[ad_1]

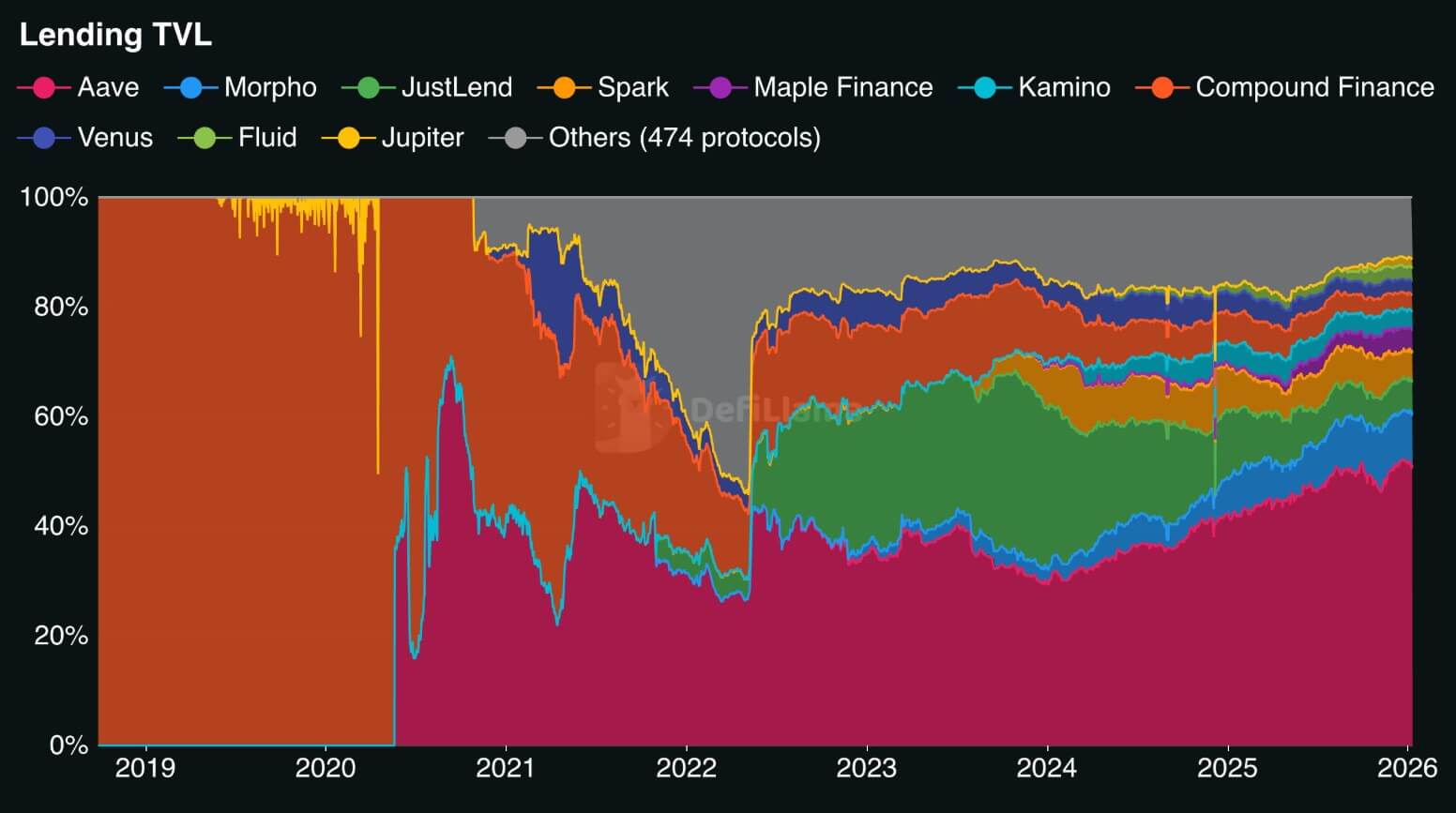

Aave now controls 51.5% of the DeFi lending market share, the first time any protocol has crossed the 50% threshold since 2020.

The milestone arrives not through competitor collapse but through steady accumulation: Aave’s $33.37 billion in total value locked sits atop a $64.83 billion lending category that has consolidated around a single liquidity hub.

The concentration raises a question DeFi has avoided for years: when one protocol becomes the ecosystem’s primary margin engine, does efficiency create fragility?

The answer depends on the metric used.

Aave’s total value locked (TVL) dominance reflects collateral custody, not credit exposure. DeFiLlama excludes borrowed funds from lending TVL calculations to prevent cycled lending from inflating figures.

As a result, Aave’s $24 billion in outstanding borrows translates to a 71% borrowed-to-TVL ratio, meaning the protocol runs meaningful leverage atop its collateral base.

That makes Aave less a passive vault and more an active leverage machine, where systemic risk manifests not through size but through the speed and violence of forced deleveraging when markets turn.

DeFi liquidation engine at scale

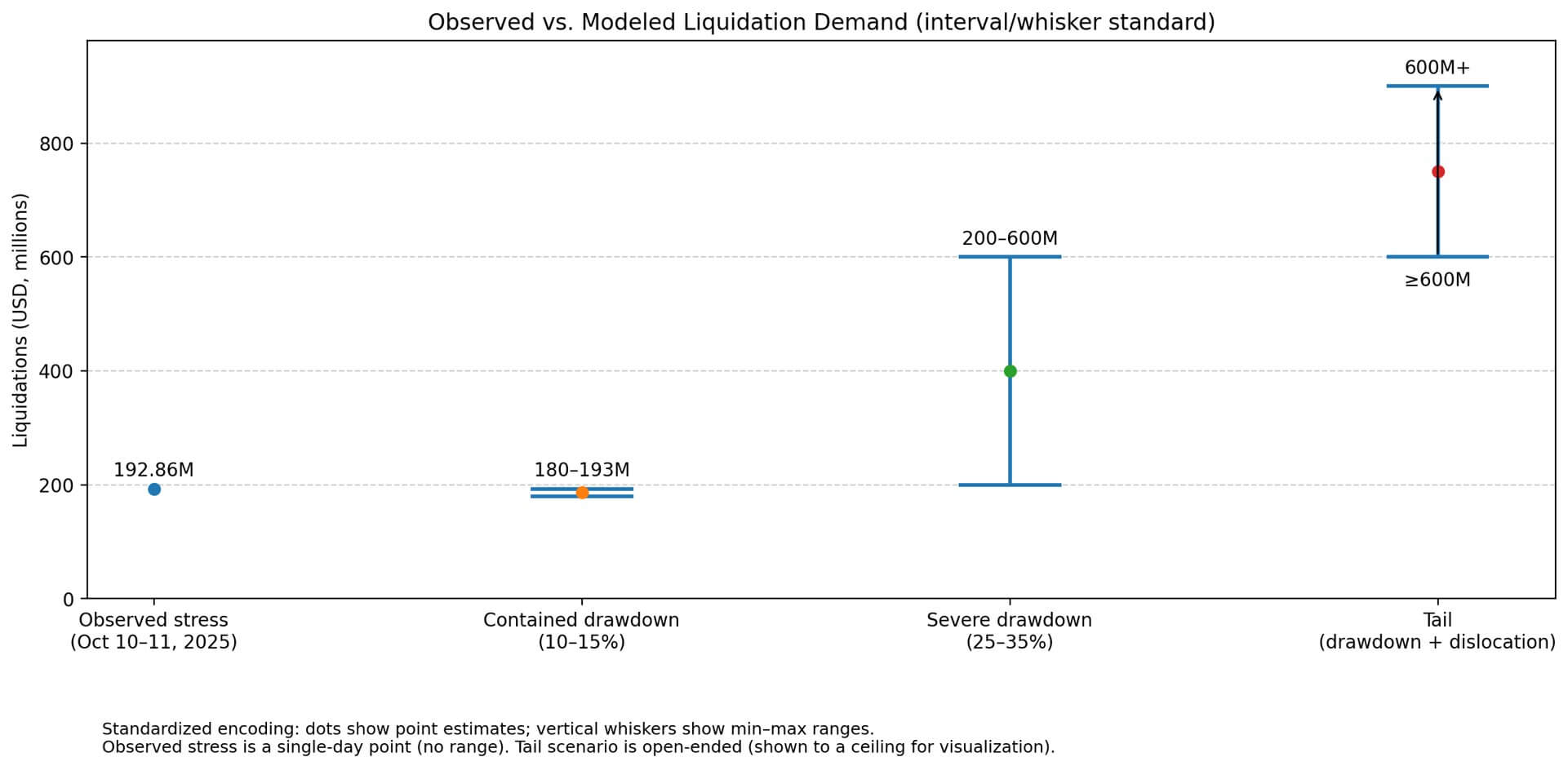

The Oct. 10 washout provided a preview.

Over two days, Aave on Ethereum processed $192.86 million in liquidations, with wrapped Bitcoin accounting for $82.17 million of the total.

The episode marked the third-largest liquidation day in the protocol’s history. Liquidators collected roughly $10 million in bonuses, while Aave’s treasury captured $1 million in fees.

The system worked: collateral moved from underwater borrowers to liquidators without observable bad debt accumulation or oracle failures.

But October’s stress test occurred under favorable conditions: stablecoins held their pegs, on-chain liquidity remained deep, and the drawdown stayed contained to high-teens percentage moves in major assets.

The real systemic question arises when those assumptions break.

When a 25-35% drawdown coincides with stablecoin dislocations or liquidity-sensitive tokens like liquid staking derivatives trading wide of their theoretical value, the landscape changes quickly.

Aave governance documents acknowledge this tail risk explicitly: a January 2026 proposal reduced supply and borrow caps for USDtb while oracle adjustments finalized, citing the need to “increase liquidation profitability and reduce bad-debt likelihood” during potential depegs.

Aave’s concentration creates a feedback loop. As the dominant venue, it attracts more collateral, and as collateral grows, liquidation events scale proportionally. As the liquidation scale increases, the protocol’s ability to absorb stress without moving prices becomes the system’s primary shock absorber.

Traditional finance would classify this as a systemically important financial institution, but with automatic liquidations replacing human margin calls and no lender of last resort beyond a $460.5 million governance-controlled backstop.

Backstop arithmetic and asset-scoped coverage

The Safety Module’s $460.5 million represents roughly 2% of Aave’s outstanding borrows.

Governance is transitioning toward Umbrella modules, which provide asset-scoped deficit coverage rather than blanket guarantees. In this module, staked aUSDC covers $USDC shortfalls, for instance.

The design choice reflects a tradeoff: capital efficiency versus systemic coverage.

A blanket reserve large enough to cover tail losses across all borrowed assets would require immobilizing capital at scale. Instead, asset-scoped modules distribute coverage but leave cross-asset contagion scenarios partially unhedged.

The protocol’s risk controls operate through active parameter adjustment rather than static buffers.

Recent governance actions include interest rate changes on Base as liquidity mining incentives expire and oracle design choices that prioritize liquidation profitability during stress.

This approach mirrors how a prime broker manages margin in traditional markets, with continuous monitoring, dynamic risk limits, and proactive deleveraging before positions become unsalvageable.

However, prime brokers operate with credit teams, discretionary margin calls, and access to central bank facilities during liquidity crunches. Aave runs on immutable smart contracts, deterministic oracles, and liquidator incentives.

When those mechanisms work, the protocol deleverages smoothly. When they don’t, or when external liquidity evaporates faster than liquidators can execute, bad debt accumulates.

Modeling DeFi stress without wild assumptions

Three DeFi scenarios frame the range of plausible outcomes, each anchored to observed liquidation magnitudes rather than speculative projections.

In a contained drawdown of 10-15%, moves in major assets with stable stablecoin pegs and normal on-chain liquidity, liquidation volumes are likely to mirror October’s $180-193 million range.

In this case, Aave acts as a shock absorber, liquidators profit, and the system rebalances. Systemic risk remains low because the protocol is designed for exactly this scenario.

A severe drawdown of 25-35% moves with widening spreads and thinner liquidity could push liquidations to one-to-three times recent stress days, or roughly $200-600 million over the peak window.

Contagion depends on whether forced sales move collateral prices enough to trigger liquidations in other protocols. This is where concentration matters: if multiple venues use similar collateral sets and Aave processes the bulk of deleveraging, price impacts propagate faster than if liquidations were distributed across competing protocols.

The tail scenario pairs a major drawdown with collateral or borrow asset dislocation, such as a liquid staking derivative trading materially below its peg or a stablecoin breaking its dollar anchor during peak liquidation demand.

Here, liquidation volumes could exceed $600 million as oracle adjustments lag price moves and liquidity providers step back.

This is the case where Aave’s role as the primary margin engine creates genuine systemic exposure: correlated collateral, concentrated liquidation demand, and impaired execution infrastructure converging simultaneously.

What 51.5% actually means

Aave crossing the majority threshold likely signals that DeFi lending has entered a natural monopoly phase, where liquidity begets liquidity faster than competitors can match.

The systemic risk implications depend less on the static market share number and more on whether Aave’s liquidation machinery, oracle design, and backstop capacity scale proportionally with growing exposure.

Recent governance actions suggest risk management is keeping pace with growth. The protocol has processed multiple $180-193 million liquidation days without observable bad debt spirals.

Yet, those stress tests occurred under relatively benign conditions. The tail scenario in which systemic risk materializes involves correlated collateral shocks, liquidity dislocations, and forced deleveraging at speeds that exceed liquidator capacity or the oracle’s responsiveness.

Aave’s dominance makes it the primary margin engine in DeFi.

Whether that creates fragility or resilience will be determined not by market share but by the protocol’s ability to handle liquidations under conditions it hasn’t yet experienced, and whether the ecosystem has viable alternatives if it can’t.

[ad_2]