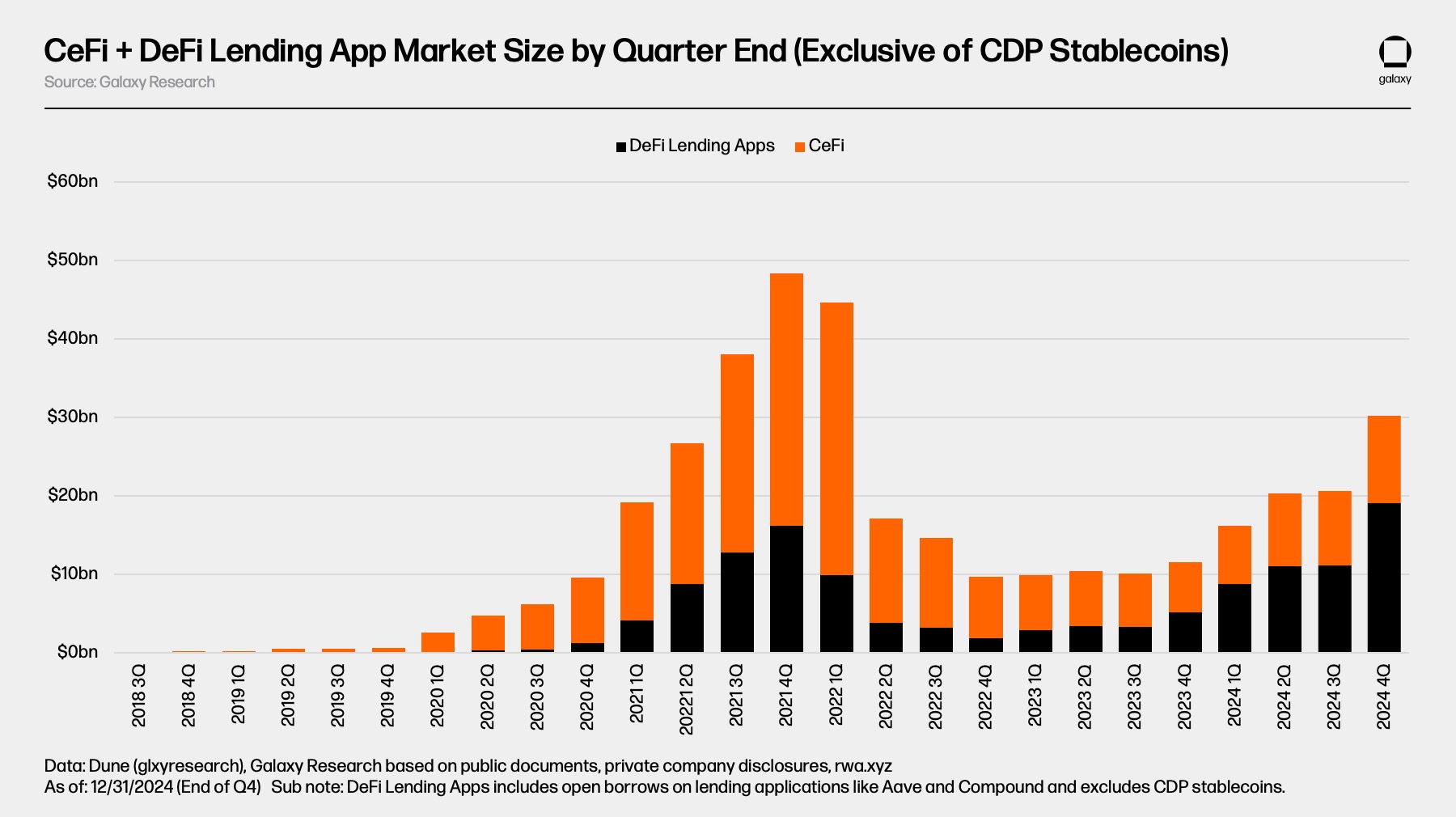

The crypto lending market has plunged from its bull market peak and has fallen 43% from its all-time high to $36.5 billion in Q4 2024, according to a new report from Galaxy Research.

The decline came from the collapse of major lending platforms during the 2022-2023 bear market. Despite this overall contraction, the market has rebounded 157% from its Q3 2023 low of $14.2 billion.

CeFi lenders consolidate after market collapse

The CeFi lending market saw huge disruption following bankruptcies of dominant players. The CeFi crypto lending market peaked at an estimated $34.8 billion in outstanding loans before it dropped to $6.4 billion at its lowest point – an 82% decline.

By Q4 2024, the CeFi lending market has rebounded halfway to $11.2 billion, 68% below its all-time high but 73% higher than the bear market low. The rebound is accompanied by greater concentration among fewer players.

The three largest CeFi lenders – Ledn, Galaxy, and Tether – now dominate the market with a combined loan book value of $9.9 billion and a combined 89% market share. This is a shift from the Q1 2022 bull market top when the top three lenders (Genesis, BlockFi, and Celsius) held 76% market share with $26.4 billion of loans.

Source: Galaxy report.

The failure of these market leaders has altered the competitive landscape. Genesis, Celsius Network, BlockFi, and Voyager all went bankrupt within a two-year span as crypto asset prices declined and market liquidity evaporated.

Not all CeFi lenders are the same, the Galaxy report implies. Some offer only specific types of loans, e.g., BTC-collateralized products or cash loans minus stablecoins. Some offer their services to only specific types of customers or jurisdictions. This heterogeneity allows some lenders to grow larger than others by default.

The report notes potential double counting between CeFi loan book size and DeFi borrows, as some CeFi entities use DeFi lending applications to service borrows to off-chain clients.

DeFi lending shows strong recovery

DeFi lending through on-chain applications has seen strong growth from the bear market bottom. There were $19.1 billion in open borrows across 20 crypto lending applications and 12 blockchains at the conclusion of Q4 2024. This marks a 959% increase in open DeFi borrows over eight quarters since the bottom was set.

As of the Q4 2024 snapshot, the amount of outstanding loans through on-chain lending applications was 18% higher than the $16.2 billion previous peak set during the 2020-2021 bull market.

DeFi borrowing has recovered more strongly than CeFi lending. This can be attributed to the permissionless nature of blockchain-based applications and the survival of lending applications through the bear market. Unlike the largest CeFi lenders that went bankrupt, the major lending applications continued to function throughout the downturn.

According to the Galaxy report, this outcome highlights the strength of the design and risk management practices of large on-chain lending apps and the benefits of algorithmic, overcollateralized, and supply/demand-based borrowing.

A key development in the crypto lending market is the growing dominance of DeFi lending apps over CeFi venues. DeFi lending applications’ share of total cryptocurrency borrows (excluding CDP stablecoins) only reached 34% during the 2020-2021 bull cycle. As of Q4 2024, it makes up 63% of the market, nearly doubling its dominance.

The trend becomes more pronounced when including crypto-backed CDP stablecoins. At the end of Q4 2024, DeFi lending apps and CDP stablecoins captured a combined 69% of the entire market.

The report notes a decreasing dominance of CDP stablecoins as a source of crypto-collateralized leverage, partly due to increased liquidity of stablecoins, improved parameters on lending applications, and the introduction of delta neutral stablecoins like Ethena.

Venture capital funding slows for lending sector

CeFi and DeFi lending and credit applications raised a combined $1.63 billion through deals with known amounts between Q1 2022 and Q4 2024 across 89 deals. The sector saw its highest quarterly funding in Q2 2022. It got hold of $502 million across eight deals. The lowest point came in Q4 2023 with just $2.2 million in total funding.

Venture capital allocation to lending and credit applications has made up only a small portion of total VC investment in the crypto economy. On average, lending and credit applications captured just 2.8% of all VC capital allocated to the space on a quarterly basis between Q1 2022 and Q4 2024.

The crypto lending sector’s share of total quarterly funding peaked at 9.75% in Q4 2022. However, by Q4 2024, it fell to a mere 0.62% of total crypto VC funding.

The Galaxy report connects this decrease in funding to the market collapses of 2022-2023 that saw major players like BlockFi, Celsius, Genesis, and Voyager file for bankruptcy. These four entities alone accounted for 40% of the entire crypto lending market and 82% of the CeFi lending market at their peak.

According to the report, the downfall of these lenders stemmed primarily from the general crypto market implosion. However, it was worsened by mismanagement of risk and acceptance of toxic collateral from borrowers.