[ad_1]

Curve’s latest collaboration with Yieldbasis has reshaped decentralized governance on the protocol, sparking a flurry of DAO proposals, liquidity expansions, and fresh revenue channels centered on crvUSD growth.

Curve and Yieldbasis Deepen Integration

The partnership between Curve and Yieldbasis is off to a strong start, built on mutual incentives and shared liquidity infrastructure, according to Curve’s latest analysis.

Yieldbasis, which aims to eliminate impermanent loss (IL) in automated market makers (AMMs), allows users to deposit BTC derivatives such as cbBTC, tBTC, and WBTC while maintaining 2x compounding leverage through Curve’s crvUSD credit line. The setup integrates Curve’s AMM and DAO-approved credit facilities to create a self-reinforcing liquidity mechanism.

Governance activity has surged in recent weeks. On Sept. 24, Curve DAO approved Yieldbasis’ initial 60 million crvUSD credit line, with pools filling within minutes. Subsequent votes expanded the credit line to 300 million crvUSD by mid-October, each round quickly reaching full capacity as demand soared. The most recent vote on Oct. 15 initiated YB token emissions and an airdrop for veCRV holders who supported the earlier proposals.

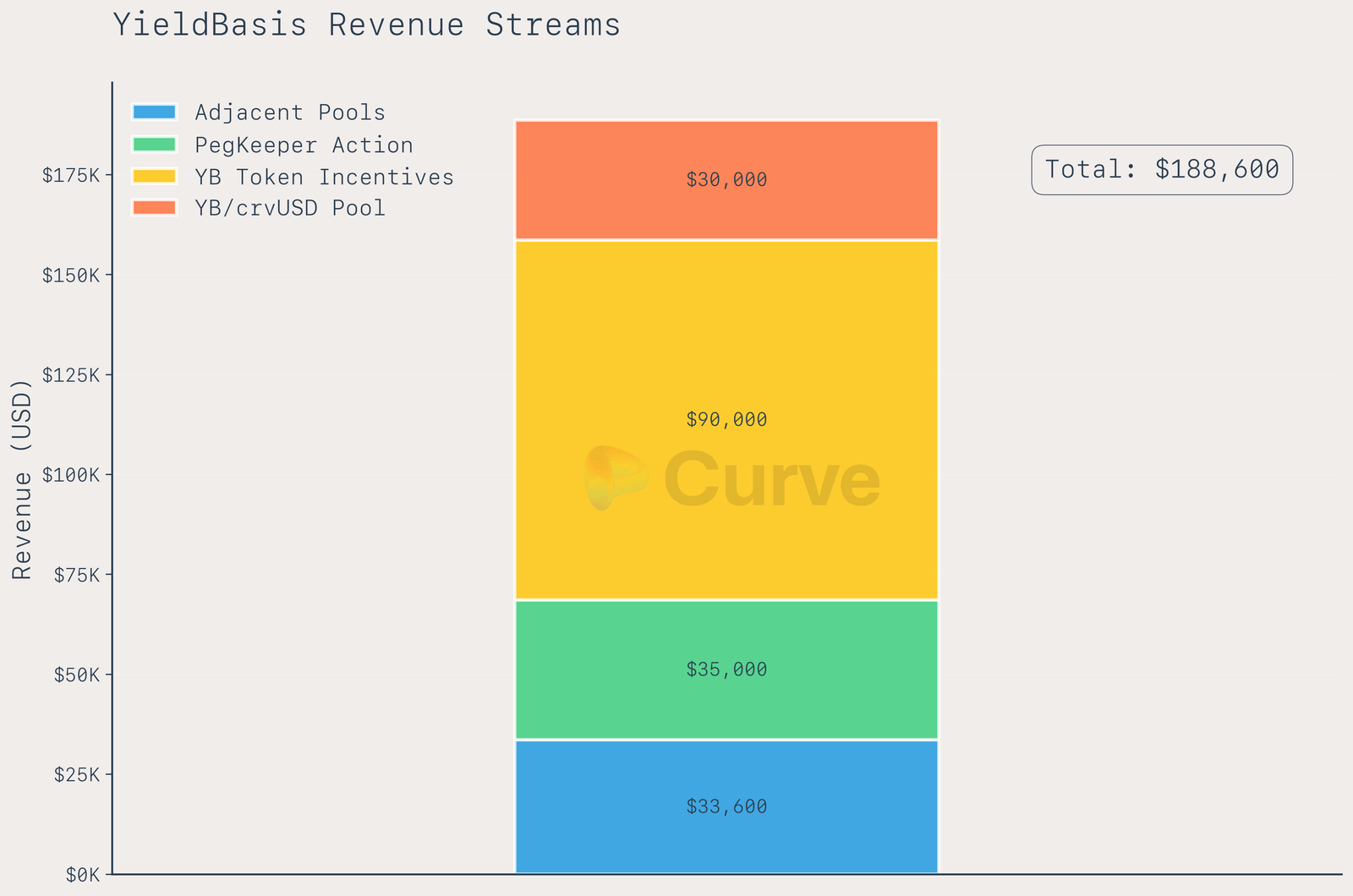

“In total, YieldBasis has generated approximately $188K in revenue (for LPs and the DAO combined),” Curve’s report details. “This is a conservative estimate, as it doesn’t include secondary effects, such as new crvUSD minted in response to higher demand,” the team added.

The report states that every BTC dollar deposited into Yieldbasis translates to $2 in total value locked (TVL) on Curve due to its leveraged structure, pushing Curve’s TVL from $6 million to $300 million. Trading activity from Yieldbasis also amplified adjacent volume on Curve’s crvUSD-based pools, generating an estimated $188,000 in total revenue so far. PegKeeper operations contributed roughly $35,000, stabilizing crvUSD’s peg while adding DAO profit.

Looking ahead, Curve governance is evaluating proposals to scale Yieldbasis responsibly. Proposal #1238 seeks to redirect YB emissions into a DepositPlatformDivider contract to fund vote incentives via Votium and VoteMarket, while Proposal #1241 aims to triple PegKeeper capacity. These measures are designed to deepen crvUSD liquidity, which remains essential before additional credit line expansions.

Founder Michael Egorov’s proposal package emphasizes controlled scaling — boosting crvUSD stablecoin supply, aligning emissions incentives, and preparing for a potential $1 billion allocation to Yieldbasis once liquidity conditions stabilize. DAO participants continue to deliberate on the measures to ensure long-term equilibrium between Yieldbasis growth and Curve stability.

Yieldbasis has demonstrated its capacity to amplify Curve’s liquidity, volume, and DAO revenue. Future DAO actions will determine whether this partnership can sustain expansion without jeopardizing crvUSD’s stability — a pivotal test for Curve’s next phase of decentralized growth.

FAQ

- What is Yieldbasis?Yieldbasis is a protocol built on Curve that eliminates impermanent loss for BTC liquidity providers through 2x leveraged crvUSD positions.

- How has Curve benefited from Yieldbasis?Curve has gained TVL growth, new trading revenue, and long-term token emissions from Yieldbasis integration.

- What DAO votes shaped the partnership?Key votes expanded Yieldbasis’ crvUSD credit line to $300 million and launched YB token emissions.

- What’s next for Curve and Yieldbasis?Governance votes aim to expand crvUSD liquidity and prepare for safe scaling of Yieldbasis pools.

[ad_2]