[ad_1]

Bitcoin demonstrates ongoing momentum surging to a high of $73,887 without showing signs of exhaustion.

The crypto market saw Bitcoin (BTC) break new ground, hitting an all-time high of $73,887 (on EXMO) before experiencing a rapid pullback as it briefly touched $74,000. This surge in volatility followed a record-breaking day, with net inflows totaling over $1 billion, according to data from BitMEX Research.

[1/4] Bitcoin ETF Flow – 12 March 2024

All data in. Record day with over $1 billion of net inflow. Blackrock with a record $849 million of inflow pic.twitter.com/dKFmM3Qvaa

— BitMEX Research (@BitMEXResearch) March 13, 2024

As per data, Blackrock recorded a historic $849 million cash inflow for spot Bitcoin exchange-traded funds (ETFs) as demand keeps growing.

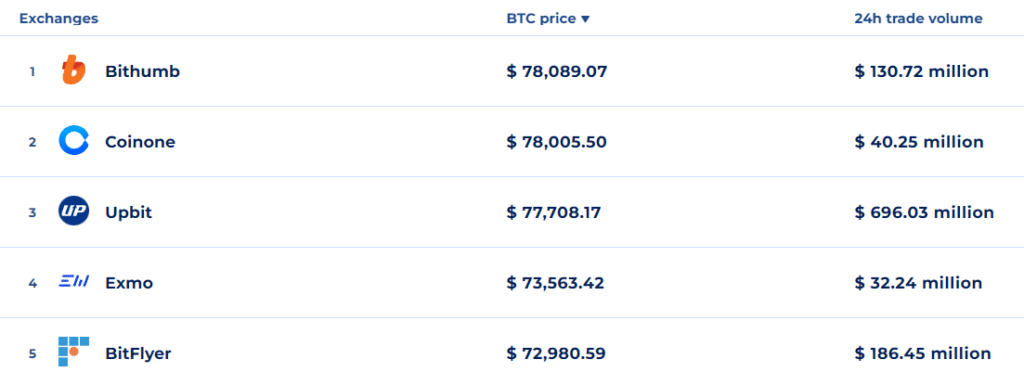

Meanwhile, data from Coinranking indicate that Bitcoin surpassed the $78,000 mark on Korean crypto exchanges such as Bithumb and Coinone. However, this apparent price gap is attributed to the phenomenon known as the Kimchi premium, as crypto.news reported earlier.

You might also like: Patient Capital Management replaces Grayscale Bitcoin Trust with crypto ETP

Bitcoin’s latest rally comes on the heels of a recent dip below the $69,000 mark on Mar. 12, when the largest crypto by market capitalization briefly dropped to around $68,600. Despite the setback, Bitcoin appears to be regaining strength, with long traders anticipating further positive movements.

According to data from Coinglass, the number of long positions exceeds short positions by nearly $10 million at the time of writing.

Meanwhile, analysts at QCP Capital observe a softening in front-end volumes, with Ethereum (ETH) volumes experiencing a more significant decline compared to Bitcoin. They suggest that investors seeking to capitalize on high yields without taking directional risks may view current price levels as “another chance to sell the spot-forward spreads at these elevated levels.”

Read more: The Bitcoin effect: why altcoins follow BTC’s lead

[ad_2]