[ad_1]

A confidential draft bill circulating among Senate Democrats proposes sweeping new oversight of DeFi, extending Know-Your-Customer (KYC) and Anti-Money-Laundering (AML) duties to DeFi interfaces, validators, and even node operators.

According to reports, the leaked bill was intended as the Democrats’ counterweight to the House-backed market-structure bill. However, internal backlash has reportedly stalled those broader discussions inside the Senate Banking Committee.

Under the leaked framework, all DeFi applications enabling financial transactions must implement front-end KYC controls, potentially including browser-based wallets and liquidity interfaces.

The leaked language also places new responsibility on oracle operators, potentially exposing them to enforcement if price feeds are linked to “sanctioned” protocols.

The Treasury Department would also gain authority to create a “restricted list” of protocols deemed too risky for US users.

Senator Ruben Gallego claimed that the Democrats’ bill represents the party’s attempt to build bipartisan consensus on crypto market structure.

According to him:

“Democrats have shown up ready to work… They asked for paper and substance, and we delivered.”

Market impact

The move has ignited a fresh round of partisan tension in Washington, with Republican lawmakers and crypto industry figures warning that it could cripple innovation and push US Bitcoin and Ethereum liquidity offshore.

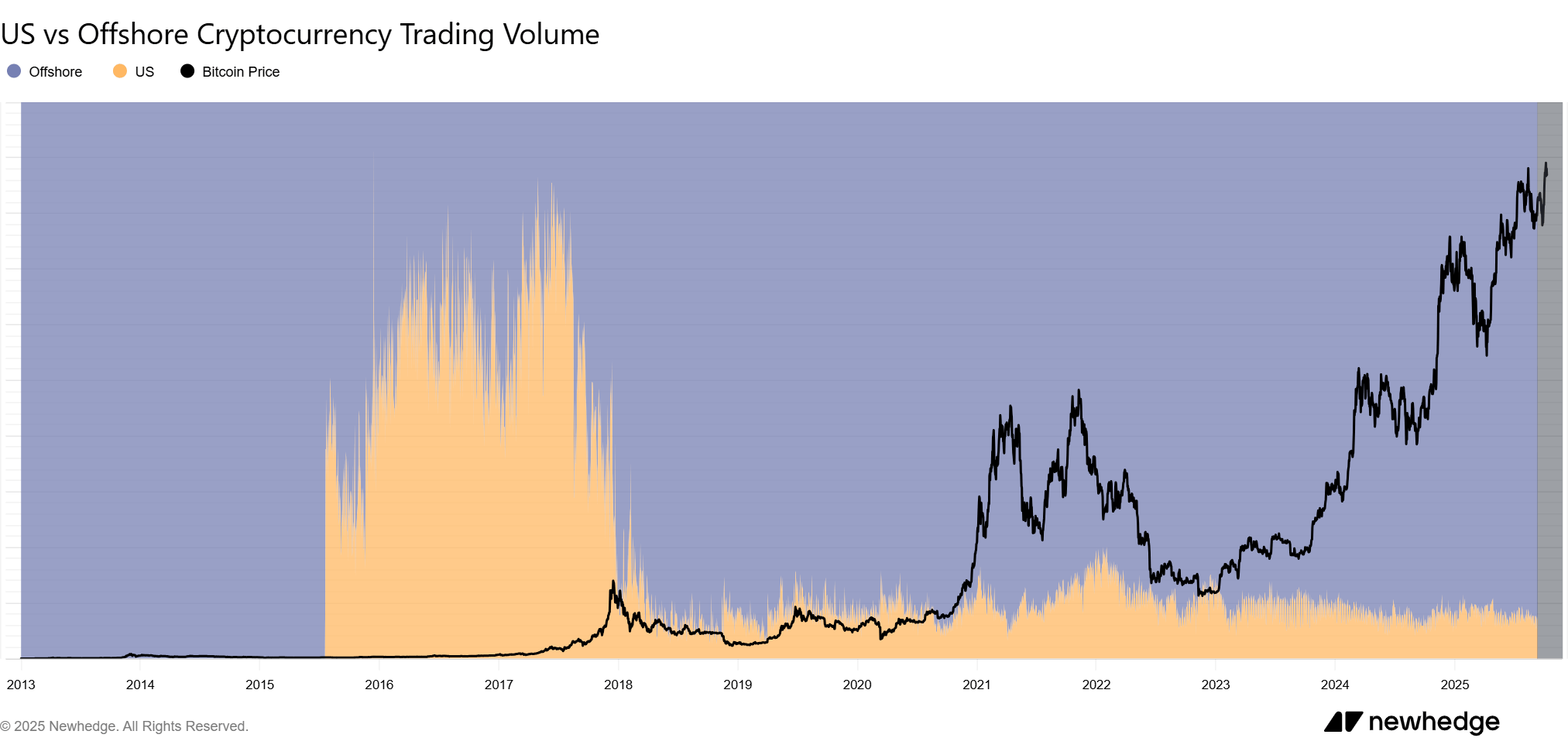

To understand the risk, one has to consider the current landscape where US-based platforms account for only a small fraction of global volume.

According to Newhedge data, US crypto trading venues already capture less than 10% of global trading volume, while the top eight (mainly offshore) platforms account for roughly 90% of global market depth.

These numbers show that liquidity already gravitates to platforms with fewer regulatory constraints. The Senate proposal’s forced compliance at the protocol level could accelerate that flight.

If US users are forced to interact only through KYC-verified front ends, or if the Treasury can block access to specific protocols, traders seeking anonymity, flexibility, and lower friction may migrate to bridges or foreign exchanges where those constraints are looser or unenforced.

Over time, that shift would entrench offshore platforms as liquidity hubs, deepen the dominance of already-large non-US exchanges, and fragment trading across jurisdictions.

At the same time, US liquidity pools would shrink due to fewer active counterparties, wider spreads, and reduced depth. That fragmentation would hamper innovation, worsen market inefficiencies, and weaken the US’s competitive position in the global crypto rails.

Moreover, implementing these rules could impact US crypto users’ interaction with the rapidly expanding DeFi sector.

A recent DeFi Funds report revealed that many Americans do not trust the traditional financial system.

As a result, they have become curious about the DeFi industry, which they believe offers them more benefits over the current system, including control over their money and lower transaction fees.

Industry backlash

Considering the significant market impact that this bill would have on the market, industry stakeholders have begun to speak against it.

Jake Chervinsky, the chief legal officer of Variant Fund, said:

“Many aspects of the proposal are fundamentally broken and unworkable. This is not a ‘first offer’ in a negotiation, it’s a list of demands that appear designed to kill the bill.”

Chervinsky furthered that this was an “unprecedented [and] unconstitutional government takeover of an entire industry.” He added:

“It’s not just anti-crypto, it’s anti-innovation, and a dangerous precedent for the entire tech sector.”

Zack Shapiro, head of policy at the Bitcoin Policy Institute, echoed this view by pointing out that the draft “stretches illicit-finance laws to target software and software developers rather than criminal conduct.”

According to him, this sets a dangerous precedent for censoring lawful private exchange, similar to how the government has targeted Tornado Cash and Samourai Wallet developers.

Coinbase CEO Brian Armstrong said the bill would “set innovation back years” and block America from leading in crypto finance.

He stated:

“We absolutely won’t accept this. It’s a bad proposal, plain and simple, that would set innovation back, and prevent the US from becoming the crypto capital of the world.”

Uniswap founder Hayden Adams added that the language “would kill DeFi” domestically.

Considering this, he called for “a huge shift from Democratic senators” if progress on market-structure reform is to continue.

[ad_2]