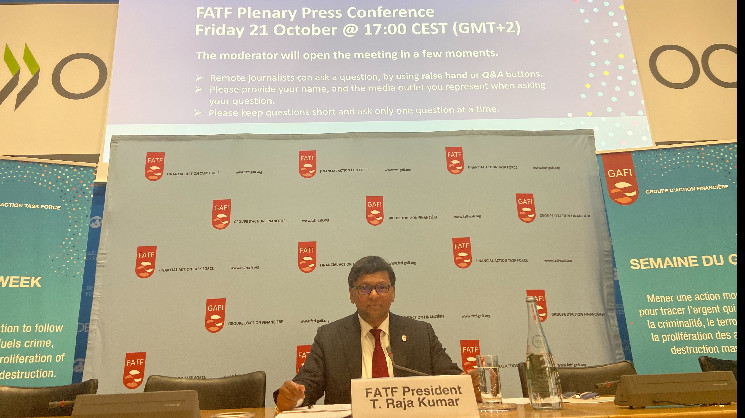

A lack of regulation “creates significant loopholes for both criminals and terrorists to exploit” and is “a call to action that we need countries to take this problem seriously,” Financial Action Task Force President T. Raja Kumar said in an interview with CoinDesk.

FATF published a new report evaluating jurisdictions on their crypto regulation after a 12-month process involving FATF’s 39 members and 20 jurisdictions that aren’t members.

Fewer than 30% of jurisdictions around the globe had started regulating the crypto sector as of June 2023, Financial Action Task Force (FATF) President T. Raja Kumar told CoinDesk in an interview from Singapore.

That low level of attention warrants “call to action,” said Raja Kumar. The statistic was detailed in a progress report made public on Thursday and shared with CoinDesk, which explored how dozens of jurisdictions have adhered to the FATF’s recommendations.

The report is titled “Status of Implementation of Recommendation 15 by FATF Members and Jurisdictions with Materially Important VASP Activity.” The recommendation had suggested that jurisdictions should move to get a better handle on money-laundering and terrorist-financing risks posed by crypto, and they should license or register virtual asset service providers (VASPs) and conduct reviews of their business practices, products and technology.

The FATF recommendations are not mandatory, but non-abiding jurisdictions could face global isolation through drops in their credibility ratings and other actions, such as the repercussions of being put on the FATF’s watchlist.

The crypto sector has faced a credibility and safety crisis as it’s been beset by hacks, many of which are linked to North Korea, sanctions from the U.S. and the U.N., and allegations of being a conduit for terrorist financing, including for those aiding Hamas and ISIS.

FATF’s ‘call to action’

The boss of the global money laundering and terrorist financing watchdog said it was “the first such report” addressing the concern that a lack of regulation “creates significant loopholes for both criminals and terrorists to exploit” and is “a call to action that we need countries to take this problem seriously.”

“I would describe virtual assets as being akin to water, and essentially they will flow to jurisdictions that are less regulated,” Raja Kumar said. “Criminals and terrorists are very quick to spot the opportunity leading to regulatory arbitrage. We just can’t allow this. Every part of the global chain needs to be strong. This is not a trivial matter.”

Purpose of report

The FATF chief said the report is meant to bring global attention to the issue as a “constructive” effort to inform regulators and the private sector about what’s going on with the group’s standards.

“Virtual assets are inherently international and borderless, meaning a failure to regulate VASPs in one jurisdiction can have serious global implications,” the report said.

In one example, the report referred to “the Democratic People’s Republic of Korea’s (DPRK) theft and laundering of hundreds of millions of dollars’ worth of virtual assets,” which have been said to be used for “weapons of mass destruction.”

It also noted the increasing use of cryptocurrencies to raise and move funds for terrorist groups. The report contended that bad actors were ‘almost exclusively’ demanding ransomware payments in cryptocurrencies.

Compliance levels of jurisdictions

The FATF has been urging jurisdictions to fully implement its recommendations for some time now. The table in the report rates each jurisdiction as compliant, largely compliant, partially compliant, or non-compliant.

The criteria include enacting legislation or regulation requiring the licensing or registration of VASPs, having registered or licensed such businesses, conducting supervisory inspections, taking enforcement actions against VASPs or enacting the travel rule for them.

FATF’s controversial “travel rule” requires crypto service providers to collect and share information on transactions above a certain threshold.

In several cases such as India, Singapore, Spain, Portugal, Italy and Malaysia, their assessments around compliance with Recommendation 15 are ongoing so the table rated them as N/A (not applicable). Other nations, such as Argentina, had conducted a risk assessment covering VASPs but had not completed any of the other seven relevant criteria.

North Korea is blacklisted by the FATF, while Russia’s membership was suspended in Feb. 2023.

Raja Kumar said the FATF isn’t demanding jurisdictions implement their recommendations by passing laws but that notifications from the government could be enough.

Methodology

At a FATF plenary held in February 2024, the group agreed to publish an overview of the steps jurisdictions have taken to regulate VASPs, resulting in this analysis. The 12-month examination took a look at the FATF’s 39 members and 20 other jurisdictions who host materially important crypto-related activities.

The selection of “materially important” jurisdictions was based on jurisdictions that hosted VASPs with more than 0.25% of global virtual asset trading volume or that had at least one million virtual asset users.

Collectively, those jurisdictions accounted for 97% of global crypto activity.

Read More: G-7 Must Take Charge in Ending ‘Lawless’ Crypto Space, FATF Chief Says