Bitcoin mining is a tough business. When one considers deploying economic resources to mine traditional commodities such as gold, copper or oil, prospecting for those resources in the field is always done beforehand, to ensure that any capital invested in a mining project will not be in vain. But due to the very nature of Bitcoin’s security protocol, miners are not able to prospect for anything, since finding a block is a purely statistical and random event. Since there are only 144 blocks to be found per day, there is no way to ensure that a miner’s work will be rewarded in a timely fashion without significant variability, unless the miner has a considerable amount of hash rate. A miner needs roughly 1.2% of the total hashrate (approximately 10 Exahashes per second at the time of writing) to guarantee consistent payouts and significantly diminish its revenue variance. The CAPEX required to achieve such an amount of hashrate is in order of hundreds of millions of dollars. Unless a miner is a gigantic enterprise that has an enormous flock of ASICS, he will have a problem in his hands.

Pool mining was created to address and solve this issue. Let’s take a single miner, with a small but considerable mining operation. Out of the 52560 yearly blocks, he’s expected to find one, since he has 1/52560th of all the hashrate of the network. In other words, he’s expected to find one block every 12 months. But his electricity bill comes due every 4 weeks, and if he was to wait for a whole year paying bills before getting some revenue through the door, he’d go bankrupt. Given this discrepancy between its ongoing costs and its revenues, an idea comes to his mind. He sets out to find 499 other people with a similar sized operation, and they strike a deal. Instead of everyone mining on their own, the miner proposes to the others that they all mine collectively as if they are part of the same entity, splitting the mining rewards according to each miner’s work every time someone finds a block. If every miner has 1/52560th of all the hashrate of the network, the 500 miners collectively are expected to find a block approximately two times per week. With a pool mining approach, every miner guarantees that all the effort and hard work they put in will be rewarded much more frequently. This way everyone gets to pay their bills every month, and by the end of the year, they have all effectively managed to avoid bankruptcy. Nevertheless, there are still sources of variance within those same payouts.

Pool mining makes sure miners get paid much more frequently compared to solo mining. However, it doesn’t guarantee predictable payouts based on the hashing power that each miner has. This problem is commonly known as the pool’s luck risk. Let´s go back to the previous example. 500 miners with 1/52560th of the total hashrate of the network each are expected to find 500 blocks in a year. Nevertheless, they may find 480. Or 497. Or 520. There is no assurance that the pool will mine exactly 500 blocks in a year. A Pool’s luck is calculated by dividing the number of blocks found by the number of blocks that was expected to be found based on the total hashrate of the pool. If a pool mines 480 blocks when they were expected to mine 500, the pool’s luck was 95%. Pool luck can cause significant fluctuations in earnings over short periods. However, luck tends to even out over time, and payouts will eventually align with the expected distribution based on the pool’s hash rate. Two additional factors contribute to the overall variance in miners’ payment rewards, with the first factor being more significant than the second. The first is transaction fees. These tend to vary considerably as witnessed in the last few years. Transactions fees from the blocks that were mined right after the last halving represented more than 50% of the total block reward for the first time in Bitcoin’s history. As of the writing date of this article, (block height 883208), there were several non-full blocks mined in the past week, since the mempool cleared for several occasions during these past days. Quite a jump in such a short amount of time. The second factor is related to the variance associated with the time between blocks found by the network. When a block is found right after another, there is less time for transactions to build up in the mempool, which leads to lower transaction fees in that block. Conversely, if a more extended period elapses between blocks, more transactions will be broadcast, driving up transaction fees in the process.

During the 2024 halving, for the first time in bitcoin’s history, daily transaction fees paid to miners were higher than the block subsidy.

Uncertainty is painful. Especially where there is substantial capital at risk. Thus, most miners find value in having more predictable, stable and less volatile payouts to recoup the significant amount of capital deployed. This is where a Full Pay Per Share payout scheme paid by pools comes into play. FPPS works as a traditional insurance product. A pure risk transfer. Regardless of how many blocks the miners of the pool collectively find and what the transaction fees paid on them are, miners get paid by the pool based on the expected value of their hashing power. The pool assumes all that risk. The predictability that FPPS provides to miners is unrivaled by any other method. Hence, no one should be surprised to learn that FPPS is pretty much the standard nowadays when it comes to pool payouts, although not without a significant cost.

FPPS is not a free lunch. To withstand any bad luck period and all the risks associated with a FPPS payout scheme, pools need to have big fat pockets. These high capital requirements cost money. And pools are not charitable organizations. These high costs end up being paid by miners through higher pool fees. Like previously mentioned, miners need to keep in mind the fact that an FPPS payout scheme works as an insurance policy. And insurance policies rely on counterparties. And sometimes, counterparties fail to honor their commitments when they are most needed, as witnessed back in the 2008 Global Financial Crisis. The miner must trust that the pool will fulfill their insurance contract obligations. Sure, if the pool is very big in size, that risk is very small indeed. Pools can also develop ways to offload this risk from their operations. But isn’t Bitcoin all about minimizing trust, counter-party risk and eliminating it if possible? Looks like the Bitcoin ethos hasn’t arrived yet at the pool mining side of the protocol.

Furthermore, any miner that receives FPPS rewards for their work must necessarily forfeit any revenue related to transaction fee spikes. The FPPS payout formula determines miner rewards by analyzing transaction fees from the previous n blocks and calculating an “expected value” for transaction fees. The pool then uses this calculation to decide how much to pay miners for the transaction fee portion of their shares. As a result, when transaction fees surge, the payout is made according to what happened in the past, where there is no transaction fees spike whatsoever. No need to be a PhD in mathematics to understand that all those rewards end up in the pool’s pockets rather than the miners’ in this scenario. Moreover, even if there was a recent spike in transactions, pools cannot factor this into payout calculations. The probability of such a spike not being an outlier is almost negligible. In other words, pools have no guarantee that the fee spikes will be consistent and frequent in the future. Therefore, they cannot include it in miner payouts without risking bankruptcy.

The unsustainability of the FPPS payout scheme

Having a closer look at how the FPPS payout scheme is built, we can easily see that it is like the modern pension systems of many governments, unsustainable by design. FPPS as it stands today, will collapse under its own weight soon. As time goes by, transaction fees will represent a bigger percentage of the total payout to miners. This dynamic, alongside their inherent variability, will lead to a significant increase of the total payout variance, thus increasing the insurance costs of FPPS pools to infinity. In other words, as the Coinbase reward keeps halving, the variance of the rewards in the block will increase significantly. If the variance increases, so does the associated risk of providing this insurance product for miners. Thus, premiums for the insured will have to increase as well. This means that FFPS pools will be taking additional risk when compromising themselves to a fixed payment to miners. With more risks comes higher capital costs. The extent to which pool fees will have to rise for pools to continue providing a FPPS insurance product remains to be seen. Only insurance actuaries can determine the precise amount. One thing we already know for sure. It won’t be cheap, because it already isn’t.

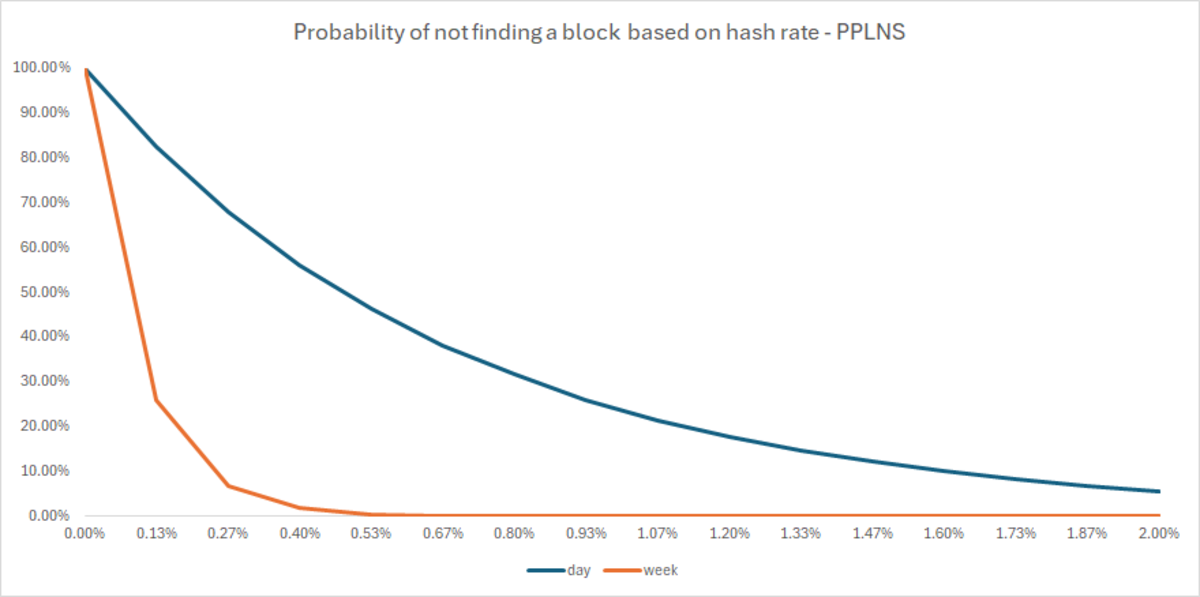

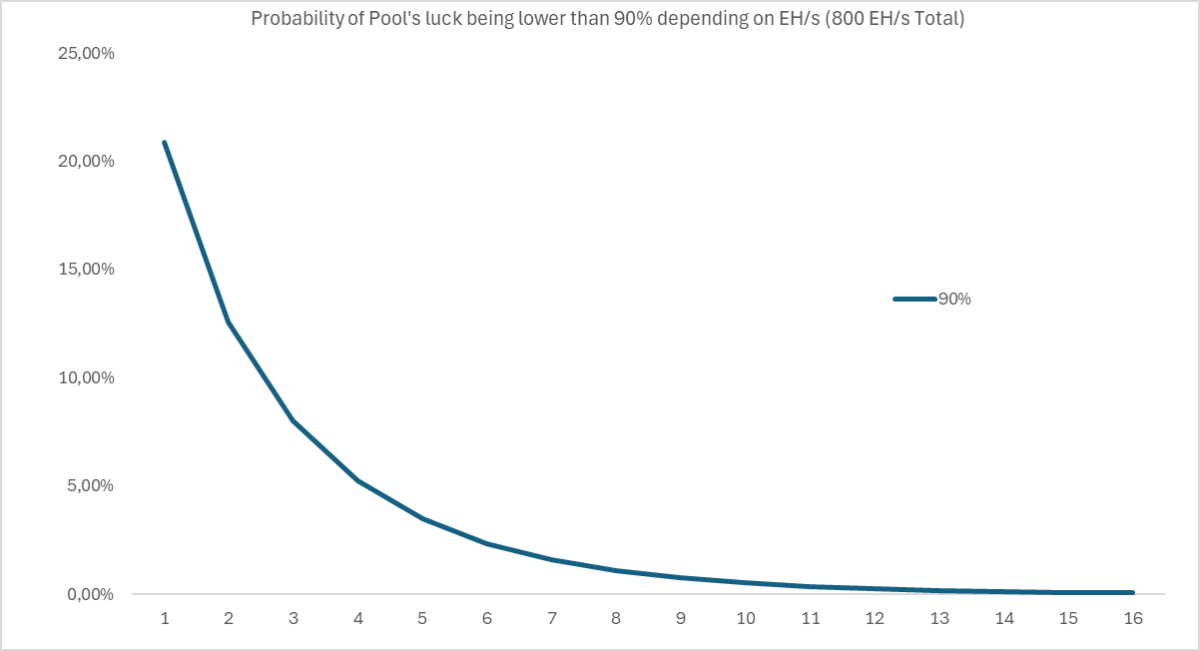

A much higher pool fee for stable predictable payouts offered by FPPS will make a PPLNS method reward method much more attractive for any miners that are looking to maximize their profitability, as the previously described dynamic of the changing composition of blocks is played out. Under this scheme, miners are paid once a block is found by the pool. When a block is found, the pool assesses how many valid shares each miner contributed during a period comprised of the last N blocks found by the pool and distributes payouts accordingly. This time window is commonly referred to as the PPLNS window. The biggest setback with this payment method is of course the risk associated with the pool’s luck being under 100% and the risk that there might be periods when the pool doesn’t find any block and as a result, miners don’t get paid. However, a pool with only 1% of the hash rate has only a 0.0042% chance of not finding a block within a week, while the odds of the pool’s luck being lower than 90% in a year are approximately 1.09%.

If a PPLNS pool has more than 1% of the total hash rate, the risk of not finding a block during a significant period of time is negligible.

The odds that the pool’s luck of a PPLNS pool with more than 1% of the hash rate falling under 90% are less than 1%. (Calculations made assuming the number of blocks found by the pool follows a Poisson distribution where λ = expected number of blocks found by the pool within a year.)

Will there be a market soon for FPPS pool services at a high enough price that compensates the pool for all the variance associated with the total block rewards? No one can know for sure. One thing we know. Pool fees will have to be enormous. The revenue that miners will have to forfeit will just be too big to be worth it to get rid of the risk associated with not getting paid consistently in a timely manner. And as other more mature players enter the bitcoin mining industry, such as energy companies, one should expect other risk management tools to be readily available in the market for miners to hedge all types of risks. New innovative pool payment schemes will probably surface as these instruments become more available to everyone.

Miners’ revenue and profitability will be significantly impacted by the dynamics described in this article. Exploring alternative pool payment schemes and risk hedging strategies will be required for any miner that looks to maximize the profitability of their operation. The FPPS payout method might still be helpful for miners as of today. But as was previously explained, FPPS will soon be buried in bitcoin’s history.

This is a guest post by Francisco Quadrio Monteiro. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.