Ethereum has struggled to register meaningful upward movement in recent days despite strong investor activity.

The altcoin king’s price is being pulled by two opposing forces: heavy accumulation from retail and institutional players, and continued selling pressure from long-term holders. This clash has kept ETH rangebound.

Ethereum Exchange Supply Falls

Ethereum’s supply on exchanges has steadily declined for months, now sitting at a nine-year low. This signals investors are withdrawing tokens from centralized platforms, a move often linked to long-term accumulation strategies rather than short-term speculation.

In just the past month, more than 2.7 million ETH, valued at over $11.3 billion, has been accumulated by investors. This buying spree highlights strong conviction in Ethereum’s long-term potential, even as the short-term price action remains uncertain.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Exchange Supply. Source: Glassnode

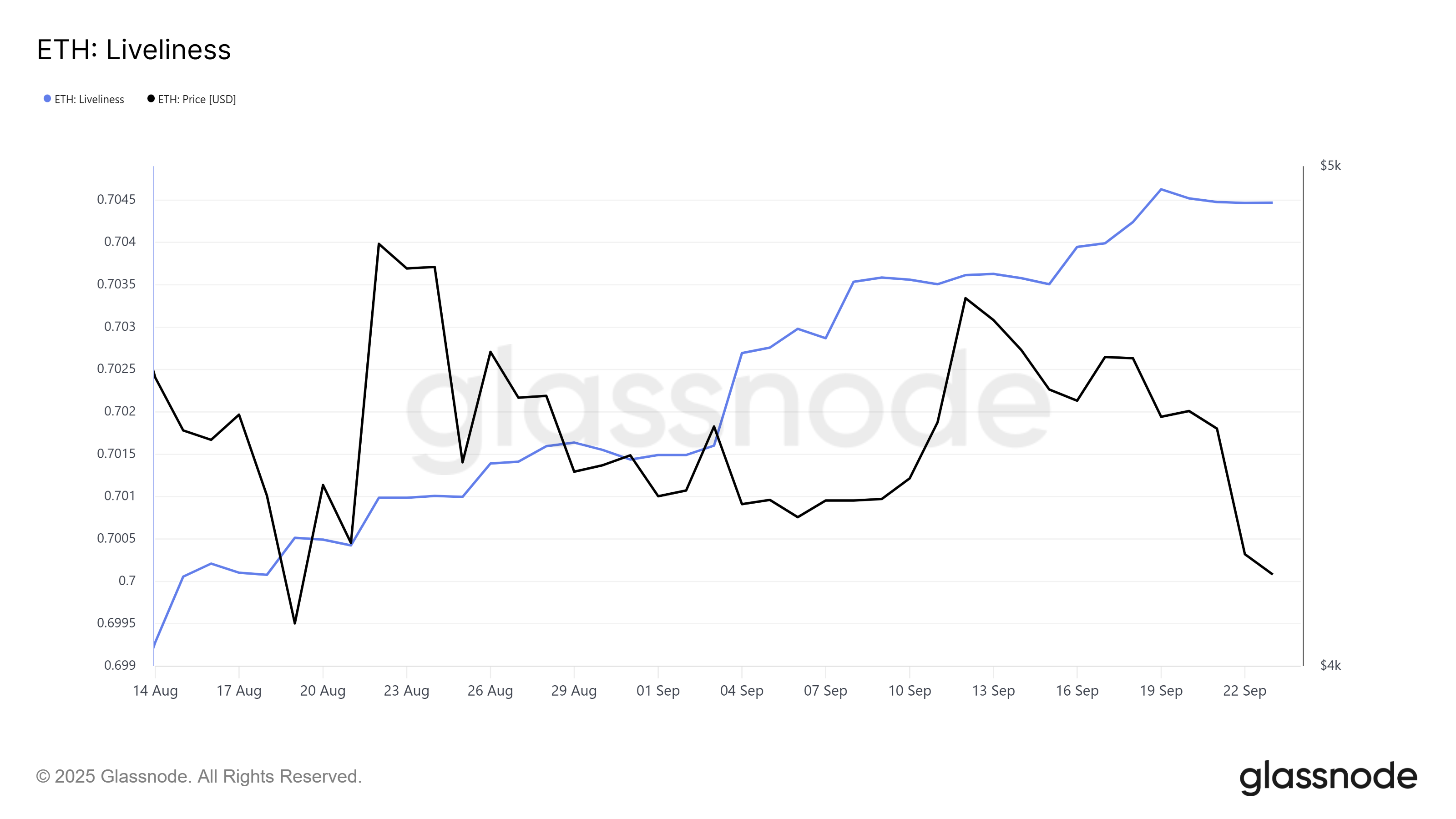

Despite this bullish accumulation, Ethereum’s Liveliness metric has been trending upward. Liveliness measures the behavior of long-term holders (LTHs), and an increase typically suggests these investors are selling rather than accumulating.

This selling from LTHs counters the bullish pressure from fresh inflows. As a result, Ethereum is caught between two opposing market forces. The standoff is limiting strong price swings, leaving ETH vulnerable to sideways trading until one side gains dominance.

Ethereum Liveliness. Source: Glassnode

ETH Price Is Vulnerable To Correction

Ethereum’s price is currently at $4,176, holding just above the critical $4,074 support zone. The immediate resistance lies at $4,222, which ETH must break to attempt further recovery.

Given the conflicting signals, ETH is likely to remain consolidated within a macro range between $4,000 and $4,500. This has been the case for several weeks as bullish and bearish pressures balance out.

ETH Price Analysis. Source: TradingView

However, if long-term holder selling continues to weigh heavily, Ethereum’s price could fall further. A breakdown below $4,027 support would leave ETH vulnerable to a decline toward $3,910, invalidating the bullish thesis.

The post Ethereum Exchange Supply Falls To 9-Year Low, Yet Price Is Struggling At $4,000 appeared first on BeInCrypto.