The crypto treasury narrative, which has become a major feature of the current market cycle, parallels investor sentiment from the dotcom era of the late 1990s and early 2000s, which caused the stock market to sink by about 80%, according to Ray Youssef, founder of peer-to-peer lending platform NoOnes app.

The same overzealous investor psychology that led to over-investment in early internet and tech companies during the dotcom crash has not disappeared due to the presence of financial institutions in crypto, Youssef told Cointelegraph. He said:

“Dotcoms were an innovative phenomenon of the emerging IT market, alongside major companies with serious ideas and long-term strategies, the race for investment capital also attracted enthusiasts, opportunists, and dreamers, because bold and futuristic visions of the future are easy to sell to the mass market.

Today, the global financial market is driven by the idea of cryptocurrency, decentralized finance, and the Web3 revolution,” he added.

An overview of digital asset treasury sector. Source: Galaxy

He predicted that a majority of crypto treasury companies would fizzle out and be forced to offload their holdings, creating the conditions for the next crypto bear market, but that a select few would survive and continue accumulating crypto at a significant discount.

Crypto treasury companies have dominated the headlines during the current market cycle, as institutional investment is touted as a sign that crypto has matured from a niche phenomenon to a global asset class courted by nation-states and corporations.

Related: Crypto markets are down, but corporate proxies are doing far worse

Not all crypto treasury companies are doomed; responsible management can mitigate downturns

Crypto treasury companies can mitigate the effects of a market downturn and even thrive if responsible treasury and risk management are practiced.

Reducing a company’s debt burden significantly mitigates the chances of bankruptcy, and corporations that issue new equity, as opposed to corporate debt, have a higher chance of surviving a downturn because equity holders do not have the same legal rights as creditors.

If a company chooses to take on debt to finance crypto purchases, terming out the debt, or spacing out when each debt tranche must be paid back, is paramount.

For example, if a company knows Bitcoin (BTC) tends to operate in four-year cycles, it can structure its debt to come due in 5 years to avoid having to pay back loans when crypto prices are depressed.

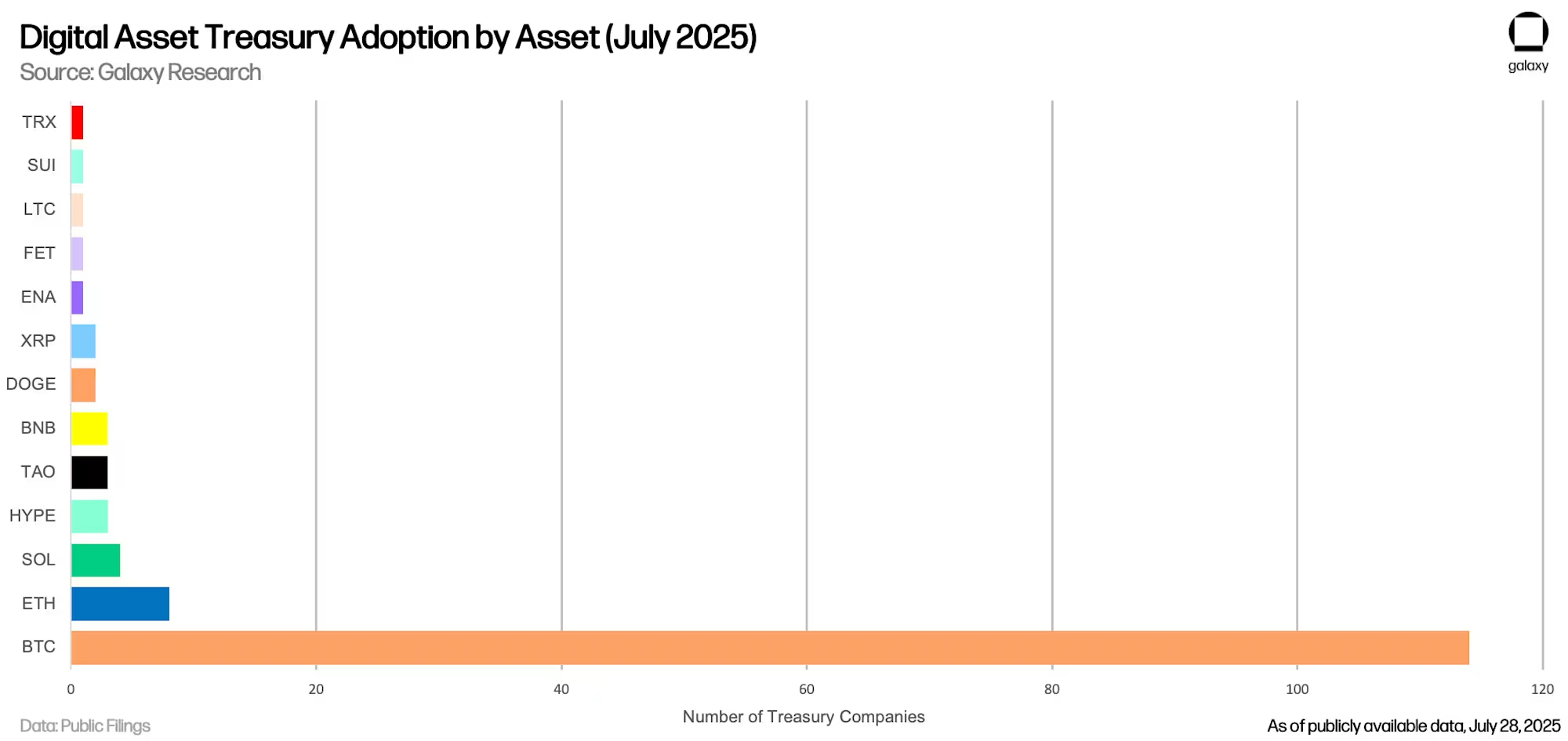

A breakdown of digital assets adopted by corporations for treasury purposes. Source: Galaxy

Companies should also invest in supply-capped cryptocurrencies or blue-chip digital assets that are perennial and recover between cycles, as opposed to altcoins that can lose up to 90% of their value between market cycles and sometimes never recover.

Finally, companies that have an operating business generating revenue are in a better position than pure treasury plays that have no revenue streams to funnel into crypto purchases and function as publicly traded acquisition vehicles reliant on funding.

Magazine: How Ethereum treasury companies could spark ‘DeFi Summer 2.0’