This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

More than a year after its initial announcement, Arbitrum launched Timeboost yesterday.

Timeboost is a new way of ordering transactions on Arbitrum. That seems pretty boring and unexciting on the surface, but hopefully we can show you why it’s a pretty big deal.

Transactions today on Arbitrum are ordered on a simple first come, first serve (FCFS) basis. Seems fair! But it’s problematic in practice:

- Financial systems need a way to efficiently process transactions. When markets crash, a lending application like Aave needs a way to quickly liquidate pledged collateral before prices plummet further.

- Since transactions are cheap and not regulated by prices due to the FCFS mechanism, MEV searchers repeatedly spam the network to increase their chances of transaction inclusion. This degrades the overall network user experience.

Think Uber without surge pricing. Sounds fair, but then everyone — regardless of their priority — would be calling for cabs, and a pregnant woman in labor who needs to get to the hospital asap struggles to get a ride.

Timeboost tries to mitigate this problem by introducing an auction where MEV searchers can bid for transaction priority. The winner of the auction gets their transaction fast-tracked in an “express lane.”

This is roughly how it works:

- Tony and Janice are MEV searchers.

- Both compete for priority inclusion — Tony pays 1 ETH and Janice pays 2 ETH in the auction.

- Neither knows how much the other is bidding because transactions sit in a private mempool.

- Janice wins the auction and pays the price of Tony’s bid (1 ETH).

- Tony’s transaction is delayed by 200ms while Janice’s transaction receives immediate inclusion in the express lane. Hence the name: Timeboost.

Timeboost in effect introduces an optional market pricing mechanism into its fee market. It’s similar to what EIP-1559 and Flashbots’ MEV-Boost software does for the Ethereum L1, FastLane does for Polygon, and what Priority Gas Auction does for Optimism.

Timeboost is generally perceived as bullish because it creates value accrual for the ARB token by taking it back from MEV searchers.

How much are we talking? About a $30m opportunity for ARB stakers, Entropy Advisors estimates. Arbitrum MEV searchers extracted an estimated $29.3m in March alone.

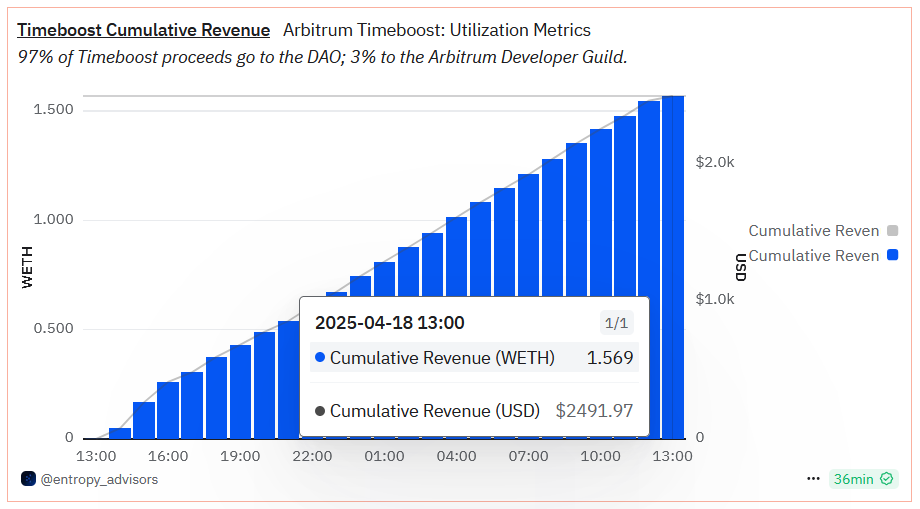

After a mere one day of being live, Timeboost has generated $2492 in DAO revenue.

Source: Dune

OK, so Timeboost is great. But there are broader complaints.

Some worry that the ability to monetize sequencer revenue means a shrinking incentive for Arbitrum to decentralize the sequencer. Max Resnick, for instance, has previously made that argument on the Bankless podcast.

Personally, I think the hand-wringing around centralized sequencers is somewhat overblown. Recall back in January how users were able to bypass sequencer-level censorship on the Soneium chain by triggering a forced transaction inclusion on the L1. Sequencer centralization is a problem, but it’s not quite as important as, say, having fraud proofs.

Yet, Arbitrum has plans to make Timeboost compatible with decentralized sequencing. It’s all part of the roadmap, Offchain Labs CEO Steven Goldfeder told me at ETHDenver.