Corporate Bitcoin adoption continues its proliferation as more companies pursue accumulation strategies for their treasuries. Firms can benefit from capital appreciation, diversification, and an inflation hedge if executed properly.

However, not all Bitcoin acquisition strategies are created equal. If a company’s sole purpose is to hold BTC without sufficient resources or scale, it can risk total collapse during extended bear market periods. A chain reaction could further amplify downward pressure that could prove catastrophic.

Varying Approaches to Corporate Bitcoin Holdings

Institutional Bitcoin adoption is rising worldwide, with Bitcoin Treasuries data indicating that holdings have doubled since 2024. Public companies now collectively own over 4% of the total Bitcoin supply.

Interestingly, this increase in volume also represents a broadening range of reasons for doing so.

Top Public Bitcoin Treasury Companies. Source: Bitcoin Treasuries.

Some companies, most notably Strategy (formerly MicroStrategy), intentionally pursue such a playbook to become a Bitcoin treasury holding company. The move worked well for Strategy, whose supply accounts for 53% of total company holdings with over 580,000 BTC.

Other firms, like GameStop or PublicSquare, have taken a different approach, prioritizing exposure over aggressive accumulation. This scenario is optimal for firms that simply want to add BTC to their balance sheets while continuing to focus on their core businesses.

Initiatives like this carry far less risk than companies whose core business solely holds Bitcoin.

However, the increasing trend of companies adding Bitcoin to their financial reserves solely to dedicate themselves to holding Bitcoin carries profound implications for their businesses and Bitcoin’s future.

How Do Bitcoin-Focused Companies Attract Investors?

Building a successful Bitcoin treasury holding company involves much more than just aggressively buying Bitcoin. When a business’s sole purpose becomes Bitcoin holding, it will be exclusively valued based on the Bitcoin it holds.

To attract investors to buy their stock rather than just holding Bitcoin directly, these companies must outperform Bitcoin itself, reaching a premium known as Multiple on Net Asset Value (MNAV).

In other words, they must convince the market that their stock is worth more than the sum of its Bitcoin holdings.

Strategy implements this, for example, by convincing investors that by buying MSTR stock, they aren’t just purchasing a fixed amount of Bitcoin. Instead, they’re investing in a strategy where management actively works to increase the amount of Bitcoin attributed to each share.

If investors believe MicroStrategy can consistently grow its Bitcoin per share, they will pay a premium for that dual ability.

However, that’s just one part of the equation. If investors buy into that promise, Strategy has to deliver by raising capital to buy more Bitcoin.

The MNAV Premium: How It’s Built, How It Breaks

A company can only deliver an MNAV premium if it increases the total amount of Bitcoin it holds. Strategy does this by issuing convertible debt, which allows it to borrow funds at low interest rates.

It also leverages At-The-Market (ATM) equity offerings by selling new shares when their stock trades at a premium to its underlying Bitcoin value. Such a move enables Strategy to acquire more Bitcoin per dollar raised than existing shares, increasing Bitcoin per share for current holders.

This self-reinforcing cycle—where a premium allows efficient capital raises, which fund more Bitcoin, strengthening the narrative—helps sustain the elevated stock valuation beyond Strategy’s direct Bitcoin holdings.

However, such a process involves several risks. For many companies, the model is directly unsustainable. Even a pioneer like Strategy endured heightened stress when Bitcoin’s price dropped.

Nonetheless, over 60 companies have already adopted a Bitcoin-accumulating playbook during the first half of 2025. As that number grows, new treasury companies will face the associated risks even more acutely.

Aggressive BTC Accumulation Risks for Small Players

Unlike Strategy, most companies lack scale, an established reputation, and the “guru status” of a leader like Michael Saylor. These characteristics are crucial for attracting and retaining the investor confidence needed for a premium.

They also don’t generally have the same creditworthiness or market power. Knowing this, smaller players will likely incur higher interest rates on their debt and face more restrictive covenants, making the debt more expensive and harder to manage.

If their debt is collateralized by Bitcoin in a bear market, a price drop can quickly trigger margin calls. During an extended period of downward pressure, refinancing maturing debt becomes extremely difficult and costly for already overburdened companies.

To make matters worse, if these companies have shifted their core operations to focus solely on Bitcoin acquisition, they have no alternative business cushion that generates a stable and separate cash flow. They become entirely dependent on capital raises and Bitcoin’s price appreciation.

When several companies take such a move simultaneously, the consequences for the greater market can go south dramatically.

Does Corporate Bitcoin Adoption Risk a “Death Spiral”?

If many smaller firms pursue a Bitcoin accumulation strategy, the market consequences during a downturn can be severe. If Bitcoin’s price falls, these companies may run out of options and be forced to sell their holdings.

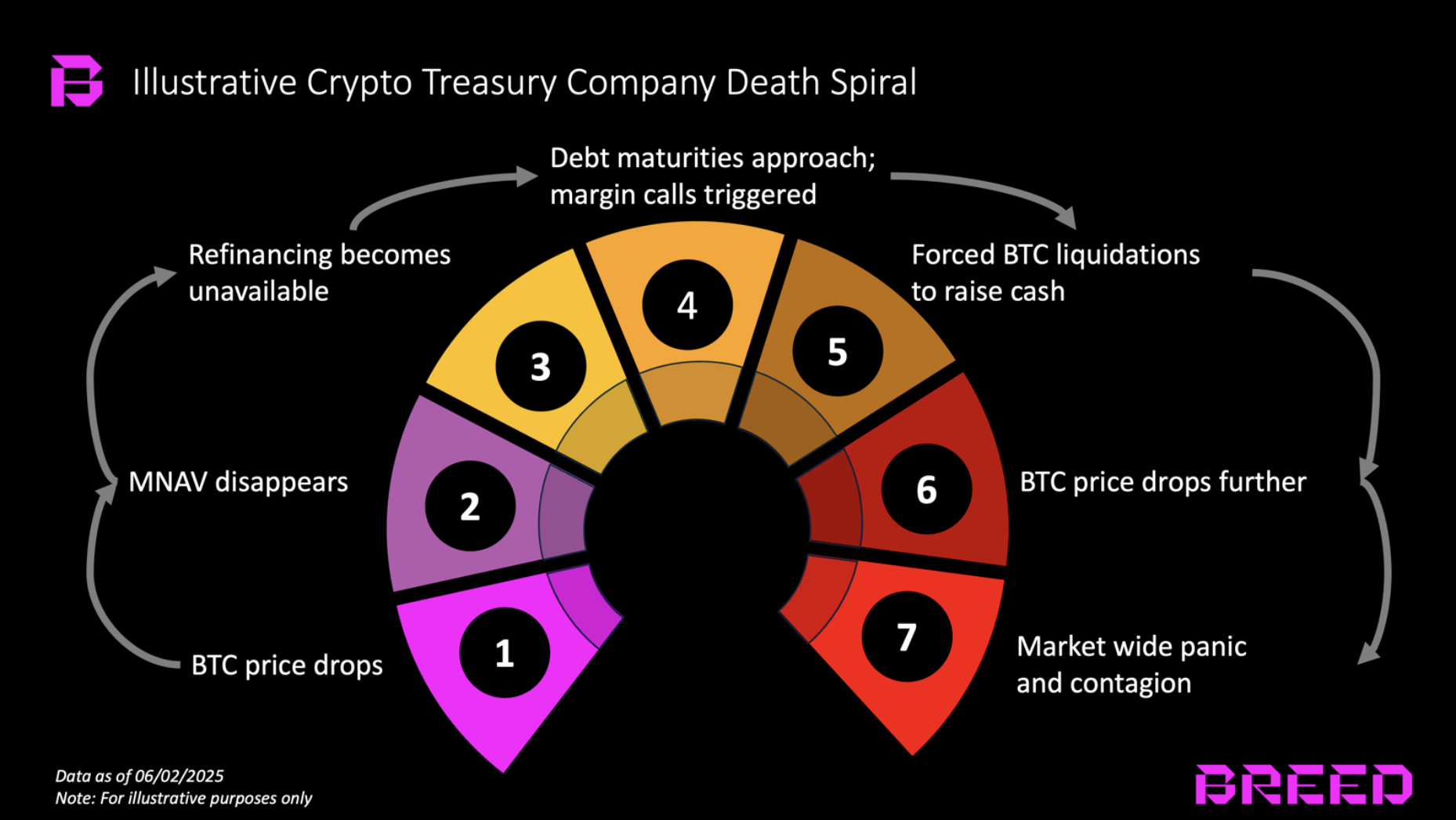

This widespread, distressed selling would inject an enormous supply into the market, significantly amplifying downward pressure. As seen during the 2022 crypto winter, such events can trigger a “reflexive death spiral.”

The different stages of a Bitcoin death spiral. Source: Breed VC.

The forced selling by one distressed company can further drive Bitcoin’s price down, triggering forced liquidations for other firms in a similar position. Such a negative feedback loop can provoke an accelerated market decline.

In turn, highly publicized failures could damage broader investor confidence. This “risk-off” sentiment could lead to widespread selling across other cryptocurrencies due to market correlations and a general flight to safety.

Such a move would also inevitably put regulators on high alert and spook off investors who may have considered investing in Bitcoin at one point.

Beyond Strategy: The Risks of Going “All-In” on Bitcoin

Strategy’s position as a Bitcoin treasury holding company is unique because it was a first mover. Only a handful of companies match Saylor’s resources, market influence, and competitive advantage.

The risks associated with such a playbook are various and, if proliferated, can be detrimental to the greater market. As more public companies move to add Bitcoin to their balance sheets, they must carefully decide between getting some exposure or going all-in.

If they choose the latter, they must cautiously and thoroughly weigh the consequences. Though Bitcoin is currently at all-time highs, a bear market is never entirely out of the question.