The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) released a joint statement on Sept. 5, 2025 signaling coordinated steps toward modernizing American financial markets. In the press release, the agencies confirmed that they are evaluating policies to introduce 24/7 trading cycles, regulate perpetual futures, and expand oversight across crypto and derivatives markets.

Push Toward Continuous Market Access

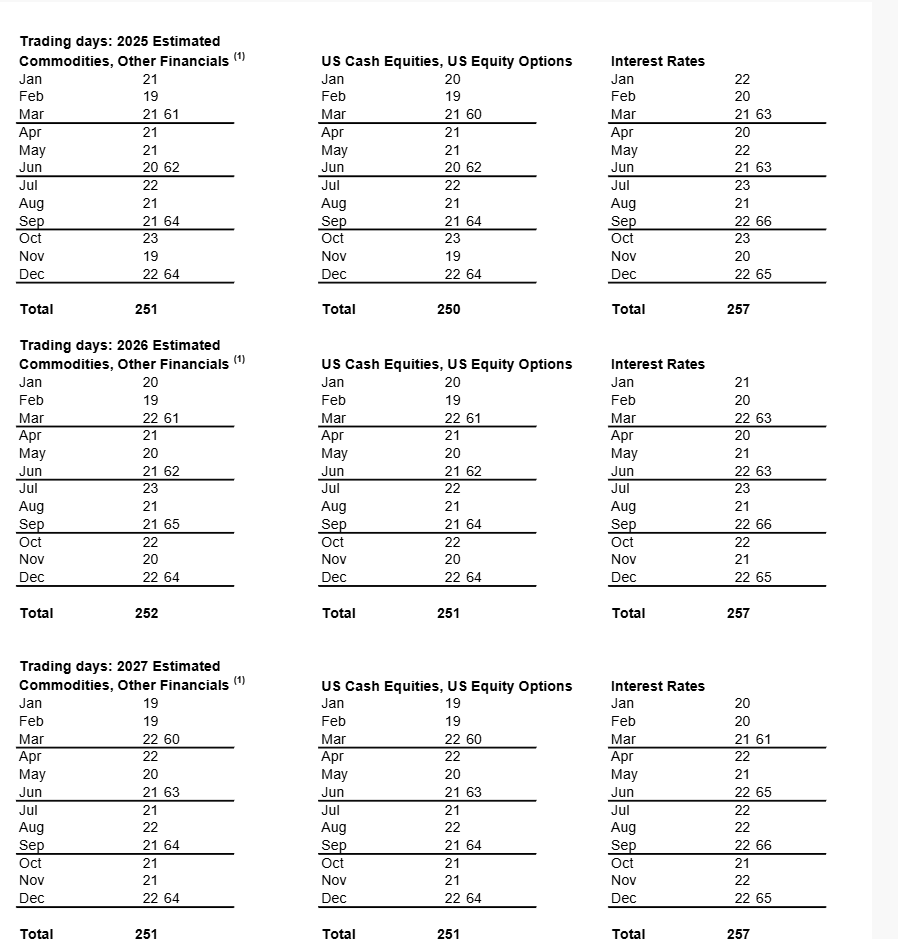

For more than a century, U.S. markets have operated under fixed weekday hours. Since 1985, the New York Stock Exchange and Nasdaq have followed a standard schedule, closing on nights and weekends. The joint statement questioned whether that framework remains suitable in a financial system increasingly shaped by crypto, foreign exchange, and commodities, all of which trade continuously across jurisdictions.

Source: New York Stock Exchange (Trading Days)

“Further expanding trading hours could better align U.S. markets with the evolving reality of a global, always-on economy,” the statement read.

Both agencies stressed that while extended hours could accelerate capital velocity, they also bring added risks. Overnight positions may face exposure to global participants in different time zones, creating vulnerability for traders who cannot monitor markets constantly. Officials noted that expansion “may be more viable in some asset classes than others,” ruling out a universal approach.

Source: SEC/CFTC Press Release

The shift to continuous trading would mark a major break with long-standing U.S. practice. It would also require significant upgrades to clearing, settlement, and risk management infrastructure to handle around-the-clock transactions.

Regulatory Focus on Crypto Derivatives

The SEC and CFTC confirmed that perpetual futures contracts are under active review. These products, which lack an expiry date, dominate offshore crypto exchanges and account for most derivatives volume. Bringing them under U.S. jurisdiction could give domestic investors access to stricter leverage controls and improved risk frameworks.

The agencies also acknowledged the need for regulatory clarity on event contracts, a type of derivative central to prediction markets. Event contracts, tied to specific outcomes like elections or economic data releases, have surged worldwide but remain inconsistently regulated in the United States. By setting clear rules, regulators aim to accommodate innovation while maintaining investor safeguards.

Officials said perpetual contracts and prediction markets would be discussed at a public roundtable scheduled for September 29. The meeting is expected to draw industry participants, academics, and market operators.

Alignment With Trump Administration’s Crypto Framework

The joint proposals follow policy direction from President Donald Trump’s administration. In July, the administration published an interagency report outlining recommendations for a unified digital economy framework. That report tasked the SEC and CFTC with coordinating oversight of crypto markets, assigning the CFTC authority over spot trading and the SEC jurisdiction over tokenized securities.

In August, the CFTC expanded its Foreign Board of Trade (FBOT) pathway, opening regulated channels for offshore exchanges to serve U.S. clients. The FBOT registry, in place since the 1990s, allows foreign exchanges to apply for licenses covering multiple asset classes. Officials described the update as part of a broader effort to integrate crypto within existing structures while maintaining oversight.

The July report also recommended building quantum-resistant architecture to secure cryptographic protocols. Regulators warned that advances in quantum computing could eventually compromise the encryption standards protecting banking, finance, and defense systems. The SEC’s Crypto Assets Task Force is reviewing a proposal to quantum-proof digital assets before such risks materialize.

Movement Toward Unified Oversight

Atkins and Pham described the current initiatives as “a new beginning” for their agencies. Both regulators emphasized that markets for securities and non-securities are converging, requiring tighter coordination and updated rules. By expanding trading hours, easing restrictions on derivatives, and providing innovation exemptions for DeFi protocols, the agencies aim to reduce gaps between U.S. and foreign markets.

Officials also outlined the concept of “super-apps.” These platforms could offer trading across securities, spot crypto, leveraged futures, and event contracts under one regulatory framework. Atkins argued that such systems would eliminate the need for multiple licenses and state-by-state requirements. During a July speech at the America First Policy Institute, he described super-apps as a “key priority,” citing crypto as a justification for their creation.

Industry participants welcomed the discussion. Crypto firms said access to perpetual contracts and integrated platforms could reduce reliance on offshore exchanges. Traditional finance representatives expressed caution, stressing that infrastructure, liquidity, and investor protection mechanisms would need upgrades before continuous trading could launch at scale.

Risks and Criticism

While the agencies presented the proposals as steps toward modernization, critics warned of potential consequences. Some policy analysts argued that creating super-apps blending securities, crypto, and derivatives may increase systemic risk. Others said continuous trading could disadvantage smaller investors who are unable to monitor markets at all hours.

Fischer, a former SEC official, stated that reforms allowing perpetuals, prediction markets, and integrated platforms “will give crypto native firms an edge over TradFi in all markets.” She added that such reforms could take years to implement but described them as “extremely dangerous” without adequate safeguards. Critics also raised concerns about volatility in overnight markets and challenges in ensuring orderly settlement across time zones.

The SEC and CFTC confirmed that discussions will continue at the September 29 roundtable. Participants are expected to review proposals for continuous trading, event contracts, perpetual futures, and innovation exemptions for DeFi. Outcomes from the meeting could form the basis of formal rulemaking processes later this year.

Conclusion

The joint announcement marks a rare display of alignment between the SEC and CFTC. For years, differences over jurisdiction slowed regulatory progress, especially in crypto markets. The new framework, shaped by White House policy and interagency cooperation, signals Washington’s intent to adapt U.S. finance to digital realities.

If implemented, 24/7 trading would represent the most significant transformation in U.S. market structure since electronic trading emerged in the 1980s. Perpetual futures and event contracts could bring products long limited to offshore exchanges under domestic oversight. Super-apps, if realized, could merge previously separate functions into a unified marketplace.

However, the reforms face legal, technical, and operational hurdles. Market operators must overhaul systems to handle constant settlement. Regulators must design protections against volatility, manipulation, and cyber risks. Investors, both institutional and retail, must adapt to a market with no closing bell.

The September 29 roundtable will begin shaping how these challenges are addressed. As global finance moves toward nonstop operation, U.S. regulators appear determined to ensure American markets remain competitive in a digital, always-on economy.