Dive into Cipher Mining’s Q3 2024 performance. From revenue challenges to strategic investment in fleet upgrades, data center expansion and plans for AI/HPC. Discover what’s next for this Bitcoin miner!

The following guest post comes from Bitcoinminingstock.io, providing comprehensive data, in-depth research, and analyses on Bitcoin mining stocks. Originally published on Nov. 21, 2024, it was penned by Bitcoinminingstock.io author Cindy Feng.

Cipher Mining (NASDAQ: CIFR) has delivered one of the strongest YTD performances among public Bitcoin miners as of November 19, 2024. Within investment circles, comparisons between TeraWulf and Cipher have sparked interest, with some noting the latter’s stronger performance in specific areas. Having concluded TeraWulf as a rising Bitcoin miner in my previous analysis, now it’s time to take a close look at Cipher, a miner that has quietly carved out its position in the market.

Basic Profile

Cipher Mining is a U.S.-based Bitcoin mining company that positions itself as a data center developer. Its operations are primarily located in Texas, leveraging the state’s favorable energy infrastructure. The company’s operating facilities include:

- Odessa Data Center: A wholly owned facility in Odessa, Texas, accounting for 7.1 EH/s, representing 76% of Cipher’s total hash rate.

- Joint Ventures with WindHQ LLC: Alborz, Bear and Chief facilities located in Happy and Andrews, Texas, contributing an additional 2.2 EH/s to the company’s overall capacity.

Image Background Source: ciphermining.com/sites

Beyond Bitcoin mining, Cipher also participates in grid curtailment programs to optimize profitability. Similar to Riot Platforms, Cipher leverages ERCOT’s low-cost energy grid and programs like the Four Coincident Peak (4CP) to manage electricity usage during high-demand periods. In Q3 2024, Cipher reported $1.4M in power sales, generated by selling electricity to ERCOT when profitable. This additional revenue stream supports the company’s operating costs.

Not So Pretty Q3 2024 Performance

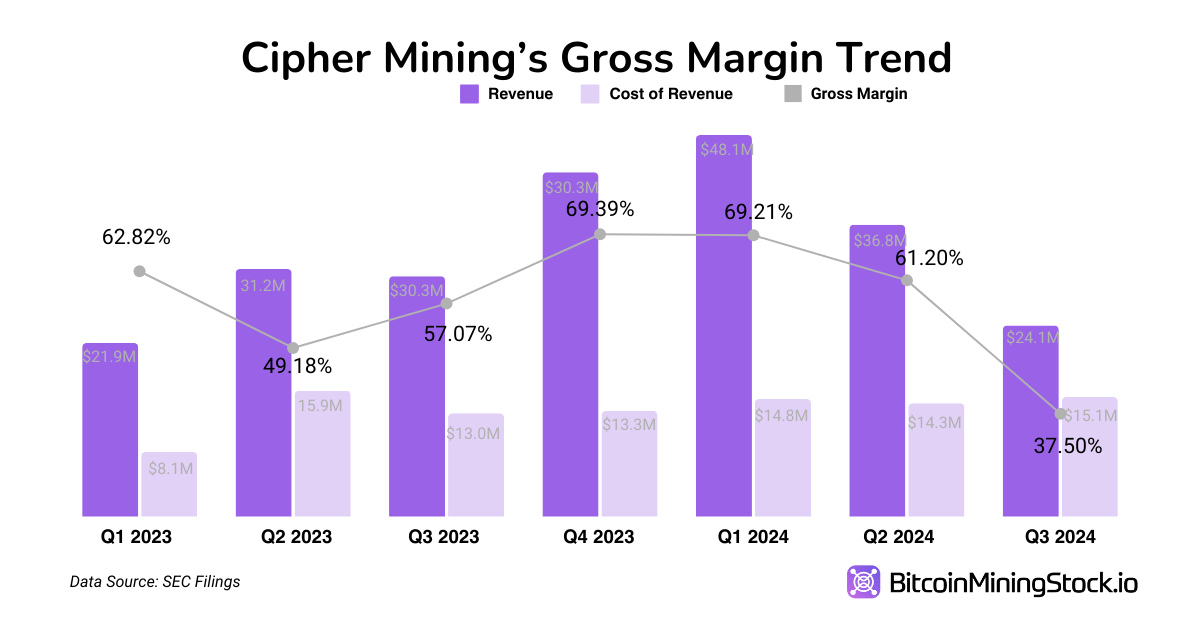

In Q3 2024, Cipher reported $24.1M in revenue, a 35% QoQ and 20.5% YoY decline. This drop was primarily driven by reduced Bitcoin production. The company mined 493 BTC in Q3, down from 638 BTC in Q2. Seasonal surges in electricity rates during ERCOT’s summer 4CP periods further compounded the impact.

During this period, Cipher’s cost of revenue rose to $15.1M, up from $13.0M in Q3 2023. Net losses widened to $87M, a stark contrast to the $19M loss in Q3 2023. Contributing factors included higher depreciation costs associated with new mining rigs and facilities, as well as derivative losses linked to power contracts. As a result, Cipher’s gross margin declined significantly, from 57.1% in Q3 2023 to 37.5% in Q3 2024.

Cipher Mining: Quarterly Revenue, Cost of Revenue, and Gross Margin Trends (Q3 2023 – Q3 2024)

These numbers together painted an undesirable operational pressure for Cipher.

A Change of Perspective

Amid operational challenges, Cipher’s total assets grew to $775.4M as of Q3 2024, up from $566.1M at the start of the year. This growth reflects significant investments in its Bitcoin treasury and mining infrastructure.

Bitcoin Treasury Strategy: Hold Some and Sell Some

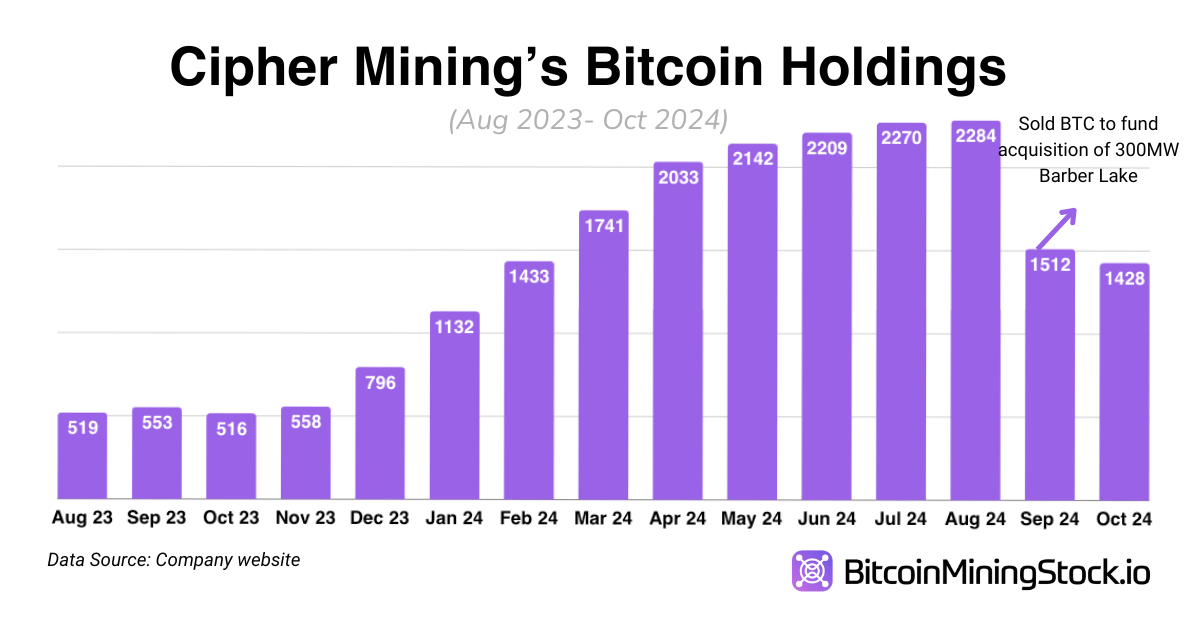

As of September 30, 2024, Cipher held 1,512 Bitcoin valued at approximately $138.1M, up from 796 Bitcoin valued at $32.98M at the end of last year. However, compared to Q2, Cipher had a 33.4% (923 BTC) QoQ decline due to strategic sales. In September, Cipher sold a good portion of its Bitcoin holdings, raising $67.5M to finance the acquisition of the 300 MW Barber Lake facility. This approach allows the company to leverage its Bitcoin treasury for liquidity while minimizing equity issuance.

Cipher Mining’s Bitcoin holdings (August 2023- October 2024)

Fleet Upgrade: Strengthening Operational Efficiency

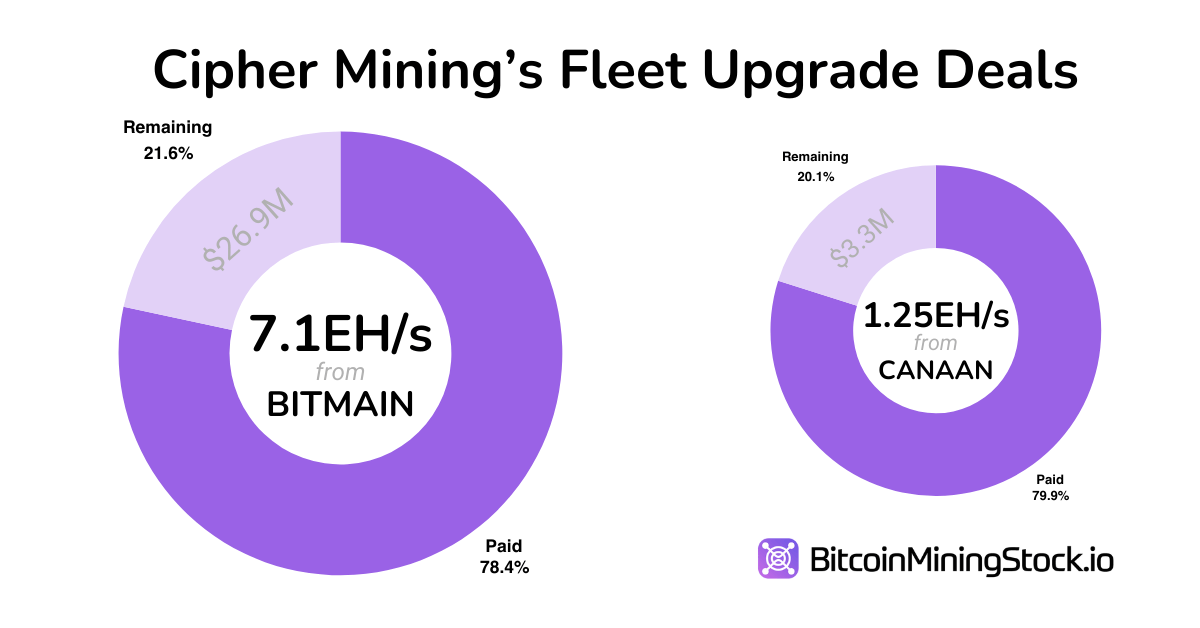

Investments in fleet upgrades significantly impacted Cipher’s cost structure. Since Q4 2023, Cipher entered agreements with Bitmain and Canaan to acquire cutting-edge mining rigs:

- The Bitmain agreement involves 7.1 EH/s of miners, initially scheduled for delivery for 2025 but accelerated to Q4 2024 through an amendment in June 2024. Cipher paid $97.5M in deposits during the nine months ended September 30, 2024, with $26.9M remaining.

- The Canaan agreement includes 1.25 EH/s of miners, with delivery expected in Q4 2024. Cipher paid $13.1M upfront in Q2, with $3.3M remaining. As part of this agreement, Cipher secured an option to acquire additional miners equivalent to 160 MW of capacity by June 30, 2025, by paying $5.3M as deposit (paid in Q2).

Cipher Mining entered agreements with Bitmain and Canaan to acquire mining rigs

Bitmain’s Antminer S21 Pro and Canaan’s A1566 will be utilized to replace less efficient machines at Cipher’s Odessa facility, rather than being deployed at the Black Pearl Facility.

To align with these upgrades, Cipher revised the useful lives of its mining rigs from five years to three years effective from June 1, 2024. This change added $9.4M and $12.2M in depreciation amortization expense for Q3 2024, which heavily contributed to the net loss. In Q3 2024, the company integrated Bitmain’s Antminer S21 Pro and Canaan’s A1566 miners at its Odessa facility, Cipher’s largest wholly-owned data center.

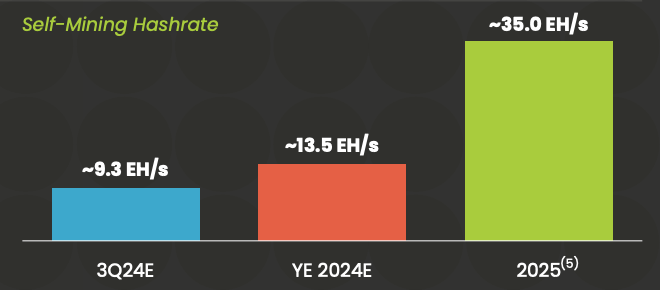

However, these upgrades are essential for Cipher to reach its target of 13.5 EH/s self-mining capacity by year-end 2024, up from 9.3 EH/s as of Q3. By making these upgrades, Cipher is laying the foundation for improved operational efficiency and profitability.

Cipher Mining’s Hash Rate Target (screenshot from its presentation)

Forward Looking Growth Potential

Data Center Expansion Pipeline

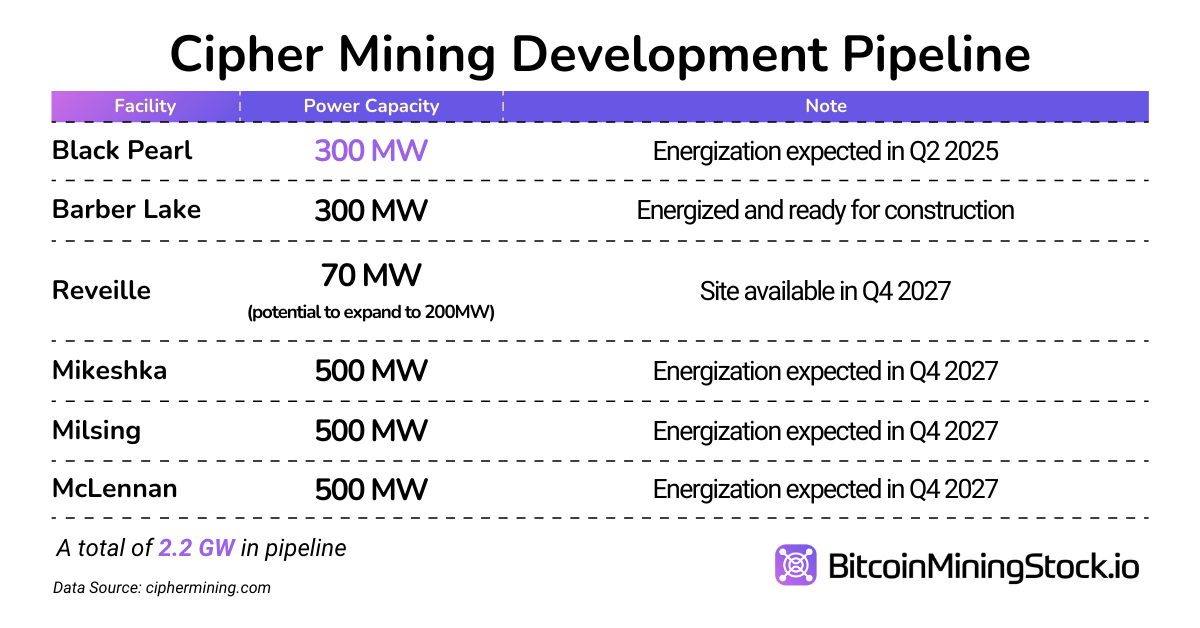

Looking ahead, Cipher is undertaking substantial expansion of its data center capacity. The Black Pearl facility (acquired last Dec), a 300 MW data center under development in Winkler County, Texas, is expected to be energized by Q2 2025, adding approximately 21.5 EH/s of mining capacity. Similarly, they recently acquired a Barber Lake facility in Colorado City, Texas, boasting 300 MW of capacity and is ready for construction. The 70 MW Reveille site located in Cotulla, Texas was another recent acquisition. This site has the potential to be expanded into a 200 MW data center, pending regulatory approval (note: Cipher hasn’t issued a formal PR about this acquisition, but it was mentioned in their recent 10-K filing).

On Oct 15, 2024, Cipher announced acquiring options for 1.5 GW of additional data center capacity in West and North Texas. This brings their active portfolio and development pipeline to a total of 2.5 GW across 10 sites. Upcoming facilities like Mikeska, Milsing, and McLennan facilities, each have 500 MW of potential power capacity pending regulatory approvals.

AI and HPC Ventures

In response to the highly competitive mining environment, like many other miners I previously discussed, Cipher is also diversifying into AI/HPC hosting to reduce reliance on Bitcoin mining. As of Q3 there is no revenue reported from this business sector, but we can see data centers in the pipeline which are strategically designed to support both Bitcoin mining and HPC activities.

According to a recent company presentation, their team includes veterans from Google, Vantage, and Meta, bringing deep expertise to its AI infrastructure and tier-3 data centers. On Oct 31, its CEO Tyler Page said the company has “made great progress in our discussions with hyperscalers in recent weeks as we seek our first HPC tenants”. This seems to signal promising revenue potential in HPC hosting for Cipher in the near future, presenting a significant long-term growth opportunity.

Some Things Remain Unclear

As of September 30, 2024, Cipher reported $39.7M in cash and cash equivalents (including $14.4 M restricted cash). While this provides some liquidity, it raises concerns about whether the company has sufficient resources to meet its ambitious expansion plans. With over $30.2M payments due for new mining rigs and significant capital requirements for data center developments and HPC business ventures, Cipher may need to explore additional financing options.

Cipher’s recent financing activities highlight its ability to raise capital, generating $213.5M during nine months ended September 30, 2024. These funds were primarily raised through the issuance of common stock. However, reliance on stock issuance could lead to shareholder dilution if it continues in the long-run. Now, the question is whether Cipher can diversify its funding strategy to balance its growth ambitions and preserve shareholder value.

Final Thoughts

Cipher Mining’s Q3 2024 results reflect the challenges of operating in an increasingly competitive Bitcoin mining environment, especially during summer months for those located in Texas.

However, Cipher’s forward-looking strategy and ambitious expansion plans could position it well for future growth. If these initiatives are executed effectively and supported by adequate resources, Cipher has the potential to emerge as a compelling player in the current market cycle.