

Galaxy sees regulatory approval for a Bitcoin ETF as a significant step towards establishing Bitcoin as a mainstream investment. An ETF could help reduce market volatility by offering “greater price transparency and discovery for market participants.”

Estimating Inflows From ETF Approval

Galaxy’s forecast suggests the US wealth management sector, managing a combined asset worth $48.3 trillion, will be the most impacted by a Bitcoin ETF’s launch. They estimate potential inflows into the Bitcoin ETF to be around $14 billion in the first year, escalating to $27 billion in the second year and reaching $39 billion by the third year.

Factoring in the historical relationship between gold ETF fund flows and gold price change, Galaxy predicts a potential price increase of 6.2% for BTC in the first month after an ETF’s launch. They project this to taper down to +3.7% by the last month of the first year, resulting in an estimated +74% increase in BTC in the first year of an ETF approval. At the current price, this would mean that BTC could rise above $59,000 in the post-ETF debut year.

The Bigger Picture

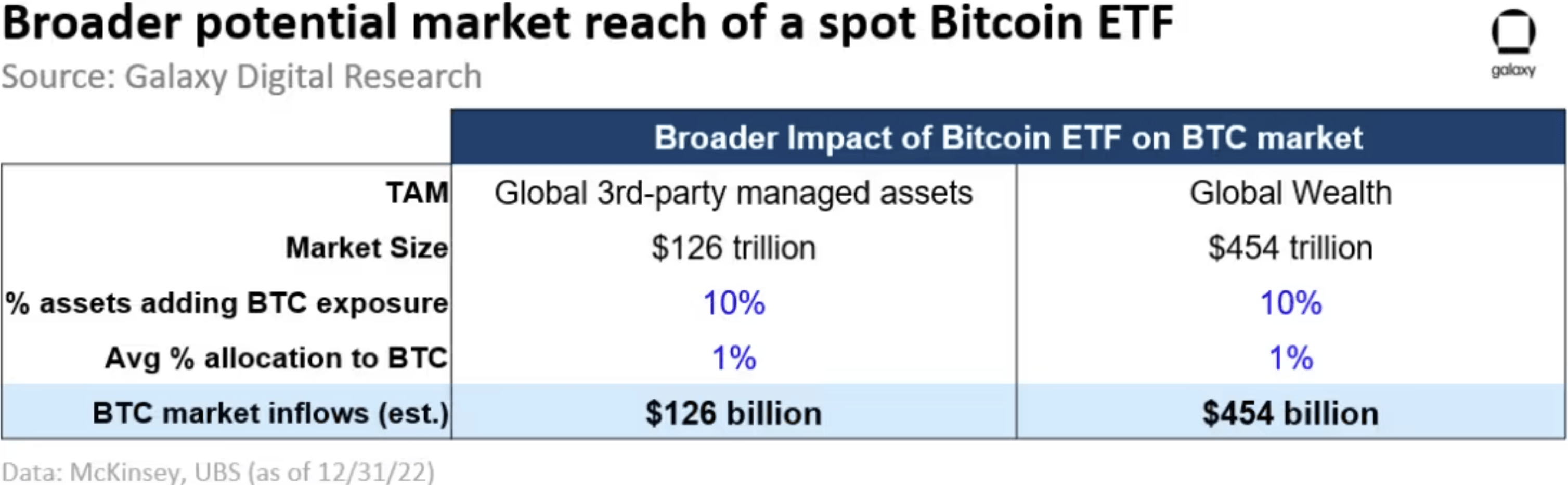

Beyond the potential inflows into a US ETF product, Galaxy predicts that there will be a much larger impact on BTC demand “from second-order effects”. The potential approval of a spot ETF in the US might instigate similar products in other global markets. Moreover, Galaxy expects that various other investment vehicles, like mutual funds and private funds, will integrate Bitcoin into their strategies.

Galaxy suggests the potential for Bitcoin’s Total Addressable Market (TAM) to grow substantially, perhaps encroaching on traditional asset sectors like real estate and precious metals. The estimated potential new inflows into BTC could range between $125 billion to $450 billion “over an extended period.”

Featured image from Shutterstock, chart from TradingView.com