[ad_1]

Coinbase, the largest U.S.-based cryptocurrency exchange, is embroiled in controversies, from listing fees and community backlash regarding meme coin descriptions to charges from the Securities and Exchange Commission (SEC). The platform is now under intense scrutiny from industry leaders, investors, and regulators, raising questions about its practices and regulatory compliance.

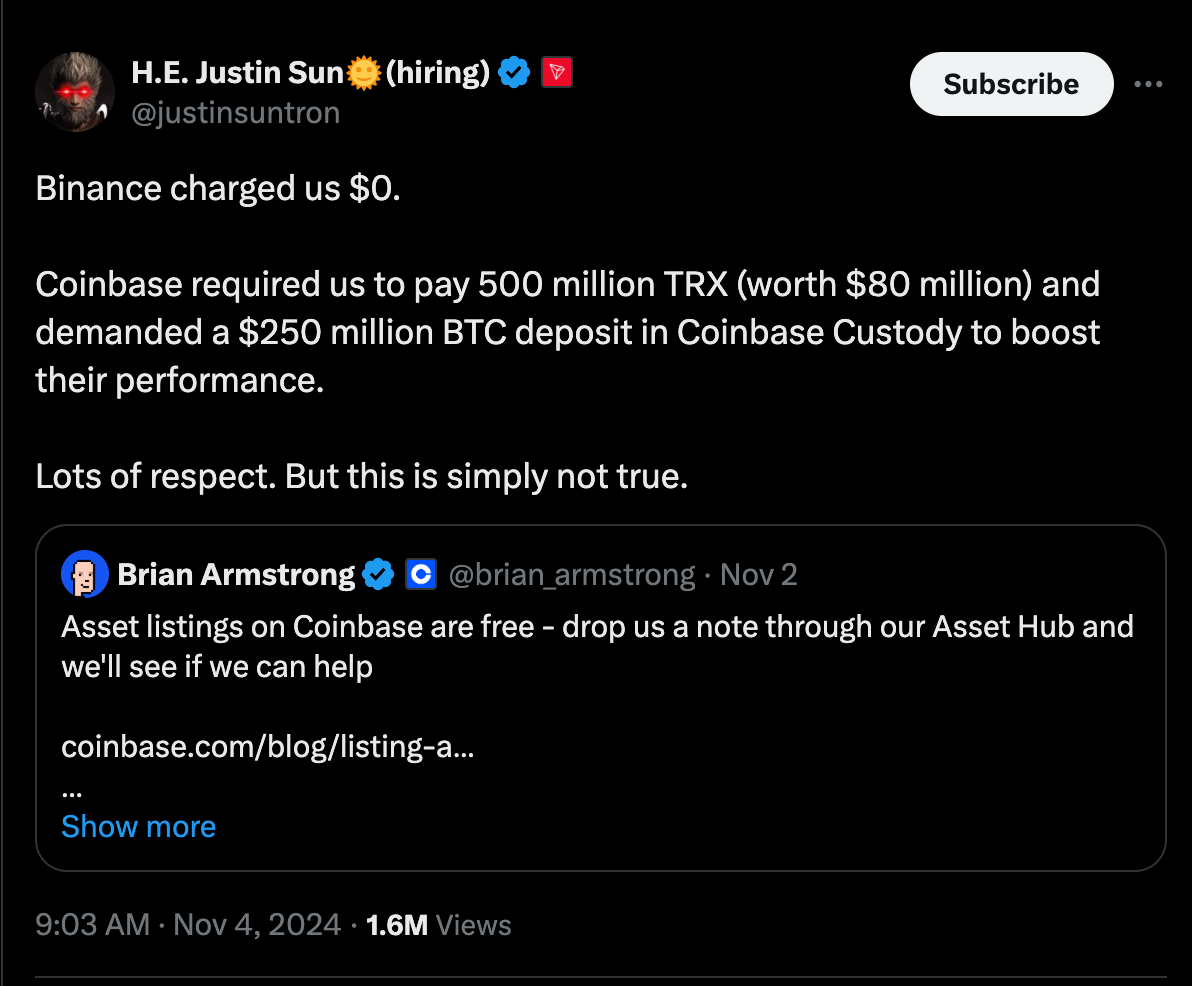

A significant point of controversy involves claims made by TRON founder Justin Sun, who alleges that Coinbase demanded exorbitant fees to list TRON (TRX). According to Sun, Coinbase requested 500 million TRX tokens, roughly equivalent to $80 million at the time, for the listing. Sun’s allegations contradict Coinbase CEO Brian Armstrong’s assertion that the exchange offers free cryptocurrency listings. This disagreement has fueled a broader debate within the crypto industry regarding transparency and fairness in exchange listing fees.

Source

In response, Armstrong reaffirmed that Coinbase does not charge fees for token listings and encourages projects to apply freely. However, Sun’s statement was quickly supported by other prominent figures, including Andre Cronje, founder of the Fantom project, who revealed his experience with Coinbase seeking payments between $30 million and $300 million for various listings over the years. The alleged high costs are seen as a significant barrier for emerging crypto projects, which may lack the resources to meet such demands, ultimately limiting diversity and innovation within the market.

Impact of Listing Fees on the Crypto Community

The ongoing conversation about Coinbase’s listing practices touches on a broader issue within the cryptocurrency ecosystem. When platforms like Coinbase impose high listing fees, smaller projects are effectively priced out, reducing their chances of success. Some argue that this restriction stifles competition and slows the industry’s growth.

A recent report from a venture capitalist highlighted an instance where a high-profile project was asked for 15% of its total token supply for a listing. Such practices, if true, pose a considerable challenge to the accessibility and inclusivity of the digital asset market. As the industry matures, calls for greater transparency and equitable practices around listing fees will likely increase, putting further pressure on exchanges like Coinbase.

Controversial Newsletter Description of Pepe Coin Sparks Backlash

Coinbase’s internal challenges are compounded by a social media backlash following a newsletter article describing the meme coin Pepe as “a hate symbol co-opted by alt-right groups.” This reference, attributed to the Anti-Defamation League, has unsettled many in the cryptocurrency community, who argue that Pepe represents an internet meme with no political agenda. The meme coin, named after the popular internet character Pepe the Frog, recently surged. It reached a $1 billion market cap within days of its launch before seeing a subsequent decline.

Critics of the newsletter, including crypto community figures like Spottie WiFi and Kenobi, expressed their disappointment with Coinbase’s characterization of Pepe. Kenobi, a musician and educator, announced his intention to close his Coinbase account over the remarks, reflecting the strong sentiment within the community. Although Coinbase issued a disclaimer stating that the views in the article did not reflect those of the company, the damage to its reputation among some segments of the user base appears significant.

SEC Charges Coinbase with Operating as an Unregistered Exchange, Broker, and Clearing Agency

Beyond public relations issues, Coinbase faces severe regulatory challenges. On June 6, 2023, the SEC charged Coinbase with operating as an unregistered national securities exchange, broker, and clearing agency. The regulator alleges that Coinbase has facilitated billions of dollars in crypto asset securities transactions without the necessary registration, depriving investors of critical protections.

According to the SEC’s complaint, Coinbase combines the roles of an exchange, broker, and clearing agency — services typically separated in traditional finance. The SEC claims that by operating in this manner without registration, Coinbase bypasses essential safeguards, such as rulebooks, to prevent fraud and conflicts of interest, along with routine inspections by the Commission. The regulator’s action extends to Coinbase’s staking-as-a-service program, which the SEC argues constitutes an unregistered securities offering.

The SEC’s complaint alleges that Coinbase Global Inc. (CGI), Coinbase’s holding company, bears responsibility for these violations. The complaint seeks injunctive relief, disgorgement of gains, and penalties, emphasizing the SEC’s intent to hold Coinbase accountable for allegedly sidestepping federal securities laws.

SEC’s Enforcement and Crypto Regulation

The SEC’s crackdown on Coinbase underscores the agency’s broader regulatory push within the crypto industry. SEC Chair Gary Gensler stated that Coinbase’s alleged blending of exchange, broker, and clearinghouse functions sets a dangerous precedent by depriving investors of necessary protections. Gensler argued that while Coinbase may have earned billions through these operations, it did so at the expense of investor safeguards mandated by law.

The enforcement action against Coinbase is part of a larger initiative by the SEC’s Crypto Assets and Cyber Unit, which has intensified its scrutiny of cryptocurrency exchanges. Coinbase, for its part, contends that it has operated in good faith and within the bounds of existing law. Nevertheless, the outcome of this case could have far-reaching implications for the cryptocurrency industry, as other exchanges closely monitor the developments.

Coinbase’s Future Amid its challenges

As Coinbase navigates these overlapping controversies, its future in the U.S. market faces increasing uncertainty. The allegations around listing fees, compounded by community discontent over the Pepe description and severe legal battles with the SEC, reflect a pivotal moment for the exchange. Whether Coinbase can address these issues while retaining user trust and complying with regulatory standards remains to be seen.

Coinbase’s legal struggle with the SEC has significant implications for its operations and the crypto industry’s regulatory landscape. If the SEC prevails, other exchanges may face similar regulatory pressures to separate exchange, broker, and clearing functions, potentially reshaping the operational models of crypto platforms in the United States.

Coinbase’s recent controversies illustrate the complex and often conflicting pressures facing cryptocurrency exchanges in today’s regulatory environment. The exchange’s listing practices, community relations, and compliance with securities laws have come under scrutiny, and the stakes are high for both Coinbase and the wider industry. As the SEC’s legal action progresses and public sentiment remains mixed, the outcome of these challenges may set the tone for how the U.S. cryptocurrency sector navigates regulation and transparency in the years ahead.

[ad_2]