[ad_1]

- Aave has published a post to comprehensively explain how V4 architecture compares to V3.

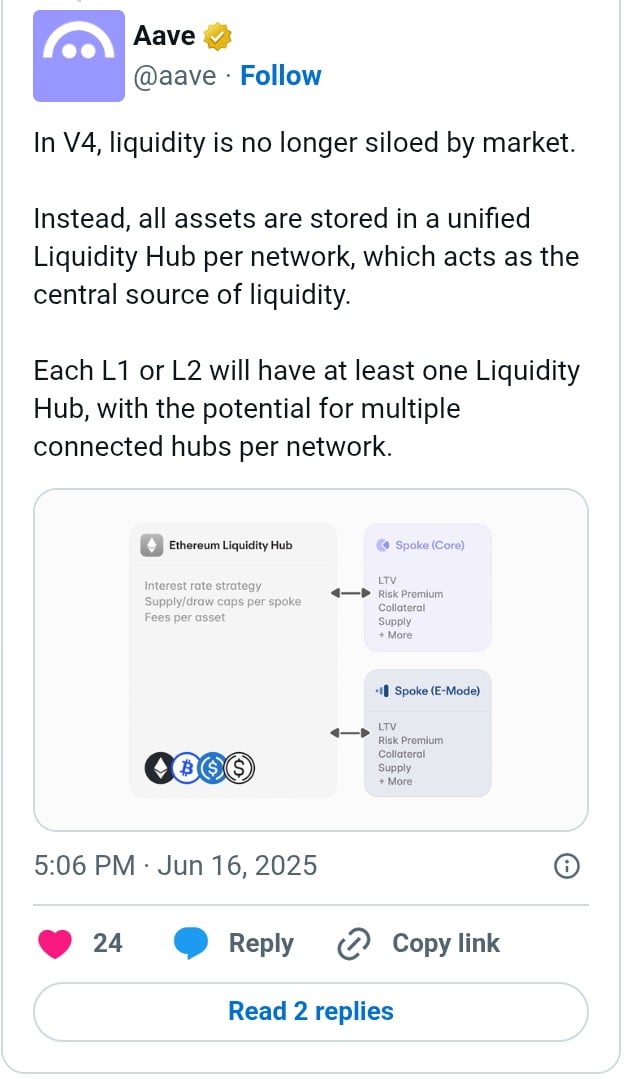

- While markets are independent across networks in the V3 architecture, all assets in the V4 are unified in a Liquidity Hub.

Last year, the firm behind the Decentralized Finance (DeFi) lending protocol Aave, Aave Labs, unveiled a governance proposal to gather community feedback on its groundbreaking upgrade to its next-generation Version 4. At that time, the development timeline was disclosed to stretch from the second quarter of 2024 (Q2 2024) to mid-2025.

A post has been published to comprehensively explain how the Aave V4 could “become the Ethereum of DeFi lending” and how it differs from the V3 architecture.

In the V3 architecture, the protocol was highlighted to use independent markets across different networks. What it means is that each market owns its isolated liquidity pool. Assets supplied to the V3 are supplied to specific markets and cannot be borrowed outside the jurisdiction of that market. The inability to use liquidity in one market to meet the demand of borrowing in another leads to frictions in the launch of new markets.

The Aave V4 architecture, fascinatingly, operates differently. According to the post reviewed by CNF, all assets in V4 are “unified in a liquidity hub based on the network.”

When users supply assets to Aave V4, those assets are stored in the Liquidity Hub, but the user doesn’t interact with the Hub directly. Instead, the Liquidity Hub works behind the scenes, while users interact with various Spokes as an entry point to the protocol. The Liquidity Hub tracks all assets using a share-based system that makes calculations more efficient and keeps everything within proper limits as interest accumulates over time.

Spokes are reported to be a component of Aave 4 that are interacted with by users directly. Each can provide specific borrowing and lending functionality as they are connected to a Liquidity Hub. With each spoke designed to have its own rules and settings, they could seamlessly be optimised for staked ETH derivatives, stablecoins, etc.

Some Notable Benefits of Aave V4 and Recent Updates

Compared to the previous versions, Aave V4 is said to prevent the fragmentation of capital across networks on the same chain. The flow of liquidity via the Liquidity Hubs increases utilisation and ensures that both suppliers and borrowers access better rates. Above all, this architecture encourages innovation, which is more difficult in the previous version.

Meanwhile, the Aave is effectively functioning and attracting jaw-dropping partnerships with Ripple’s stablecoin RLUSD integrating on the Core Market as noted in our earlier post.

Aave has also embarked on a strategic initiative to upgrade its tokenomics by recently commencing phase one, which includes the Buy and Distribute program. As detailed in our last news piece, a $4 million token buyback was approved with a weekly allocation of $1 million for a month. Meanwhile, the program is expected to continue for six months.

Apart from these, Aave has been making efforts to rub shoulders with industry giants through partnerships and upgrades. As outlined in our recent blog post, it has partnered with Chainlink to integrate its Smart Value Recapture (SVR) service.

Amidst the backdrop of these, Aave is struggling to hold above a crucial support level as it declines by 3% in the last 24 hours to trade at $276. According to our recent analysis, the asset could likely break out from the current trend to hit $300 in the short term. A hold above this level could send the price to $338, as also mentioned in our previous news brief.

[ad_2]