[ad_1]

Ethereum (ETH) traders have watched closely as large holders began making major on-chain moves this week.

The cryptocurrency surged above key resistance at $1,620, reaching a high near $1,705 earlier and then pushing to nearly $1800.

Market participants have questioned whether this momentum could push Ethereum to $1,850.

However, recent whale transactions and on-chain activity may influence the direction of the price in the short term.

Ethereum Surges Past Key Resistance as Price Targets $1,850

Ethereum started a strong bullish movement as it exited its trading range at $1,555 to $1,620.

The price exceeded resistance levels to hit its new highest point at $1,705 during this short period.

The upward movement occurred after Ethereum traded sideways for several days, thereby developing support to increase.

After hitting $1,705, the Ethereum price met resistance near $1,720 and started consolidating above the $1,693 level.

Market analysts shared charts indicating a bullish continuation was possible if Ethereum held support above $1,693.

A breakdown below this point could open the door for a retest of support zones at $1,660 and $1,620.

Market participants continuously observed volume levels to validate enduring buyer participation.

Professional analysts predict that if the price surpasses $1,720, it will boost the potential for prices to rise toward $1,850.

Source: X

Analyzing the ETH/BTC price pair added complexity to the study. The relative value of Ethereum compared to Bitcoin experienced a more than 79% decrease from its highest point in 2021.

The trading pair maintained a position close to 0.01835, one of its lowest points during its multi-year history.

A change in market sentiment towards Ethereum’s ecosystem and positive feelings towards its network would lead to a potential ETH/BTC relationship.

Whale Transactions Raise Concerns Over Short-Term Selling

Large holders made several notable transactions following Ethereum’s price surge. A wallet linked to the Ethereum Foundation transferred 1,000 ETH, worth around $1.58 Million, to the exchange Kraken.

According to blockchain records, this wallet received 84,513 ETH a decade ago when the asset was priced at approximately $1.20.

Another large transaction came from a whale that borrowed 15,000 ETH from Aave and sold it for 24.9 million USDT.

The average selling price was around $1,660. This move occurred shortly after the recent price rally, leading to concerns that other large holders might follow with similar actions.

After the $ETH price rose, a whale borrowed 15,000 $ETH from #Aave and dumped it for 24.9M $USDT at an average price of $1,660.https://t.co/9x1ZEatzZE pic.twitter.com/vImz9wAUrc

— Lookonchain (@lookonchain) April 22, 2025

According to a blockchain analyst, the transaction happened within 15 minutes. The rapid transaction and its large volume made some investors worry about intense market seller influence.

On-Chain Metrics Point to Possible Accumulation Zone

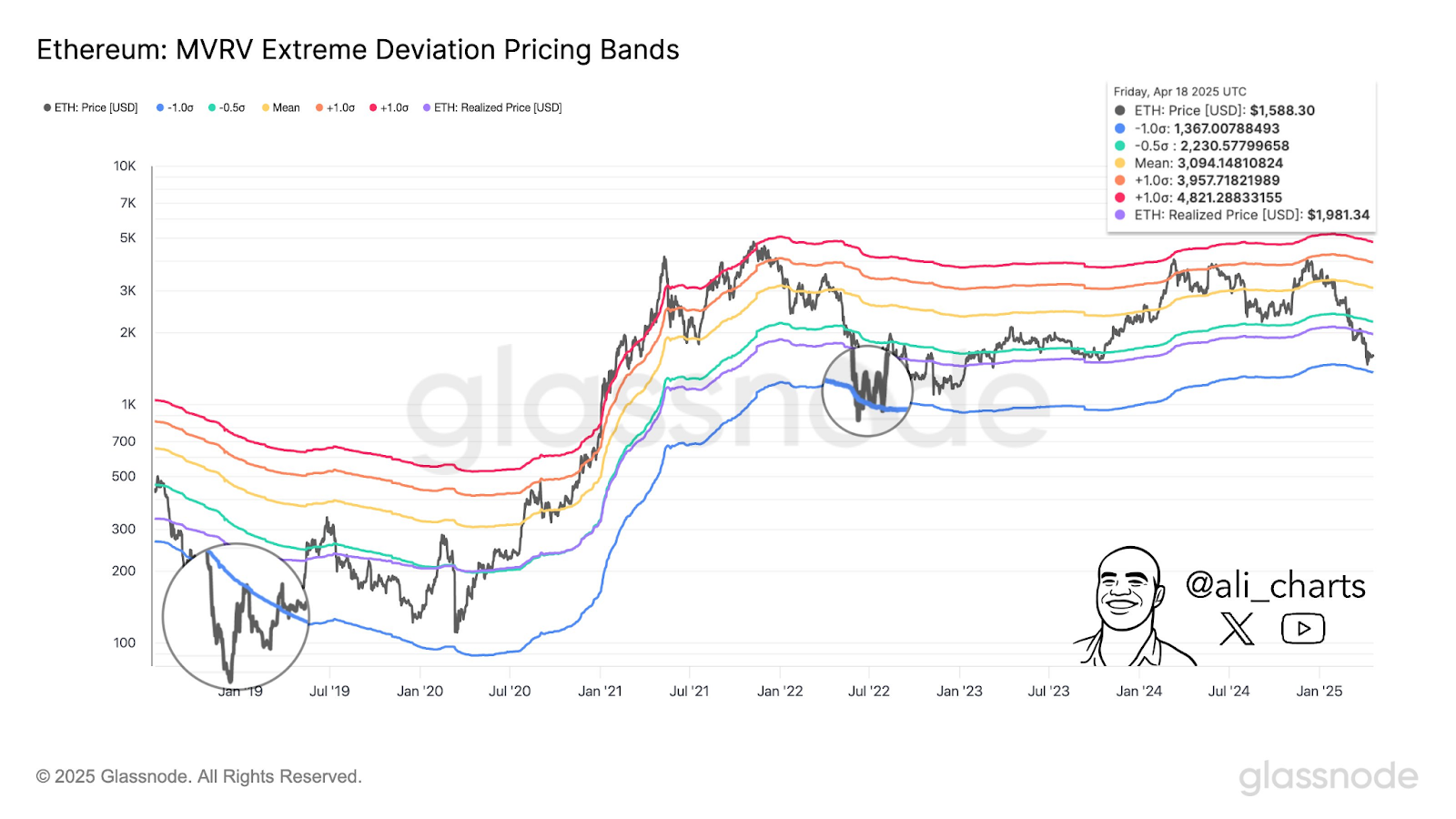

Ethereum’s MVRV Pricing Bands presented an alternate perspective about the asset’s market standing during April 2025.

The market valued Ethereum at $1,588.30, while its actual value remained at $1,981.34.

Ethereum is positioned within the lower section of MVRV deviation bands, where historical data shows buying activity steers towards accumulation.

Glassnode data indicated that the previous falls into these bands during 2018 and 2022 established market bottom points.

Analysts followed this data point since it revealed the feelings of long-term holders and market actors in Bitcoin markets.

The price range indicates ongoing selling or weak demand if it stays stable for a prolonged period.

Source: X

The current price received positive and negative assessments from traders because of whale transactions and broader market conditions.

The Ethereum market showed signs of recovering to reach previous MVRV bands, including the $3,094 mark.

[ad_2]