[ad_1]

Bitcoin has crashed below the $90K support today, reaching fresh lows at $88,000. Will the BTC dip continue, or is a rebound likely from here?

After a massive overnight crash, the crypto market has seen $881 million in liquidations, with Bitcoin alone suffering $272 million in liquidations and Ethereum nearing $200 million.

Long-position liquidations total $809.24 million, while short liquidations amount to $72.04 million. Following the crash, Bitcoin hit a new 30-day low of $88,600. With a massive supply wave, is Bitcoin destined to fall below the $85,000 mark? Let’s explore.

Bitcoin Hits $88,600: What’s Next?

In the 4-hour price chart, Bitcoin has broken under the 23.6% Fibonacci level, as warned in our previous analysis. With this downfall, Bitcoin has dipped below the critical support of $90,000.

With the short-term price reversal, the current market price of Bitcoin remains at $89,200. In the daily chart, the overall downfall accounted for an 8.9% drop last night. This has brought Bitcoin to its lowest daily closing price since November 18, 2024.

Trading Frenzy: Bulls Jump In Despite Market Crash

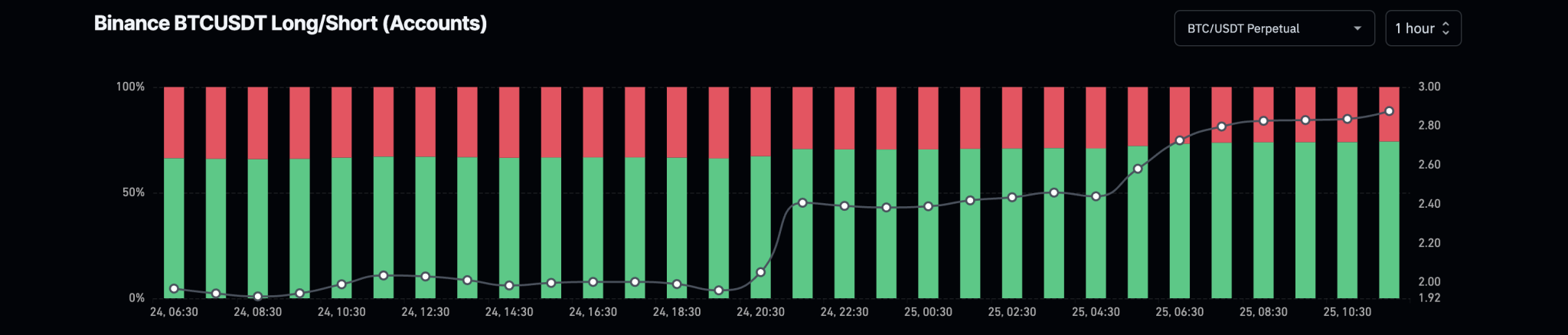

With the massive crash in Bitcoin, optimistic traders have initiated a buy-the-dip frenzy over the past 24 hours. On Binance, the biggest centralized crypto exchange, the long-to-short ratio based on accounts has risen to an astronomical figure of 2.88.

LongShort Ratio

This highlights that 74% of accounts holding long positions are hoping for a bullish turnaround. Meanwhile, the funding rate over Binance remains at 0.0073%.

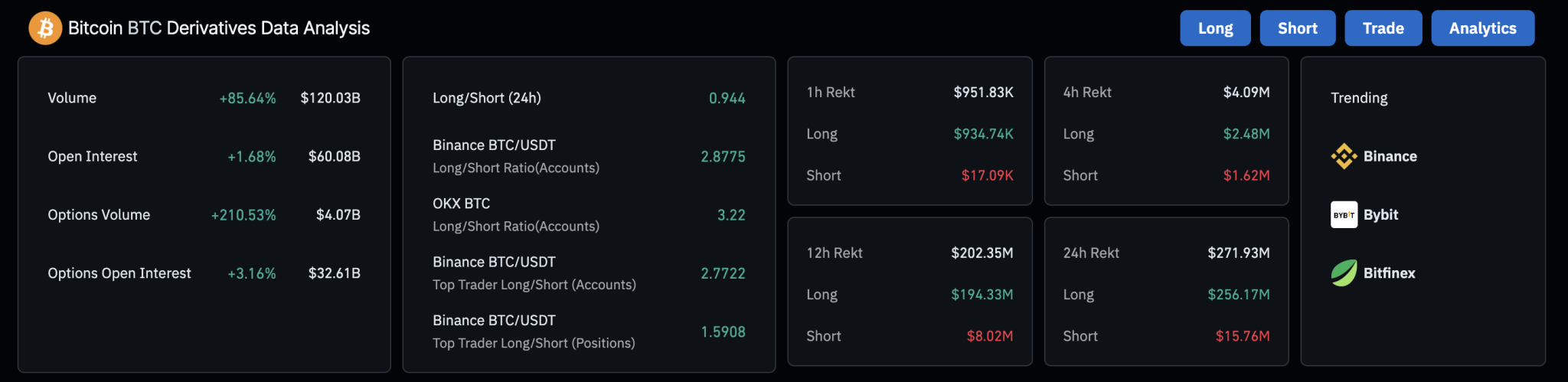

Bitcoin Derivatives

Currently, Bitcoin’s open interest remains at nearly $60.05 billion, highlighting strong sentiment. Overall, the long-to-short ratio based on all exchanges remains at 0.944, while the options volume has risen to $4.07 billion. Bitcoin’s option open interest has risen by 3.16% to $32.60 billion.

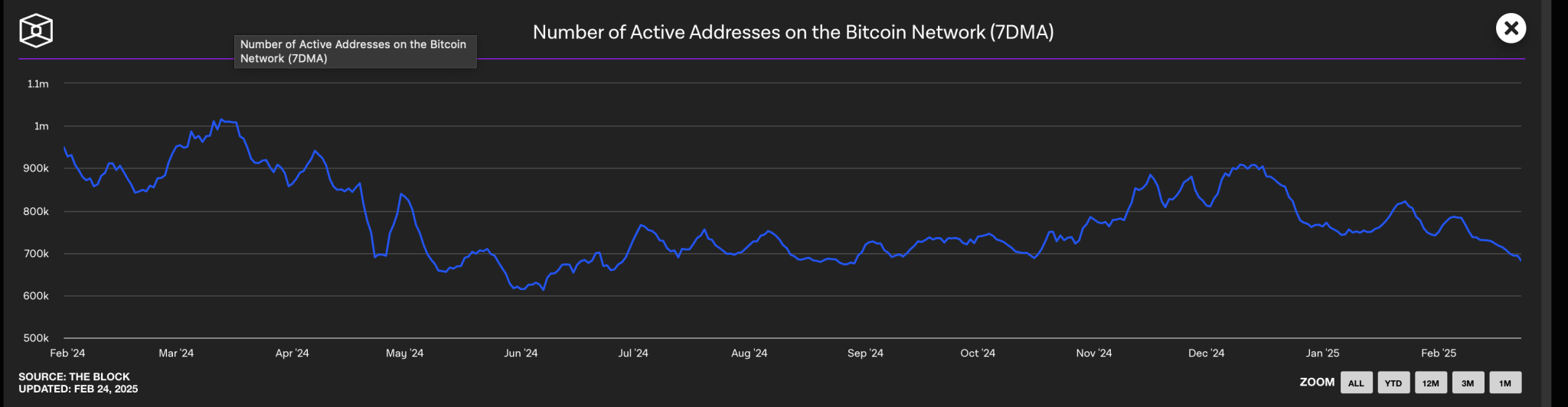

Bitcoin Network Activity Drops to New Lows!

However, the Bitcoin network has taken a significant hit. As per Ali Martinez, a crypto analyst, the number of new Bitcoin addresses created daily has dropped to 240,534.

This marks the lowest number of new addresses created since July 2024. This might suggest a consolidation phase coming for Bitcoin.

Along with the declining number of new users, the number of active users on the Bitcoin network has reached a significant low. Currently, it is down at 681.62K active addresses, marking the lowest since October 18, 2024.

Bitcoin Active Users

Critical Price Levels: Will Bitcoin Reboud $90K?

Despite the short-term optimism among crypto traders, the declining activity over the network warns of a potential consolidation or a prolonged correction phase. As per the price analysis, the $90,000 level remains a critical crossroad for Bitcoin.

Hence, a closing under this could result in a quick revisit to the $86,707 support level. Conversely, a bullish comeback will face immediate resistance at the 23.60% Fibonacci at $94,393.

[ad_2]