Ethena Labs’ USDe stablecoin provides a yield through a tokenized cash-and-carry trade.

Counterparty risk and a funding-rates reversal are two of the protocol’s main challenges.

Ethena founder Guy Young labeled comparisons with Terra’s failed UST as a “weak, surface-level argument.”

Ethena Labs, a decentralized protocol centered on the yield-bearing USDe stablecoin, has polarized crypto traders in the weeks since introducing the token to the public in February over similarities to the Terra ecosystem, which imploded in 2021.

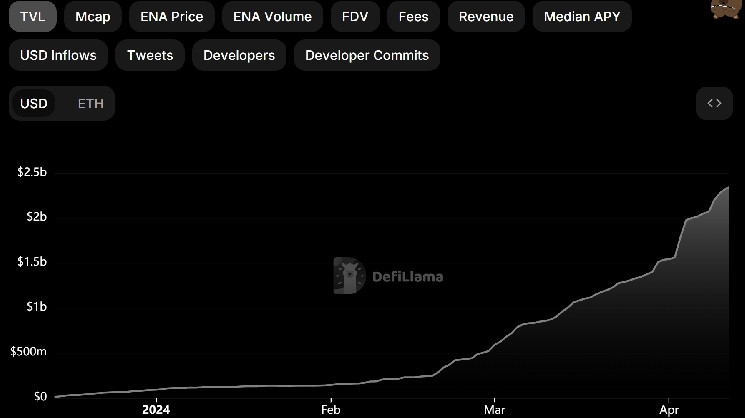

People who stake USDe for a minimum of seven days currently earn an annualized yield of about 37%, high enough to spur total value locked (TVL) on the protocol to $2.3 billion from $178 million – a 12-fold increase in just 60 days. High yield, however, is a double-edged sword and usually reflects high risk: Terra’s UST paid out nearly 20% to stakers before its demise.

Unlike asset-backed stablecoins like tether (USDT) and USDC, whose value is secured against dollars or dollar-equivalents such as U.S. government debt, USDe calls itself a synthetic stablecoin with its $1 value maintained through a financial technique known as the cash-and-carry trade. The trade, which involves buying an asset and simultaneously shorting a derivative of the asset to collect the funding rate, or the difference between the two prices, is well known in traditional finance and doesn’t carry directional, or delta, risk.

“The trade itself is very safe and well understood, many folks (including Folkvang) have been running trades like this for years,” Folkvang founder Mike van Rossum said in a post on X. “But keep in mind it’s only risk free when talking about delta. There are a lot of things that can go wrong here. Such as any issue with any of the exchanges these positions (and collateral) are managed on. As well as issues around trying to execute hundreds of millions (or billions) in very volatile markets.”

How does Ethena work?

Ethena users mint USDe tokens by depositing stablecoins like USDT, dai (DAI) and USDC on the protocol. They can then stake the minted USDe, which has a market cap of $21.3 billion, in return for the yield.

To generate that yield, Ethena has deployed several strategies that hinge around the cash-and-carry trade.

Funding rates on bitcoin (BTC) and ether (ETH) perpetuals are currently positive, which means long positions pay short positions, generating a return for those shorting the market. Funding rates typically flip negative in falling markets, which means Ethena’s yield source might dry up if cryptocurrency enters another bearish cycle.

Crypto whales seem unperturbed. Earlier this week 10 wallets withdrew a total of $51 million of Ethena’s native governance token (ENA) from exchanges and locked that on Ethena for a minimum of seven days, according to Lookonchain.

“The risks to Ethena is that the yield goes away due to natural market forces, or that they have a counterparty blow up, not the collateral itself,” Jeff Dorman, chief investment officer at Arca, said in an interview.

“What Ethena is trying to do with basis trades is fairly easy, and has been done in traditional markets for decades,” he said. “Anyone can do the same thing on their own, if they have enough capital for collateral, and trusted counterparties. All Ethena is doing is increasing the risk while decreasing the time it takes for you to do it on your own.”

Long-lasting scars

Terra’s traumatic demise led to the bankruptcy of several other crypto firms, and left long-lasting scars across the industry. It blew up because UST, an algorithmic stablecoin, entered a death spiral following aggressive selling and a slump in the value of LUNA, which acted as collateral.

“It is a really weak, surface-level argument to compare what Ethena is doing to Luna,” Ethena Labs founder Guy Young said in an interview with Laura Shin on the Unchained podcast. “The core difference here is thinking about what’s backing the stable asset. So UST was backed by the LUNA token, which mooned up 100% and dumped 50% in a week. Ethena’s USD is fully backed and fully collateralized.”

As for its reliance on a bull market, Young said: “I think it’s a valid concern around this. What we did see even in 2022 when you had staked ETH together with basis you could still sustain rates above U.S. Treasuries, but I do imagine that in a bear market you do see a reasonable unwind of USDe supply.”

“This is something that we’re okay with,” Young said. “It’s just something that is responding to market dynamics, and if there is less leverage demand to be long as the interest rate is lower, we’re going to adjust to a smaller size.”

Young didn’t rule out changing Ethena’s yield-generation strategy to something that “makes sense in a bear market” if necessary.