[ad_1]

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Cooking with flywheels

It’s not always the case that crypto prices make sense. DePIN may eventually change that.

Take Bitcoin. It’s tempting to think that its price might go up or down depending on how many people are using the network.

Sometimes that’s true — both 2017 and 2021 bull runs were preceded by huge growth in the number of active wallets. And the number of transacting addresses often falls almost in tandem with bitcoin’s price, usually after markets peak.

But active Bitcoin addresses grew throughout most of 2022, the depths of the most recent bear market, even as prices went down. There’s an obvious simple explanation: Some of those active addresses were actively selling, pushing prices down.

All this makes predicting bitcoin prices with onchain activity rather squirrely. You never know if that “active wallet” is posturing to buy or sell on a crypto exchange.

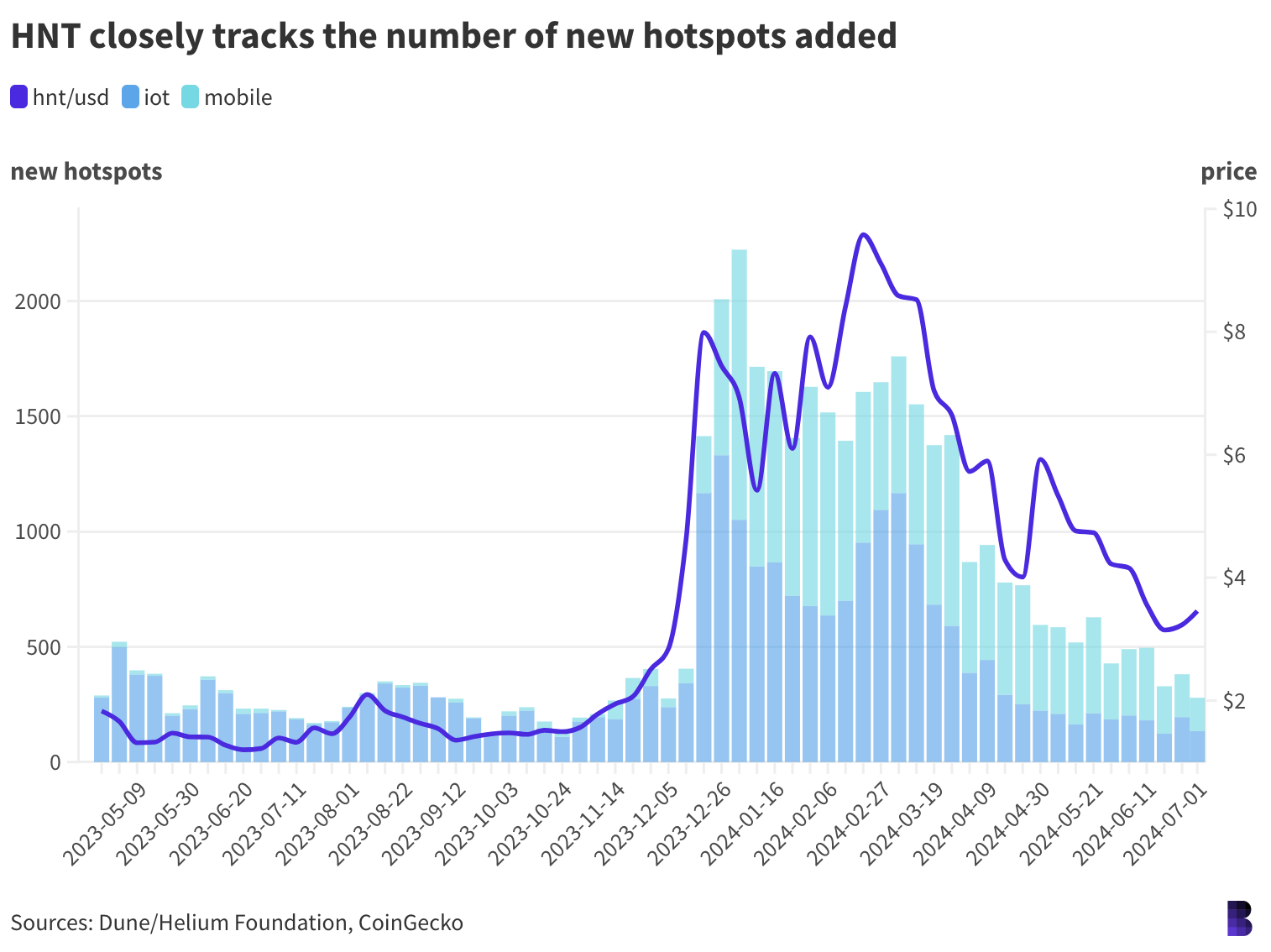

DePIN is showing early signs of more reliable metrics, at least on the surface. Helium, for example, pays users crypto for setting up mobile and IoT hotspots around the world. Over the past year or so, almost 42,000 Helium devices have been deployed.

Nothing seems to boost new hotspots more than rising prices

It just so happens that the rate of new Helium hotspot deployments matches the price performance of HNT almost exactly.

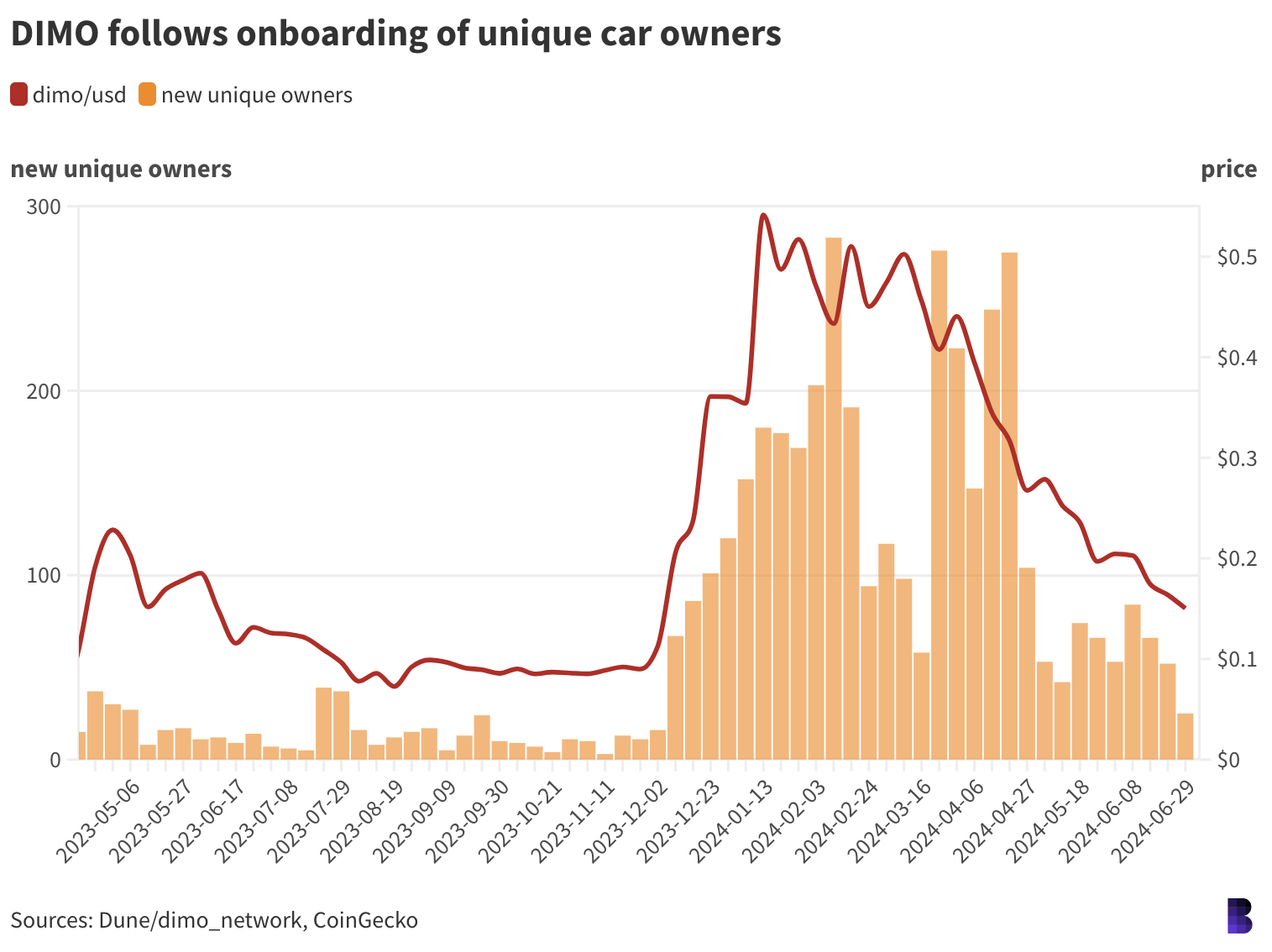

DIMO is another. It pays vehicle owners a steady stream of tokens in return for their car-related data.

Almost 5,000 unique owners have opted into DIMO since December 2022, reaching close to 300 new owners per week as markets topped out earlier this year.

New signups have since declined, along with DIMO’s price.

Looks familiar…

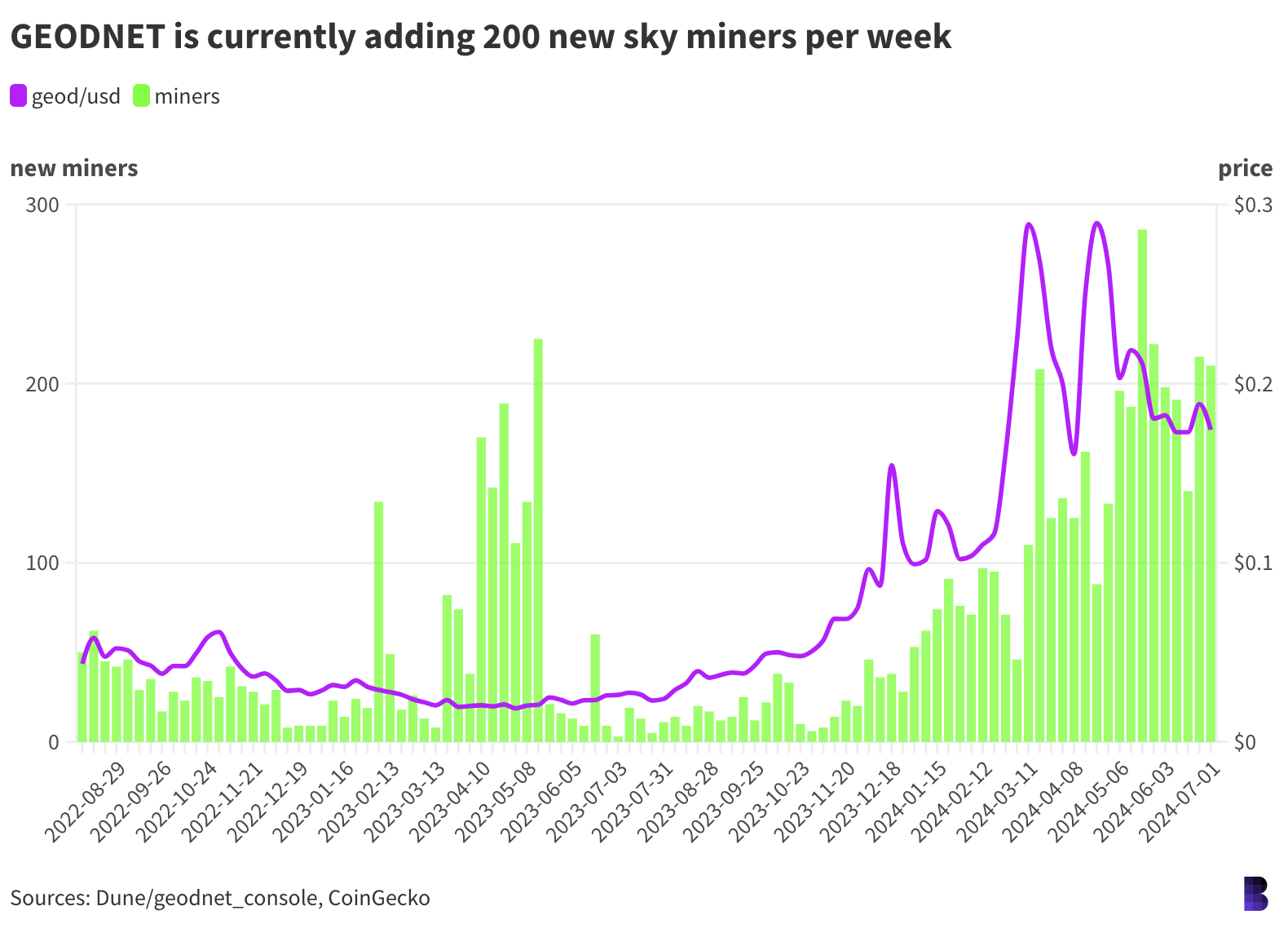

GEODNET, the Real-Time Kinematics project looking to make geo-location more precise with crypto incentives, is following a similar trend.

The project has so far onboarded almost 7,400 “sky miners” — small satellites on rooftops and other high places that collect real-time space weather data — over the past two years or so.

Aside from a major uptick in the second quarter of 2023 as GEOD’s price bottomed out, the price of its native token has risen alongside the number of new satellite miners coming online.

Some of the correlation can be explained by the operation spending 80% of its revenue on buying back GEOD and burning it, with about $500,000 removed from circulation to date (~2% of its current market cap).

GEODNET has so far paid out nearly $8 million tokens for mining the sky

Modeling DePIN token prices on how many users are building out the infrastructure looks promising, but frustratingly, it’s a chicken-and-egg problem.

Did rising prices drive users to add devices to the respective networks? Were new sign-ups scared off when markets corrected? We might never know.

What the correlation does suggest is that ‘number-go-up’ could still be the primary driver of infrastructure growth in DePIN, as is tradition in crypto.

DePIN’s ties to the physical world may only get it so far, for now.

— David Canellis

Data Center

- Weekly Helium revenues have leveled out after falling for most of this year, currently sitting at about $32,000.

- DePIN tokens overall are currently worth $26.6 billion, per CoinMarketCap, down from $40 billion in March.

- BTC and ETH are flat on the day and up 2% in the past seven days, now $62,700 and $3,450 respectively.

- Global stablecoin supplies have risen over $1 billion month on month to $161.7 billion but have shed around $300 million in the last week.

- Blast processed over 25% of all DEX derivatives volumelast week amid its airdrop, handling $11.24 billion. Its volumes have since normalized but are still ahead of Arbitrum.

Circling back

We’ve previously chatted about the staggered Markets in Crypto Assets (MiCA) rollout over in Europe. The first part has arrived and it’s mostly focused on stablecoins.

In case you missed the hoopla leading up MiCA’s implementation, or Circle’s big announcement yesterday, the stablecoin issuer seems excited about the new rules.

CEO Jeremy Allaire said the framework legalizes stablecoins in a Monday press conference. Through this, the stablecoin issuer can now issue both USDC and EURC in the EU.

In a press release accompanying Circle’s announcement that it was the first EU-regulated stablecoin under the new provisions, Allaire added that the rules unlock “the enormous potential of digital assets to transform finance and commerce.”

Per Chainalysis data, onchain transaction volume reached $10 trillion last year. Stablecoins made up 60% of that volume. Clearly that’s no small sum, and points to how widely used and accepted stablecoins have become. To put that number further into perspective, bitcoin only represented 10% of onchain volume in 2023.

(I want to quickly note that I’m focusing on the big stablecoin issuers, but other European-specific issuers have also become MiCA compliant.)

With that being said, let’s take a look at Tether. CEO Paolo Ardoino seems a tad more hesitant about the new regulations, at least in comparison to Allaire. However, there’s no doubt that such regulations do encourage growth, he noted.

“Tether commends EU regulators for their efforts in establishing a framework for crypto assets. While the effects of these new regulations will take time to manifest, there remain important aspects of the regulation which we continue to believe could render the job of a stablecoin issuer extremely complex but also make EU-licensed stablecoins vulnerable and riskier to operate,” Ardoino told me.

His point is a valid one, though. Chainalysis highlighted that regulation emphasizes the need for issuers to really pay attention to onchain analytics, so they can better understand the use cases for their stablecoins.

“This sort of data can provide insights into holders, balances, and transactional behavior, offering a degree of transparency on the usage of particular tokens on an aggregate-basis, as well as at the transaction-level,” the firm wrote.

“This allows issuers to have a real-time view of active wallets holding their tokens, including holder behavior (i.e. exchange vs. personal wallets, duration of holdings), overall transaction volume across multiple blockchains, and alerts for transactions involving sanctioned entities or jurisdictions.”

Ardoino said more discussions are warranted to better understand and implement the technical aspects of this regulation.

“While Tether is optimistic about MiCA’s long term implementation, it remains crucial that stablecoin regulatory policies enacted are balanced, protect consumers, and nurture growth in our emerging industry,” he said.

Change is hard, but here’s to hoping that MiCA is able to succeed in uniting regulators across the EU. And perhaps the US could learn a lesson or two.

— Katherine Ross

The Works

- Bitcoin miner Northern Data is mulling an IPO for its AI and data center business segment, Bloomberg reported.

- Binance.US is “confident” in its legal battle against the SEC, the company said on X.

- The Bahamas is prepping regulations requiring commercial banks to provide access to its CBDC, Reuters reported.

- The SEC filed a suit against and a settlement with FTX-linked (and now defunct) Silvergate Bank.

- The German government continues to send millions in bitcoin to exchanges, per Arkham data.

The Riff

Q: Are stablecoins still crypto’s killer app?

Probably.

I’m not one to say definitively one way or another because there are so many unknowns in this world (can you tell I went to Las Vegas and didn’t spend a dime gambling?) but I think the use cases for stablecoins are strong. I mean, just scroll up and look at the Chainalysis data I mentioned above.

There’s always going to be something sexier and unique in crypto that people hail as the next killer app, but if we’re just looking at utility and overall use, then I think stablecoins have this race locked down.

— Katherine Ross

The maxi suppressed inside of me would say Bitcoin is the ultimate crypto app: uncensorable digital money.

Can’t say the same for tether and USDC. Their respective issuers can freeze whatever balances they like, which they regularly do upon request from law enforcement.

Luckily, crypto has DAI, which doesn’t have that problem. That also makes it uncensorable digital money. So yes, stablecoins are crypto’s killer app…if you don’t count the original.

— David Canellis

[ad_2]