[ad_1]

The payment industry usually plays it safe. Rather than jumping on trends, PSP companies place a strong focus on compliance and security. That said, there are incentives for and signs of a growing openness to cryptocurrencies.

· The global user base for cryptocurrencies has reached 617 million as of June 2024.

· Cryptocurrency payments are projected to grow at a compound annual growth rate of nearly 17% between 2023 and 2030.

· Major PSPs like Stripe, PayPal, and Braintree have already integrated crypto payment options.

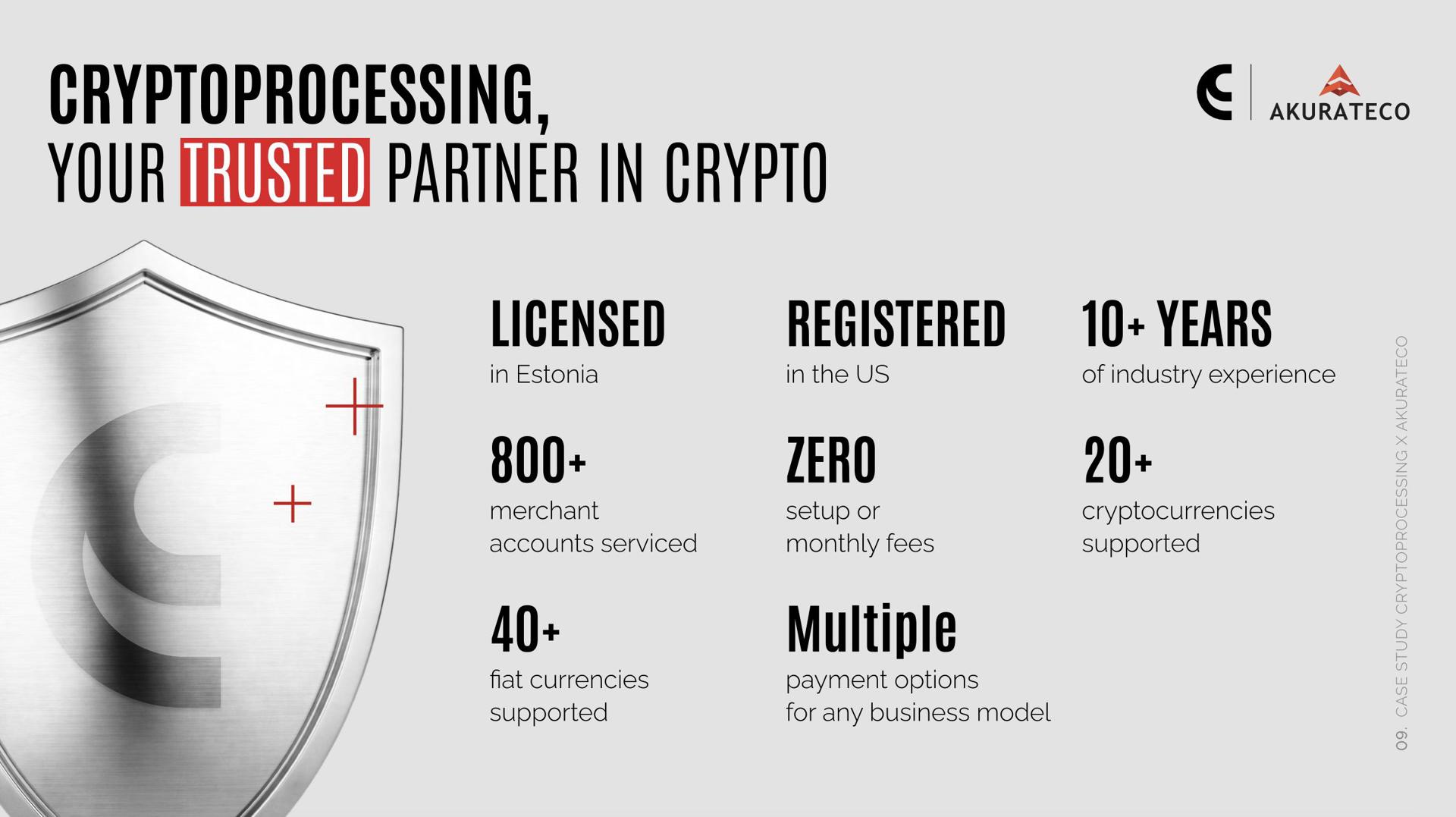

Our customer, Akurateco, a payment solutions provider, recognized the potential of crypto payments in the PSP sector and started looking for a reliable partner to make it happen.

Client

Akurateco empowers payment providers, merchants, and financial institutions with payment infrastructure, software, and managed teams. The company currently operates on every continent except Australia, with a larger share of its customers located in the UK and EU.

Since its launch in 2019, Akurateco has helped numerous businesses launch a straightforward payment process, bypassing the technical hurdles and expense of building their own system, through its white-label, turnkey payment platform.

Objectives

Akurateco, attuned to the needs of their customers, recognised a growing demand for cryptocurrency payment options. Without a second thought, the company set out to find a partner who could integrate a secure and compliant crypto payment gateway into their platform.

Objective #1. Enhance customer experience

Akurateco wanted to provide a wider range of payment options to meet their customers’ needs and improve their overall experience.

Objective #2. Gain a strategic edge

Akurateco saw the potential of crypto payments to optimise costs, improve efficiency, and expand market reach.

Objective #3. Future-proof their business

With the growing popularity of cryptocurrencies and increasing institutional adoption, Akurateco recognized the need to adapt and stay ahead of the curve. Partnering with a crypto payment gateway was seen as a way to future-proof their business and prepare for the new era of digital finance.

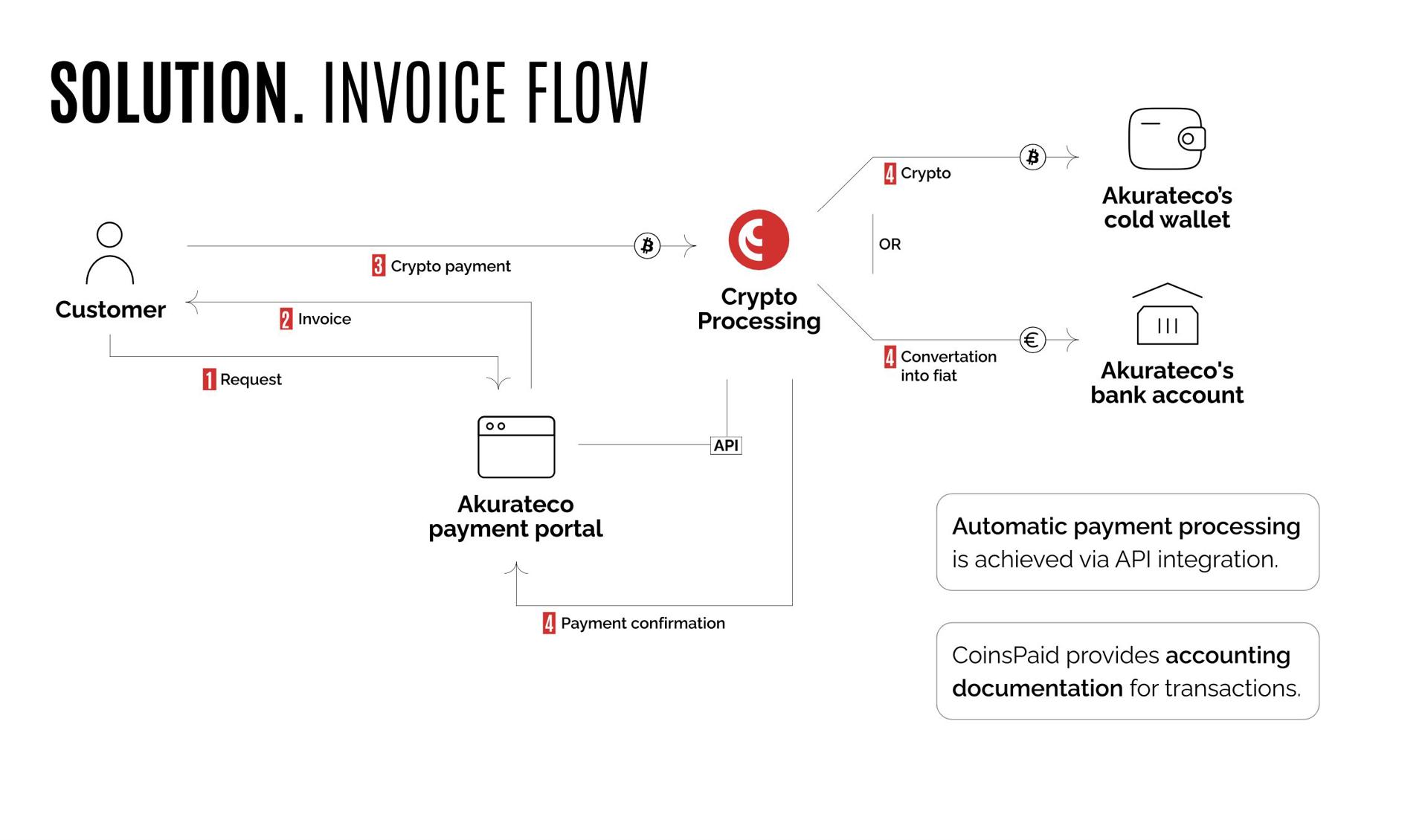

We’ve designed our onboarding and integration process to be as smooth and straightforward as possible. Our dedicated account managers guided the customer every step of the way.

1. We prepared a personalised offer to fit Akurateco’s business model.

2. We ensured full legal compliance and security for Akurateco’s crypto payment integration.

3. We integrated the crypto gateway into Akurateco’s payment platform via API with minimal disruption to their operations.

“The integration wasn’t done in a click, which is normal for projects like this. It was a process that required time and effort. But looking back after two years, I’m happy to say everything has been smooth. The gateway works nicely, and both we and our customers are very satisfied with the results.”

—Volodymyr Kuiantsev, Co-Founder and CEO

· 10% of Akurateco’s revenue is now generated through crypto payments.

“We’ve been partnering with CoinsPaid for two years now, and both we and our customers are happy with the crypto payment experience. I’m quite optimistic about the future of crypto payments. Currently, around 10% of our customers prefer to pay in crypto, but I believe that number will only grow over time.”

— Volodymyr Kuiantsev, Co-Founder and CEO

[ad_2]