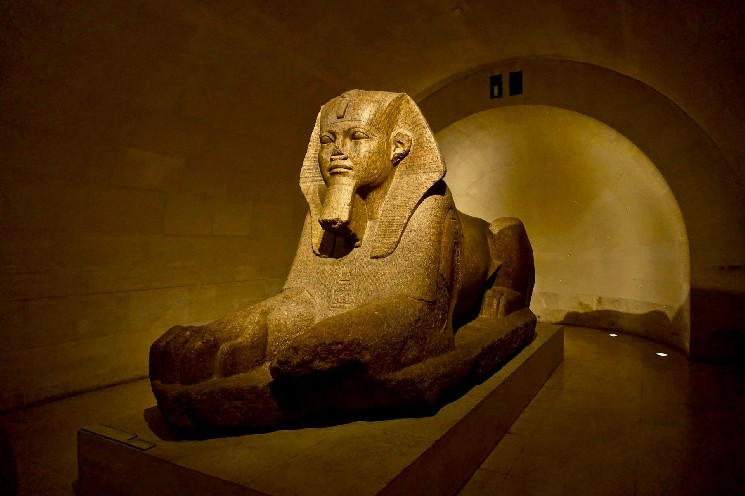

In the Ancient Greek tale of Oedipus, great rewards awaited travelers able to solve difficult riddles, but a powerful sphinx posed the riddles and devoured those who failed to solve them. Similarly, in ancient crypto times, circa 2017, blockchain technology stood to revolutionize finance and other fields. But two challenges stood in the way of this technology enjoying its full potential: (1) securities laws that don’t easily map onto decentralized systems, and (2) a securities regulator hostile to digital assets, which often posed grave risks to those who tried to solve the first challenge.

Today, the sphinx has resolved to be more helpful, but the riddles remain. The Securities and Exchange Commission’s (“SEC”) Crypto Task Force has stated that the agency’s previous regime created “an environment hostile to innovation” and has committed to working with industry participants to craft sensible regulations. While promising, significant challenges remain. U.S. securities laws are a mix of statutes passed by Congress and rules adopted by the SEC. The Task Force has signaled the SEC’s willingness to make the latter more workable through new rules and exemptions. Statutes, however, present most of the challenges and only Congress, not the SEC, can change them.

Below is a primer on the more common riddles currently facing developers of tokenized securities.

Regulatory Considerations

For tokenized securities, the developer creates on-chain tokens that each represent a share of equity in a company or other security, or another asset that offers the right to cashflows. This tokenization can open up possibilities—such as instantaneous settlement, share fractionalization, and daily dividend payments—that make the product more efficient or functionally diverse than its TradFi counterpart.

Even though the SEC may be more receptive to ideas for tokenized securities, it doesn’t have the authority to change statutes. Tokenized securities projects, therefore, will still need to solve or avoid the riddles these statutes present.

The Investment Company Act

If a token gives its holder economic exposure to assets that the developer has pooled, that token project could be an investment company covered by the Investment Company Act, which regulates companies, like mutual funds, that invest in securities and let investors get exposure to those investments through shares that they issue.

This riddle existed well before crypto, and most opted to navigate it by avoiding being classified as an investment company in the first place. That’s because the requirements imposed by the Investment Company Act don’t work well with business models that involve more than the buying and selling of securities. There are substantial restrictions on debt and equity raises, borrowing, and even business with affiliates. For those unable to avoid triggering these requirements, there are exemptions that may be available.

Broker-Dealers Under the Securities Exchange Act

Anyone who buys and sells securities for others or stands ready to buy and sell securities for their own account may be a broker or dealer. There is no bright line rule for qualifying as a broker-dealer, but the SEC and courts consider as indicia whether you provide liquidity, charge a fee related to the trade price, actively find investors, or play a role in holding customer funds or securities.

While there’s no practical way to trade digital assets as a broker-dealer currently, the SEC could use its existing authority to chart a realistic path for doing so. In the best case, that will take time and still come with some compliance obligations.

Exchanges Under the Securities Exchange Act

While it may not look like a traditional securities exchange, a platform using smart contracts to bring together orders for tokenized securities from multiple buyers and multiple sellers for matching and execution could qualify as one, depending on its structure.

Currently, only broker-dealers can trade on exchanges, and exchanges can’t hold customer accounts or custody customer securities. Even if the SEC is able to rework these rules, some requirements would no doubt persist.

Security-Based Swaps Under the Securities Exchange Act

If a tokenized security gives its holder exposure to the economic performance of one or more securities, it may have crossed over into the complicated world of security-based swaps. Generally, tokens that provide for the exchange of future payments based on the value of a security (or events relating to that security) withoutconveying ownership rights are likely to be swaps. Security-based swaps are under the joint jurisdiction of the SEC and the Commodity Futures Trading Commission. The requirements for them are many, with the most notable being rules prohibiting retail investors from purchasing swaps.

AML and KYC

Companies involved in trading or transferring tokenized securities also need to consider the applicability of anti-money laundering and know-your-customer laws. Compliance requirements depend on the role being played in the transactions but can include collecting and verifying the name, birthdate, and address of customers.

The Riddles Must Be Worked Through, Not Around

Solving these riddles is not an end in itself. When designing any tokenized securities project, developers make choices based on the economics, the technology, and the regulatory framework. These areas are intertwined, as the technology can make the economics possible and decide where a project falls within the regulatory framework. But because these considerations are so interrelated, developers should analyze them holistically from the beginning. Leaving regulatory considerations for the end can turn into a game of Jenga where problematic parts are removed only to topple the benefits of and objectives for the economics and technology. The riddles posed today aren’t merely obstacles to the many advantages of blockchain technology, but crucial parts of the answer.

The opinions expressed in this article are those of the author(s) and do not necessarily reflect the views of Skadden or its clients.