One thing we rarely think about is how bad weather can affect Bitcoin’s security, but it happens fairly regularly. Snow can legitimately pose a risk to Bitcoin miners who secure the blockchain.

The snow shows up on the weather map first, a fat smear of color stretching across state lines. Then it turns into the stuff you actually feel: power lines dancing in the wind, crews on standby, households trying to keep the heat on.

Somewhere behind that very normal human scene is a different kind of appliance: rows of Bitcoin miners that do one job when electricity is cheap and plentiful, then sometimes stop on purpose when the grid is under stress.

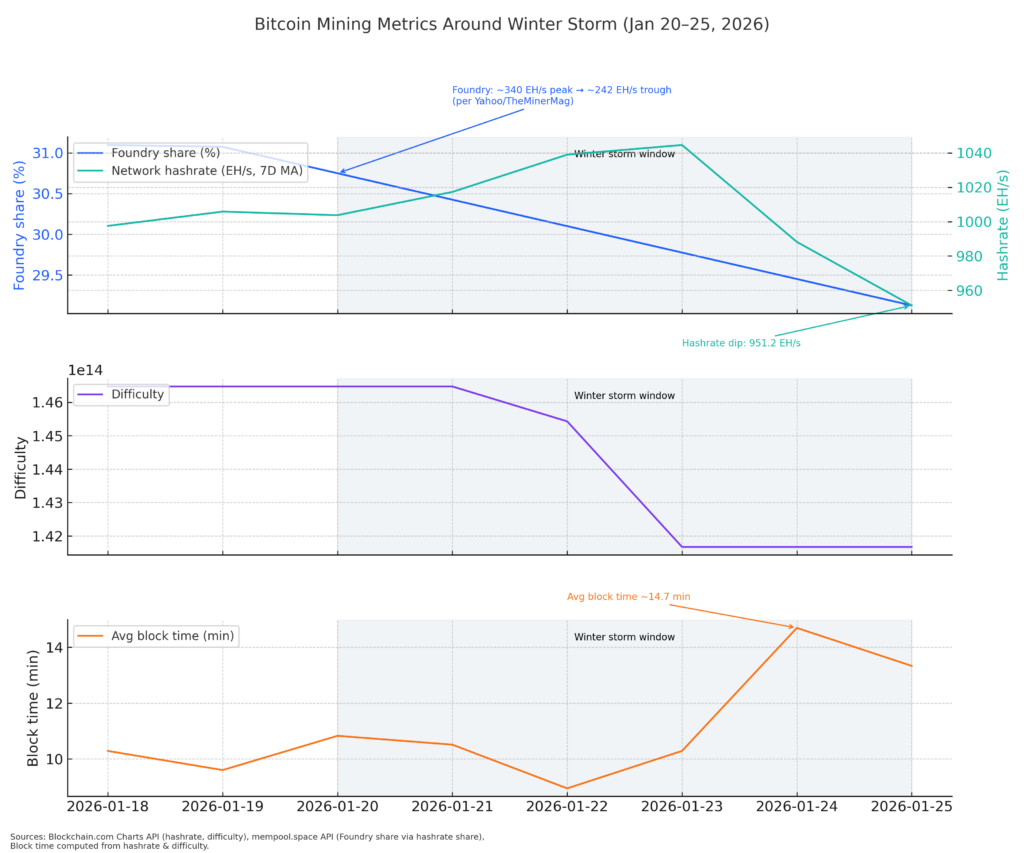

That is the backdrop for two things that happened close together and are easy to misread if you only look at the headline numbers: a sharp shift at the largest Bitcoin mining pool in the US, Foundry, and a broad dip in network hashrate that showed up in the charts.

The hashrate dip everyone sees

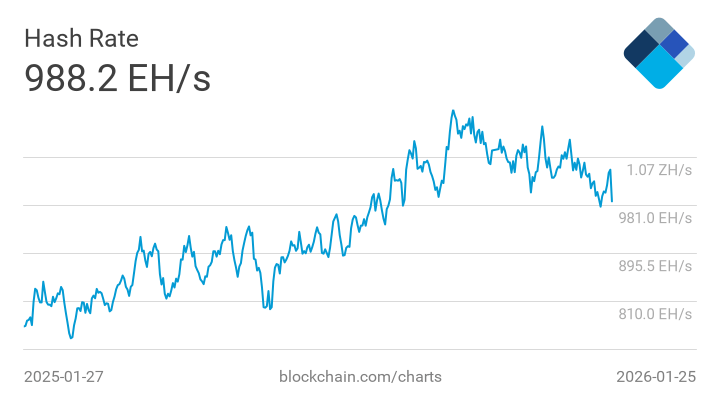

If you follow mining data day to day, you probably saw the same thing: hashrate suddenly printing lower, with a big red percentage next to it.

BitInfoCharts, a chart many people screenshot and share, showed a notable 24-hour drop in its daily estimate at the time of writing. That is where the “nearly 10%” chatter comes from, and the swing can print even larger depending on the exact moment you check.

The first thing to keep in mind is that “hashrate” on these dashboards is rarely a direct reading of machines. It is an estimate inferred from blocks found over a period of time.

That sounds academic until you remember how Bitcoin works. Blocks come in bursts and then dry spells, even when nothing changes in the real world.

Providers like Blockchain.com have long noted that short windows can be noisy for exactly that reason, and using a 7 or 14-day average is often less sensationalist.

So a one-day drop is a clue. It is not a conviction.

When the dip is real, you usually see it somewhere else too. Block times stretch out, difficulty estimates roll over, and the mempool can start to feel tighter if demand is there.

In fact, on the day in question, mempool data did show slower block production, with average block time prints around the 11-minute range in a snapshot view on mempool.space.

Still, that kind of reading does not prove a specific percentage drop on its own. But it does rhyme with a period where a chunk of mining capacity is actually offline, not just shuffled between pools.

The storm, the grid, and the part people forget

Now we add the human part back in: the US is heading into a major winter system.

Reporting from AP described a massive storm setup with widespread impacts and large numbers of customers losing power in some regions.

When storms like that hit, the grid becomes the story, not Bitcoin. It is easy to see miners as bystanders.

In the US, they are often wired into the plot.

A growing slice of industrial-scale mining in places like Texas behaves like an interruptible load. Miners sign agreements; they can curtail quickly, they can earn credits, and the grid operator has a lever to pull when demand spikes.

You can see this concept described in government language too. The US EIA has discussed large loads, including crypto mining, participating in voluntary curtailment arrangements with ERCOT.

On the corporate side, the speed is not hypothetical.

CleanSpark has described curtailing hundreds of megawatts across multiple sites within minutes in response to a TVA request, as covered by DataCenterDynamics.

That is the kind of capability that can show up on a chart as a cliff, because it is a cliff.

This is why a big storm and a sudden hashrate dip can be related, even if you never see a miner in a snowbank.

Weather drives demand. Demand stresses the grid. Miners either lose power or choose to sell power back to the grid.

The network feels it as fewer hashes per second.

There is another layer too: grid operators often telegraph the stress windows.

Coverage from Axios flagged the strain risk across systems like ERCOT and PJM during the storm period.

Local reporting has also pointed to emergency measures and backup generation being considered, including reporting from the HoustonChronicle on steps taken around extreme cold.

This is where we need to ground the narrative without overselling it. Storms create the conditions for curtailment and outages.

Curtailment and outages can create a real hashrate drawdown. The drawdown can show up as slower blocks and a dip in daily hashrate estimates.

Foundry, and why this one pool matters

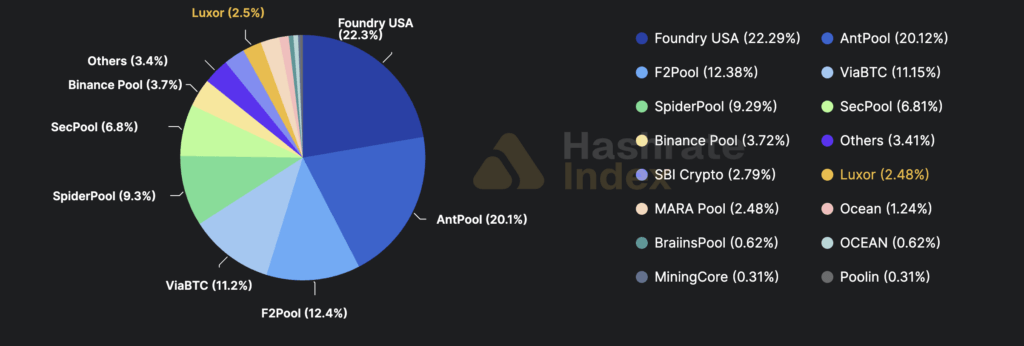

Foundry is a lightning rod in mining discourse because it is big, US-linked, and coordinates a meaningful chunk of block production.

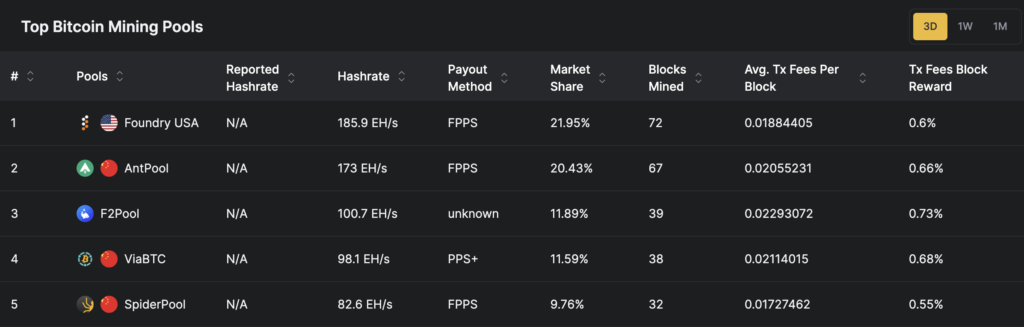

Depending on the lookback window, Foundry’s block share often sits in the high 20s to low 30s. The Hashrate Index currently has it around 22% over the past 3 days, down from 30% over the month.

When Foundry shows a sharp move, it starts conversations that go way beyond Foundry.

During the recent cold snap, reporting from TheMinerMag, described Foundry’s hashrate falling from roughly 340 EH/s at a peak to around 242 EH/s, a drop of around 30%.

It also cited Luxor dropping, with more than 110 EH/s taken offline across those two pools.

As of press time, Foundry’s 3-day average market share has fallen to 21.95% with its hashrate at just 185.9 EH/s.

The reason this matters is that Foundry can function as a proxy for US mining behavior.

If a lot of US-based capacity is clustered in the same weather system, connected to the same power market logic, and coordinated through a few major pools, a storm does not just knock on one door.

It knocks on the same hallway.

The risk that matters

This is where we get out of the day-to-day churn and into something we can hold onto.

The mining system has two kinds of concentration that matter during stress: geographic concentration and coordination concentration.

Geographic concentration means a bunch of machines sit under the same sky, exposed to the same cold front, the same ice, the same grid-operator notices.

Coordination concentration means a lot of those machines point at the same pool, so the public dashboard moves in a way that feels like a single organism.

When both are true, weather becomes a trigger for a sudden and visible hashrate shock.

Even if the wider network does not lose 30%, the public sees a big pool wobble, and that has its own consequences.

The technical consequences are straightforward. If miners truly go offline, blocks slow until difficulty adjusts.

The economic consequences depend on demand. If blocks slow and the mempool is busy, fees rise.

If blocks slow and the mempool is quiet, the fee impact is muted.

Right now, the “busy mempool” part is not guaranteed.

Recommended fee levels have been sitting low at times on mempool.space, so you can frame fee impact as conditional, tied to whether demand spikes during a supply shock.

The narrative consequence is bigger. Every time a big US-linked pool moves sharply, people start asking questions about resilience, decentralization, and who really steers block production.

Miner behavior when the lights flicker

There is another reason storms matter to mining: they intersect with a quieter story about miner balance sheets and survival.

If a miner curtails for a few hours or a day, revenue drops, and fixed costs keep ticking. Management has to decide what to do.

Some miners will monetize power markets, some will sell Bitcoin, and some will do both, and those choices show up downstream.

Riot’s updates are a useful example of how active treasury management has become.

Riot disclosed selling 1,818 BTC in December 2025 for $161.6 million in net proceeds, according to the company’s own release at Riot.

CleanSpark also reported sales activity in its own updates, with industry coverage summarizing those figures, including Blockspace.

This matters because a storm-driven curtailment window can become a cash-flow event.

If miners can earn credits by turning off, they have a cushion. If they cannot, they may lean harder on treasury sales.

We all understand what happens when the income clock pauses, but the bills do not.

The macro layer, why this keeps coming back

Storms are episodic. The system design is ongoing.

Mining has been moving toward regions where power is plentiful, flexible, and market-based. That often means being closer to grids that can ask for curtailment when demand spikes.

That is part of why US mining has become both influential and exposed.

Commentary from mining analytics shops has also highlighted winter energy dynamics and curtailment as a recurring driver behind hashrate weakness, as discussed by HashrateIndex.

JPMorgan’s view points to the other side of the coin: when hashrate falls, profitability for the remaining miners can improve.

That creates a perverse incentive loop where some miners benefit from others being forced offline.

Then you have longer-range forecasts that put more weight on the supply side: more hashrate coming online over time, more competition for megawatts, and more pressure on margins.

Hashlabs, for example, has modeled a wide range of end-2026 hashrate outcomes, with estimates in the 1.7 ZH/s neighborhood depending on assumptions.

Storms punch harder in a tight-margin environment.

When miners have room, they absorb downtime. When they are squeezed, every curtailment window is a financial decision.

So is the storm related to the hashrate drop?

Here is the honest version: yes, it could be.

You can build a credible case without pretending you have a meter on every ASIC in America.

A strong linkage looks like this: storm warnings intensify, grid operators brace, outages spread, miners curtail or lose power, network block times drift up, difficulty expectations tick down, daily hashrate estimates print lower, and big pools with US exposure show a visible drop.

We have several of those elements: storm severity and outages from AP, grid-stress framing from Axios, and curtailment capability and incentives from the EIA and DataCenterDynamics.

We also have Foundry’s drawdown during cold conditions.

What we should avoid is treating the loudest 24-hour number as the whole story.

Daily hashrate charts are useful. They are also jumpy, and that caveat is documented by Blockchain.com.

How this impacts everyday holders

The real theme is the idea that a network people call unstoppable is still plugged into the same messy world as everyone else.

Bitcoin runs on math, and it also runs on electricity. Electricity runs on weather, politics, and infrastructure that can fail.

When a storm barrels toward the US, families stock up on batteries, utilities position trucks, and miners decide whether to keep hashing or cash in their flexibility.

In the middle of all that, the blockchain keeps moving, sometimes a little slower, and the charts twitch like a seismograph.

Foundry’s shift is part of that picture. It is a reminder that mining coordination has gravity, that big pools reflect big concentrations of power, and that extreme weather can turn that concentration into a sudden shock you can see from your phone.

The broader hashrate dip is the other half. It is the network-level pulse check, and it raises a question readers can understand even if they never cared about hashrate before:

How fragile is this system when the weather gets weird?

Where this goes next

The forward-looking takeaway is simple: extreme weather is becoming a recurring stress test for US mining, and US mining has become a stress test for Bitcoin’s visible decentralization story.

If miners keep leaning into grid programs, expect more short-lived cliffs during heat waves and freezes.

If hashrate keeps trending upward over the long run, the cliffs may get sharper when margins are tight. That is where treasury behavior starts to matter, as shown by Riot and others.

The next storm will be a systems story, not just a weather story.

That is what makes this interesting, even when the hashrate line bounces back a day later.