[ad_1]

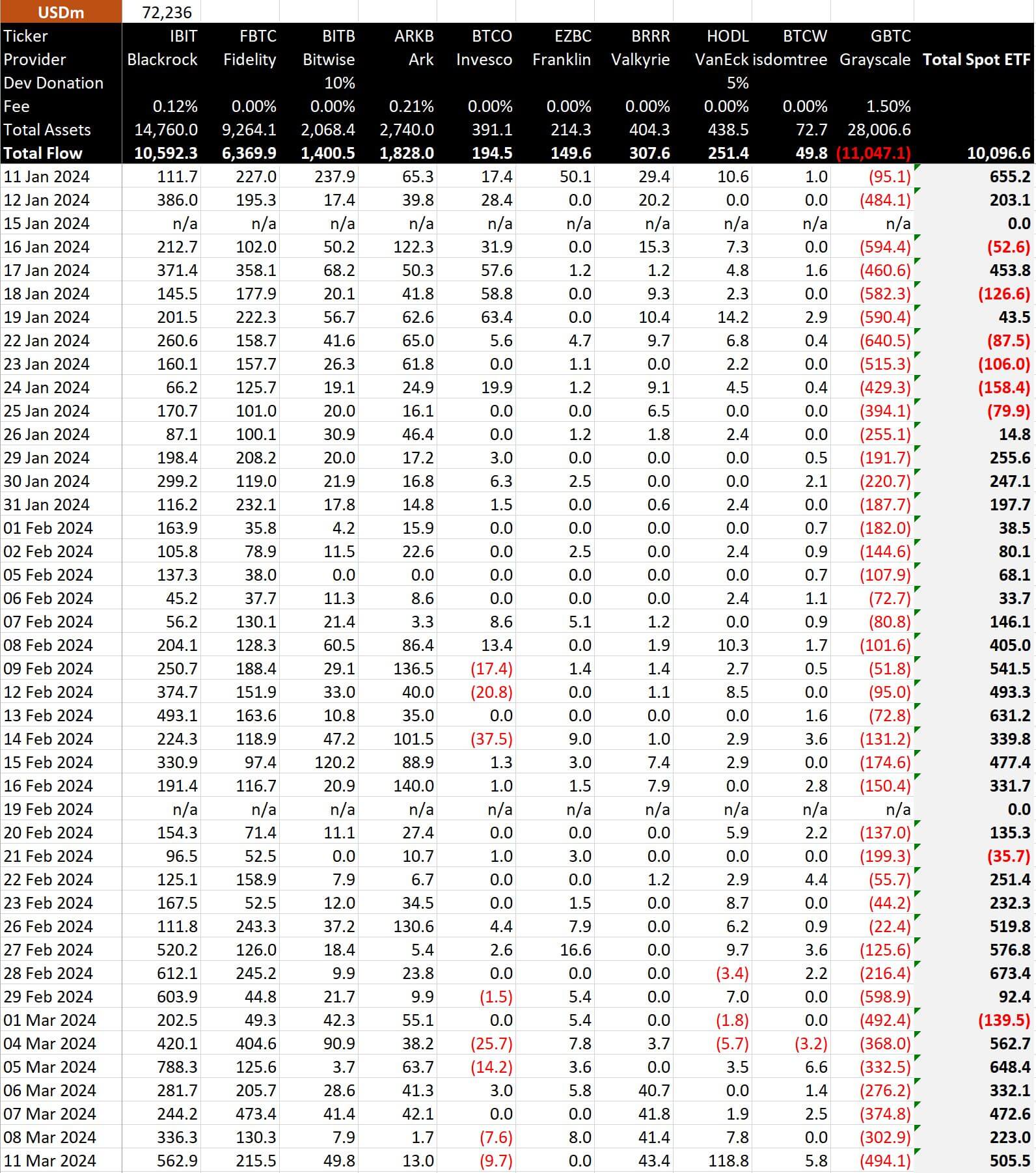

Bitcoin ETF inflows surged on March 11, 2024, with a net gain of $505.5 million, according to data from Bitmex Research. The strong performance was led by BlackRock’s iShares Bitcoin ETF (IBIT), which saw inflows of $562.9 million, representing a 0.12% increase in total assets. Fidelity’s FBTC fund also contributed to the positive momentum, attracting $215.5 million in new investments.

Other notable Newborn Nine ETFs with inflows included Bitwise’s BITB fund ($49.8 million), ARK Invest’s ARKB fund ($13.0 million), and VanEck’s BRRR fund ($118.8 million). VanEck’s announcement to waive fees until 2025 led to its strongest day by far. Previously, the fund had not seen more than $14.2 million in a single day. However, not all Newborn Nine funds experienced gains, with Invesco’s BTCO ETF reporting an outflow of $9.7 million.

Further, Grayscale continued its outflows, with $494 million leaving the fund, the highest level since Feb. 29. Yet, the inflows into Newborn Nine ETFs significantly outweighed the Grayscale outflow for the sixth consecutive day. Only two days since Jan. 26 have total outflows surpassed inflows.

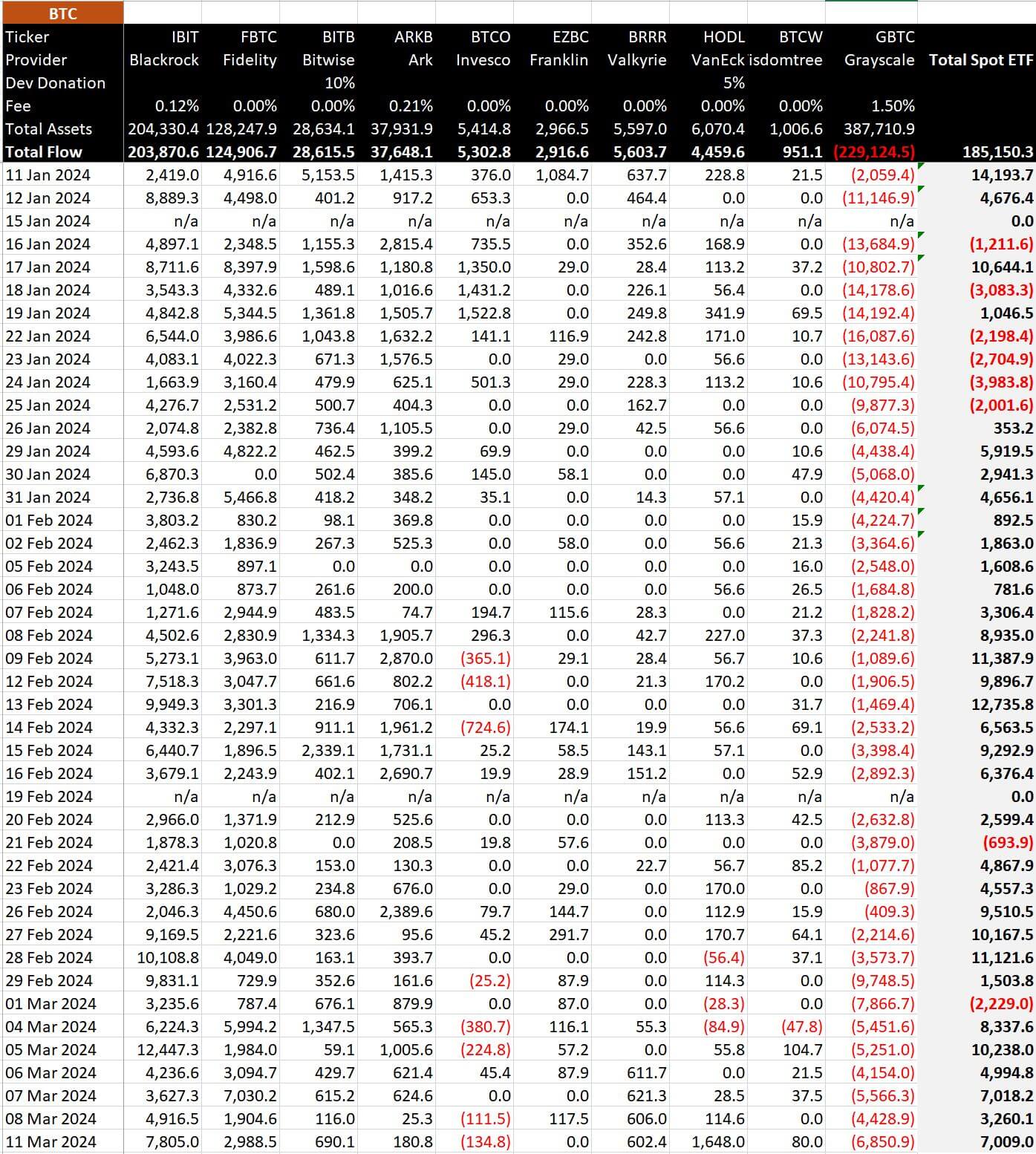

In terms of Bitcoin, the net inflow amounted to 7,009 BTC, with BlackRock’s IBIT fund accounting for 7,805 BTC of the total. Fidelity’s FBTC fund added 2,988 BTC, while Bitwise’s BITB fund saw an inflow of 690 BTC. ARK Invest’s ARKB fund and VanEck’s BRRR fund gained 180 BTC and 1,648 BTC, respectively.

The strong performance of Bitcoin ETFs on March 11, 2024, affirms the growing interest in Bitcoin investments among institutional and retail investors alike.

[ad_2]