[ad_1]

- The price barrier at $2460 functions as a powerful resistance for ETH that causes 10.95 million investors to hold 64.52 million ETH.

- The ongoing price stability of Ethereum has kept the token above its essential $2,100 support region while any downward drop might unleash bearish market forces.

- ETH prices might decrease due to declining investor faith which led to over -30,000K ETF withdrawals.

The Ethereum (ETH) cryptocurrency price fell to $2,188.96 during the last 24-hour period demonstrating a 2.3% decrease. The market value of this asset against Bitcoin marks 0.02452 BTC but demonstrates a decrease of 2.2% compared to yesterday. ETH has shown moderate pricing volatility through its $2,104.64 to $2,270.74 movement during the period.

An influential resistance has materialized at $2,460 after 10.95 million investors obtained 64.52 million ETH. Ethereum faces a major resistance threshold at $2,460 which must be surpassed for an upward price rally to commence.

Ethereum Holds $2,100 Support Amid Market Uncertainty

Ethereum’s current price movement suggests a struggle to maintain upward momentum. The recent decline could be attributed to broader market trends, macroeconomic factors, or profit-taking by traders. The cryptocurrency holds its position beyond a $2,100 support point that established itself as an enduring price resistance throughout the previous trading period.

The biggest hurdle for #Ethereum is at $2,460, where 10.95 million investors acquired 64.52 million $ETH. Breaking through this level will reignite #ETH bullish momentum! pic.twitter.com/tZLGuOPzrH

— Ali (@ali_charts) March 7, 2025

If ETH falls below this level, it could test lower supports, potentially leading to increased bearish sentiment. On the other hand, sustained support at this range may provide a foundation for recovery and an attempt to retest the $2,460 resistance.

Ethereum ETF Inflows Drop, Market Caution Rises

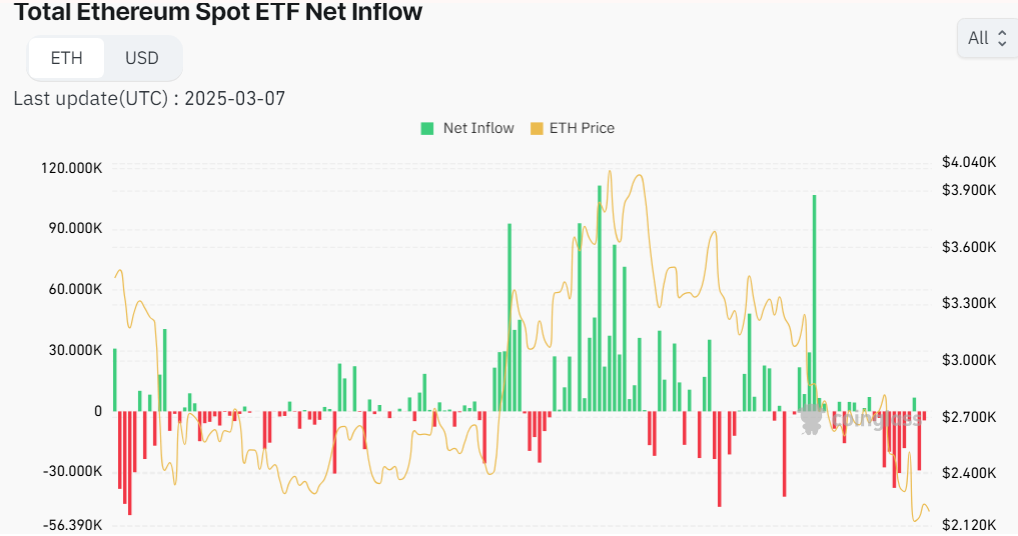

Ethereum Spot ETF recorded strong net inflows exceeding 90,000K which pushed its price to near $3,900K indicating institutions as a primary driver behind its market growth. Recent periods have witnessed a strengthening of outflows which show diminishing investor belief through red bars that surpass -30,000K.

Source:Coinglass

Ethereum ETF demand has weakened according to the current price range of $2,400K to $2,700K because of falling investment inflows. The market trend indicates investors hold back their investments because of multiple economic uncertainties across all sectors.

Continued Ethereum asset outflows may drive prices downward to potentially hit new support levels. The resurgence of inflows indicates market confidence thus elevating the possibility to surpass the $3,000K resistance level.

[ad_2]