At block height 923328, the Bitcoin blockchain logged its 23rd difficulty adjustment of the year, marking the seventh downward shift in 2025 and easing the mining process by 2.37% for those pursuing the next block reward.

Bitcoin Miners Catch a Break as Network Difficulty Slides

On Wednesday, the Bitcoin network registered a 2.37% dip in mining difficulty, trimming the metric from 155.97 trillion to 152.27 trillion. With bitcoin ( BTC) prices dragging and mining revenue trailing levels from 30 days ago, this latest adjustment is likely a welcome shift for miners.

The hashprice — the estimated worth of a single petahash per second (PH/s) of SHA256 hashrate — has fallen 11.17% since Oct. 13. At that point, 1 PH/s carried a value of $47.89, compared with $42.54 today. Fee revenue is also subdued, accounting for an average of just 0.57% of the block subsidy’s total value based on current data from hashrateindex.com.

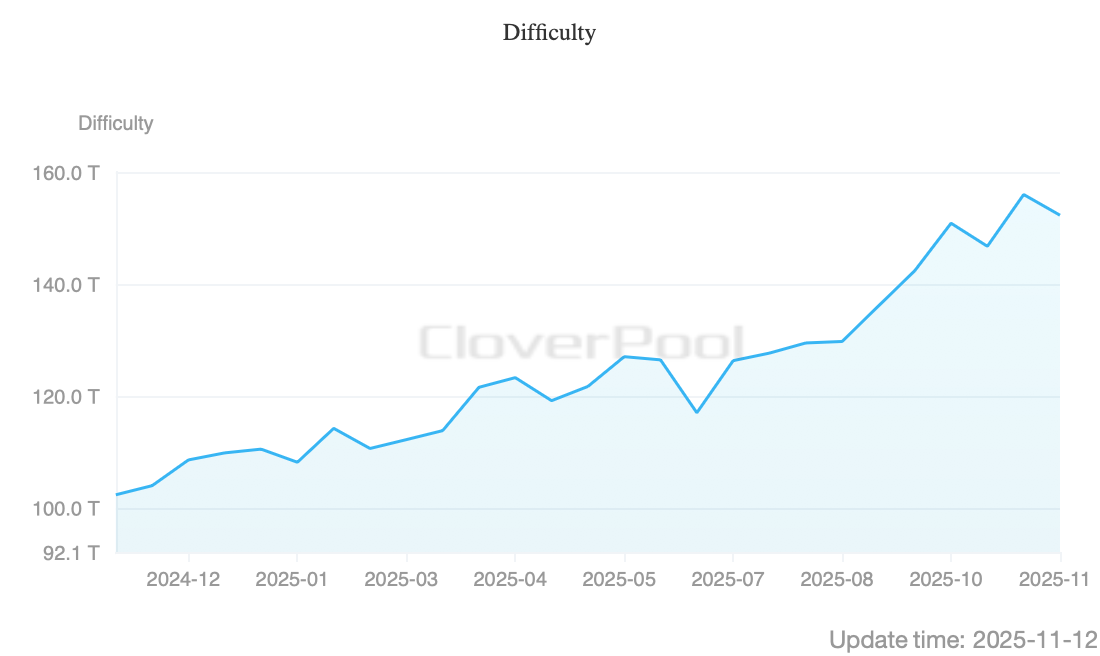

Difficulty metric over the past 12 months via cloverpool.com data.

Additionally, the global hashrate has slipped to 1,085 exahash per second (EH/s). Since Oct. 17, more than 72 EH/s has vanished from the 1,157 EH/s peak recorded that day. With difficulty now lower, block intervals — the pace at which new blocks are discovered — have dipped below the ten-minute norm. As of 9:45 a.m., the average block time sits at 9 minutes and 23 seconds.

Also read: Under 10 Joules per Terahash: Auradine Unleashes High-Efficiency Teraflux Miners With 50% Power Boost

Bitcoin’s latest difficulty adjustment arrives at a moment when miner income is strained, hashprice has cooled, and network strength has eased from last month’s highs. The modest reduction offers temporary breathing room, trimming operational pressure as block times quicken. Whether this relief proves fleeting or sets the stage for steadier conditions will depend on price action, transaction demand, and how miners recalibrate in the weeks ahead.

FAQ

-

How much did Bitcoin mining difficulty fall?

Difficulty decreased by 2.37%, dropping from 155.97 trillion to 152.27 trillion. -

Why does the difficulty change matter for miners?

Lower difficulty briefly reduces operational strain and can improve the odds of earning block rewards. -

How is miner revenue trending right now?

Hashprice and fee revenue remain subdued, reflecting weaker overall mining income.