[ad_1]

Onchain analysts are focusing on the significant whale transactions occurring this month, revealing that 3,000 bitcoin from 2010 block rewards have been moved for the first time in nearly fourteen years. However, what many may not realize is that this sequence of block reward disbursements from 2010 isn’t a new activity for this particular whale, who has been consistently liquidating coins for several years.

Tracing the Origins of a Bitcoin Mega Whale

This past week saw a notable whale move of 1,000 BTC, aligning with the crypto asset breaking its highest price point for the first time since 2021. Just three days earlier, the same whale had shifted 2,000 BTC, sourced from block rewards dating back to 2010. Specifically, on March 5, the transferred blocks originated from a sequence between block height 71,897 and 91,568, though not in consecutive order.

All 20 block rewards relocated on that day were confirmed at block height 833,219. The transaction on March 1 involved 40 block rewards from 2010, all finalized in block 832,648. These blocks spanned a range from block height 71,233 to 88,846, and similar to the previous instances, they were not moved in sequential order but were mined within those specified heights.

The movement of 40 block rewards from 40 unique Pay-to-Public-Key-Hash (P2PKH) addresses marked a departure from the whale’s usual activity of transacting around 1,000 BTC or 20 block rewards from 2010. Bitcoin.com News’ detailed onchain scrutiny points out this exceptional transfer since the whale was first identified in 2020. March 11, 2020, marked our initial spotting of this whale, which has since made an appearance a total of 15 times after this date.

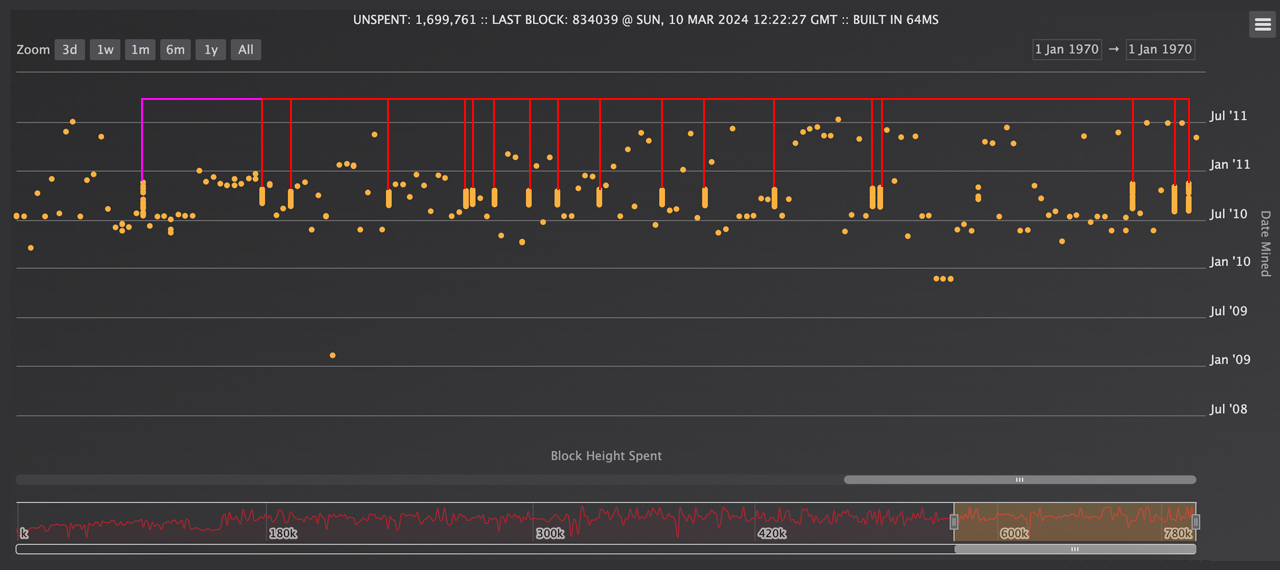

All the red lines are connected to the infamous 2010 whale, the purple line may be the same whale, but certainty is a lot less due to the outliers.

Apart from the March 11, 2024, movement of 2,000 BTC, every other string spend we’ve observed adheres to a precise formula: the blocks originated from July, August, September, October, and November of 2010, involving 20 block rewards, each constituting 1,000 BTC, with the assets being moved from 20 distinct P2PKH addresses to a single Pay-to-Script-Hash (P2SH) address.

It seems, however, that this whale might have shifted away from its predictable patterns in the past. We expanded our analysis to encompass blocks 1 through 800,000, adopting criteria such as 10 inputs of 50 BTC and a single output ranging between 999 and 1001 BTC. We utilized resources like theholyroger.com, btcparser.com, and various blockchain explorers offering unique perspectives.

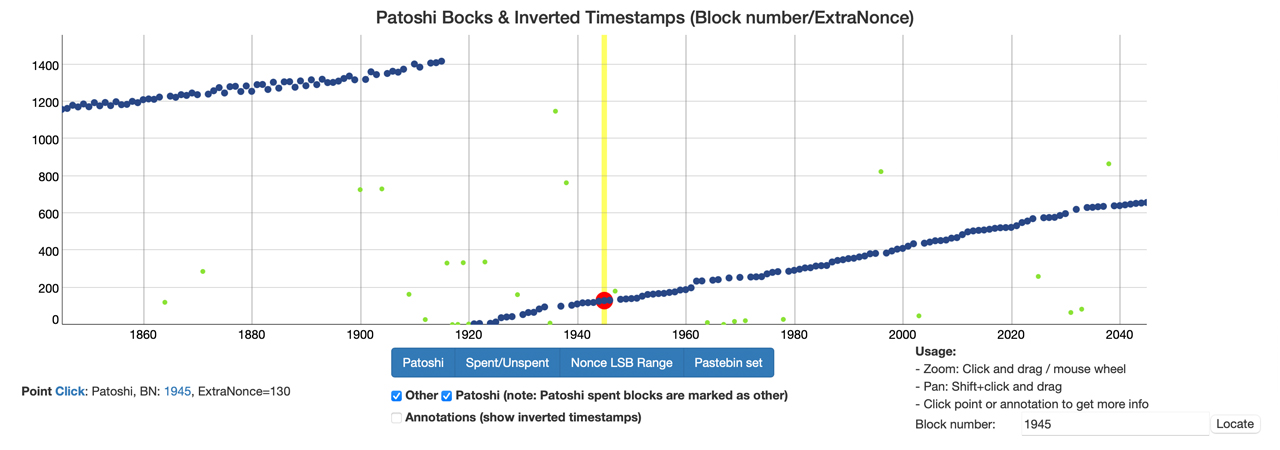

Our initial discovery highlighted that this type of pattern occurred 381 times since block 1,945, which is believed to have been mined by Satoshi. Our investigation also uncovered additional outlier transactions (above the 381) that bore a resemblance to the mega whale’s activities, yet displayed some distinct deviations. Block 1,945 featured just two transactions, with one being a consolidation of 20 block rewards.

Block 1,945, contained a 20 block reward spend that consolidated the 1,000 into a single address.

This particular transaction amalgamated 1,000 BTC from P2PKH addresses into a single P2PKH address, rather than a P2SH address, which wasn’t yet introduced in 2009. Thus, we infer that this pattern of consolidation existed both prior to and following the introduction of P2SH. Further investigation suggests the prominent whale we’ve been tracking may have executed transactions of 1,000 BTC even before we noticed the pattern in 2020.

On Nov. 24, 2019, a batch of 20 block rewards from 2010 were moved, likely by the same whale, with a very high degree of certainty. At that time, a single bitcoin was valued at $6,960. These rewards fell between block heights 77,267 and 86,968 and were mined in a single block in non-sequential order. This transaction aligned with subsequent ones, except for the March 1, 2024, transfer of 2,000 BTC, marking a notable exception.

It’s also feasible that this whale conducted a similar transaction on June 27, 2019, though this instance stands out from the usual pattern. The output range was above the 999 and 1001 BTC criteria and both P2PKH and P2SH were used in the outputs. This particular transaction had two outputs: one sending 1,152.72 BTC to a P2SH address and another transferring 1.99 BTC in change to a traditional P2PKH address.

All involved block rewards were from 2010 and were mined between blocks 67,992 and 92,336 and like the others, the spent blocks were in non-sequential order. The identification of the June 27, 2019, transaction as belonging to our whale is more challenging compared to the nearly certain match of the Nov. 24, 2019, activity. It’s evident from the 381 pattern matches and several outliers that this particular whale could have started its activities even before 2019.

We can infer that this entity was an active bitcoin miner in 2010 and suggest that either an individual miner had a penchant for moving 1,000 BTC in batches, or a collective of miners shared this same preference. This miner or group of miners likely accumulated a substantial number of bitcoins that year, ranging from tens to hundreds of thousands. Consider the Nov. 24, 2019, transaction, involving blocks mined between 77,267 and 86,968, totaling 9,701 blocks.

This implies that over 485,000 BTC were mined in that span, with this miner potentially amassing several tens to hundreds of thousands. At the time, the entire network’s hashrate was just 5 gigahash per second (GH/s). However, this period marked the transition to graphics processing unit (GPU) mining. Notably, Artforz, a prominent bitcoin miner and blockchain developer, emerged in July 2010 on the bitcointalk.org forum, becoming one of the first to mine using a GPU.

Laszlo Hanyecz, famously trading 10,000 BTC for two pizzas, is also believed to have begun GPU mining two months before Artforz. Yet, it was Artforz who drew significant attention due to the substantial volume of bitcoin he mined in 2010. On July 25, 2010, Artforz reported generating 1,700 bitcoins in just six days, and it was estimated that his farm controlled 20-30% of the network’s computing power by October of that year.

Artforz is a potential candidate for the mega whale behind the 1,000 BTC transactions, though others may have also amassed large bitcoin quantities through GPU mining. Satoshi Nakamoto expressed concerns over this trend, suggesting a “gentleman’s agreement” to delay the GPU arms race, a plea that went unheeded as the shift to GPU and subsequently to ASIC mining rapidly progressed. Nevertheless, the latest dance of vintage digits spent this month across the blockchain tells a story of mystery pioneers and Bitcoin’s nascent days.

What do you think about our efforts to trace the mega whale from 2010? Share your thoughts and opinions about this subject in the comments section below.

[ad_2]