[ad_1]

World Liberty Financial bridges traditional finance with blockchain technology through the adoption of stablecoins, governance tokens, and planned lending tools built on proven infrastructure. Since launching in 2024, the project has raised over $550 million through token sales, while establishing its USD1 stablecoin as the sixth-largest globally, with a market cap of $2.65 billion.

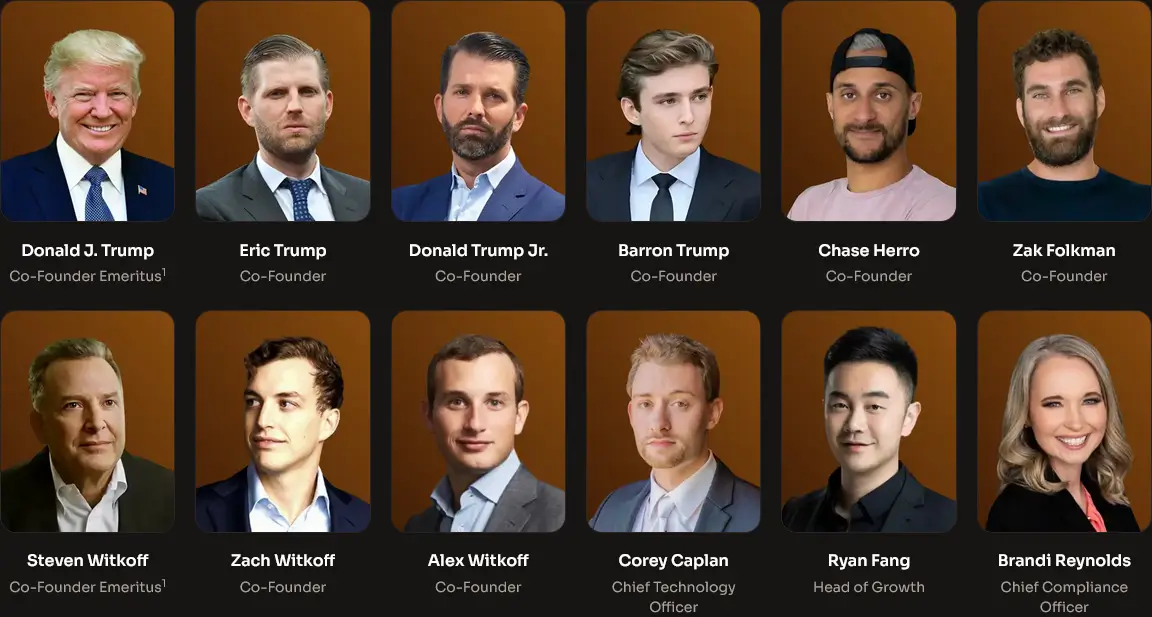

The Trump family’s involvement distinguishes WLFI from typical crypto projects. Donald J. Trump serves as the “chief crypto advocate,” while the family controls 22.5 billion WLFI tokens (22.5% of the total supply) through DT Marks DEFI LLC. Separately, the family is contractually entitled to 75% of net revenues. Donald Trump Jr. and Eric Trump hold co-founder positions, with Barron Trump listed as “DeFi visionary.” Donald Trump stepped back from active operational involvement following his presidential inauguration in January 2025, though the family maintains token control and revenue rights through DT Marks DEFI LLC. This structure creates tension between political influence and decentralized finance principles.

Complete World Liberty Financial Team (https://www.worldlibertyfinancial.com/)

WLFI Development Timeline:

- Late 2024: World Liberty Financial was established as a DeFi protocol with Trump family involvement formalized, setting the foundation for the project.

- April 2025: USD1 stablecoin launches with U.S. Treasury backing, officially pegged 1:1 to USD for DeFi stability.

- Early 2025: Project raises over $550 million through token sales while Trump family allocations become formalized through DT Marks DEFI LLC.

- August 2025: A Major $205 million USD1 minting event occurs following the Federal Reserve commentary on stablecoins, boosting the supply to the current $2.65 billion.

- September 1, 2025: WLFI governance token launches with trading on major exchanges, including Binance, Bybit, OKX, and MEXC, with initial unlock of 24.6 billion tokens.

- September 4, 2025: Protocol blacklists272 wallets citing security risks, including Justin Sun’s address holding 595 million unlocked WLFI tokens valued at approximately $107 million.

- September 5, 2025:Justin Sun publicly alleges unfair token freezing of over $100 million in holdings, raising governance transparency concerns.

- September 10, 2025: Full cross-chain bridging capabilities enabled via Transporter.io across decentralized and centralized exchanges.

What Makes World Liberty Financial Different from Other DeFi Protocols?

Unlike typicalDeFi protocols that emerge from developer communities or venture capital backing, WLFI operates with direct political endorsement and family office involvement from the current U.S. president. This political connection represents a first in the cryptocurrency space.

The protocol’s planned architecture will build on established infrastructure, utilizing Aave V3 for future lending and borrowing functionality while implementing Chainlink’s Cross-Chain Interoperability Protocol (CCIP) for multi-blockchain operations. This approach prioritizes proven technology over experimental features, focusing on user-friendly integration for institutions and individuals.

How Does WLFI Compare to Other DeFi Projects?

WLFI’s hybrid model creates a unique position that differs significantly from traditional DeFi protocols and stablecoin projects.

DeFi Protocol Comparisons

WLFI’s approach contrasts sharply with established DeFi protocols. Traditional protocols like Aave offer fully decentralized governance where token holders vote on proposals without concentrated control. WLFI’s Trump family allocation enables faster decision-making but sacrifices pure decentralization principles that define most DeFi projects.

The planned lending focus will mirror Aave’s approach, with WLFI building on Aave V3 rather than developing proprietary technology. This creates dependency on external protocols while reducing development risk. Projects like Uniswap maintain complete independence from political influence, operating through community governance without celebrity endorsement or family office control.

Stablecoin Market Position

In the stablecoin market, USD1 faces established competitors with different approaches. Tether’s USDT commands a $118 billion market cap but faces ongoing scrutiny over reserve transparency. Circle’s USDC maintains a $34 billion cap, offering stronger regulatory compliance, but lacks political backing. USD1’s Treasury backing and political endorsement aim to target institutional trust, while facing unique political and regulatory scrutiny that traditional stablecoin issuers typically avoid.

The political connection distinguishes WLFI from every major DeFi protocol. While this creates mainstream adoption opportunities, it also introduces risks that purely technical projects don’t face.

USD1 Stablecoin Foundation

The$USD1 stablecoin serves as WLFI’s primary value proposition, backed by short-term U.S. Treasuries and cash equivalents to maintain dollar parity. Since its April 2025 launch, USD1 has experienced rapid growth, including a notable $205 million minting event in August 2025 following Federal Reserve commentary on stablecoins.

The stablecoin’s backing methodology emphasizes transparency and regulatory compliance, positioning it as a bridge between crypto markets and traditional dollar-denominated assets. This approach targets institutional users seeking crypto exposure with traditional finance risk profiles.

Cross-chain deployment acrossEthereum,BNB Chain, andSolana enables USD1 to reach diverse user bases while maintaining consistent backing mechanisms. The multi-chain strategy addresses scalability concerns that limit single-blockchain stablecoins while preserving unifiedgovernance through the WLFI token system.

Platform Features and Tools

WLFI’s roadmap includes three main components, though not all features are currently operational:

- USD1 Stablecoin: Fully live and operational since April 2025. Backed by government securities and cash equivalents, with cross-chain bridging available through Transporter.io across Ethereum, BNB Chain, and Solana networks. Trading is active on external platforms, including Gemini, as of September 2025.

- WLFI App: Still in development and not yet live. The planned app will allow users to deposit crypto or fiat through wallet connections or bank accounts, providing access to liquidity for spending while maintaining crypto exposure. Portfolio monitoring and real-time analytics are planned features, with launch expected post-token generation event.

- Lending Platform: Upcoming feature marked as “coming soon.” Will be built on Aave V3’s infrastructure to enable users to supply assets as collateral and borrow against holdings. Real-time health factors and dynamic interest rates based on market conditions are planned but not yet operational.

The WLFI governance token was launched on September 1, 2025, and trades on major exchanges, including Binance, Coinbase, and Gemini. However, the full DeFi suite is rolling out in phases, with core lending and app functionality still pending deployment.

How Does WLFI’s Tokenomics Structure Work?

$WLFI operates with a total supply of 100 billion tokens, implementing governance-only functionality rather than utility or payment features. Approximately 24.7% of tokens circulated at launch, including liquidity provisioning and treasury allocations designed to support market stability.

The governance model incorporates multiple participation mechanisms alongside the 5% per-wallet voting cap to prevent excessive concentration. WLFI token holders can submit proposals through official forums, participate in Snapshot polling to gather early sentiment, and vote on formal governance decisions. However, this system operates alongside the Trump family’s 22.5 billion token allocation through DT Marks DEFI LLC, creating tension between decentralized governance principles and concentrated ownership reality.

Governance Process (https://www.worldlibertyfinancial.com/)

Keytokenomics features include:

- Governance functionality

- 5% per-wallet voting cap to limit individual influence

- Trump family controls 22.5 billion tokens (22.5% of the total supply)

- 24.7% circulating supply at launch through liquidity and treasury allocations

- Unanimous governance votes have been achieved on all major decisions to date

Token Unlock Schedule and Burns

Unlocks began in September 2025 with 20% distributions to early investors, while founder and team allocations remain locked pending community votes. The protocol has implemented burn mechanisms, including a 47 million token burn in September 2025 and governance proposals to dedicate 100% of protocol-owned liquidity fees to buybacks and burns.

These deflationary mechanisms aim to manage token supply while providing value accrual for remaining holders. The burn strategy reflects traditional corporate finance approaches adapted for tokenized governance systems.

Trading began in September 2025, following community governance approval, with initial listings on major decentralized exchanges, includingUniswap, Meteora, Raydium, andPancakeSwap, as well as centralized exchange support from Binance and Coinbase. This broad distribution strategy ensures accessibility across different user preferences and trading infrastructure.

What Key Partnerships Drive WLFI’s Growth?

WLFI has built strategic relationships across both traditional finance and cryptocurrency sectors to support its expansion and technical infrastructure.

Financial and Strategic Partners

World Liberty Financial has established strategic alliances across traditional finance and crypto-native organizations:

- Tron (Justin Sun): Committed to increasing USD1 circulation to $200 million

- DWF Labs: Shifted $250 million in reserves to USD1 adoption

- Re7 Capital: Supports expansion on BNB Chain operations

- Alt5 Sigma: Provides $1.5 billion in funding for treasury strategies as a Nasdaq-listed bridge to public markets (though Eric Trump reduced his board role in September 2025 following regulatory consultations)

Infrastructure and Technology Partners

WLFI builds on proven infrastructure through key technology partnerships:

- Chainlink: Provides cross-chain bridging infrastructure through CCIP, enabling USD1 and WLFI token movement across supported blockchains

- Aave V3: Will serve as the underlying lending protocol with battle-tested smart contracts for future borrowing and lending functionality

- Transporter.io: Recent integration for additional cross-chain bridging options

These partnerships reflect WLFI’s strategy of building on proven infrastructure rather than developing proprietary technology. The approach reduces technical risk while accelerating deployment timelines, though it creates dependency on external protocol governance and security.

The protocol has explored international expansion opportunities, including potential operations in Pakistan, through personal connections, indicating a global growth strategy that extends beyond U.S. markets.

What Controversies Has WLFI Faced?

World Liberty Financial has encountered multiple challenges that question its DeFi credentials and operational transparency.

Transparency and Security Concerns

World Liberty Financial has faced significant scrutiny regarding its claims of centralization versus decentralization. The Trump family’s control over 22.5 billion tokens and 75% of the net revenues contradicts typical DeFi principles, which emphasize distributed governance and value accrual.

Website registration through anonymous services linked to Russian hackers raised transparency concerns, while code similarities to the previously hacked Dough Finance platform (which lost $2.1 million) highlighted potential security vulnerabilities. Team overlaps between projects have intensified these security concerns.

Regulatory and Security Challenges

Regulatory risks include potential SEC enforcement actions over token mechanics, particularly given the revenue-sharing structure, which could classify WLFI as a security rather than a governance token. The project’s political associations may provide some regulatory protection, but also create additional scrutiny.

Media criticism has labeled the project a “scam” following various scam hijackings and compromised Trump social media accounts that promoted fraudulent tokens. Co-founder Zak Folkman has publicly refuted these characterizations, describing them as politically motivated attacks rather than legitimate concerns.

How Has the Crypto Community Received WLFI?

The community reception reflects broader political polarization, with supporters praising WLFI’s U.S.-centric approach and USD1’s rapid growth, while critics highlight concerns about centralization and potential scam risks. The official X account (@worldlibertyfi) maintains over 773,000 followers with active engagement on security updates, governance decisions, and product launches.

Governance votes have achieved unanimous approval, including the decision to make WLFI tokens tradable. This unanimity may reflect either genuine community consensus or the influence of concentrated token holdings on voting outcomes.

Market Performance and Adoption

USD1’s growth to $2.65 billion market cap positions it among the topstablecoins globally, demonstrating significant market acceptance despite controversies. Trading volume and adoption metrics show sustained interest beyond initial hype cycles.

Social media discussions on platforms like X tend to focus heavily on the political implications rather than the technical merits, reflecting the project’s unique position at the intersection of cryptocurrency and political influence. This dynamic creates both opportunity and risk for long-term adoption.

Public reception includes excitement from Trump-aligned users who view WLFI as validation of cryptocurrency’s legitimacy, while the broader crypto community expresses skepticism about mixing political influence with DeFi principles.

What Are WLFI’s Future Development Plans?

World Liberty Financial’s roadmap focuses on several key development areas:

- USD1 Expansion: Loyalty programs and additional exchange listings, including confirmed Coinbase support

- Public Company Structure: Exploring the establishment of a $1.5 billion public company for holding WLFI tokens, creating traditional equity exposure

- Strategic Reserve Development: Plans mirror corporate treasury strategies like MicroStrategy’sBitcoin holdings, providing additional backing beyond governance token utility

- Enhanced DeFi Tools: Planned lending products and partnerships designed to integrate with traditional financial systems

- Cross-Chain Expansion: Expanded functionality beyond current Ethereum, BNB Chain, and Solana support

- Institutional Solutions: Development of custody solutions targeting institutional users

- Buyback Programs: Ongoing governance proposals for broader buyback and burn programs to create deflationary pressure

Technical and Product Expansion

The focus remains on building practical tools rather than experimental features, reflecting the project’s emphasis on proven utility over innovation for its own sake. The integration strategy targets mainstream adoption through familiar interfaces and regulatory compliance, potentially serving as a bridge for traditional finance users entering cryptocurrency markets.

Coverfoto WLFI Goldpaper – Donald J. Trump

Conclusion

World Liberty Financial demonstrates how political influence can accelerate cryptocurrency adoption while challenging fundamental DeFi principles. The protocol’s achievement of $550 million in funding and USD1’s rapid growth to $2.65 billion market cap shows significant market demand for politically endorsed crypto projects.

The project’s centralized control structure through Trump family holdings contradicts decentralization ideals but provides clear governance direction and regulatory positioning. This trade-off may prove successful for mainstream adoption even as it draws criticism from crypto purists.

WLFI’s success depends on maintaining high security standards, navigating complex regulatory requirements, and delivering on utility promises while effectively managing political risks. The protocol’s unique position offers both exceptional opportunities and unprecedented challenges as it attempts to bridge traditional finance and DeFi innovation.

Visit the officialWorld Liberty Financial website and follow@worldlibertyfi for the latest updates.

Sources:

- Official World Liberty Financial Website – Primary source for project overview, features, and token details with linked blockchain explorers

- Trump Organization Digital Assets Page – Official page on Trump family involvement and platform goals

- World Liberty Financial Wikipedia Entry – Encyclopedic overview of 2024 founding and Trump family associations

- New York Times: “Trump Family Profits Even With Tepid Launch of Crypto Tokens” (September 1, 2025)

- Yahoo Finance: “Trump-Backed World Liberty Ethereum Token Debut” (September 1, 2025)

- World Liberty Financial Gold Paper (PDF) – Official whitepaper outlining project vision

- Forbes: “Trump Family’s WLFI Token Debuts 5 To 15 Times Above Early Sale” (September 2, 2025)

- CCN Education: “Is World Liberty Financial a Game-Changer or Trump’s Political Play?” (August 27, 2025)

- Motley Fool: “President Trump’s Latest Crypto Venture Just Launched” (September 9, 2025)

- Official X Account: @worldlibertyfi – Verified account with real-time updates on governance, security events, and community engagement

[ad_2]